Are you looking for a clear and effective way to document your forbearance plan? Crafting the perfect letter template can make all the difference in ensuring your agreement is understood by all parties involved. This template will guide you through the essential elements to include, helping to keep communication transparent and professional. So, let's dive in and explore the details that will help you create a solid forbearance plan letter!

Purpose of Forbearance

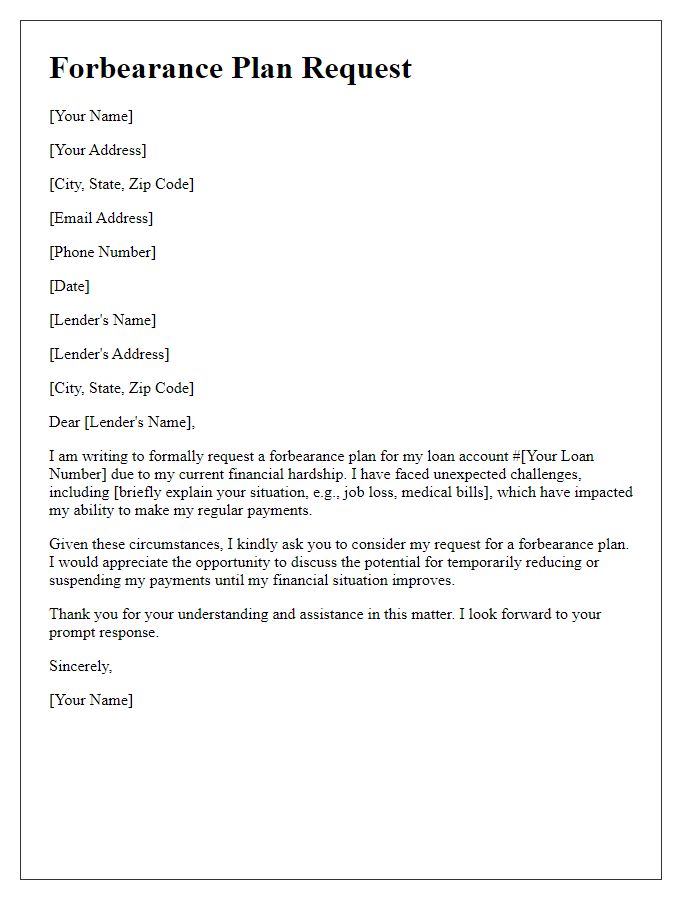

Forbearance plans serve as temporary relief solutions for borrowers facing financial hardship, enabling them to pause or reduce loan payments without immediate penalties. Such arrangements, often seen in mortgage and student loans, are designed to help individuals navigate unexpected circumstances like job loss, medical emergencies, or economic downturns. As part of this plan, lenders may agree to defer payments for a specified period, typically ranging from three to twelve months. During forbearance, interest may continue to accrue, impacting the total loan balance upon resumption of payments. Borrowers must communicate with their lenders to establish the terms and ensure compliance with any necessary documentation for eligibility under federal programs or specific lender provisions.

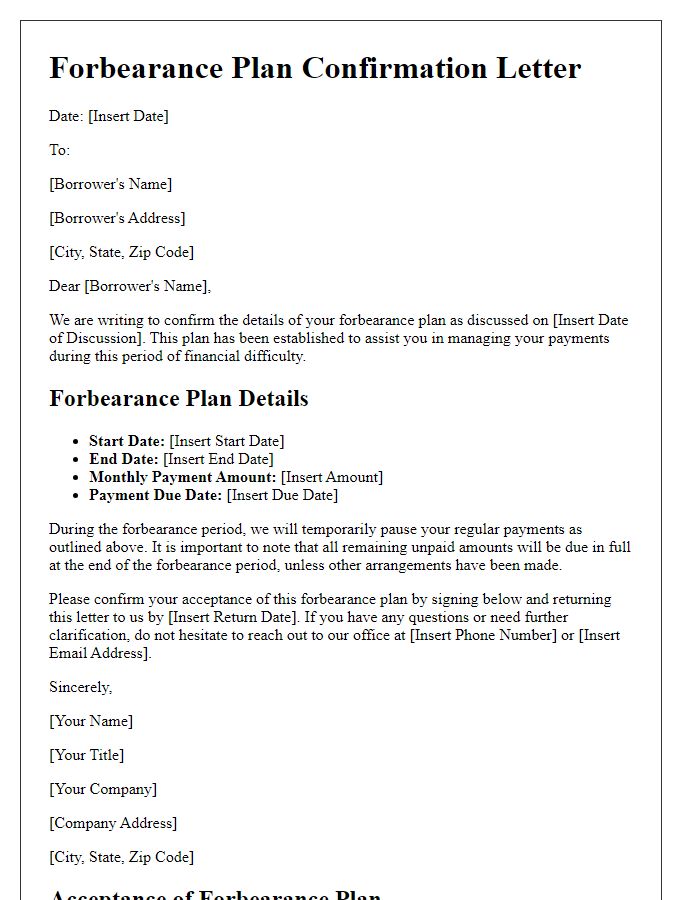

Borrower/Account Information

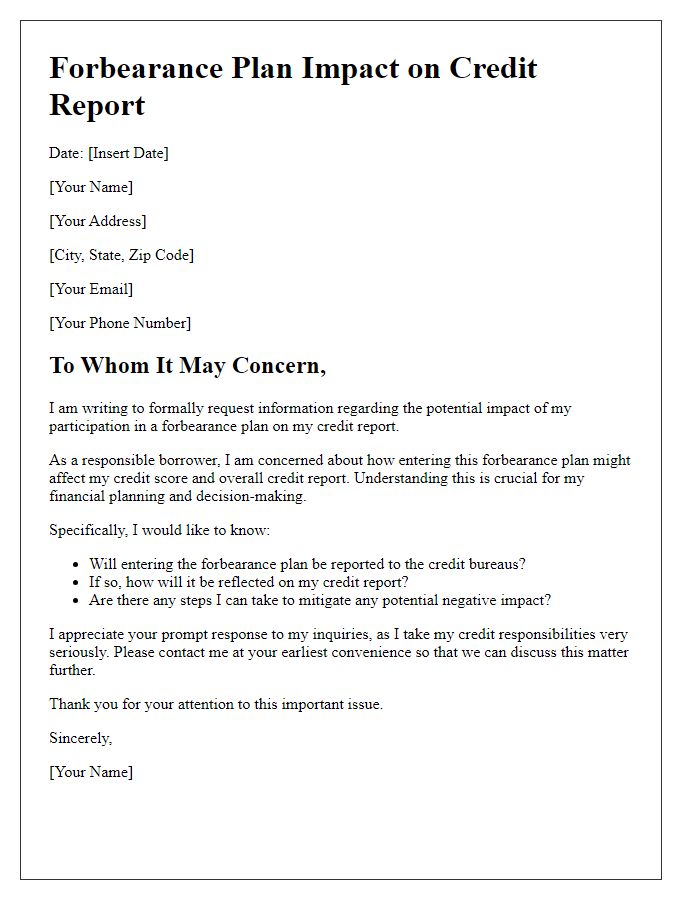

A forbearance plan is a temporary agreement between a borrower and a lender that allows the borrower to pause or reduce mortgage payments for a limited period. In this context, the borrower information includes essential details such as the borrower's name (John Doe), account number (123456789), property address (456 Oak Lane, Springfield, IL), and current loan balance (approximately $250,000). The lender, typically a financial institution (ABC Bank), outlines specific terms and conditions of the forbearance plan, including the duration of forbearance (six months) and any applicable fees or interest that may accrue during this period. It's crucial for the borrower to be aware of any potential impact on their credit score (which can drop by 50 to 100 points) due to missed payments and the need to resume regular payments post-forbearance. Clear documentation of all agreements is essential for both parties involved to ensure compliance and understanding of responsibilities during this financial agreement.

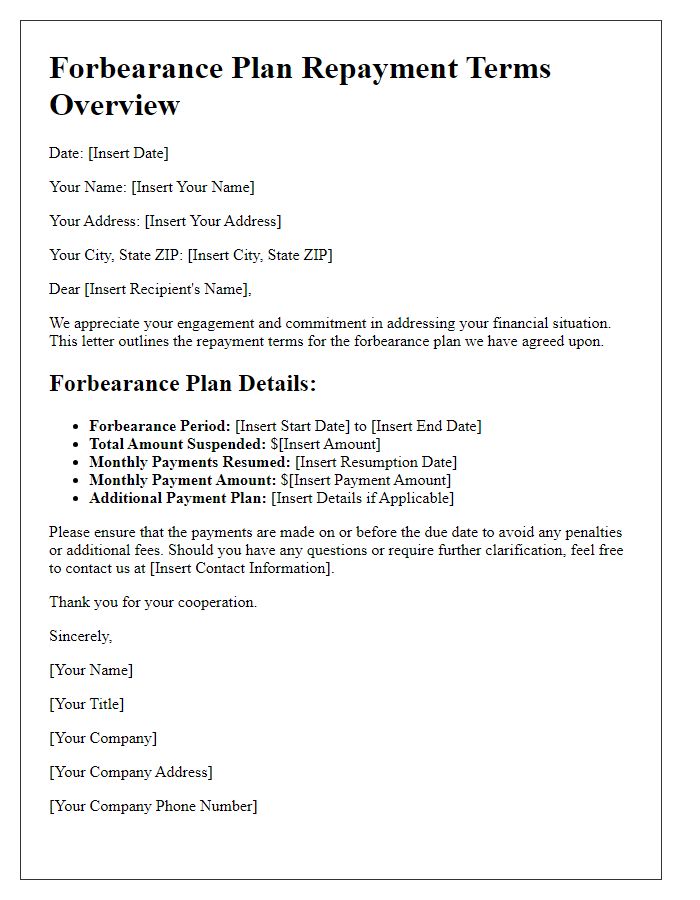

Terms and Conditions

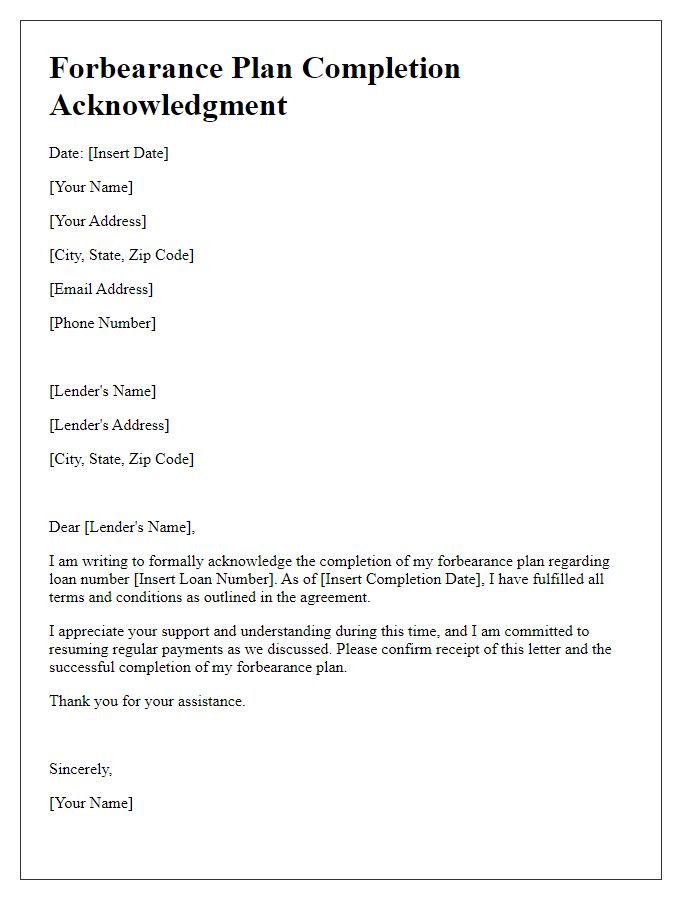

A forbearance plan allows borrowers to temporarily pause or reduce their mortgage payments due to financial hardship. Key terms may include a period (typically 3 to 12 months) during which payments are suspended or decreased. Interest accrual continues, potentially increasing the total amount owed. After the forbearance period, borrowers may need to repay missed payments in one lump sum, implement a repayment plan, or modify loan terms. Compliance with lender requirements, such as submitting documentation of hardship (e.g., unemployment verification) is crucial for approval. Institutions like Fannie Mae and Freddie Mac provide guidelines to ensure consumer protections during forbearance.

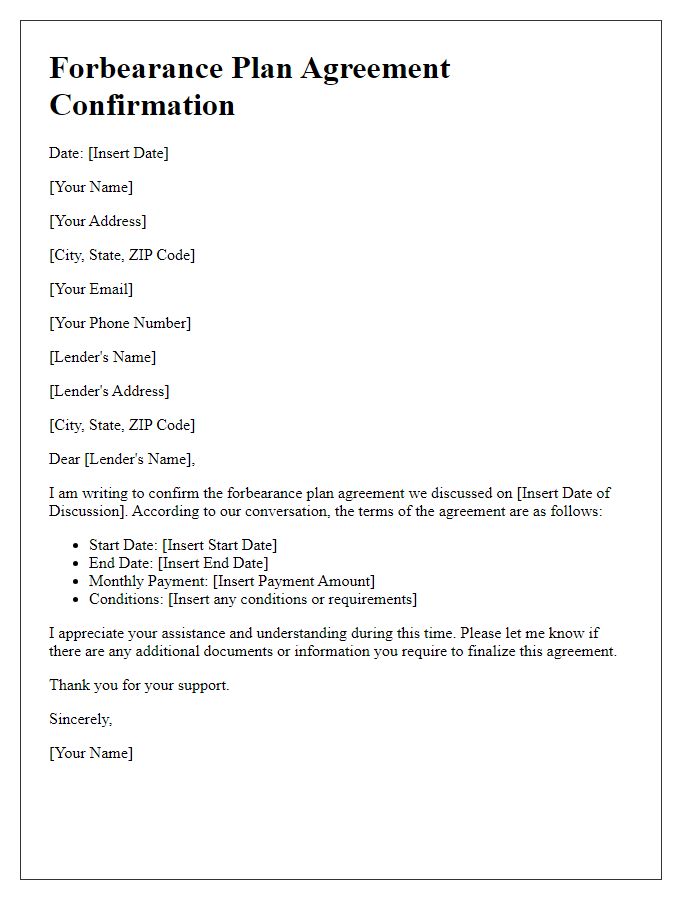

Contact Information

Contact information is crucial for effective communication and resolution in a forbearance plan. The document should include essential details such as the borrower's name, address, and phone number to enable easy reach. The lender or servicer's information, including the company name, mailing address, and a dedicated contact person or department, should also be outlined. Additionally, relevant account numbers or loan identifiers can facilitate quicker reference and processing during discussions. Clear and direct communication methods, whether through email addresses or specific contact numbers, can significantly enhance the efficiency of interactions related to the forbearance plan.

Signatures and Date

Forbearance plans can provide temporary relief for borrowers facing financial difficulties. Documentation of such arrangements typically requires a clear section indicating signatures and dates. Each party involved, including borrowers and lenders, must provide their legal signatures to validate the agreement. The date next to each signature is crucial, reflecting the moment both parties consented to the terms. Additionally, including witness signatures may further solidify the document's legitimacy, enhancing its enforceability. Properly executed, this documentation serves as a protective measure, outlining obligations and timelines associated with the forbearance plan, ensuring clarity during the repayment phase.

Comments