Are you considering adjusting the duration of your loan? Whether you're looking to extend repayment terms for more manageable monthly payments or to shorten them to pay off your debt faster, understanding how to navigate this process is essential. In the following article, we'll explore the key steps involved in requesting a loan duration change, including what information you'll need to present and the important considerations to keep in mind. So, stick around to learn how you can effectively approach this important financial request!

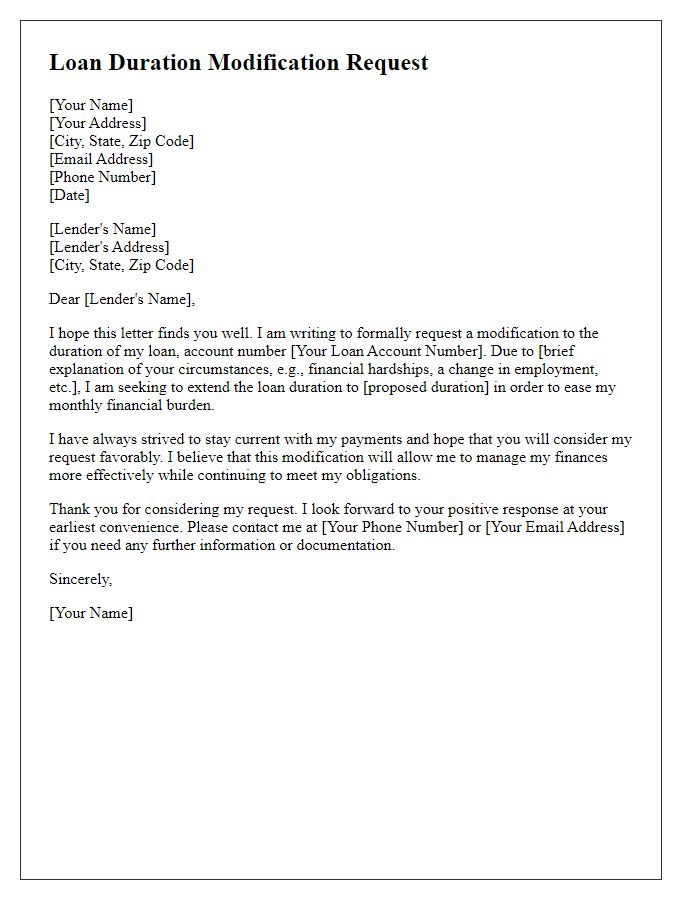

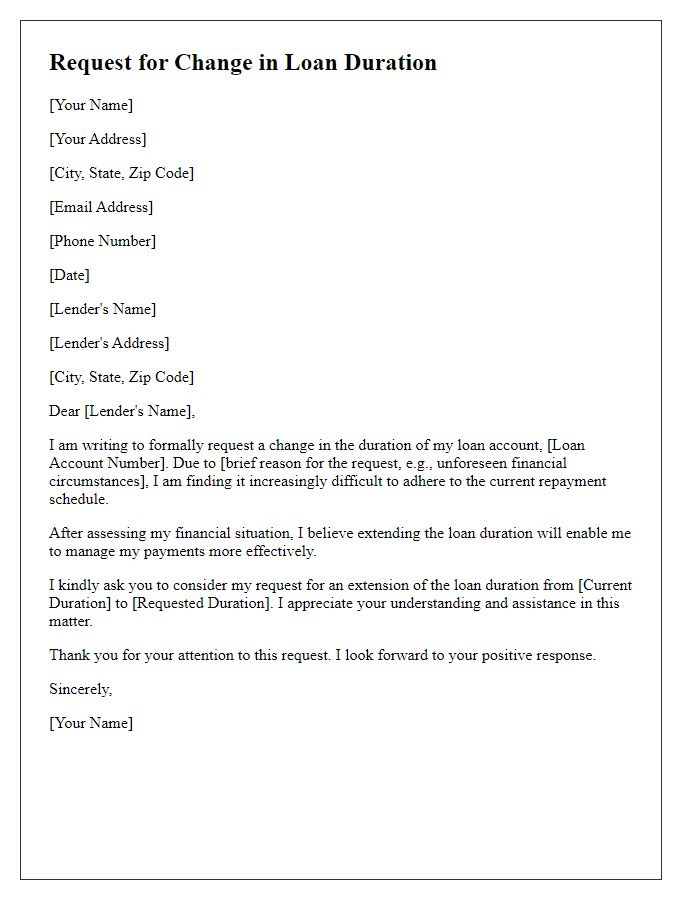

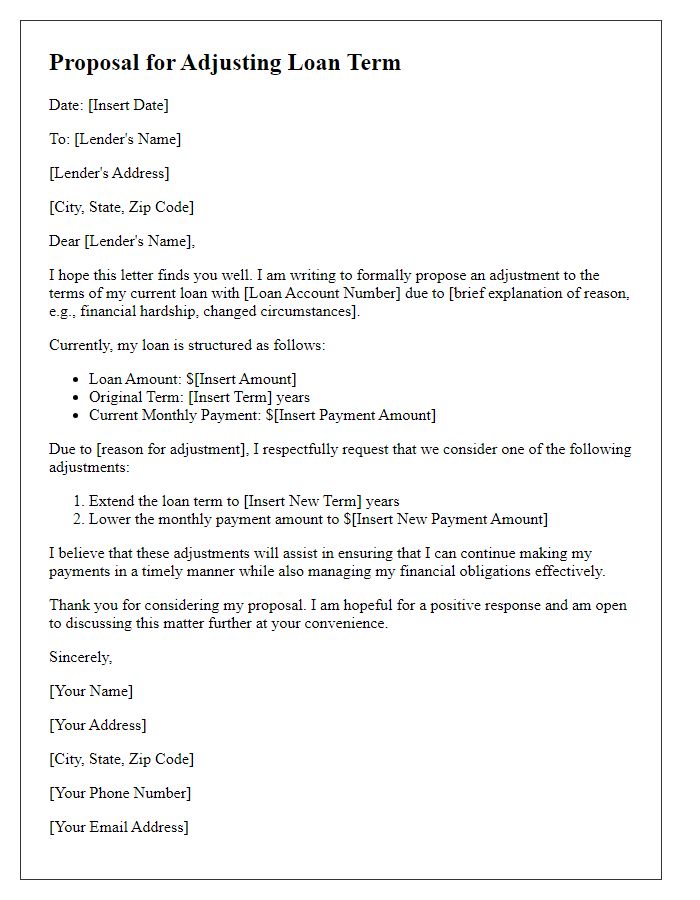

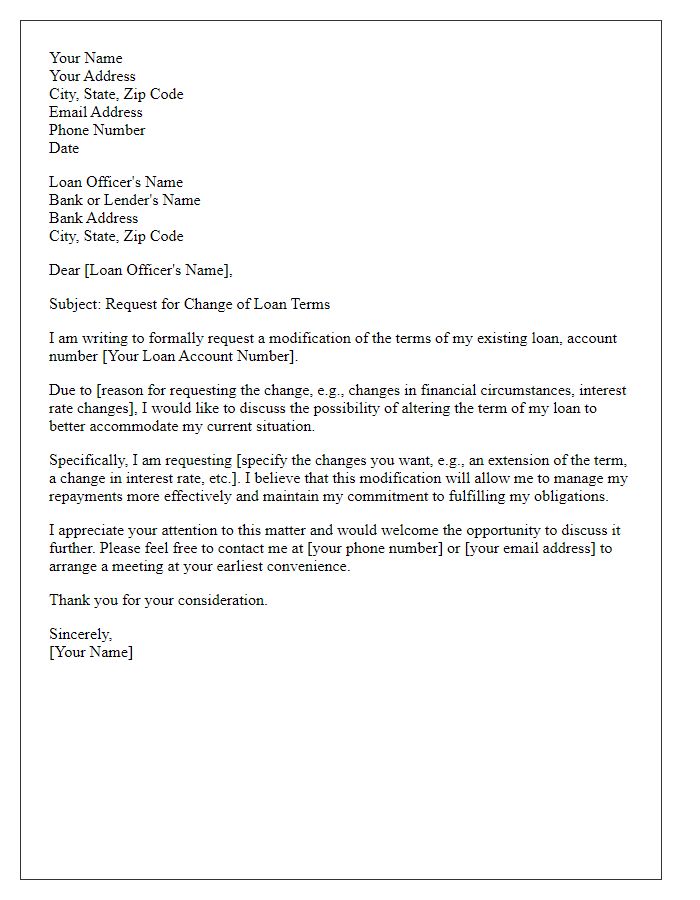

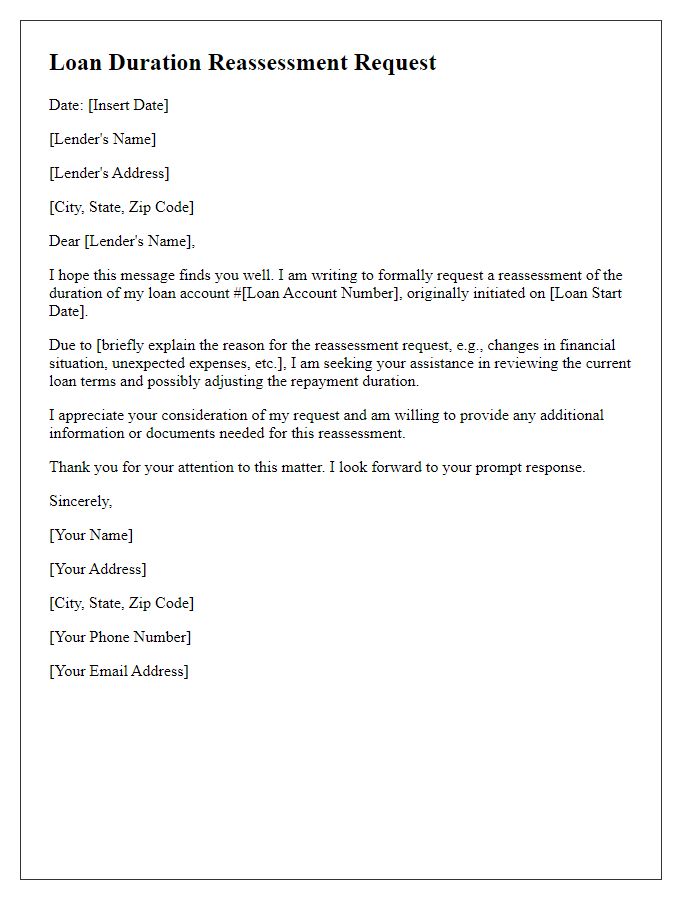

Formal Salutation

Formal requests for changing loan duration often involve detailed explanations of current financial situations, loan types, and specific terms usually outlined in the original loan agreement. Important entities include personal financial data, interest rates, loan amounts (often thousands of dollars), and the lending institution, typically a bank or credit union located within a particular state or country. Additionally, the impact of the requested changes on monthly payments and total interest paid over the loan's lifetime can be crucial to these discussions.

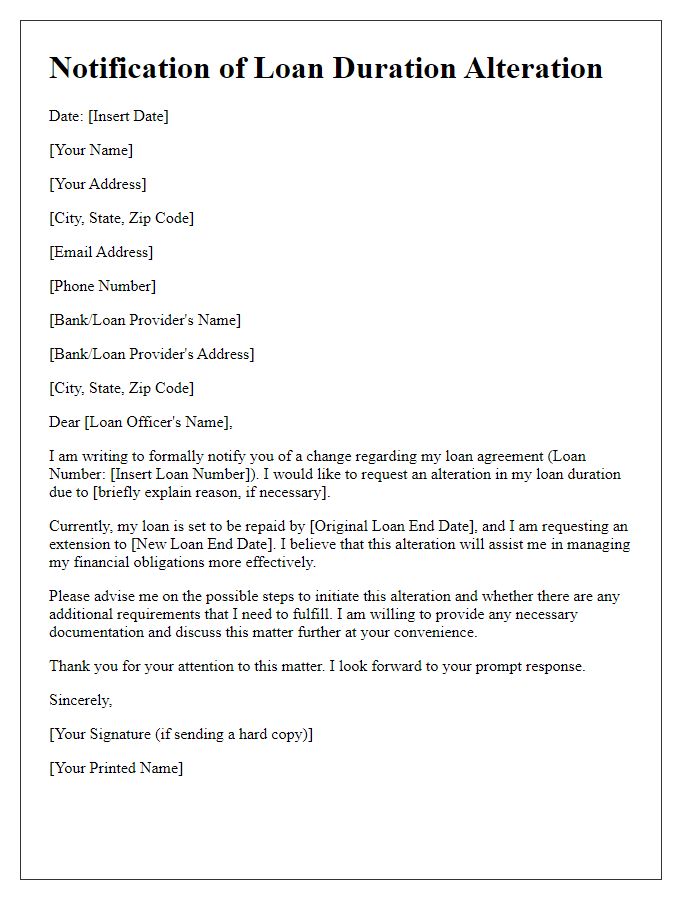

Purpose of the Request

A loan duration change request aims to modify the term length of a financial agreement, altering repayment periods for various personal or business reasons. Borrowers might seek to extend terms for lower monthly payments, improving cash flow management during financial strain. Conversely, some may request a shortening of the duration to pay off debts faster, minimizing interest costs accrued over time. Financial institutions, such as banks or credit unions, typically review these requests to assess borrower eligibility and impact on overall loan conditions. Key factors influencing the decision include payment history, credit scores, and current economic circumstances affecting the borrower's ability to meet new terms.

Current Loan Details

Current loan agreements often feature specific terms, including loan amount (for example, $50,000), interest rate (such as 5% APR), and duration (commonly 15 to 30 years). Adjusting the loan duration can significantly impact monthly payments and total interest paid. For instance, reducing a 30-year mortgage to a 15-year term increases monthly obligations but decreases long-term interest costs. This change requires a detailed review of the lender's policies, including necessary documentation and possible fees. Borrowers may seek to lower total financial burden or adjust to changing personal circumstances, such as income variations or economic shifts. Contacting the lender promptly can facilitate necessary adjustments in the repayment plan.

New Loan Duration Proposal

A loan duration change request can significantly impact financial planning and repayment strategies. Borrowers may seek to modify the original terms of their loan, such as extending or shortening the repayment period. For instance, an individual with a personal loan of $10,000 initially set for a 5-year duration may propose a new duration of 7 years to reduce monthly payments, making the financial burden lighter. This change can also influence the total interest paid over the loan's life, with extended durations potentially increasing overall cost due to accruing interest. Financial institutions typically review such requests based on credit history, current financial status, and prevailing interest rates, ensuring that both parties reach a mutually agreeable solution that aligns with their economic goals.

Justification and Supporting Information

The request for a change in loan duration stems from various financial adjustments such as unforeseen expenses or changes in income levels, influencing repayment capacity. For instance, the current loan duration may extend beyond the borrower's financial capabilities, causing stress in managing monthly payments. Evidence such as recent pay stubs or expense reports can support this justification, highlighting a significant reduction in income or increases in living costs. Furthermore, examples from similar scenarios where lenders have successfully accommodated requests may strengthen the case. Providing a clear understanding of the borrower's financial situation and a proposed new loan duration can help facilitate a favorable response from the lender.

Comments