As you embark on your journey to secure a bridging loan, understanding the nuances of the application process can make a world of difference. Feedback on your application is not just a formality; it's a crucial step that can empower you to address any concerns that might be standing in your way. By taking the time to review this feedback, you can fine-tune your approach and enhance your chances of success. So, let's dive deeper into how you can turn this feedback into a powerful tool for your financial futureâread on for more insights!

Clarity and Specificity

Bridging loans serve as short-term financing solutions, typically used in real estate transactions to bridge the gap between purchasing a new property and selling an existing one. These loans often range from PS25,000 to PS5 million, depending on the lender and the borrower's financial situation. Borrowers usually pay higher interest rates (often between 0.5% to 2% per month) compared to traditional mortgages, given the reduced time frame for repayment, usually 6 to 12 months. Lenders assess factors such as loan-to-value (LTV) ratios, the property's marketability, and the borrower's creditworthiness. Clarity in application documents, including comprehensive financial statements and detailed property appraisals, is vital to expedite the approval process and ensure effective communication between all parties involved. Specificity in outlining the intended use of funds further enhances understanding and improves the likelihood of successful loan acquisition.

Professional Tone

The application process for a bridging loan typically involves a thorough assessment of financial viability and property value. Financial institutions evaluate the applicant's current financial situation, including income levels, existing debts, and credit history. Properties considered for bridging loans, such as residential homes, commercial buildings, or land, must meet specific criteria to justify the loan amount. Generally, lenders require an agreement on terms outlined in the loan offer, including interest rates, repayment period, and any potential fees. Timeliness in responding to feedback is crucial, as delays can impact overall financing strategies and property transactions, specifically within markets like London or other competitive real estate areas.

Borrower's Financial Details

Bridging loans serve as temporary financial solutions, ideally for individuals or businesses needing quick access to capital. Borrower's financial details, such as income, debt-to-income ratio, and credit score, play a critical role in determining the viability of the loan application. For instance, a strong credit score above 700 may increase approval chances with lenders like Shawbrook Bank or United Trust Bank. Additionally, a monthly income exceeding PS3,000, combined with manageable existing debts, can signal financial stability, reassuring lenders about repayment capacity. Transparency in disclosing financial commitments also enhances credibility, giving a clearer picture of borrowing potential and facilitating smoother processing of the bridging loan request.

Loan Purpose and Benefits

Bridging loans serve as temporary financial solutions designed to provide immediate access to funds during critical periods, typically used for property transactions. Common purposes include purchasing real estate (residential or commercial) before selling an existing property, facilitating renovations, or covering gaps in financing during development projects. These loans, often with terms ranging from 1 to 18 months, allow borrowers to seize timely opportunities, such as acquiring prime properties in competitive markets like London or New York. Benefits include swift processing times, often within days, flexible repayment options, and minimal documentation requirements. Bridging finance can also enhance negotiation leverage, enabling buyers to make cash offers that expedite transactions and increase the likelihood of successful acquisitions.

Contact Information and Next Steps

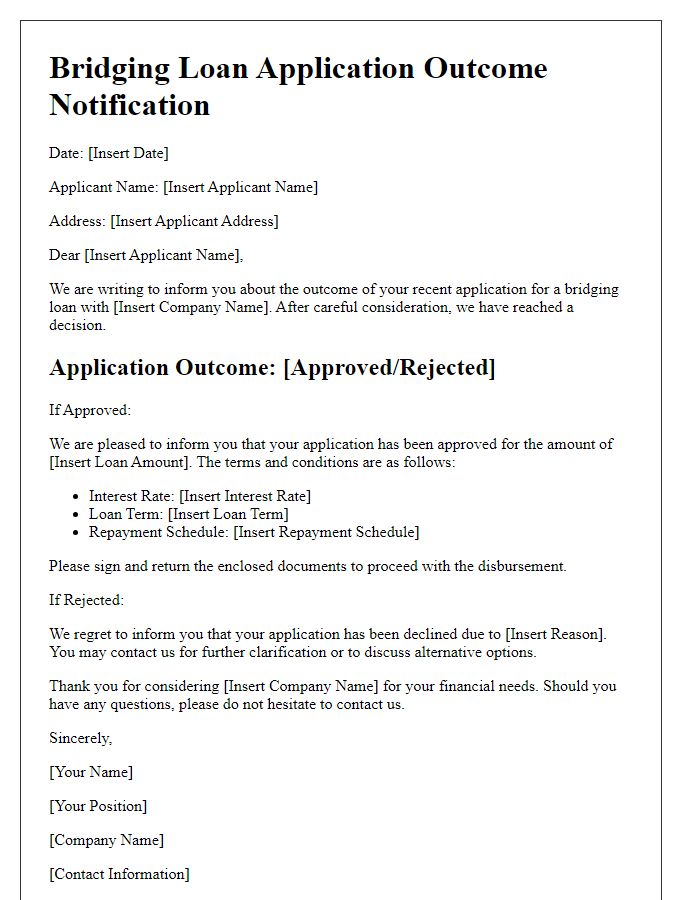

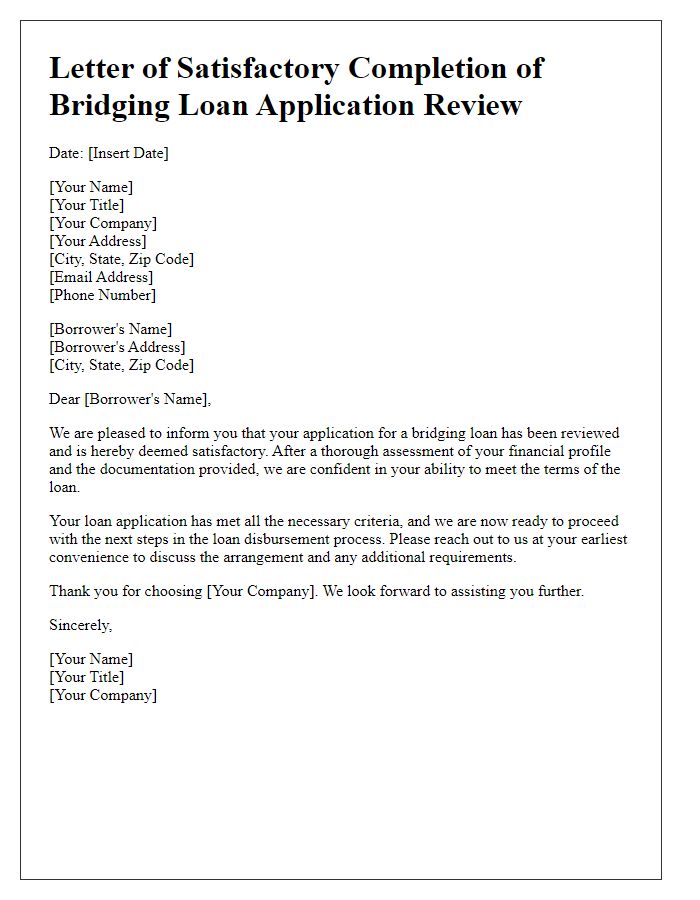

A bridging loan application feedback process involves multiple steps and essential contact details that ensure clear communication between the borrower and the lender. Typically, applicants receive written feedback (in digital format, often via email) regarding the status of their bridging loan application, which is particularly relevant for real estate purchases that are not yet finalized, often within a time frame of 6 to 12 months. The feedback outline includes key components such as application reference number, lender's contact information (including telephone numbers and email addresses), and the name of the loan officer assigned to the application. Furthermore, it details the next steps in the process, such as required documentation (like property valuation reports and income verification) and timelines for approval, which can vary based on the lender's policies or the complexity of the application. This structured approach facilitates transparency and keeps the borrower informed and prepared for what lies ahead in securing the bridging loan.

Letter Template For Bridging Loan Application Feedback Samples

Letter template of acknowledgment for bridging loan application feedback

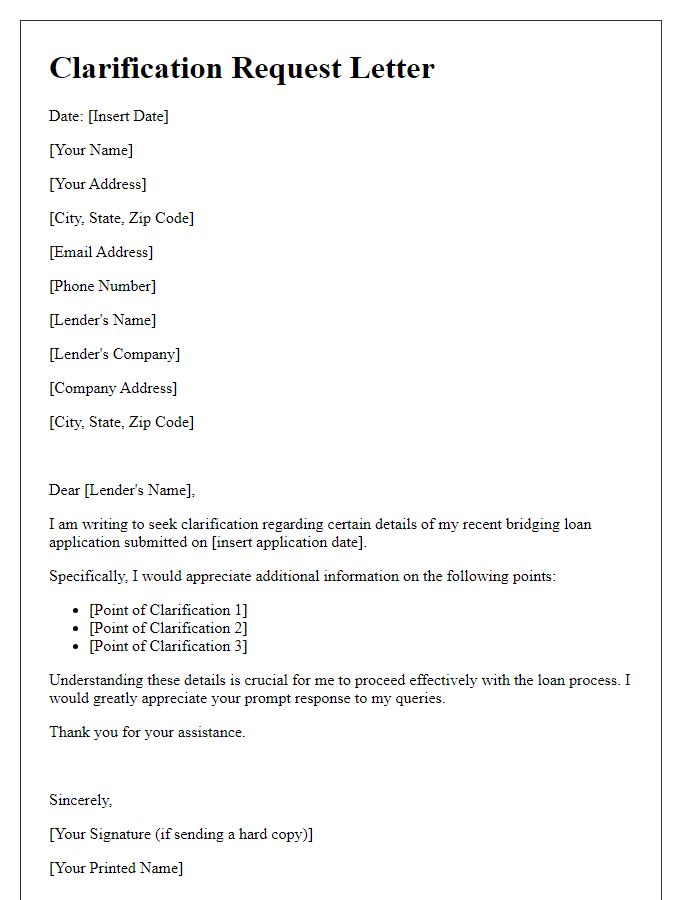

Letter template of clarification request for bridging loan application details

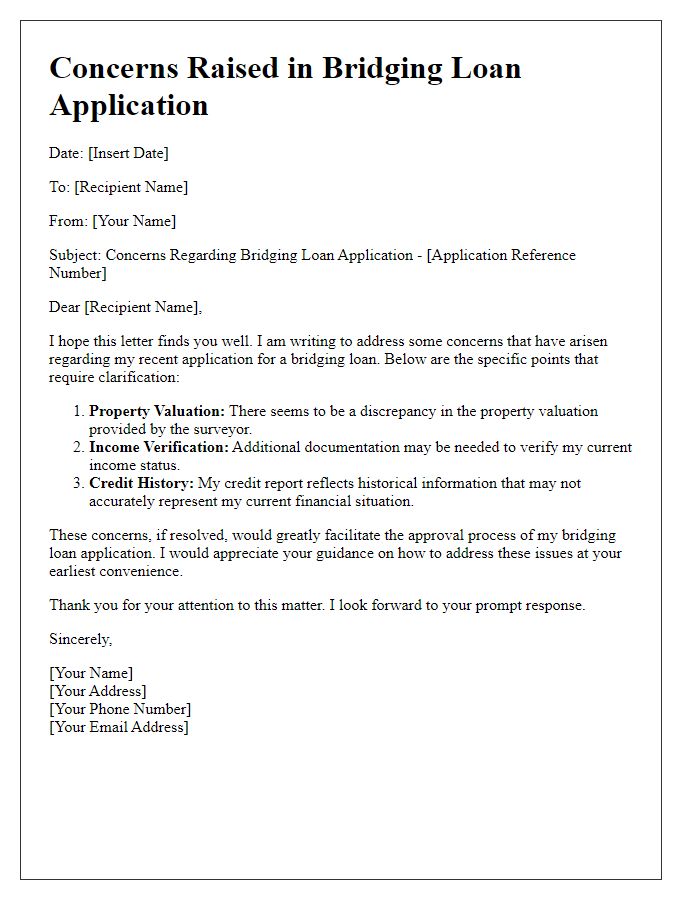

Letter template of concerns raised in bridging loan application response

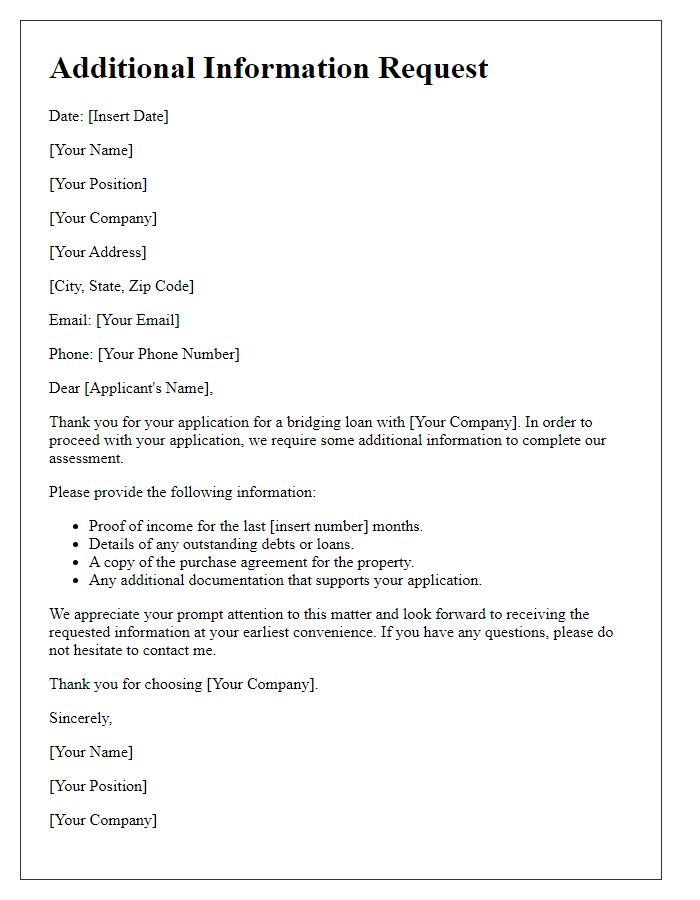

Letter template of additional information request for bridging loan application

Comments