Writing an income verification letter for loan approval may seem daunting, but it's all about being clear and concise. This document plays a crucial role in demonstrating your financial stability to lenders, making it essential to include accurate details about your income. By following a simple template, you can ensure that all necessary information is presented effectively, paving the way for a smoother loan approval process. Curious to learn how to craft the perfect income verification letter? Just read on!

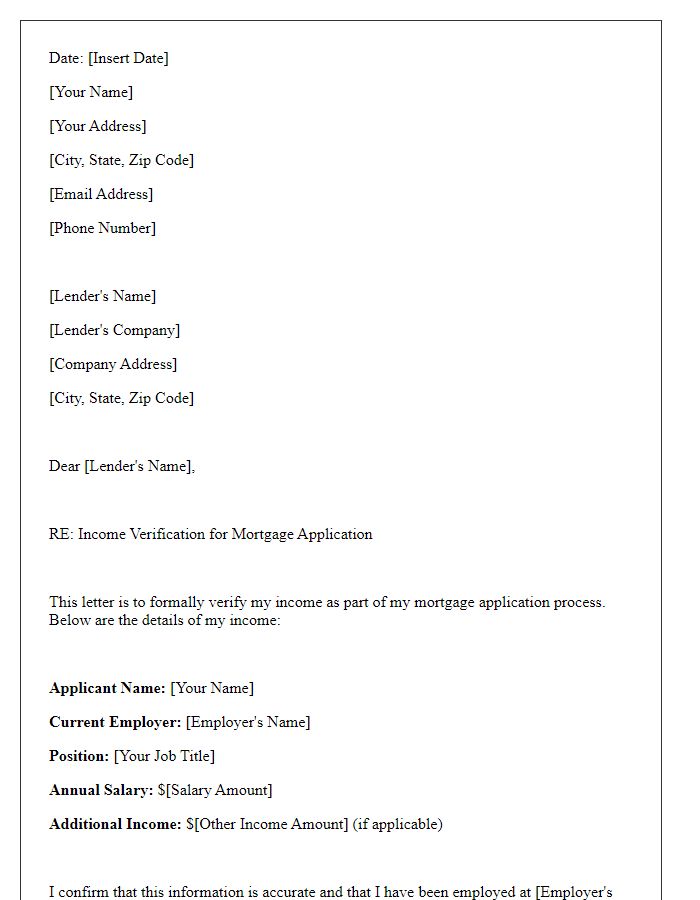

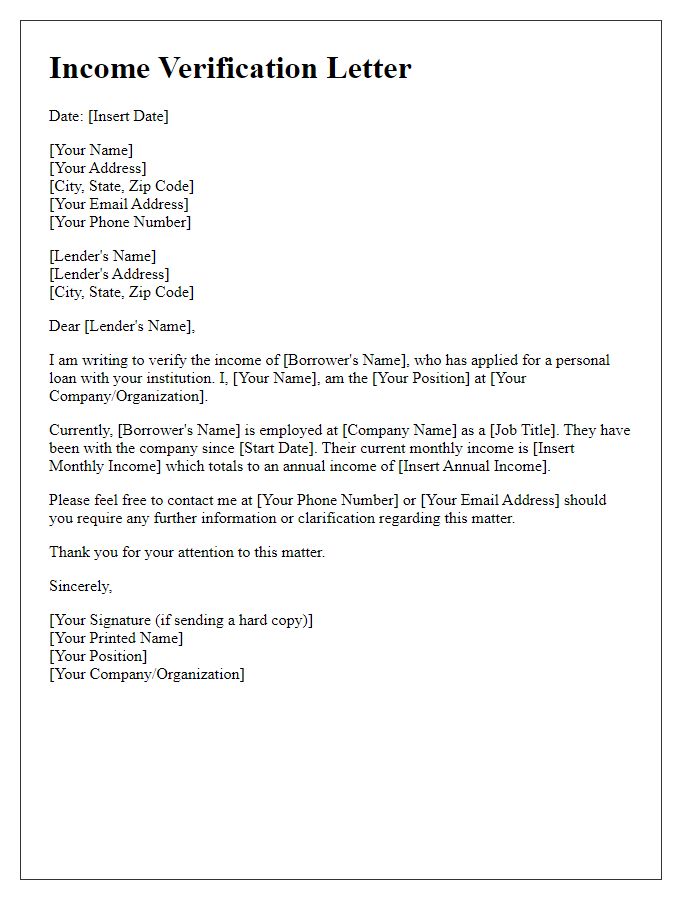

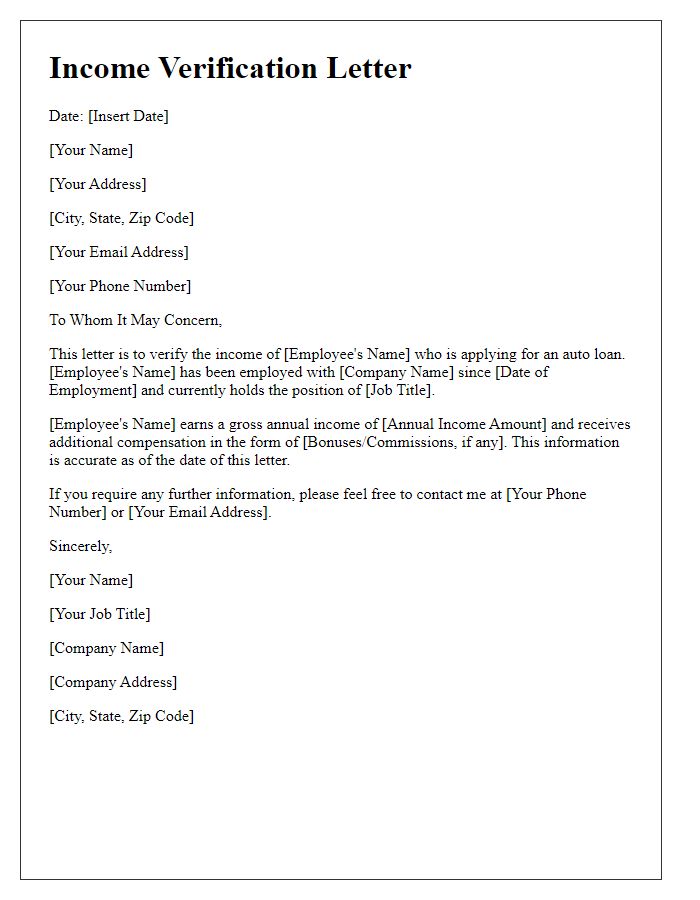

Applicant's personal identification details

An income verification for loan approval critically involves the applicant's personal identification details including full name, social security number, date of birth, and current residential address. Full name helps establish identity, while social security number serves as a unique identifier for financial records. Date of birth verifies age eligibility and is crucial for assessing credit history through agencies. Current residential address, typically listed with street name, city, and zip code, is essential for determining stability and eligibility for loan services. Accuracy in this information not only expedites the verification process but also enhances the credibility of the applicant's financial profile.

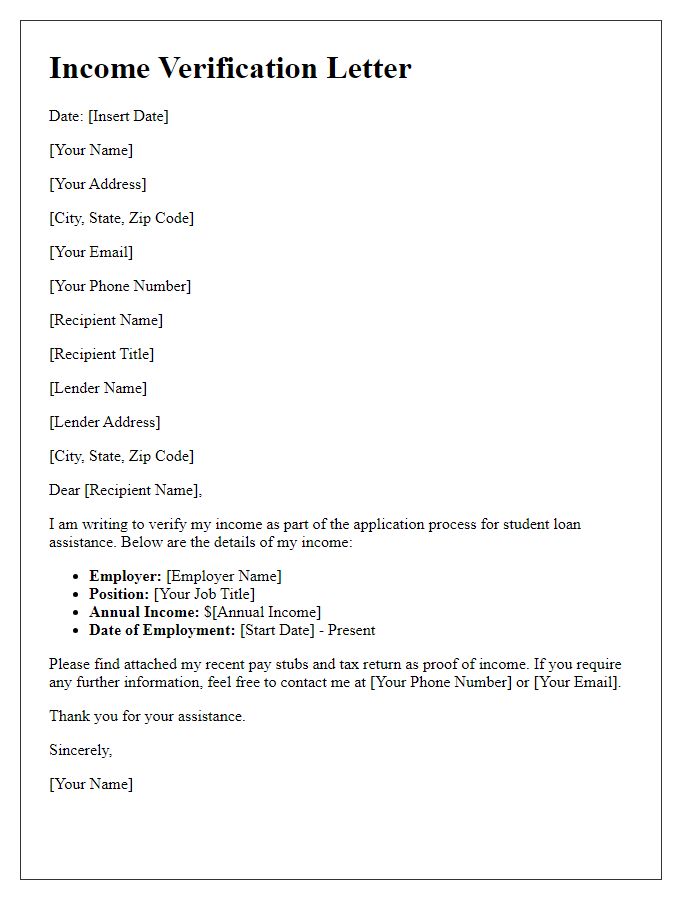

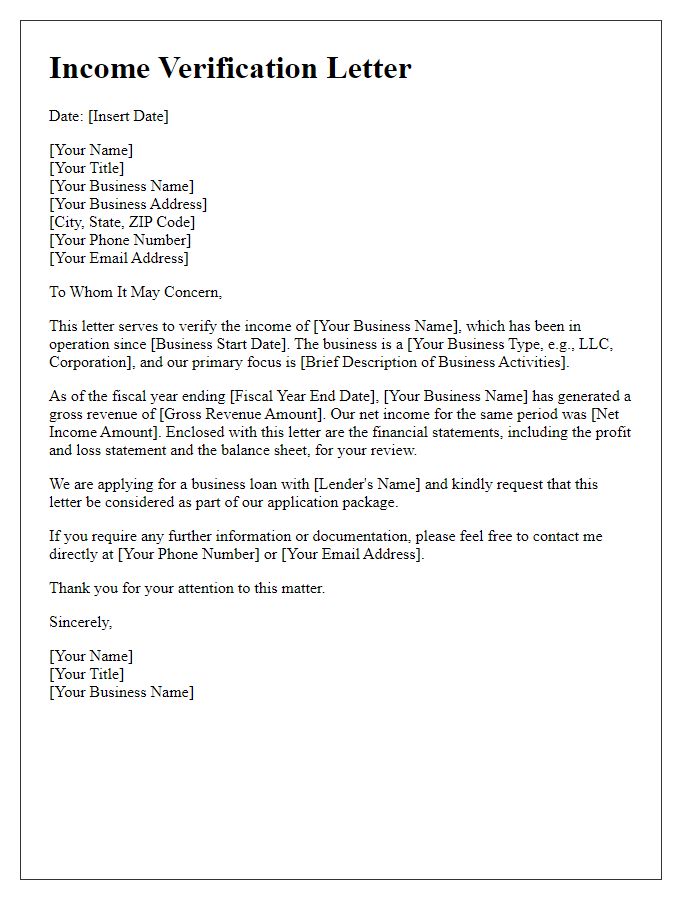

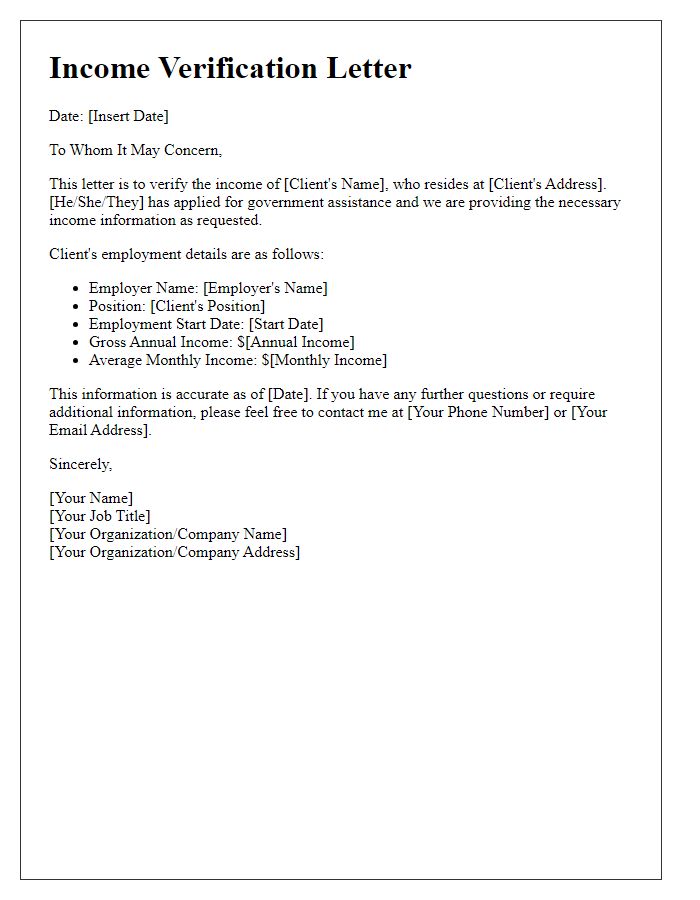

Employment verification and income source

Income verification plays a crucial role in securing loan approval, with lenders requiring detailed employment verification and reliable income sources. For instance, verification of employment typically involves confirmation from an employer, detailing position, duration, and salary. This process may require pay stubs, W-2 forms, or tax returns from the previous year to substantiate income claims. Moreover, lenders may seek to establish the consistency of income, especially for self-employed individuals, requiring profit and loss statements or bank statements. Other essential aspects encompass additional income sources, such as rental income or investment dividends, which can be necessary for assessing total financial stability. Accurate and thorough documentation can significantly impact the success of the loan approval process.

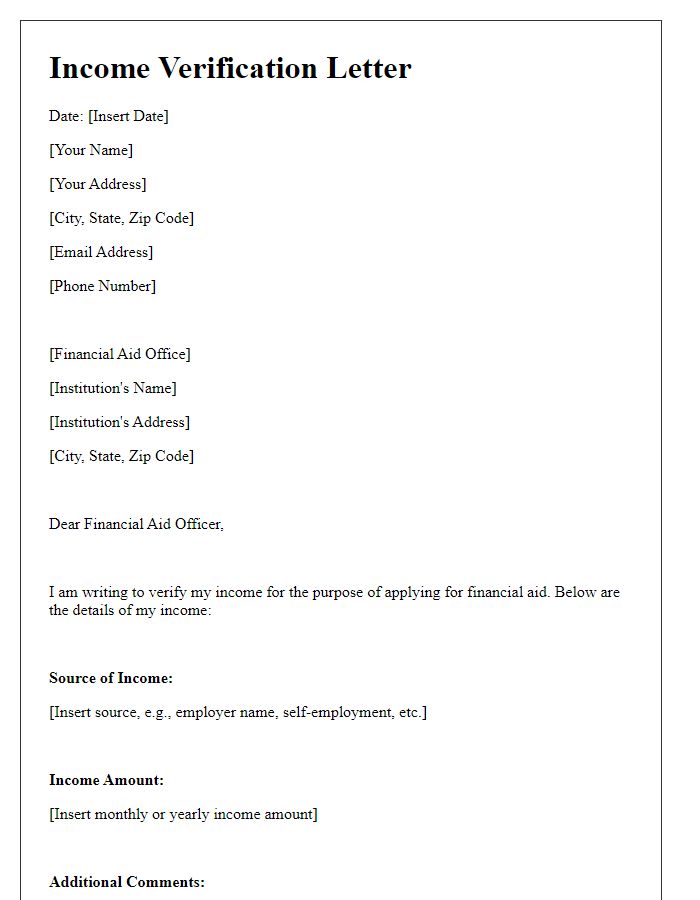

Income amount and frequency

Income verification for loan approval is a critical process for lenders assessing borrower eligibility. Common income types include salaries, hourly wages, and bonuses, which can vary in frequency such as weekly, bi-weekly, or monthly. For example, a borrower may report a monthly income of $5,000 from a full-time job at a tech firm located in Silicon Valley, California. Additional income sources may include rental income from properties in New York City yielding $2,000 monthly or freelance income fluctuating between $1,500 to $3,000 based on project availability. Accurate documentation reflecting this income, such as pay stubs, tax returns, or bank statements, is essential to provide a clear financial picture to the lender and facilitate timely loan processing.

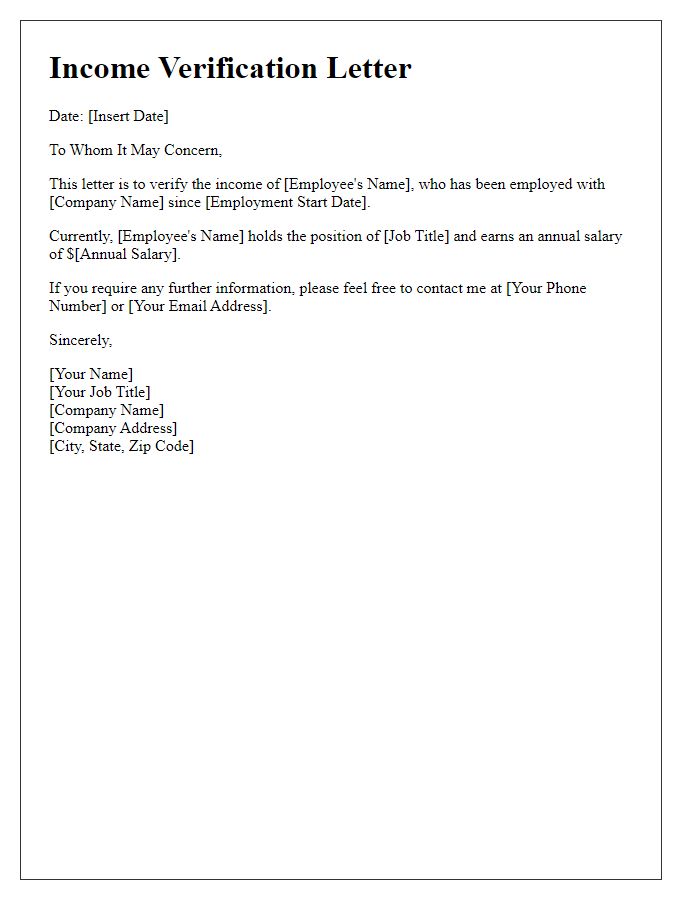

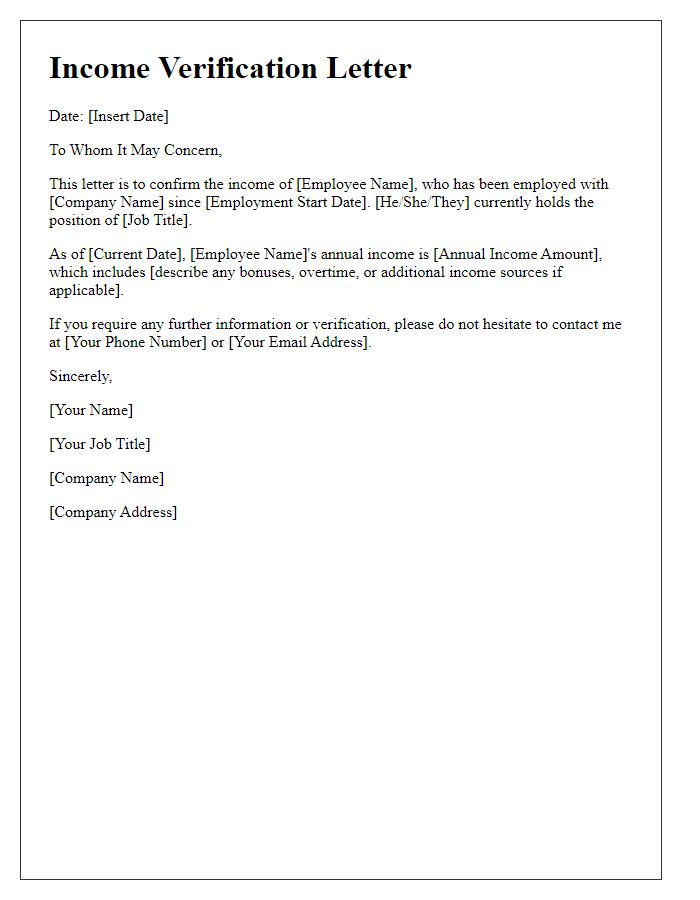

Employer's contact information

Submitting income verification is crucial for loan approval processes. Detailed information about the employer's contact information enhances verification accuracy. Key elements include the employer's name, such as XYZ Corporation, which represents the company's official identity. The corporate address, typically formatted like 123 Business Rd, Cityville, ST 12345, helps verify the physical location. A designated contact person, such as John Smith, ensures direct communication for inquiries, while a phone number, like (123) 456-7890, facilitates immediate contact. Additionally, a professional email address, for example, john.smith@xyzcorp.com, allows for documentation requests and follow-ups, streamlining the verification process and contributing to a smoother loan application.

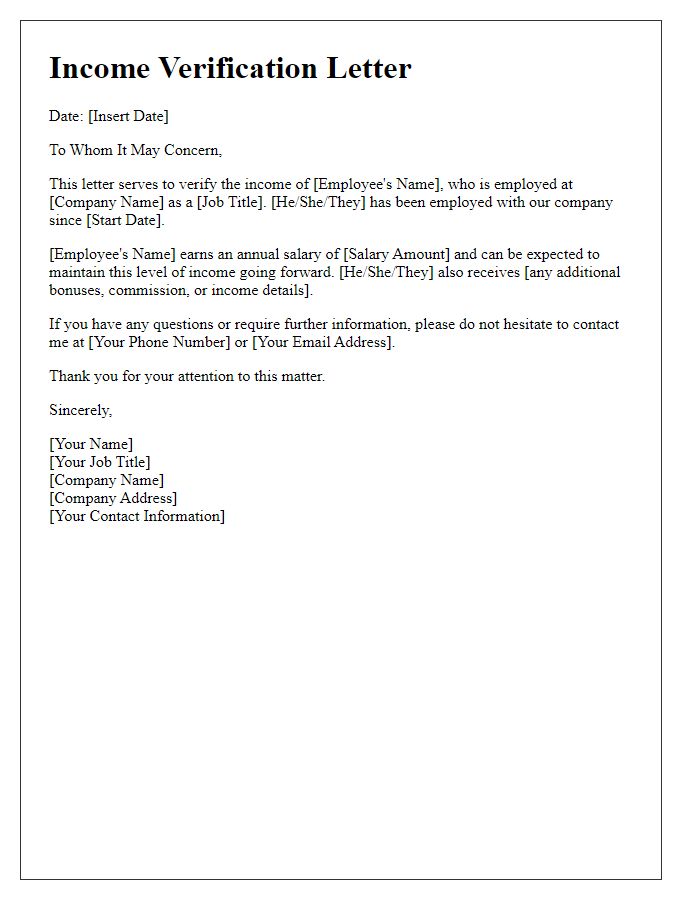

Signature and date verification

Income verification for loan approval is a critical process used by financial institutions, such as banks and credit unions, to assess a borrower's financial stability. This verification often requires documentation, including pay stubs or W-2 forms, to validate the borrower's income, which can range from full-time salaries to freelance earnings. A signature, typically indicating the borrower's consent to review their financial information, serves as an essential element in this documentation. The date of this signature is equally important to ensure the information is current and complies with the lender's guidelines. The approval process may also involve third-party verification services, which evaluate the authenticity of the income information provided. Ultimately, all these components work together to foster trust and mitigate risk in lending transactions.

Comments