Are you navigating the puzzling world of loan applications? We've all been there, anxiously awaiting a response after hitting âsend' on those crucial documents. Understanding the significance of a loan application acknowledgment letter can help ease those nerves and clarify the next steps in your journey. So, let's dive into what this essential correspondence entails and how it can benefit youâread on to discover more!

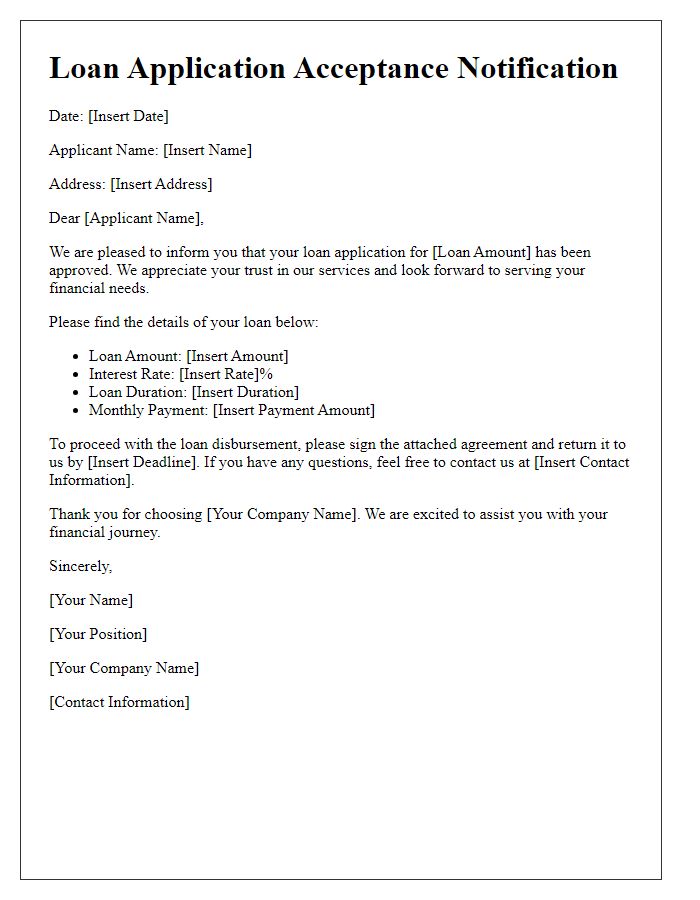

Applicant's Contact Information

A comprehensive loan application acknowledgment should include the applicant's contact information, such as full name, address, phone number, and email. This information is crucial for facilitating communication throughout the loan processing period. For example, a home mortgage applicant named Jessica Thompson may reside at 123 Maple Street, Springfield, IL 62701. Jessica's phone number could be (555) 123-4567, and her email may be jessica.thompson@email.com. Accurate contact details enable loan officers to reach out promptly regarding application status, required documents, or further clarifications during the review process.

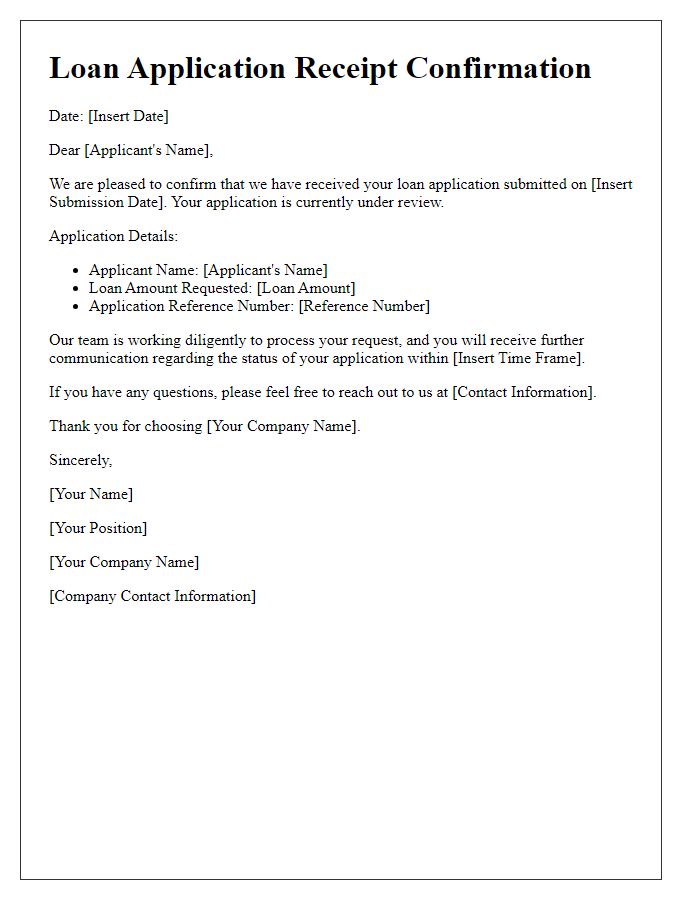

Loan Application Reference Number

The acknowledgment of a loan application is a crucial step in the borrowing process, providing customers with confirmation of their submission. Upon receipt of the Loan Application Reference Number, typically a unique alphanumeric code assigned by the lender's system, applicants can track the status of their request. The reference number serves as a key identifier for communication, ensuring all inquiries regarding the loan application are accurately associated with the specific request. Additionally, details such as the loan amount applied for, the type of loan (personal, mortgage, or auto), and the borrower's personal information are relevant in this context, streamlining the review process and fostering efficient correspondence between the borrower and the financial institution.

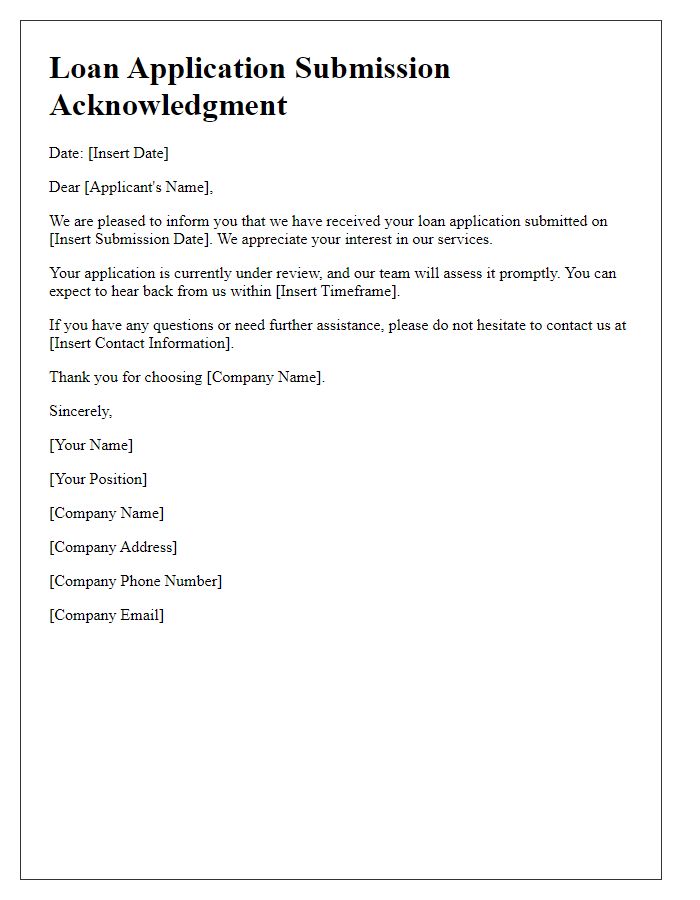

Date of Receipt

The acknowledgment of a loan application serves as an official confirmation to the applicant, typically involving crucial information such as the date of receipt (often within 24 hours), the applicant's name, and the type of loan requested (e.g., personal loan, mortgage). It can also mention next steps in the approval process, approximate timelines, and the loan officer's contact details for any queries. This document plays a significant role in the loan process, providing reassurance and clarity to applicants navigating potentially complex financial transactions.

Acknowledgment Statement

Acknowledgment of loan application is a crucial step in the financing process. Upon submission of a loan application, financial institutions such as banks and credit unions typically provide a formal acknowledgment statement to the applicant. This statement confirms receipt of the application and outlines key details including the application date, loan amount requested (e.g., $25,000 for a personal loan), and the type of loan (secured or unsecured). The acknowledgment may also indicate a timeframe for processing, usually 5 to 10 business days, and request additional documentation if necessary. This communication fosters transparency between the applicant and the lender, laying the groundwork for further evaluation and approval processes.

Next Steps and Contact Details

Acknowledging the receipt of a loan application is a crucial step in the lending process. Following submission, applicants can expect communication regarding next steps, which typically include processing times (usually between 5 to 10 business days), necessary documentation uploads (such as proof of income, identification, and credit history), and potential interviews or questions. For any inquiries or clarification during this period, applicants can reach out to the loan officer directly via the provided contact details, including phone number (e.g., +1-800-555-0199) and email address (e.g., support@bankname.com). It remains essential to stay updated on application status through the lender's online portal, where notifications will reflect progress or further requirements.

Comments