Are you ready to take the final step towards securing your dream car? The excitement of owning a new vehicle is just a few signatures away, and our streamlined car loan finalization process ensures everything is easy and straightforward. Our dedicated team is here to guide you through each requirement, making sure you get the best financing option available. So, buckle up and read on to discover how to complete your car loan and hit the road in style!

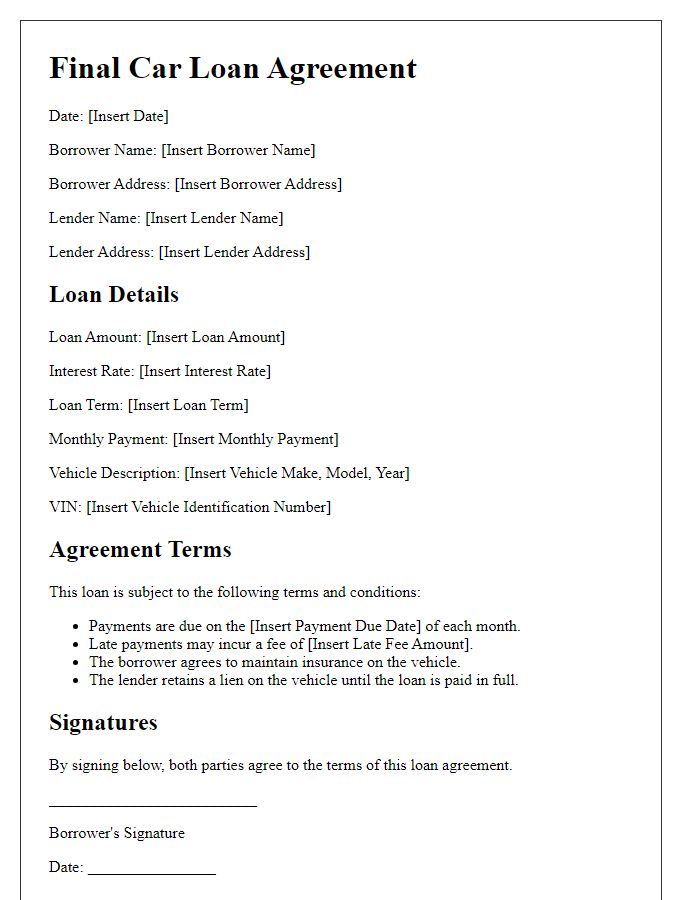

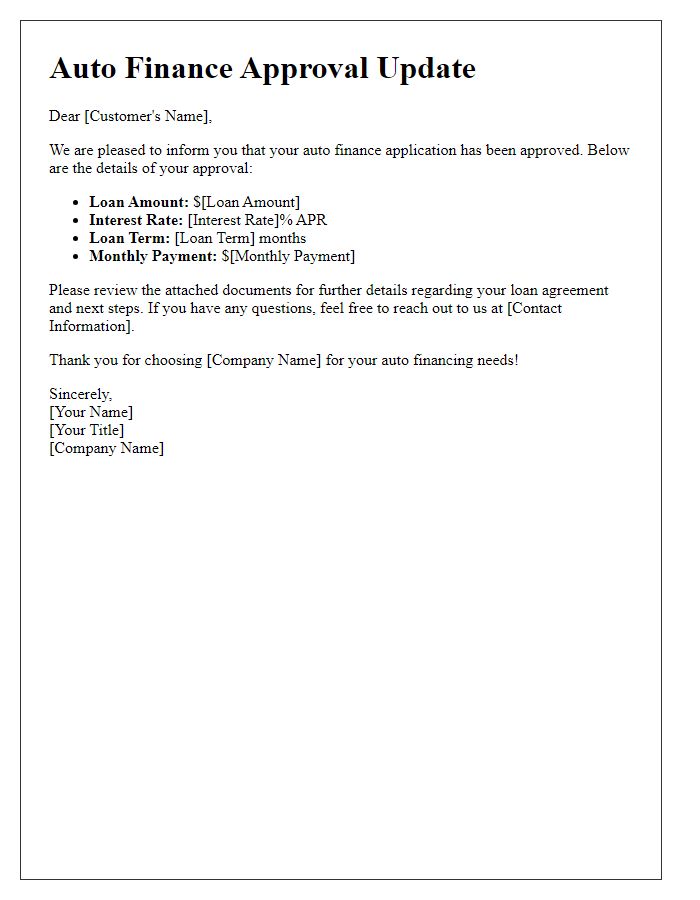

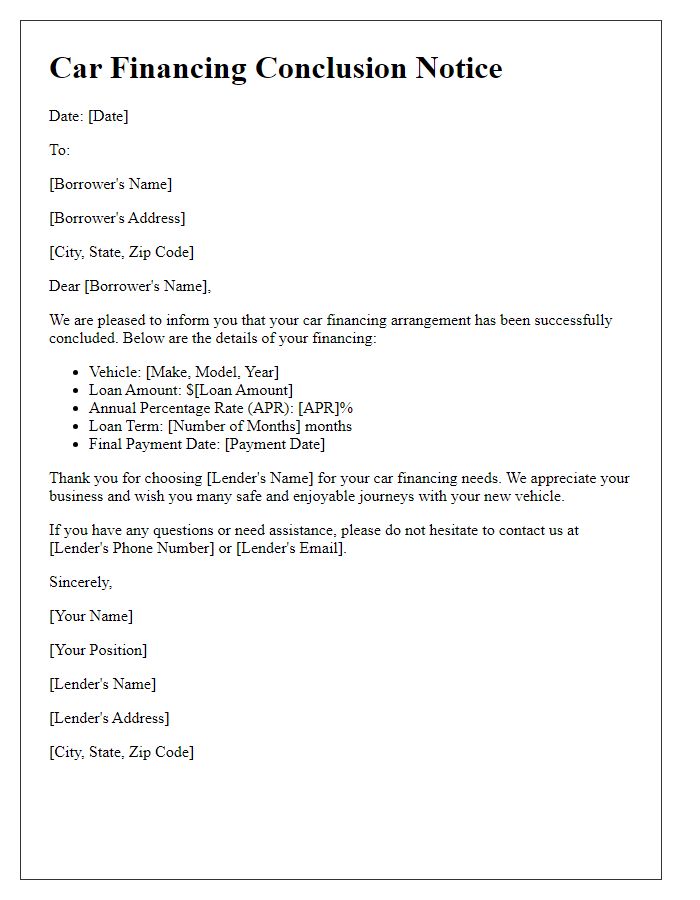

Loan identification details

The car loan finalization notice includes critical loan identification details such as Loan Account Number, which uniquely distinguishes your agreement from others within the financial institution, the Borrower Identification Number linked to your credit profile, and the Loan Amount, specifying the total amount financed for your vehicle purchase. Interest Rate, essential for understanding your repayment obligations, alongside the Loan Term, indicating the duration of the loan typically ranging from 36 to 72 months, are crucial components. Additionally, the notice may reference the Vehicle Identification Number (VIN), ensuring accuracy in identifying the specific car associated with the loan agreement, and the Start Date of the loan period, marking the beginning of your financial commitment. Finally, it may include the Lender's Name and contact details for any inquiries or clarifications regarding the loan agreement.

Borrower's information

The car loan finalization notice contains crucial details regarding the borrower's information, which includes the full name of the borrower, address (including street, city, state, and ZIP code), contact number, and email address. The notice specifies the loan amount approved, such as $25,000 for purchasing a new vehicle, as well as the interest rate, typically ranging between 3.5% to 7.5%, depending on creditworthiness. Key dates are highlighted, including the loan origination date and the first payment due date. Additionally, the notice outlines the loan term, which may vary, commonly 36, 48, or 60 months, and mentions any required insurance coverage, emphasizing the need for comprehensive and collision coverage. The notice also includes any pertinent terms and conditions associated with the loan agreement, ensuring the borrower is fully informed before the finalization process.

Payment terms and schedule

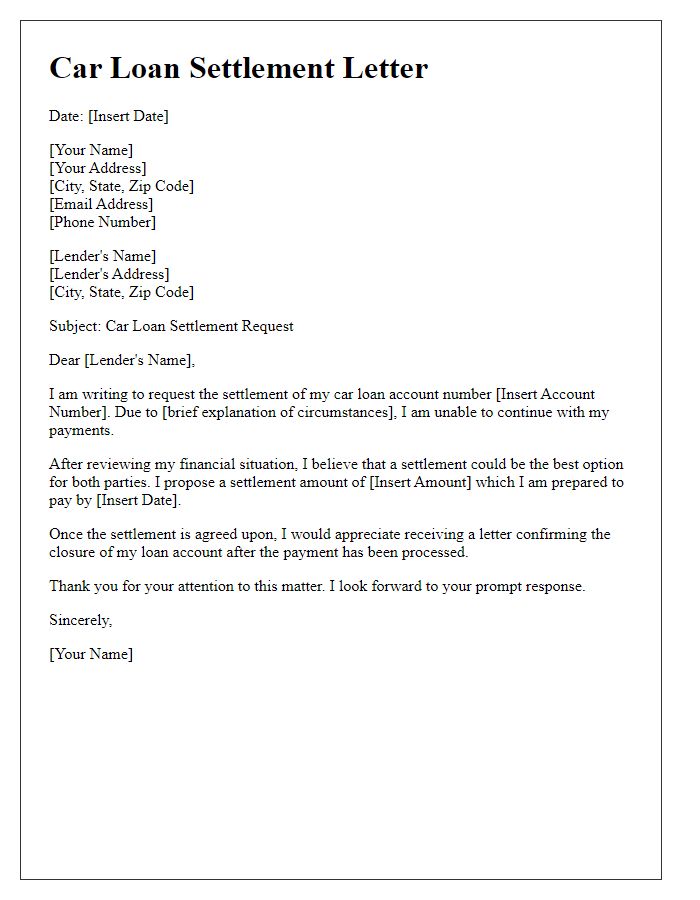

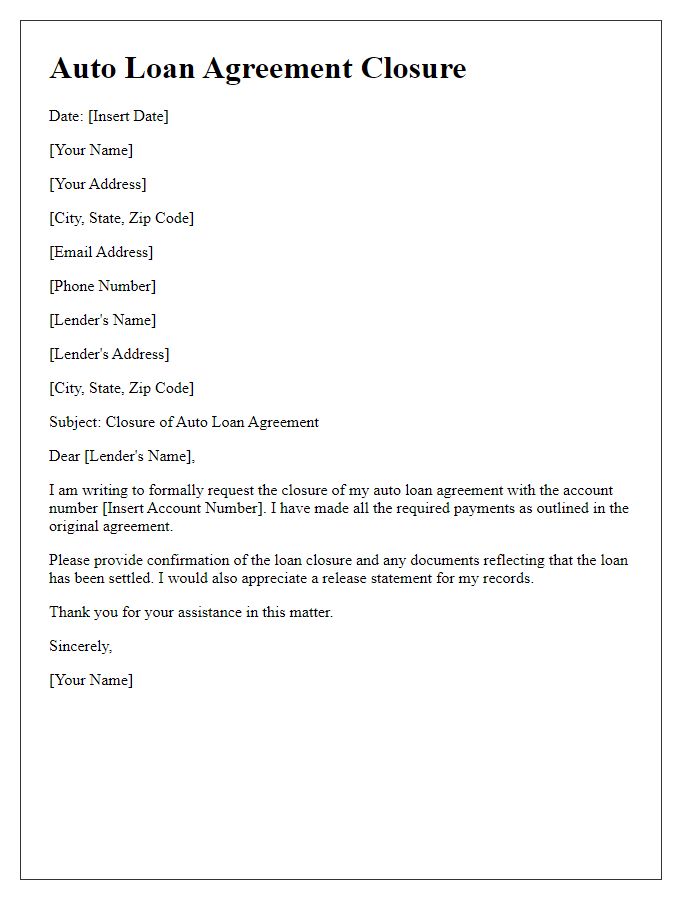

Car loan finalization notices outline payment specifics regarding financing agreements for automobile purchases. The loan amount typically ranges, for example, between $15,000 and $40,000, depending on the vehicle's price and buyer's creditworthiness. Standard payment terms often span 36 to 72 months, with monthly installments calculated based on the interest rate, which can vary from 3% to 10%, depending on the lender. Borrowers should verify their due dates, usually occurring on the same date each month, like the 15th, to ensure timely payments and avoid late fees. It's crucial to understand the total cost of the loan, including the Principal and Interest, which can be highlighted in amortization schedules. Additionally, penalties for early repayment or missed payments should be clearly outlined to inform the borrower of any financial implications.

Penalty and interest clauses

A car loan finalization notice outlines important details regarding the loan agreement for purchasing an automobile. It includes penalty and interest clauses that specify conditions under which additional charges may apply. Late payment penalties can accrue at a daily rate following a grace period of typically 10 to 15 days, depending on the lender's policy. Interest rates, which may be fixed or variable, can affect the total amount payable over the loan term, often stated as annual percentage rate (APR). The notice emphasizes the importance of timely payments to avoid financial consequences and maintain a positive credit score. Failure to adhere to these terms can lead to consequential actions such as repossession of the vehicle.

Contact information for queries

Finalization of car loan agreements often requires clear communication for any queries related to the loan process. Contact information, usually provided by financial institutions or car dealerships, includes critical details such as phone numbers, email addresses, and physical addresses. For instance, a customer service hotline may be available 24/7 at a toll-free number, typically formatted as 1-800-XXX-XXXX, offering assistance on specific loan terms or document requirements. Additionally, an email address, such as support@financialinstitution.com, allows clients to send queries at their convenience, ensuring a written record of communication. Physical locations, like the main office situated in downtown Detroit, Michigan, can provide in-person support for more complex concerns. Furthermore, operating hours, generally Monday through Friday from 9 AM to 5 PM, indicate the times when direct assistance can be obtained.

Comments