Are you considering switching mortgage lenders to save money or find better terms? It's a common decision many homeowners face, and it can lead to significant savings over time. In this article, we'll walk you through the essential steps to make the process as smooth as possible. So, let's dive in and explore how a lender switch could benefit you!

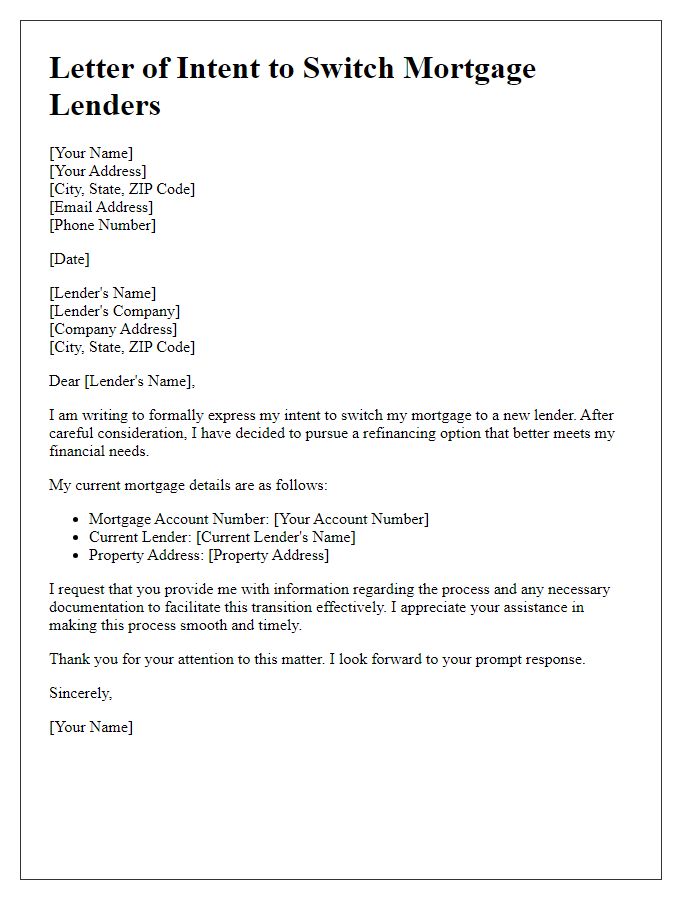

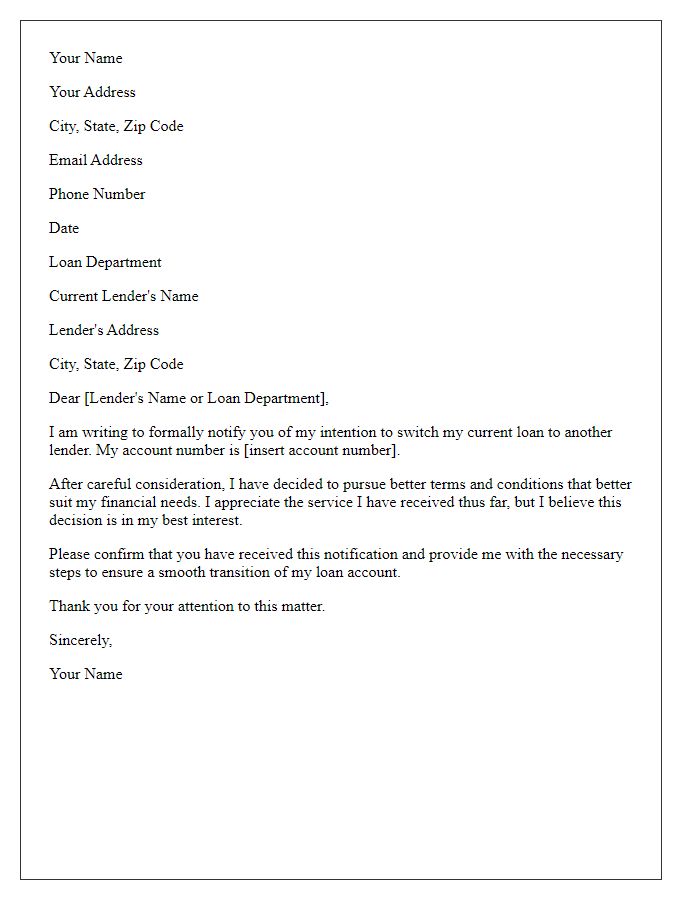

Borrower Information and Contact Details

Switching mortgage lenders can be a strategic move for homeowners seeking better rates or services. When considering a switch, it's essential to gather borrower information, including full names, property address (including city and ZIP code), loan details, and contact numbers. Borrowers should also provide current lender information, including account numbers and customer service contacts, to facilitate a seamless transition. Maintaining accurate documentation is crucial to ensure timely processing and minimize disruptions during the refinancing process. Additionally, researching potential new lenders, comparing interest rates and service offerings, and understanding relevant fees is vital for making an informed decision.

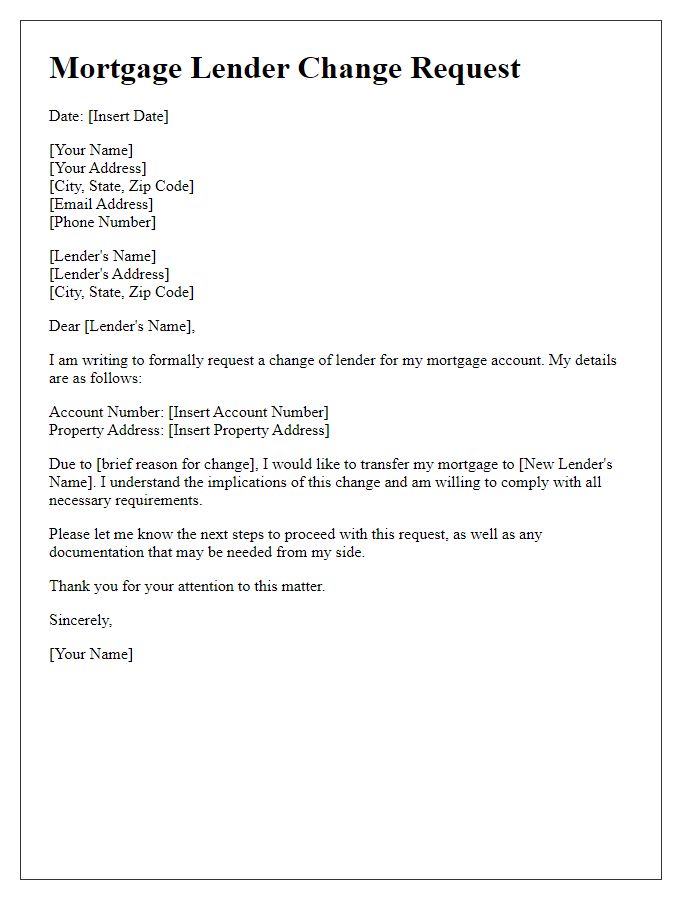

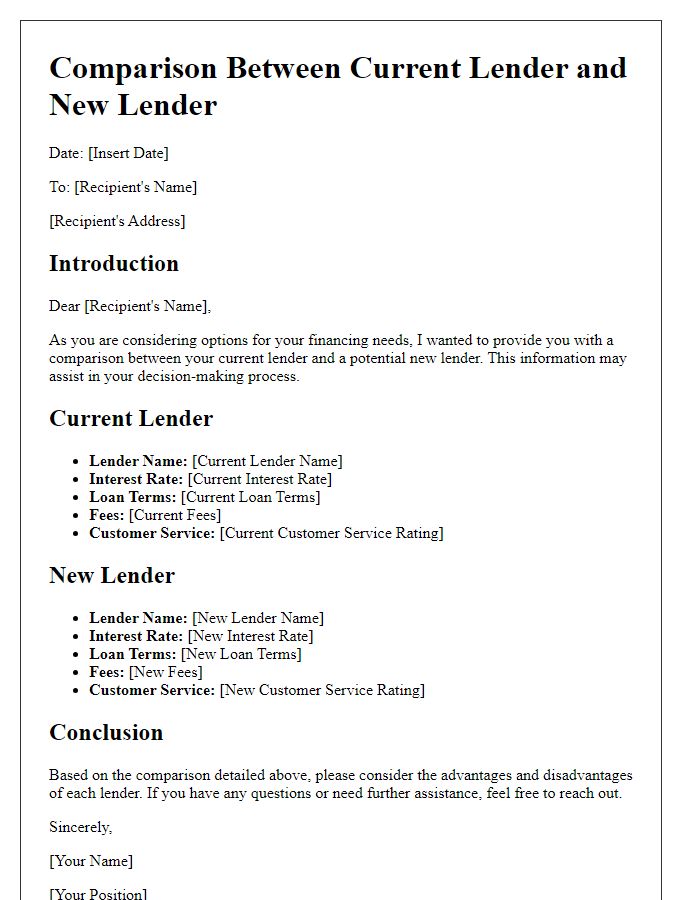

Current Lender's Information

When seeking to switch mortgage lenders, it's essential to address key details accurately. Start with the current lender's information, which includes the lender's name (e.g., ABC Mortgage Company), address (123 Finance Lane, Suite 100, Cityville, State, Zip Code), and the customer service contact number (1-800-555-0199). It's also important to include your account number (123456789) to help identify your mortgage account efficiently. Providing these details ensures a smooth transition process, allowing the new lender to comprehend the current arrangements swiftly and communicate effectively with the existing institution.

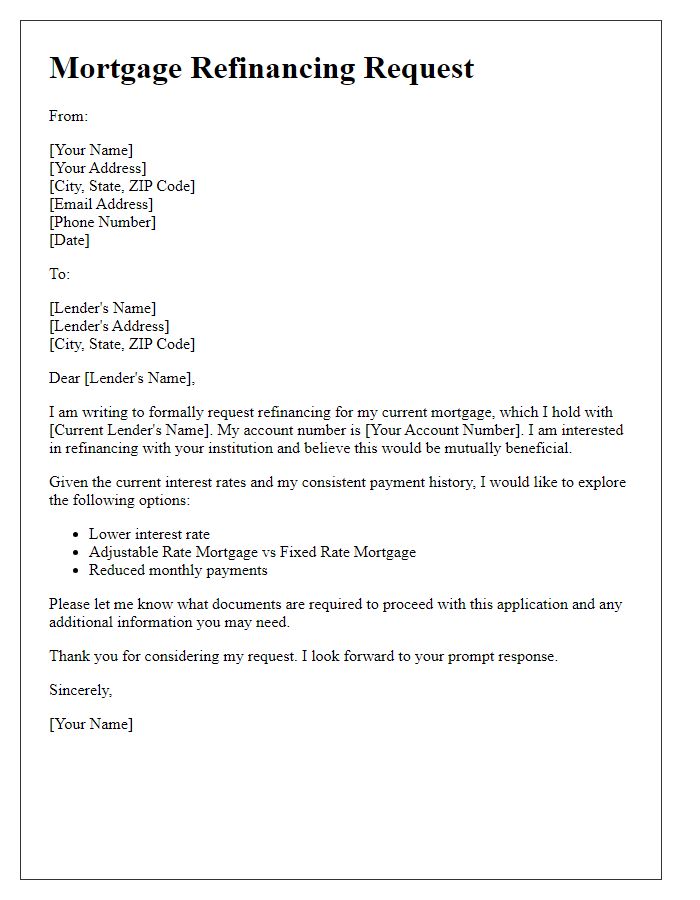

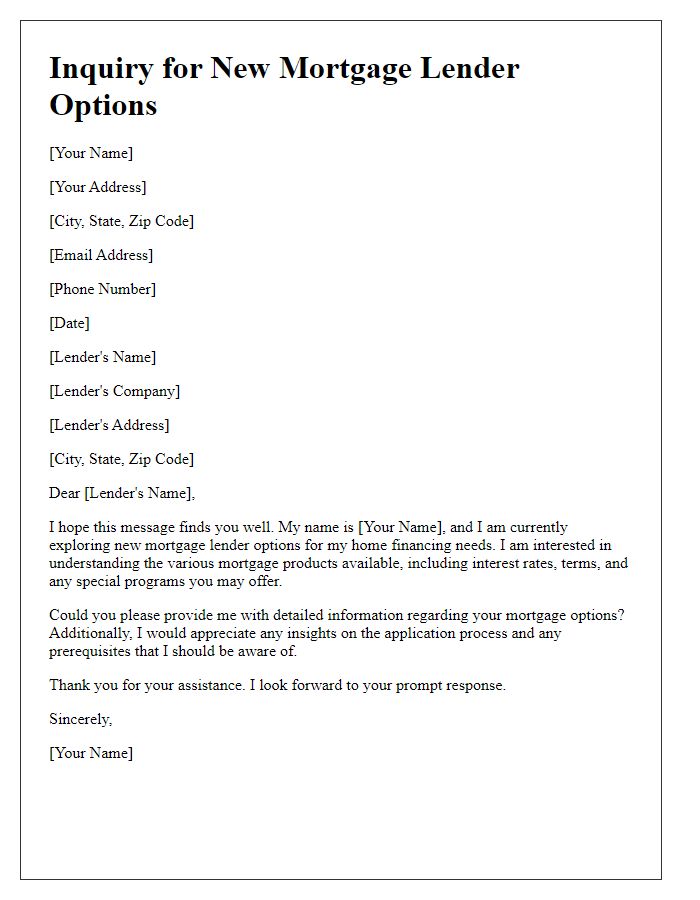

Details of the New Lender

Switching mortgage lenders can facilitate better interest rates and loan terms. The new lender, XYZ Mortgage Corporation, established in 1998 in New York City, offers competitive fixed-rate mortgages starting at 3.5% APR for a 30-year loan term. Their customer service department is available 24/7 and has received a 4.8-star rating on TrustPilot from over 1,200 reviews. The application process is streamlined, enabling online submissions and quick approvals, often within 48 hours. Additionally, XYZ Mortgage Corporation provides assistance with closing costs, which can significantly impact the overall financial strategy for homeowners.

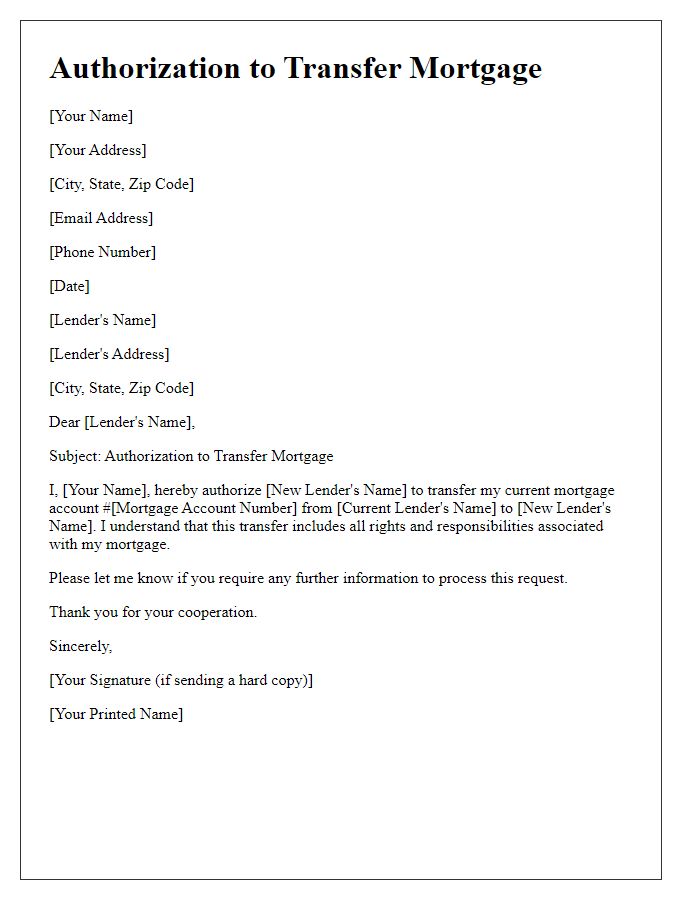

Request for Mortgage Transfer

Switching mortgage lenders can be a beneficial decision for homeowners seeking better rates or terms. A mortgage transfer request involves formal communication initiated by the homeowner, typically submitted to the new lender's processing department, detailing the desire to transition from the current lender to a more favorable option. Homeowners should include essential details such as the property address located in [specific city or zip code], the existing loan amount of [specific dollar amount], current interest rate of [specific percentage], and reasons for the switch, such as lower rates or improved customer service from the new lender. Additionally, it is crucial to outline any pending fees incurred during the transfer process, like closing costs or prepayment penalties. Proper documentation, including a copy of the current mortgage statement and proof of income, will support the mortgage transfer request, which is typically evaluated within [timeframe, e.g., 30 days] of submission. Successful transfers can lead to significant savings, allowing homeowners in [region or area] to manage their financial commitments more effectively.

Closing and Contact Instructions

Switching mortgage lenders often requires careful attention to detail and effective communication. Clear closing instructions are essential for a seamless transition between lenders. Contact instructions should specify relevant contact information, including names, phone numbers, and email addresses of key personnel involved in the mortgage process. Be mindful of deadlines, such as the closing date for the new lender and any requisite documentation submission dates. Important documents may include the Good Faith Estimate (GFE), Loan Estimate (LE), and Truth-in-Lending (TIL) disclosures. Ensure that all parties maintain open lines of communication throughout the transition to prevent misunderstandings and delays, which can affect the overall process of securing financing for your home.

Comments