If you've recently received a letter denying your application for an unsecured loan, you might be feeling a mix of confusion and frustration. It's not uncommon to wonder what went wrong in the evaluation process, especially when the intentions behind borrowing are genuine. Understanding the reasons for the denial can be beneficial as you navigate your financial options moving forward. To help clarify this situation and provide guidance, we invite you to read further on how you can strengthen your future loan applications and explore alternative solutions.

Clear explanation of denial reason.

Unsecured loan applications are often denied due to various reasons, including poor credit history or insufficient income. A low credit score (typically below 620) raises concerns for lenders about repayment ability. Inadequate income might not meet the lender's debt-to-income ratio requirements, often set at 40% or less. Additionally, a lack of employment stability, such as frequent job changes or gaps in employment, can signal financial insecurity. High existing debt levels can also contribute to denial as lenders assess the borrower's current liabilities against potential loan amounts. Understanding these factors can help applicants improve their profiles for future loan requests.

Reference to application details.

An unsecured loan application denial can stem from various factors, impacting both the applicant's financial stability and loan provider policies. In instances where an individual applies for an unsecured loan through a lending institution, such as a bank or credit union, key details such as credit score (typically ranging from 300 to 850), income verification documents, and debt-to-income ratio are crucial in the assessment process. For example, an annual income below $30,000 or a debt-to-income ratio exceeding 40% may trigger denial. Additionally, if the applicant has multiple recent hard inquiries on their credit report, this can raise red flags regarding financial behavior. Furthermore, lending institutions often use specific internal criteria to gauge risk, which can change due to market conditions or regulatory requirements, influencing the decision despite an applicant's effort to meet necessary qualifications.

Positive tone with future options.

Unsecured loans often serve as essential financial solutions for individuals needing immediate funds. A recurring reason for denial is insufficient credit history, impacting one's ability to secure approval for loans from institutions like banks or credit unions. Income instability, shown by inconsistent employment patterns or fluctuating wages, can also influence lenders' decisions, creating hurdles for aspiring borrowers. Alternative measures, such as credit counseling services in local areas or peer-to-peer lending platforms, may offer viable avenues for future financial support. Exploring secured loan options (collateral-backed loans) can provide more favorable approval chances. It is crucial to maintain an open dialogue with financial institutions to understand specific criteria and improve future loan applications.

Contact information for queries.

An unsecured loan application denial can lead to various queries from applicants. Contact information provided for queries must be clear and accessible. Include phone numbers, such as a dedicated customer service hotline (for example, 1-800-123-4567) available Monday to Friday from 9 AM to 5 PM Eastern Time. Additionally, an email address (such as support@lendername.com) can facilitate written questions. Information about further assistance through a contact form on the lender's website (e.g., www.lendername.com/contact) should be mentioned for comprehensive support. Providing an address for physical correspondence, like the lender's main office located at 123 Loan St, Suite 100, Cityville, State 12345, can also enhance trust and transparency.

Encouragement for future applications.

An unsecured loan application denial can feel discouraging, especially after investing time and effort into the process. Financial institutions often evaluate various factors, such as credit score (with optimal scores typically above 700), income stability (minimum of two years in the same job), and existing debt-to-income ratios (preferably below 36%). Although this specific application was not approved, potential borrowers should remember that many lending opportunities exist. Improving credit history, addressing outstanding debts, and ensuring a stable employment record can enhance future applications. Institutions often provide feedback on denied applications, which can guide applicants in making necessary adjustments. By taking these proactive steps, applicants can position themselves more favorably for succeeding applications in the future.

Letter Template For Unsecured Loan Application Denial Samples

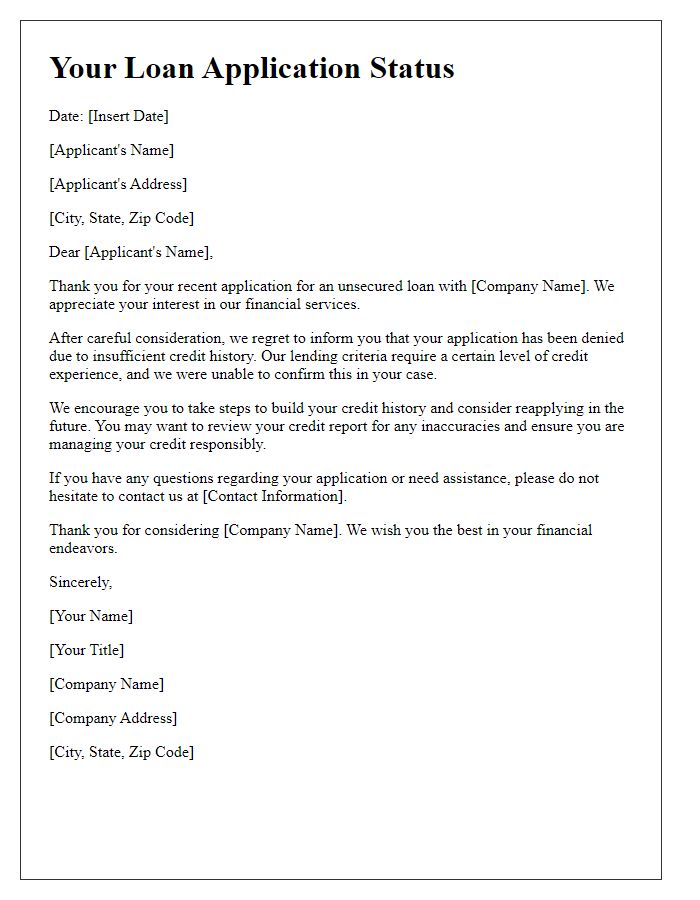

Letter template of unsecured loan application denial for insufficient credit history.

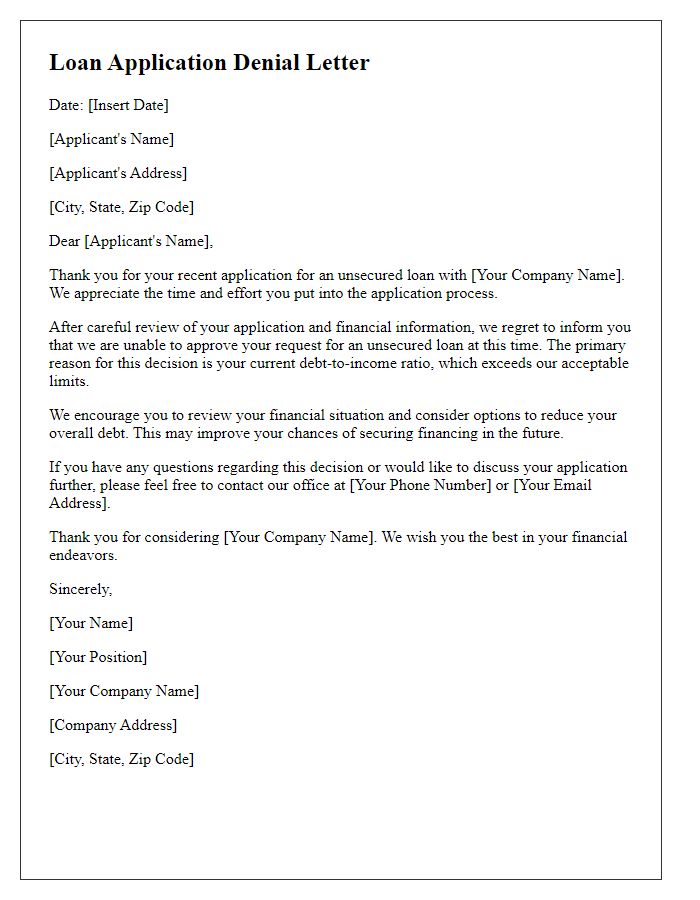

Letter template of unsecured loan application denial due to high debt-to-income ratio.

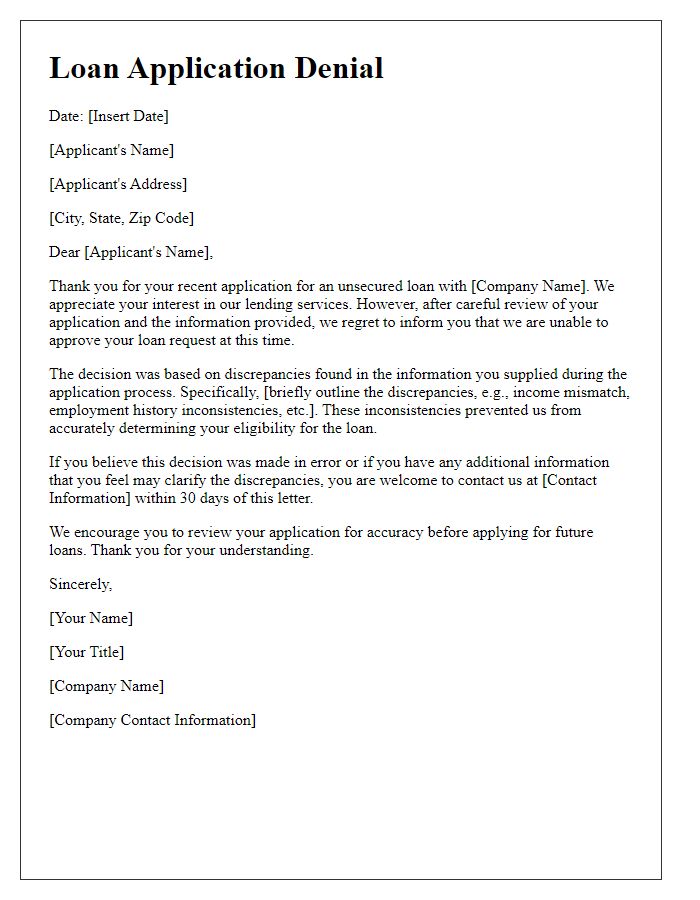

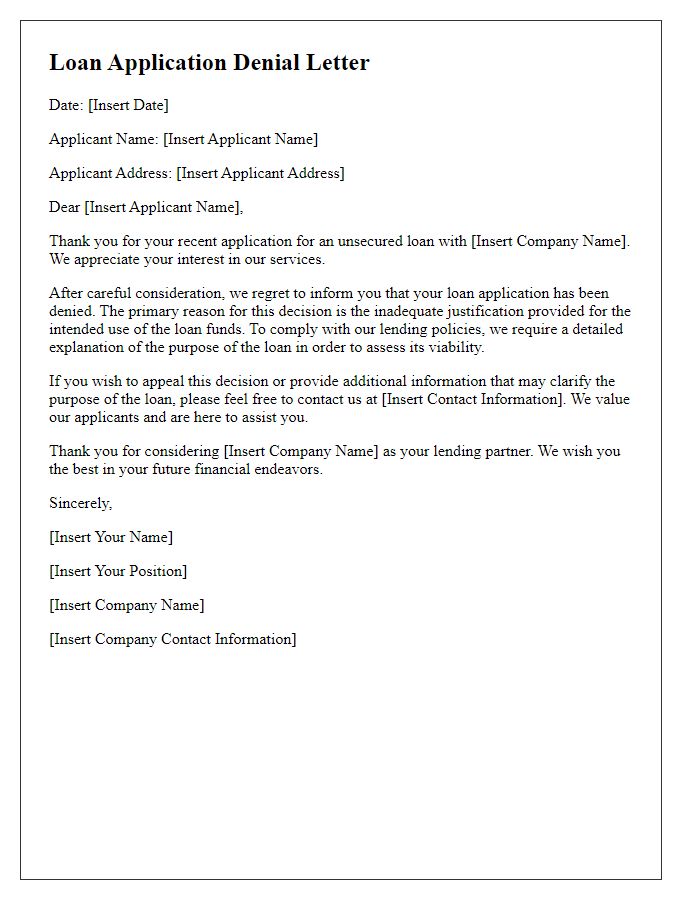

Letter template of unsecured loan application denial for discrepancies in provided information.

Letter template of unsecured loan application denial based on poor credit score.

Letter template of unsecured loan application denial due to lack of collateral.

Letter template of unsecured loan application denial for unverified income sources.

Letter template of unsecured loan application denial related to recent bankruptcy.

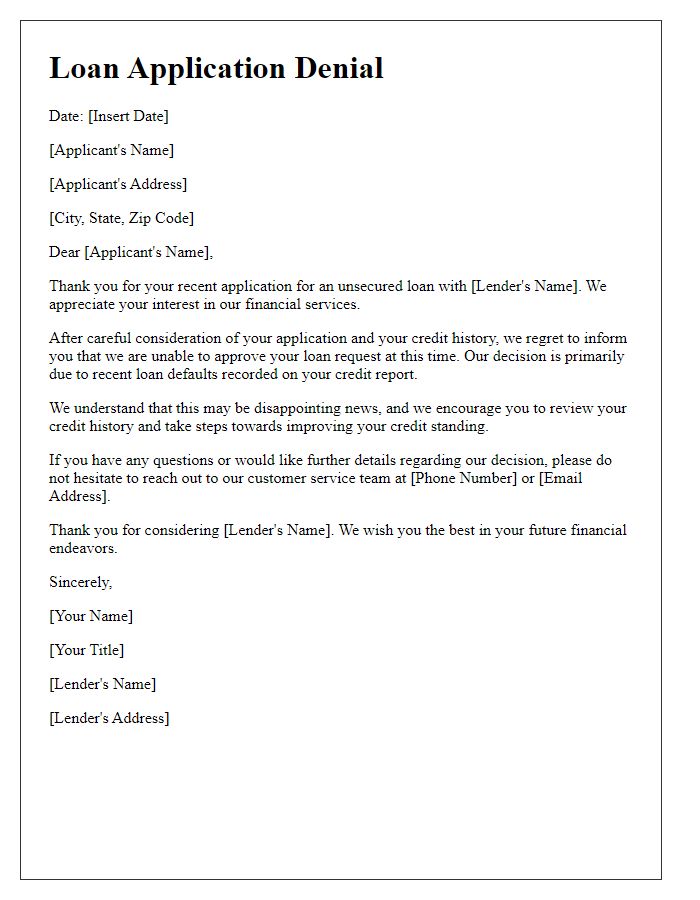

Letter template of unsecured loan application denial because of recent loan defaults.

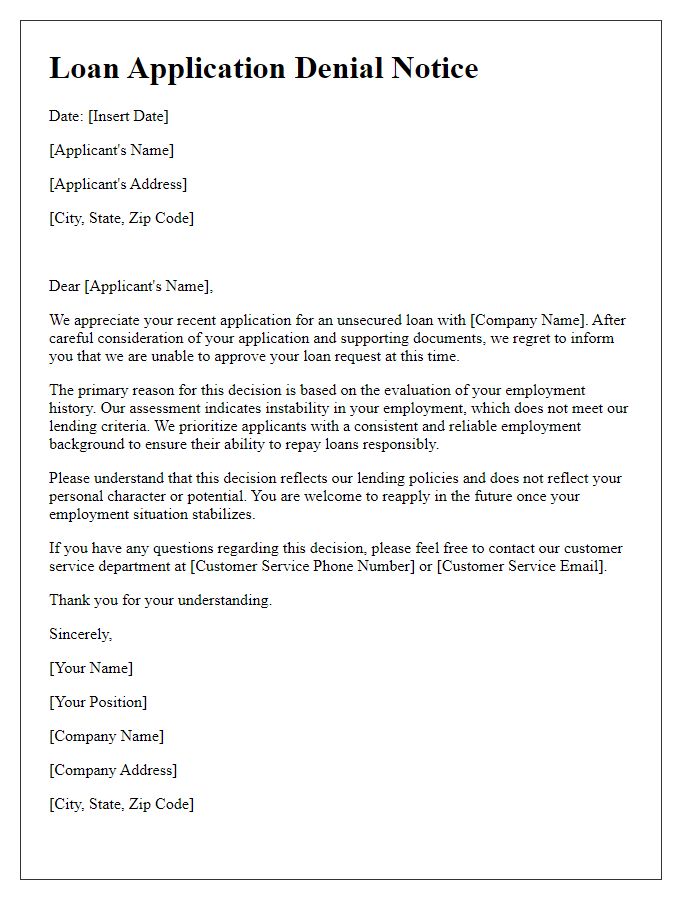

Letter template of unsecured loan application denial stemming from employment instability.

Comments