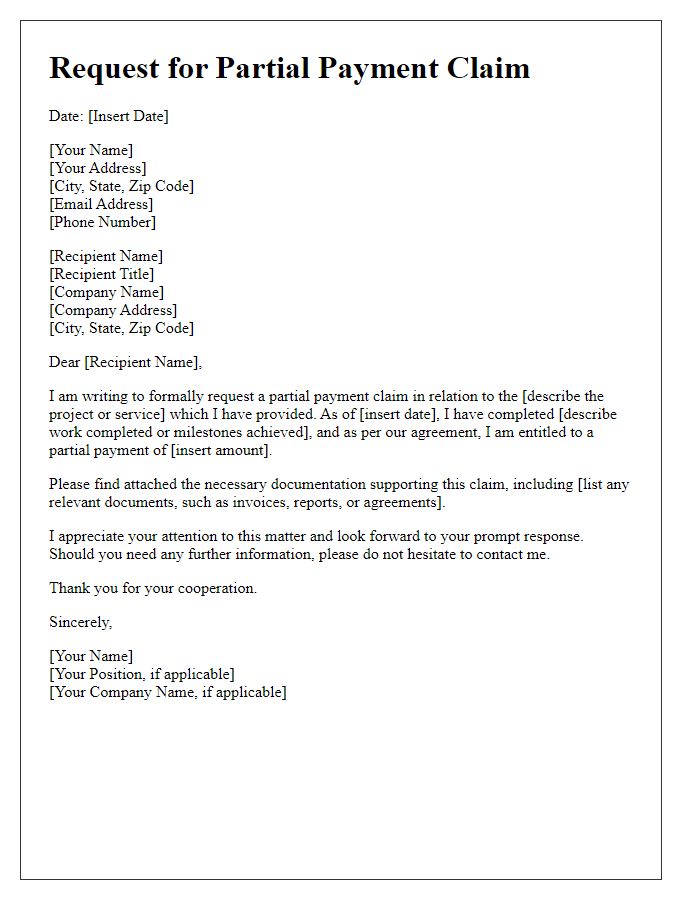

Are you navigating the complex waters of partial payment claims? Understanding how to effectively communicate your needs can make all the difference in ensuring you're compensated fairly. In this article, we'll explore key strategies and provide a simple letter template to enhance your claims process. So, if you're ready to take control of your financial dealings, keep reading for insights that can empower you!

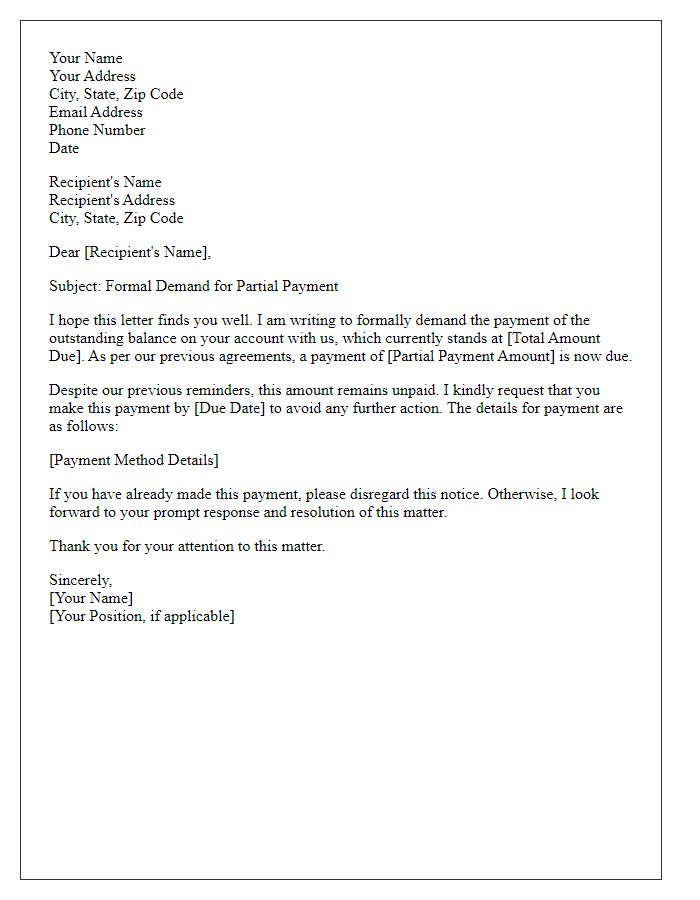

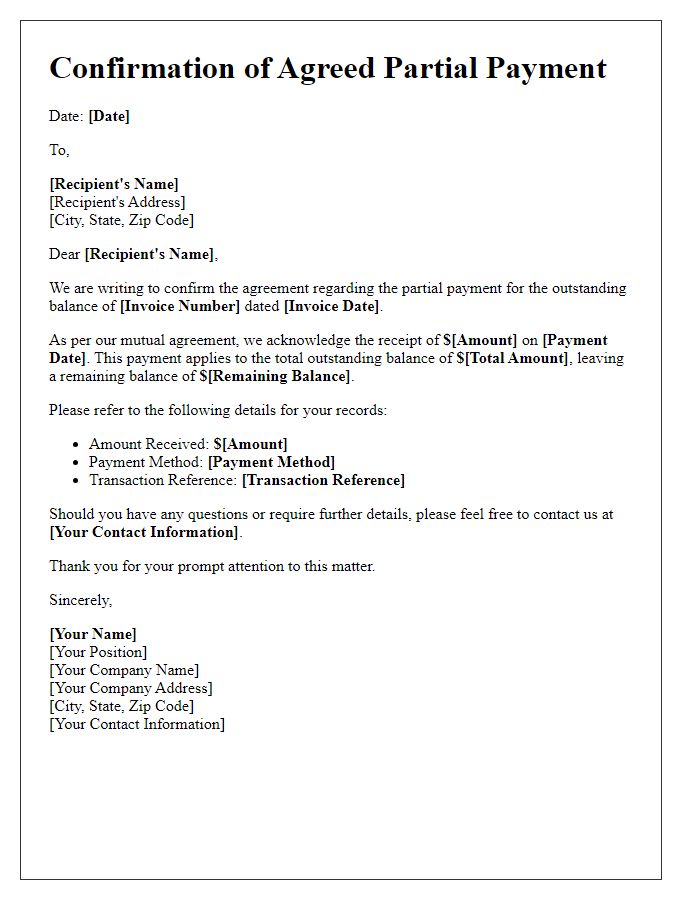

Payment Details

Partial payment claims can arise in various scenarios, such as construction projects or contractual agreements. When clients submit partial payment, specific details must be outlined for clarity. The total contract amount, for instance, might be $100,000, with an agreed-upon payment schedule that includes milestones. Each milestone may signify a specific phase of work completed, such as 30% completion (resulting in a $30,000 claim) or 50% completion ($50,000 claim). The outstanding balance post-payment must be clearly indicated, ensuring all parties understand remaining financial obligations. Additionally, payment methods, due dates, and any applicable interest rates should be specified to avoid disputes.

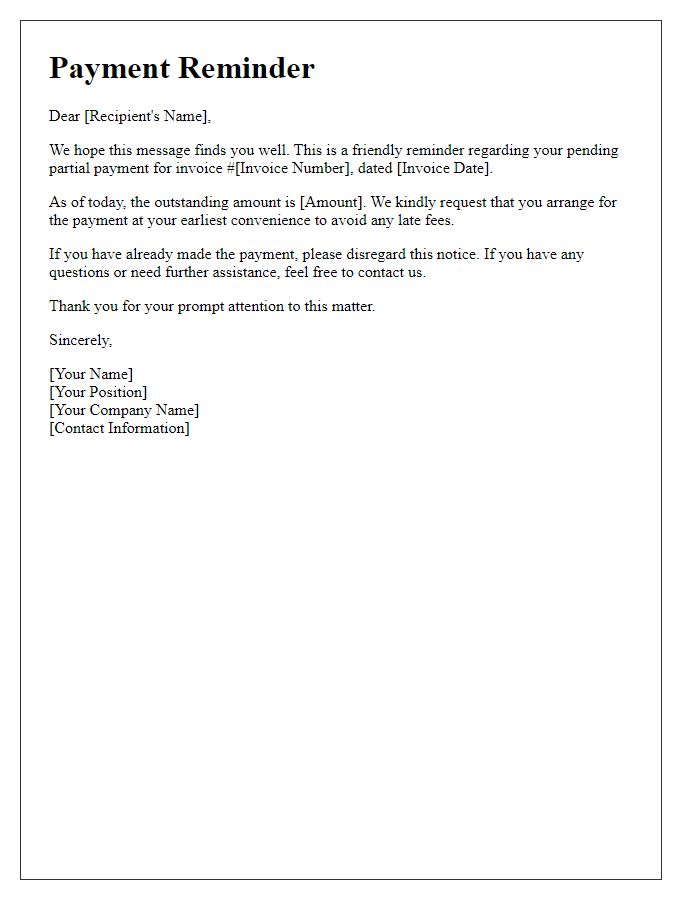

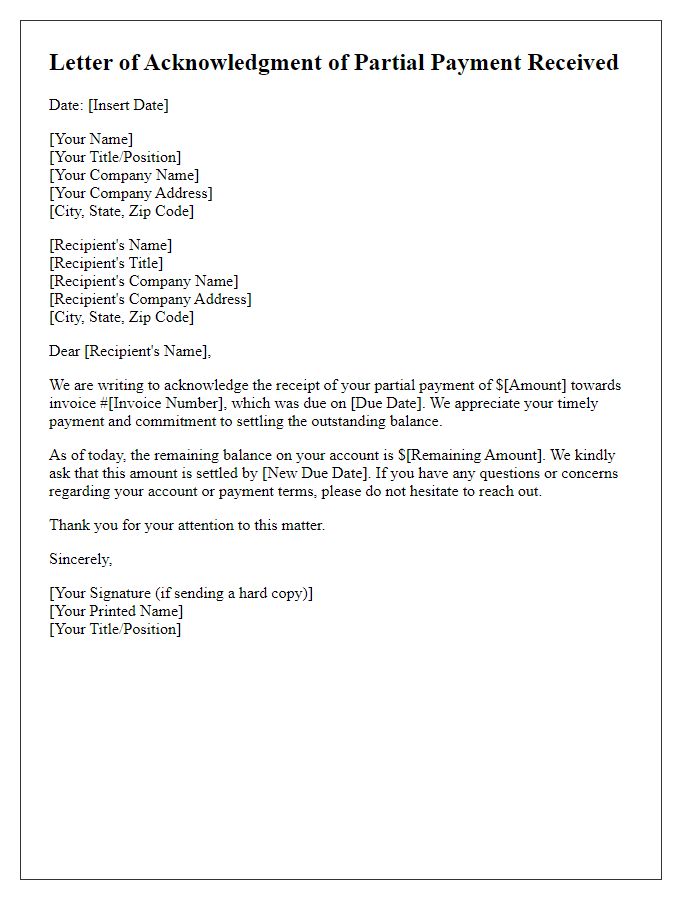

Invoice Reference

Partial payment claims are essential for managing cash flow in business transactions. For instance, a construction company could send a claim referencing Invoice #10023 for a project at 123 Main Street, dated August 1, 2023, which amounts to $50,000. If the client has paid $30,000 to date, a partial payment claim would highlight the outstanding balance of $20,000 due by September 15, 2023. Including specific payment terms and project milestones strengthens the request, ensuring clarity in documentation and facilitating timely processing.

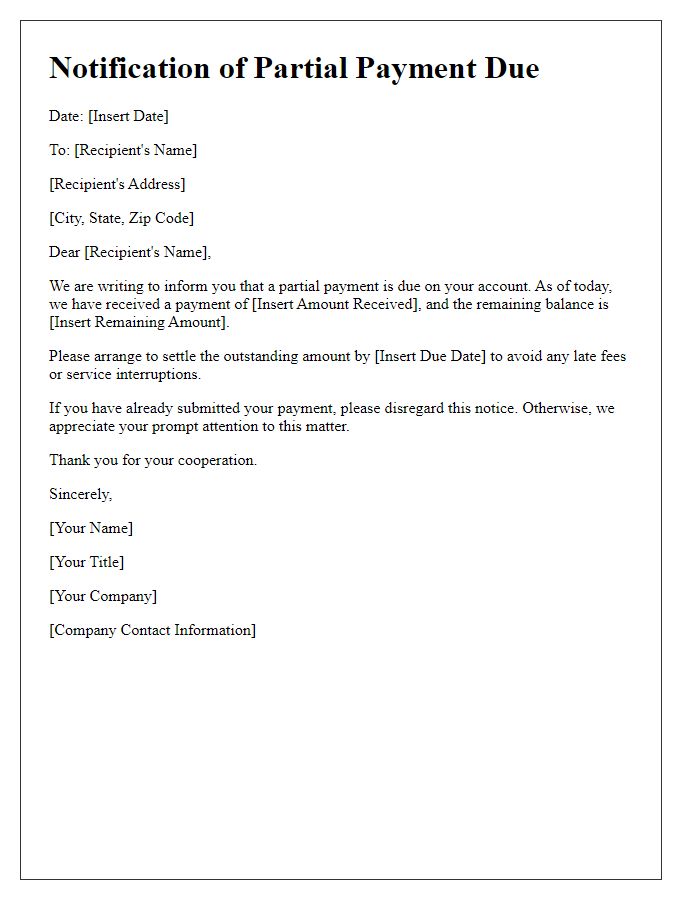

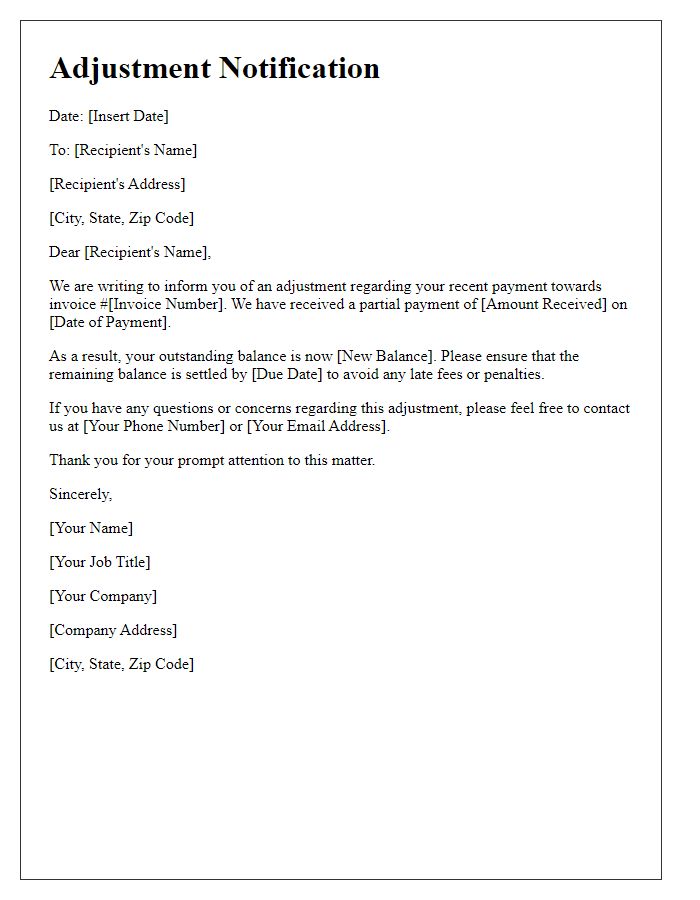

Outstanding Amount

Outstanding amounts from unpaid invoices can significantly impact cash flow for businesses. A partial payment claim often arises when clients, such as corporate entities or government agencies, miss payment deadlines, typically set at 30 days post-invoice issuance. Accruing overdue balances can lead to charges of late fees or interest, often outlined in service agreements. Legal frameworks, like the Fair Debt Collection Practices Act in the United States, govern the recovery process to ensure ethical practices. Businesses may seek resolution through written claims, detailing the specific amounts due, including invoice numbers, dates, and itemized descriptions of services rendered. Proper documentation is essential for accountability and to support potential escalation to collections if necessary.

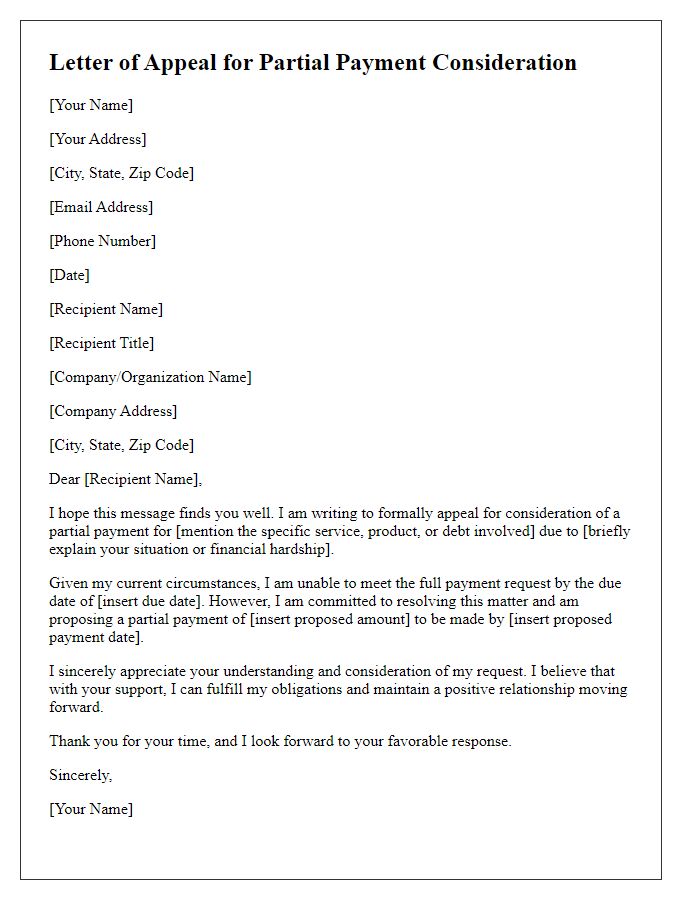

Due Date and Penalties

Partial payment claims often arise in contractual agreements, such as construction projects or service contracts. The due date for payment typically aligns with specific project milestones, often stipulated in the contract. For instance, a contractor may stipulate a due date of 30 days after invoice submission for completed work. Penalties for late payments can vary; common practices include interest fees ranging from 1.5% to 2% per month on overdue amounts, as specified under the terms of the agreement. In some cases, contracts may include stipulations for suspension of work or additional administrative fees if payments remain unpaid beyond a specified grace period, potentially impacting project timelines and relationships. Thorough record-keeping of invoices and associated correspondence is crucial to ensure clarity and enforceability in claims for partial payments.

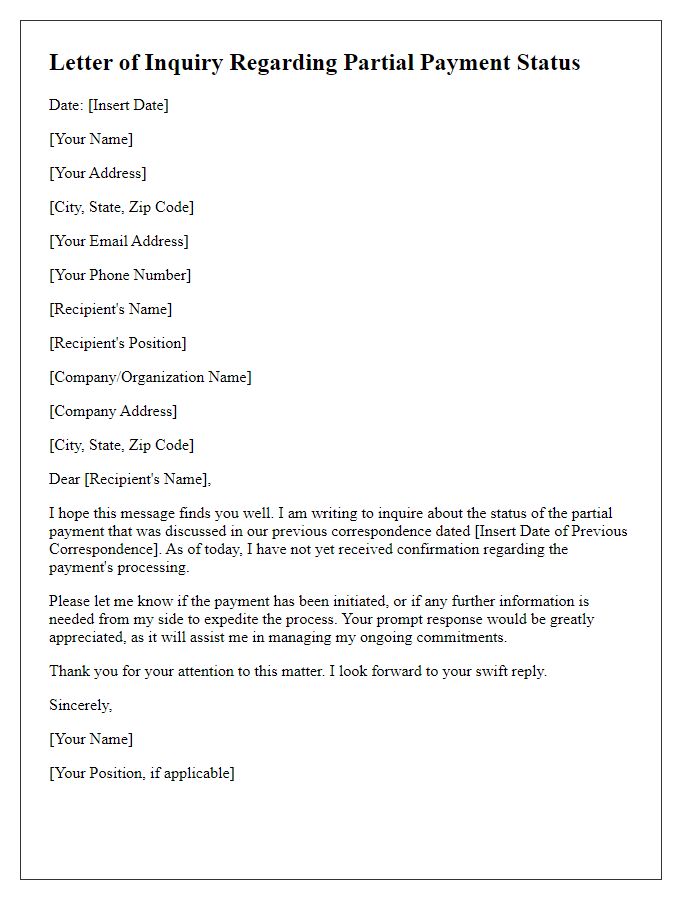

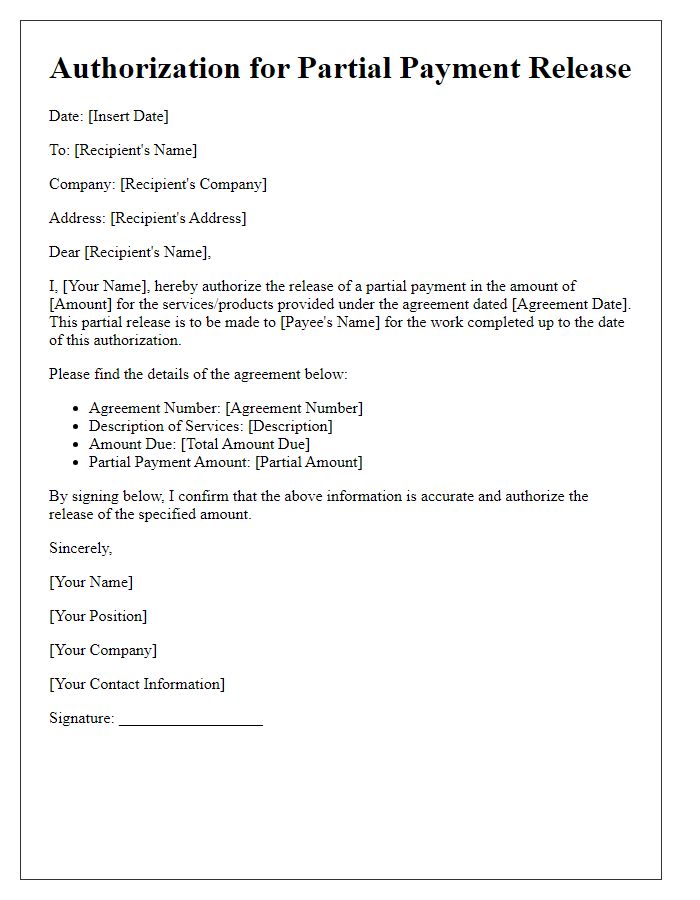

Contact Information

Partial payment claims often arise in construction projects, business transactions, or service agreements. Detailed documentation is essential for clear communication. Include contact information for all parties involved. The claimant's details should contain the full name, phone number, and email address for easy correspondence. The recipient's details must include the business name or individual's name, applicable address, and relevant department (such as Accounts Payable) to direct the claim appropriately. The inclusion of a specific project reference number or invoice number is crucial to facilitate efficient processing. Specify the amount claimed, outstanding balance, and any previous payments made to support the claim. Clear organization of this information simplifies future communication and expedites the resolution process.

Comments