Are you ready to navigate the often-confusing world of closing costs? Understanding the various fees and expenses associated with buying a home can feel overwhelming, but we're here to simplify it for you. From title insurance to appraisal fees, each element plays a crucial role in your overall financial picture. Join us as we break down the components of closing costs and empower yourself with the knowledge to make informed decisions!

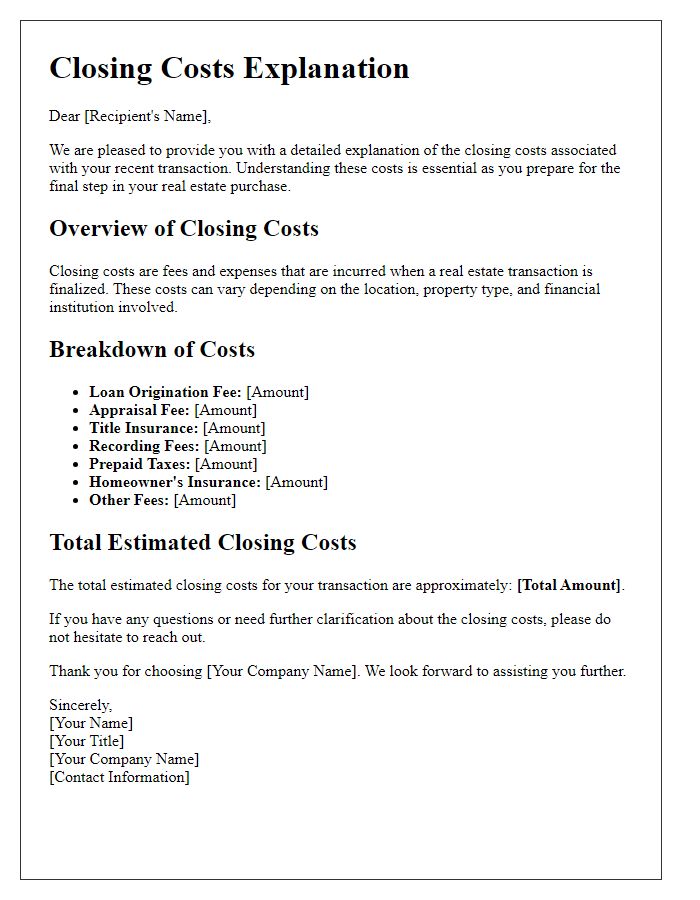

Introduction and Purpose

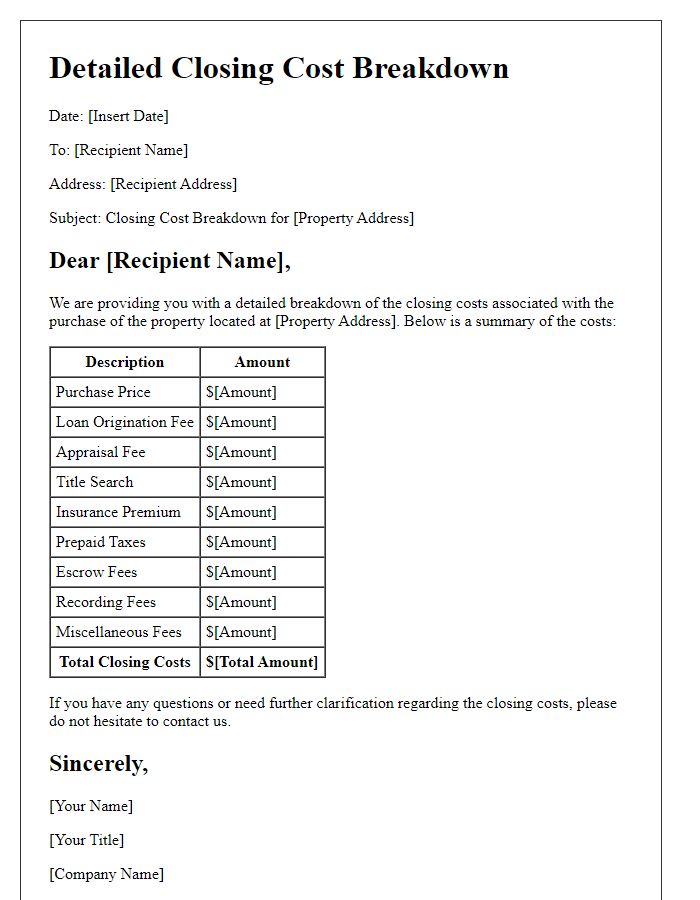

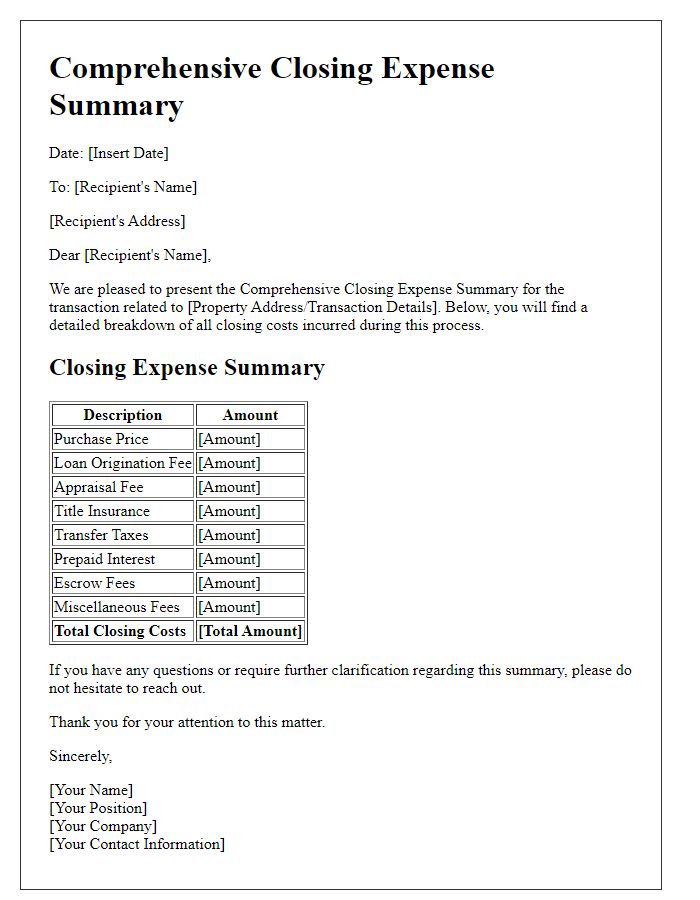

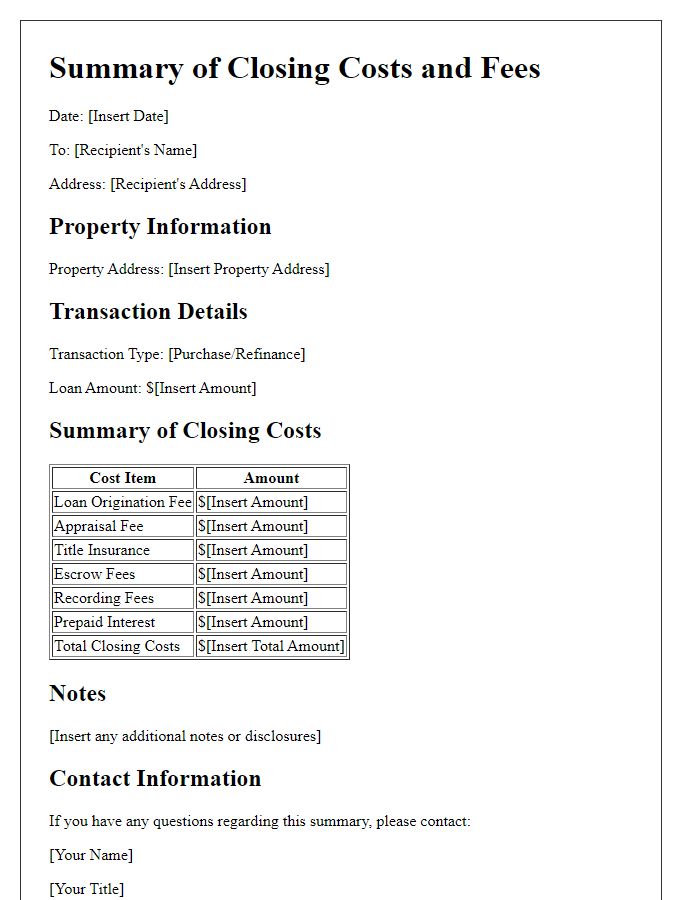

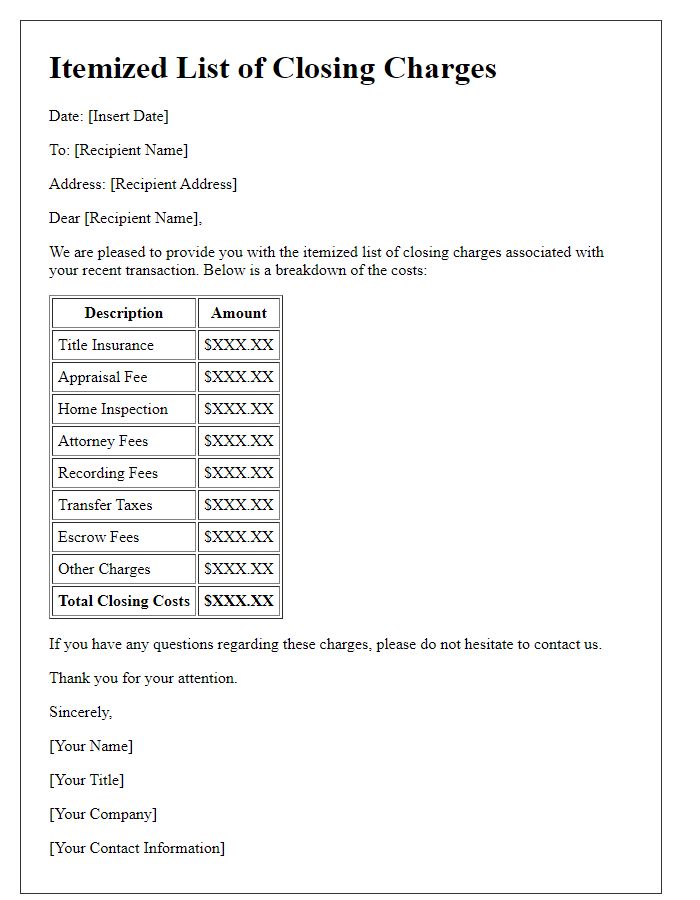

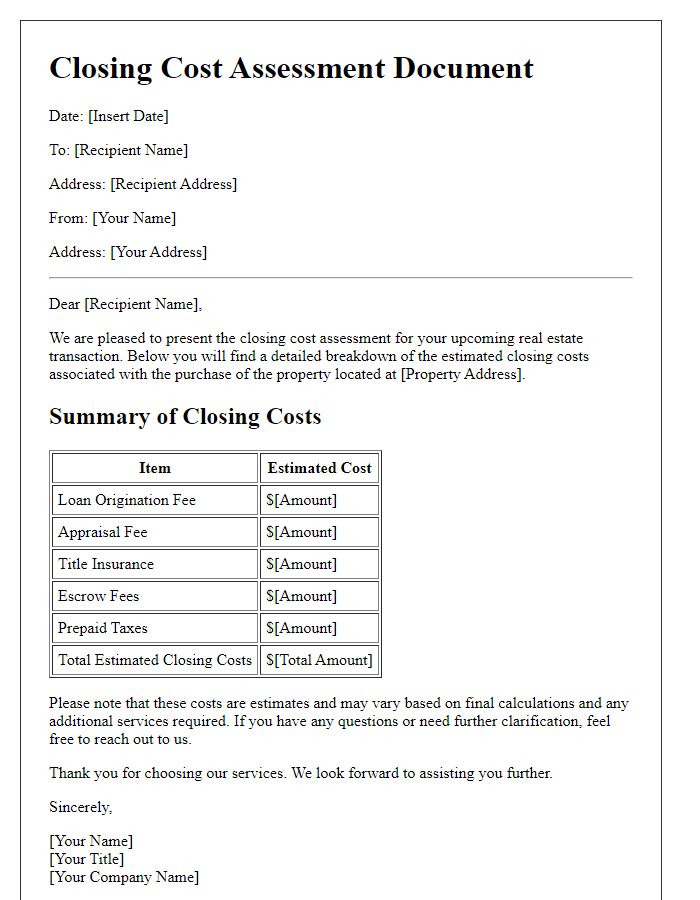

The closing cost breakdown provides buyers with a detailed overview of the financial obligations associated with finalizing a real estate transaction. This document serves to clarify the various fees incurred during closing, including but not limited to lender fees, title insurance costs, appraisal fees, and pre-paid property taxes, which can range from 2% to 5% of the home's purchase price. Understanding these costs is crucial in preparing for the total amount required at closing and ensuring a smooth transaction process in compliance with local real estate regulations.

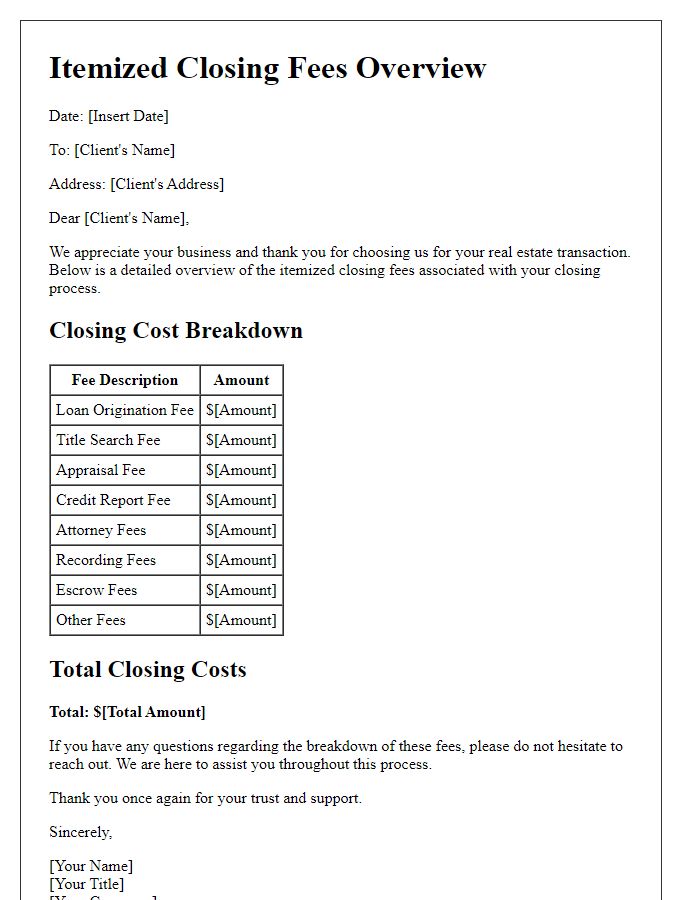

Itemized List of Costs

A detailed closing cost breakdown is essential for prospective homebuyers. This breakdown typically includes essential items such as loan origination fees, which can range from 0.5% to 1% of the loan amount, appraisal fees averaging between $300 to $500, and title insurance costs that vary based on location, often estimated at $1,000. Other notable expenses include inspection fees, usually around $300 to $700, and recording fees imposed by local authorities, which may range from $50 to $250. Taxes, such as property taxes and transfer taxes, can also significantly affect total closing costs, with average amounts differing by state. Understanding these items allows buyers to budget effectively for the purchasing process.

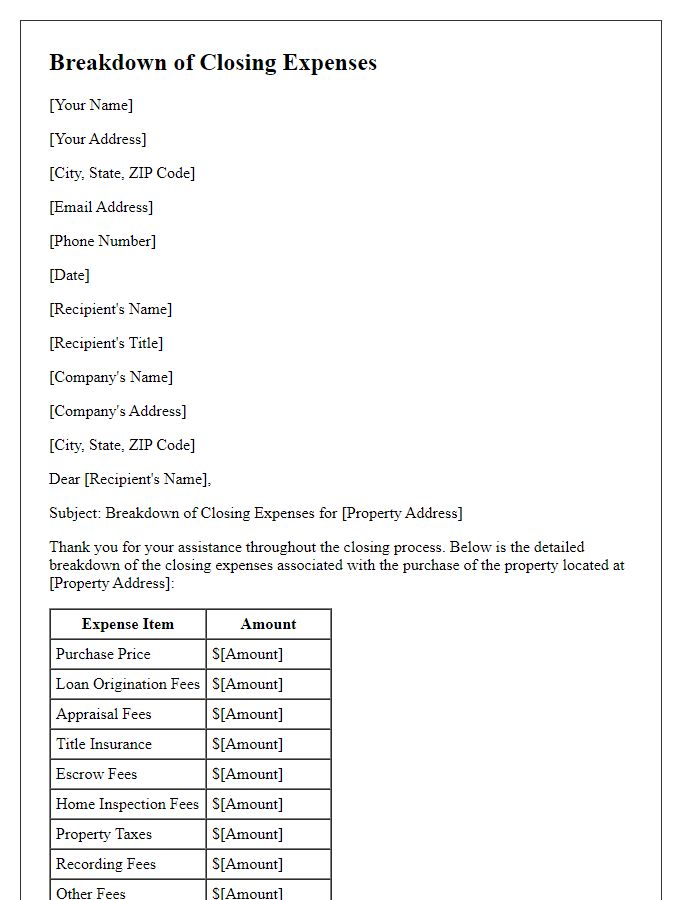

Payment Instructions

Upon closing a real estate transaction, it is essential to clearly outline the closing cost breakdown to ensure transparency and understanding for all parties involved. Typical closing costs may range from 2% to 5% of the purchase price, depending on the property's location and the lender's requirements. For example, in Los Angeles, California, buyers might encounter additional fees such as title insurance (varying between $700 and $2,000), escrow services (around $1,500), and recording fees (approximately $100 to $300). Payment instructions should clearly specify the payment methods accepted, such as wire transfers or cashier's checks, highlighting any deadlines that must be adhered to, typically at least 24 hours before the closing date. Moreover, outlining the final dollar amount due at closing will significantly aid both buyers and sellers in preparing their funds efficiently, ensuring a smooth transaction process.

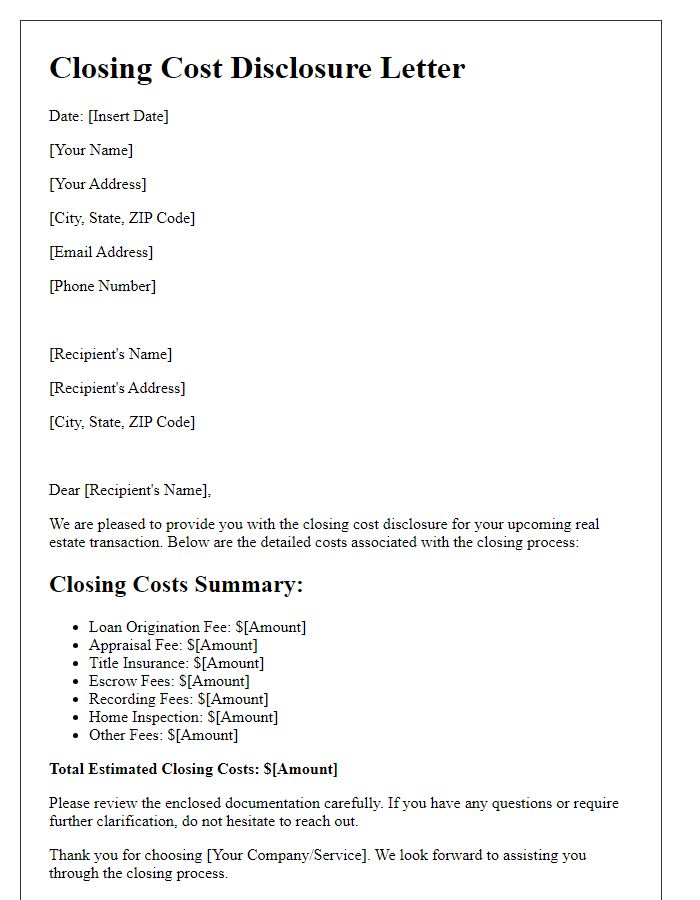

Contact Information for Questions

Closing cost breakdown provides crucial financial details for real estate transactions, typically involving various fees. Buyers and sellers encounter costs such as title insurance premiums (often between $500 to $1,500), origination fees charged by lenders (usually 0.5% to 1% of the loan amount), and appraisal fees (typically around $300 to $500). Additionally, recording fees for registering the property with county officials may range from $50 to $150. Home inspection costs can vary, averaging about $300 to $500, depending on the property's size and location. For further clarification on specific charges or discrepancies, customers can reach the contact provided in the closing documentation, often the title company representative or a mortgage broker.

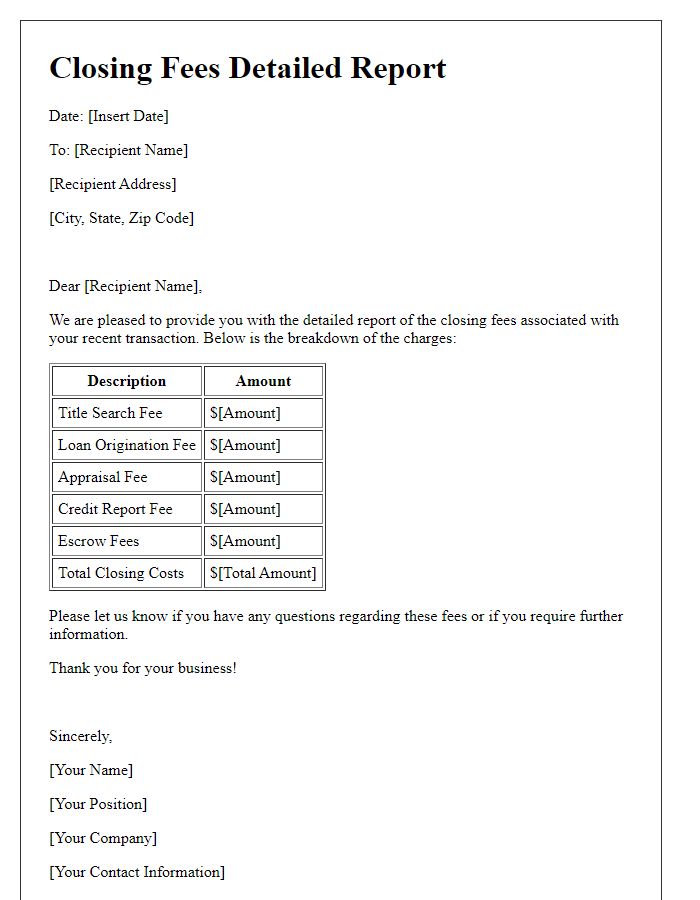

Summary and Final Remarks

Closing costs are essential financial elements in real estate transactions, encompassing various fees associated with property ownership transfer. These costs typically range from 2% to 5% of the home's purchase price, which can vary significantly based on the property's location (city or state), type of financing (conventional or FHA loans), and specific local regulations. Key components include appraisal fees (usually between $300 and $500), title search costs ($200 to $400), recording fees (often $50 to $150), and attorney fees that may rise to $1,500 or more, depending on state requirements. Understanding these costs, which can also include prepaid items like property taxes and homeowners insurance, ensures clarity for buyers and sellers during the closing process. Accurate estimates enable better financial planning and can prevent surprises at settlement meetings. Taking into account negotiation strategies can potentially reduce some costs, thereby benefiting all parties involved in the transaction.

Comments