Are you tired of sifting through piles of paperwork just to find your latest account statement? You're not alone! Many people are looking for a simpler way to access their financial information. In this article, we'll share an easy-to-use letter template for requesting your account statement issuanceâso you can streamline your financial management. Join us as we dive into the details!

Client's Personal and Account Information

Account statements serve as critical financial documents that detail a client's banking activity over a specific period. Personal information, including the client's full name and residential address, is essential for identification purposes. The account number, a unique identifier for the client's financial account, plays a crucial role in ensuring the accuracy of the statement. Transaction records encompass deposit amounts, withdrawal figures, fees incurred, and interest earned, displayed in chronological order for transparency. Statement issuance frequency, whether monthly or quarterly, aligns with the financial institution's policies, aimed at keeping clients informed about their financial health. Additionally, relevant dates such as statement start and end dates provide a clear time frame for the detailed activity reported.

Statement Period and Balance Details

Bank account statements provide crucial insights into financial activity during designated periods. The statement period, often spanning one month, details transactions from the first to the last day of that month, offering a comprehensive overview. Account balances, showing the opening balance at the start of the period, all transactions affecting the balance, and the closing balance on the last day, reveal the financial standing. This information is essential for monitoring spending habits and ensuring accurate financial management. Detailed entries include deposits, withdrawals, transfers, fees, and interest accrued, offering transparency and record-keeping benefits for account holders in banks like Chase or Bank of America.

Contact Information for Inquiries

For inquiries regarding account statements, customers can reach out to customer support via phone number 1-800-555-0199. Email correspondence can be directed to support@financialservices.com for assistance with statement requests or clarifications. Online support is available through the official website, including a live chat feature from 9 AM to 6 PM EST, Monday through Friday. For urgent matters, customers are encouraged to utilize the direct messaging option on the social media platforms, such as Twitter @FinServHelp. Such channels ensure a timely response and access to account management resources.

Security and Privacy Notice

The issuance of account statements plays a crucial role in financial transparency for customers of banking institutions, such as JPMorgan Chase. Each statement typically encompasses a detailed summary of transactions, available balance information, and any associated fees incurred during the statement period, often spanning a month. Security measures, including encryption technologies and access controls, are designed to protect sensitive information contained within these documents, ensuring privacy for account holders. These statements may also include a Security and Privacy Notice, a crucial document that outlines the rights of customers regarding their data, including how it may be shared or protected under regulations such as the Gramm-Leach-Bliley Act. Regular monitoring of account statements is recommended for detecting unauthorized transactions, thereby enhancing the overall security of personal financial information.

Instructions for Dispute Resolution

Disputes regarding account statements can arise due to discrepancies in transactions recorded by financial institutions, such as banks and credit unions. When a customer identifies an issue, prompt action is essential. Begin the dispute resolution process by gathering all relevant documents, including account statements, transaction receipts, and any correspondence related to the disputed item. The customer should clearly outline the nature of the dispute, referencing specific transaction dates, amounts, and any supporting evidence to substantiate their claim. Submission of this information should be directed to the designated customer service department, which often includes contact details in monthly statements. Many institutions also offer online portals for faster resolution. It's crucial to adhere to any specified timelines, often within 30 days, to ensure the dispute is addressed adequately. Following proper procedures can lead to effective resolution and, if necessary, escalate the issue through formal channels as outlined by the institution's policies.

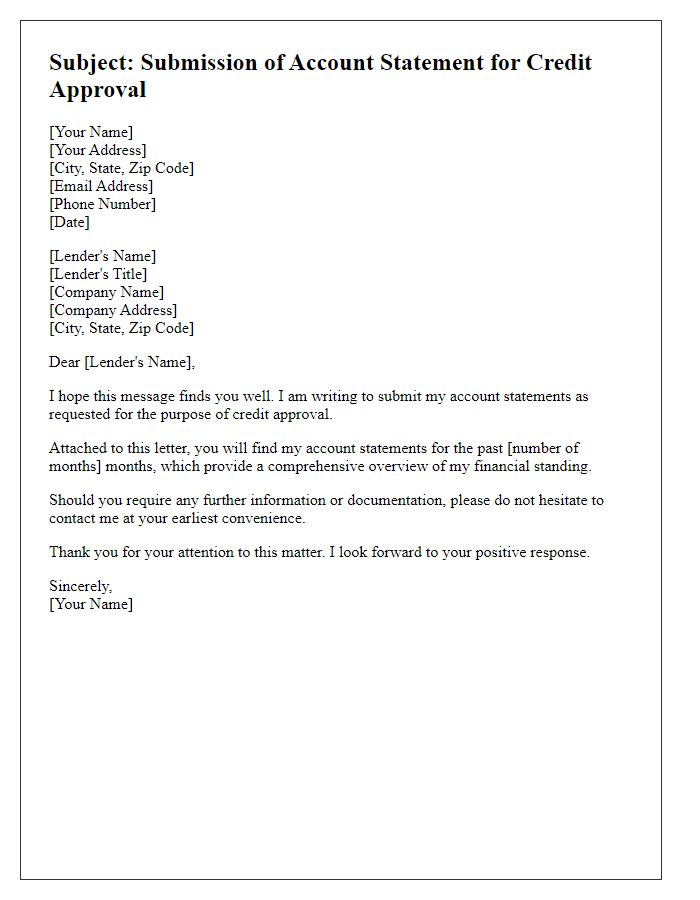

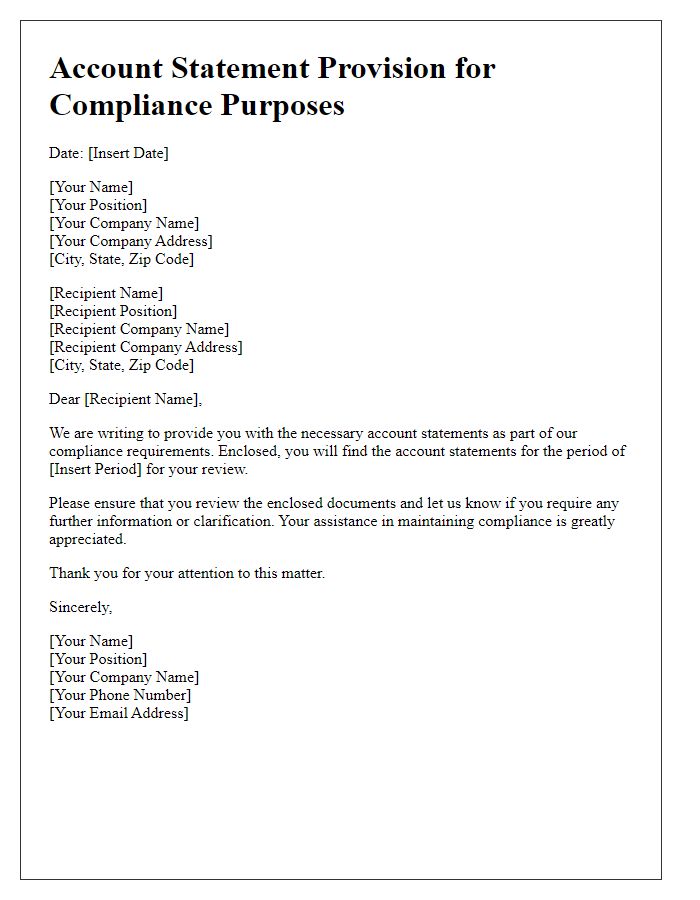

Letter Template For Account Statement Issuance Samples

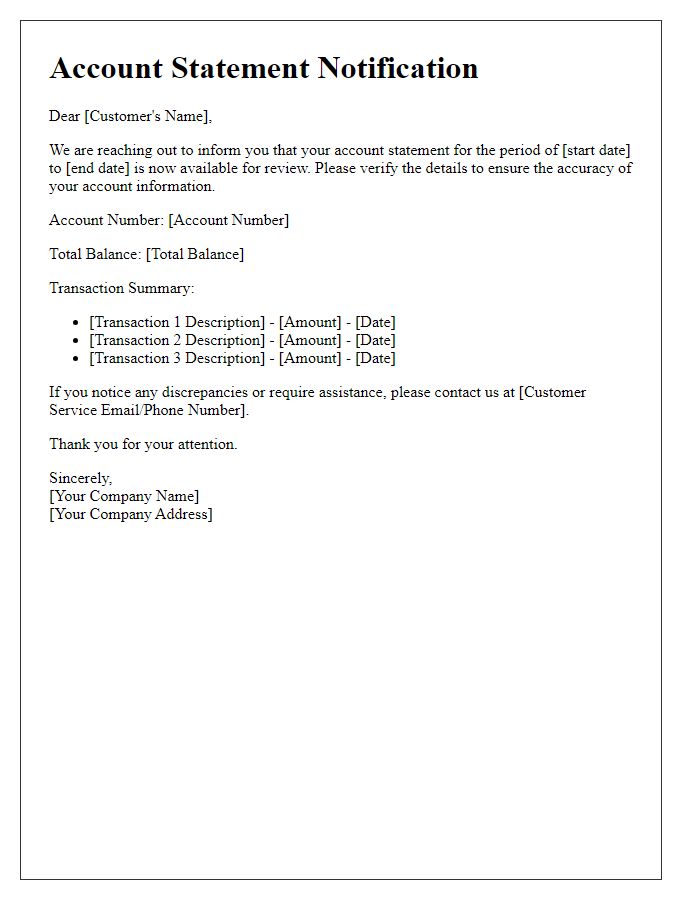

Letter template of account statement notification for account verification

Comments