Are you considering taking over a mortgage loan? A mortgage loan assumption can be a great solution, allowing you to step into someone else's mortgage under specific conditions. This process not only can save you money on closing costs, but it can also provide you with the benefit of a potentially lower interest rate. If this option piques your interest, join us as we explore the ins and outs of a mortgage loan assumption request!

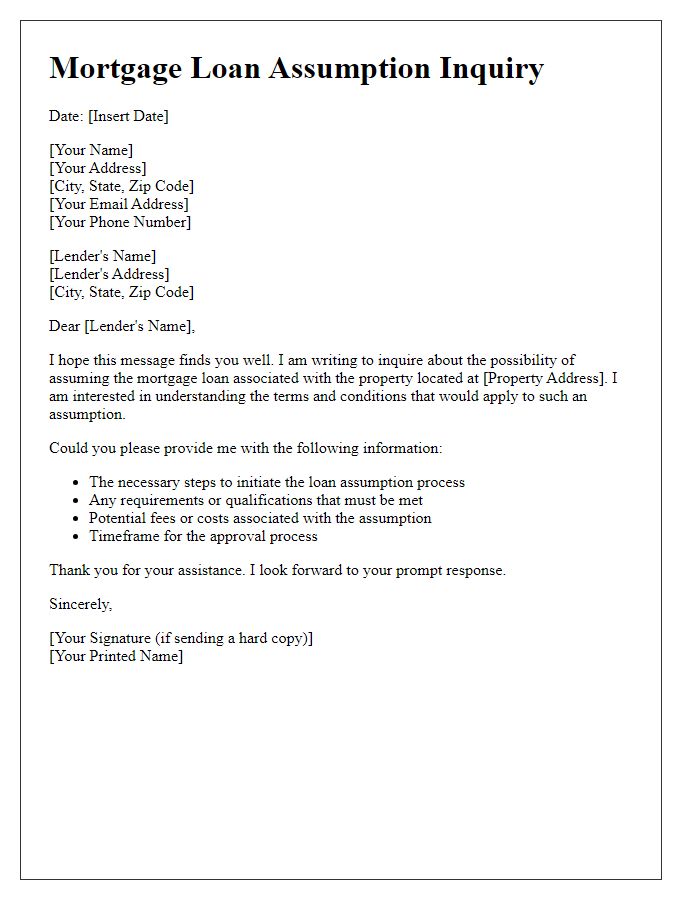

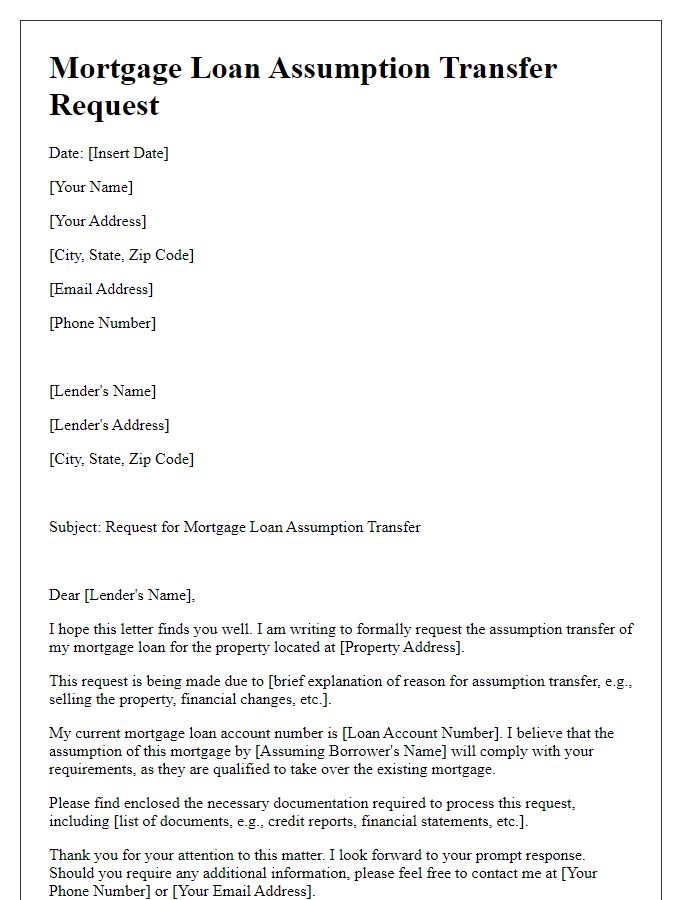

Borrower's Personal Information

When considering a mortgage loan assumption request, it is crucial to provide comprehensive personal information about the borrower. This includes full names (with middle initials), date of birth (formatted as MM/DD/YYYY), Social Security numbers, current residential address (including city, state, and zip code), and contact information (such as phone numbers and email addresses). Additionally, financial details should cover annual income, employment history (including company names and durations), and existing liabilities (such as credit card debts or other loans). Thorough documentation enhances the processing of the mortgage assumption request, promoting a smoother transition and evaluation by the lending institution.

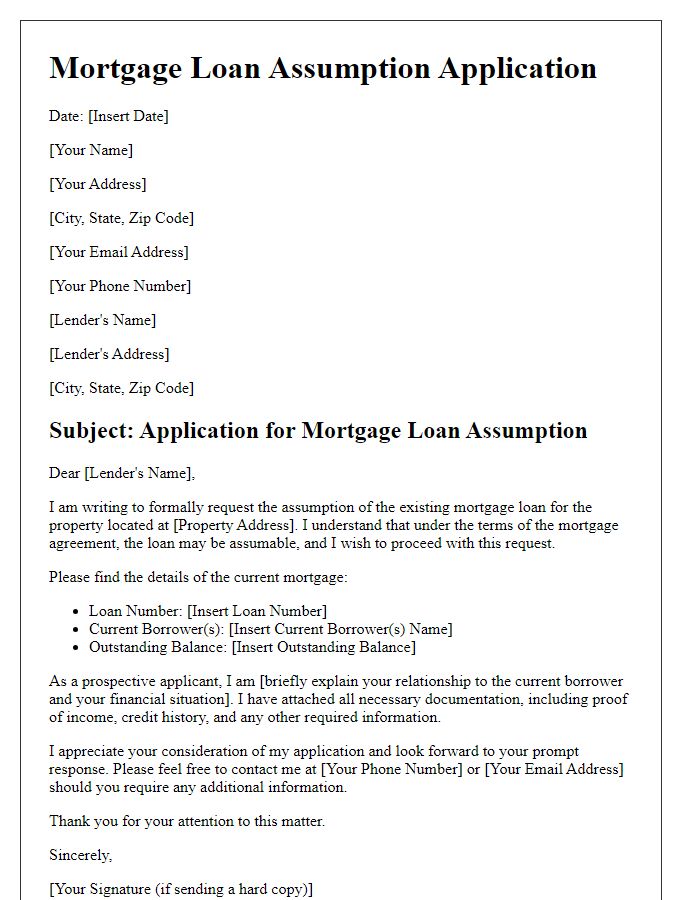

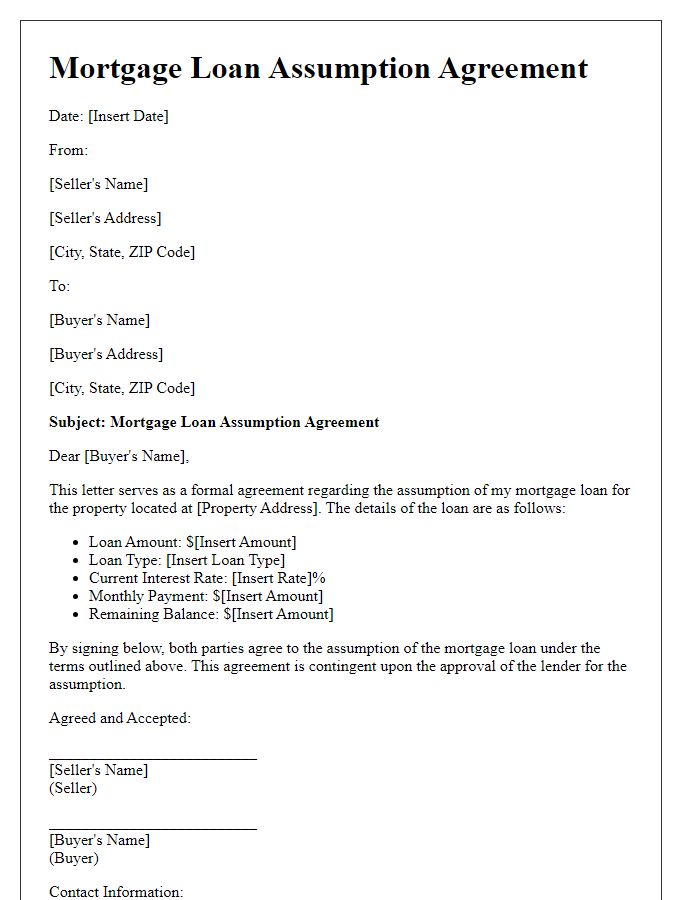

Property Details

The mortgage loan assumption request involves the property located at 123 Main Street, Springfield, with a market value of $350,000. This property features three bedrooms, two bathrooms, and an expansive backyard, spanning approximately 0.25 acres. The current mortgage balance stands at $250,000, with an interest rate of 3.5%, secured with Lender ABC since January 2020. The payment history indicates consistent monthly payments of $1,200 made on time. The request aims to assume the mortgage terms under the current lender's guidelines while ensuring that all obligations are maintained throughout the process.

Loan Account Information

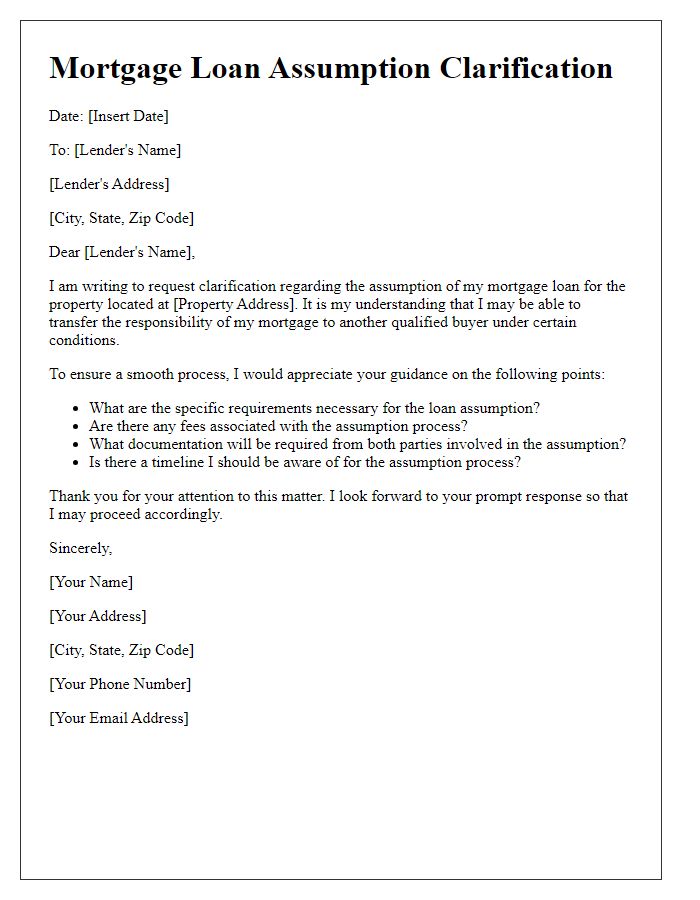

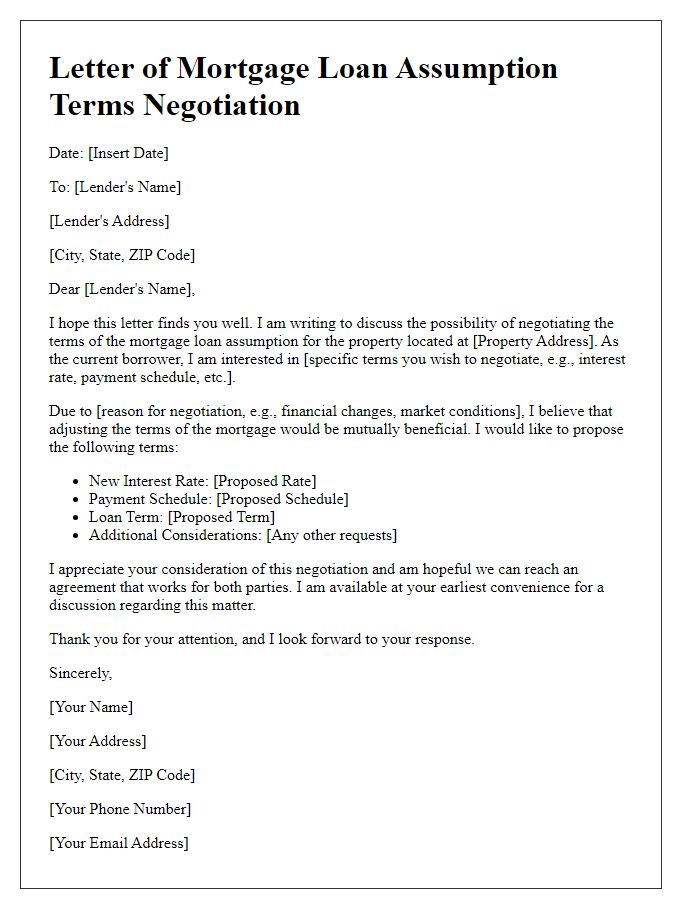

A mortgage loan assumption request involves transferring the responsibility of a mortgage from the original borrower to a new borrower. This process can be crucial for buyers interested in taking over existing loans, especially in situations where interest rates may have changed since the original loan was issued. Key details include the Loan Account Information, such as the loan number (typically a unique 10 to 15-digit identifier), the original loan balance (often a substantial amount, varying by property value and loan terms), and the name of the lender, which can significantly influence the approval process. Borrowers must also be aware of associated fees, due diligence requirements, and potentially the creditworthiness of the new borrower, as lenders often conduct credit checks before approving an assumption. This detailed financial assessment can affect rates and terms of the mortgage agreement moving forward.

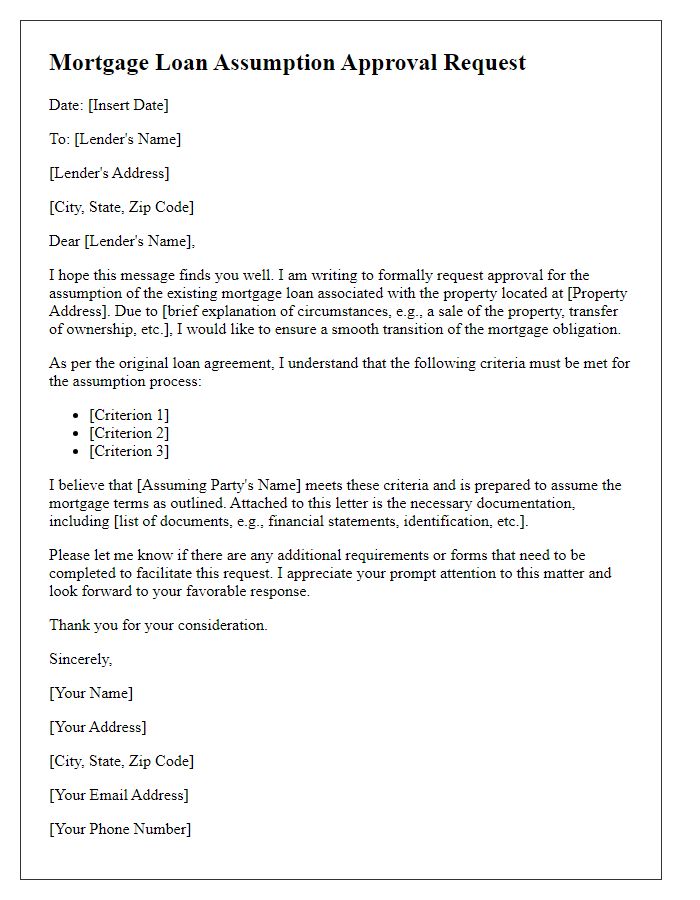

Reason for Assumption Request

When a borrower submits a mortgage loan assumption request, clarity regarding the reason for the request is paramount. A common reason often cited is the transfer of property ownership, typically due to personal circumstances such as divorce or inheritance. In instances of divorce, one party may wish to assume the mortgage to retain ownership of the family home, navigating legal obligations and ensuring financial stability. In cases of inheritance, heirs may request an assumption to maintain property continuity, honoring the deceased's wishes while managing shared family assets. Additionally, buyers may seek mortgage assumption to access potentially favorable terms, especially if the existing mortgage carries a lower interest rate than current market rates. This strategic move can influence long-term financial planning and investment strategies.

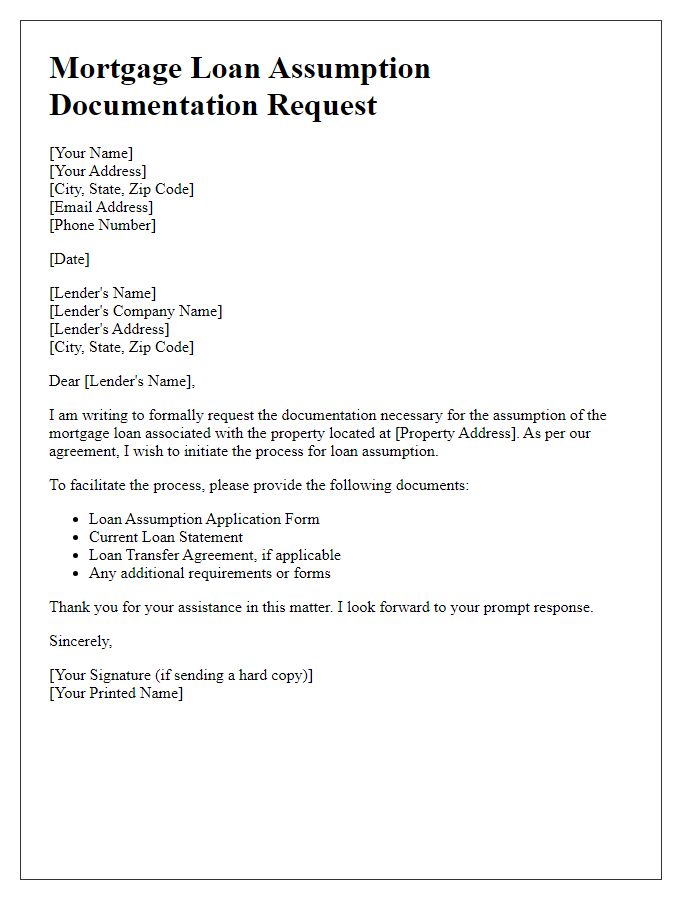

Supporting Documentation

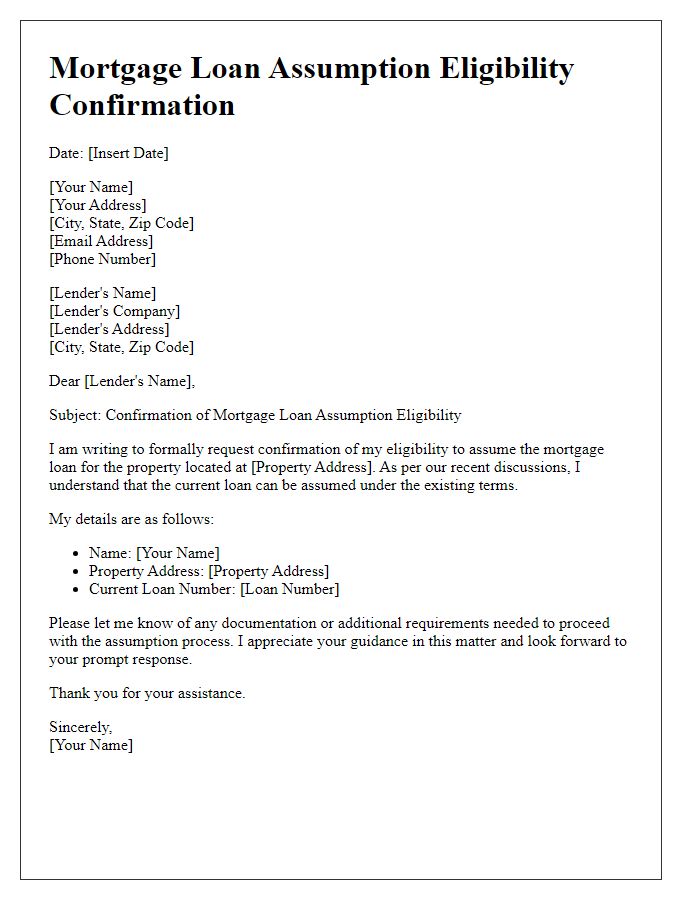

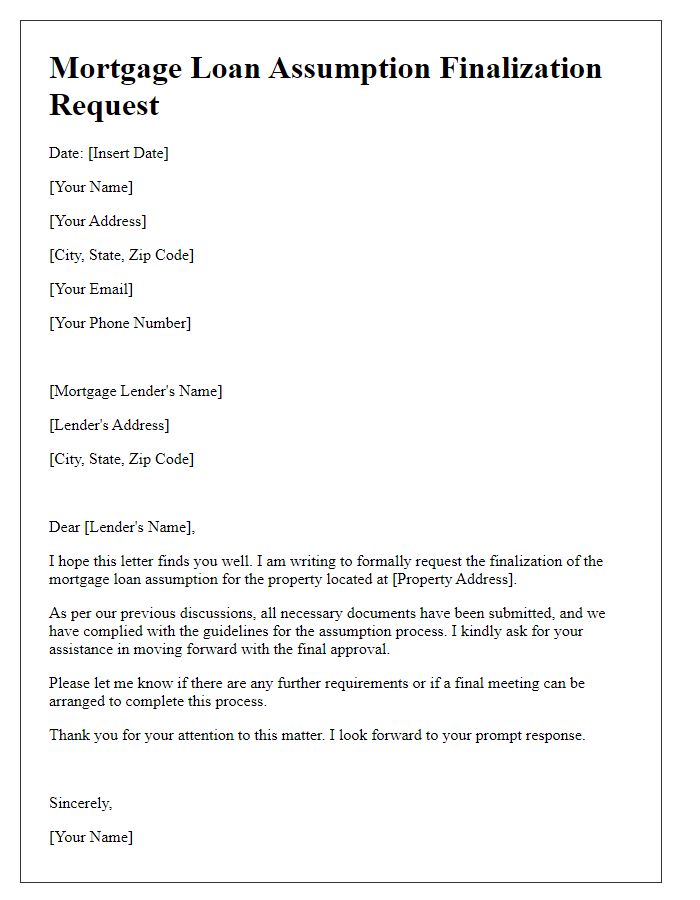

A mortgage loan assumption request requires specific supporting documentation to validate the borrower's eligibility. Key documents include the original mortgage agreement detailing loan terms from the lender, such as interest rates and payment schedules. Income verification supporting the borrower's financial stability encompasses recent pay stubs, tax returns from the previous two years, and bank statements reflecting current assets. The borrower's credit report, showing credit score and outstanding debts, is essential for assessing risk. Additionally, a purchase agreement for the property, specifying transfer details, is necessary. Documentation must also include a formal letter address to the lender, articulating the request for assumption and any relevant personal information such as address and loan number. Collectively, these documents facilitate a thorough review of the assumption request.

Comments