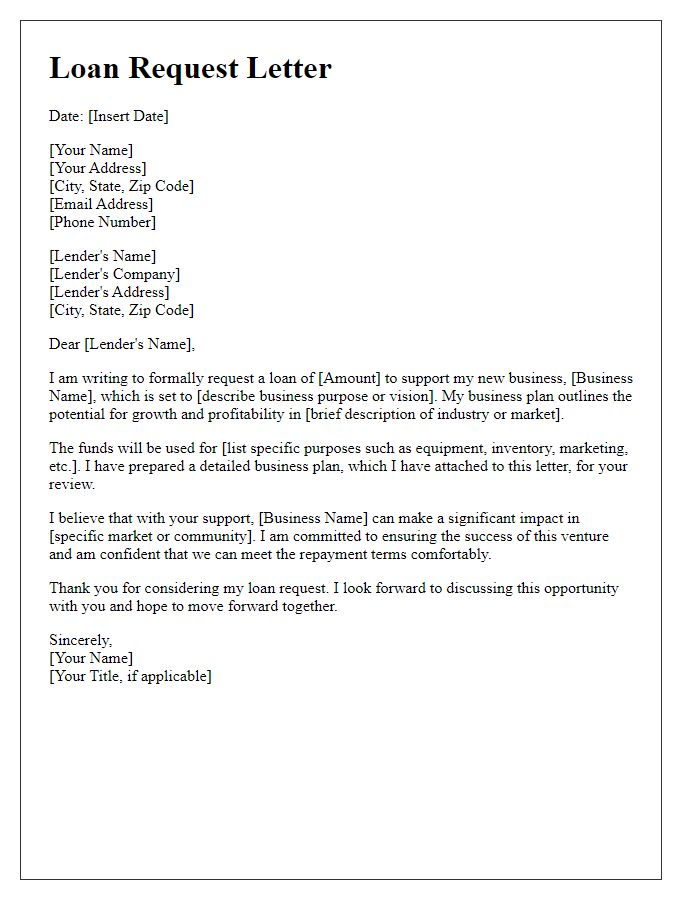

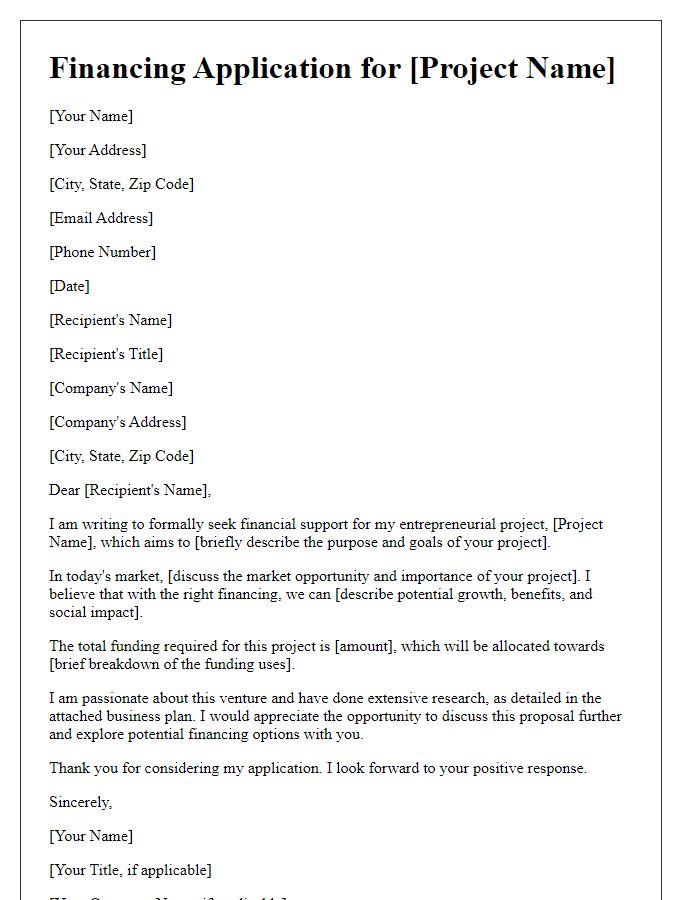

Are you ready to take your startup to the next level? Applying for a business loan can feel daunting, but with the right approach, you can craft a letter that truly resonates with lenders. In this article, we'll walk you through a solid letter template that highlights your vision, financial needs, and potential for success. So, let's dive in and explore the essential elements that can make your application stand out!

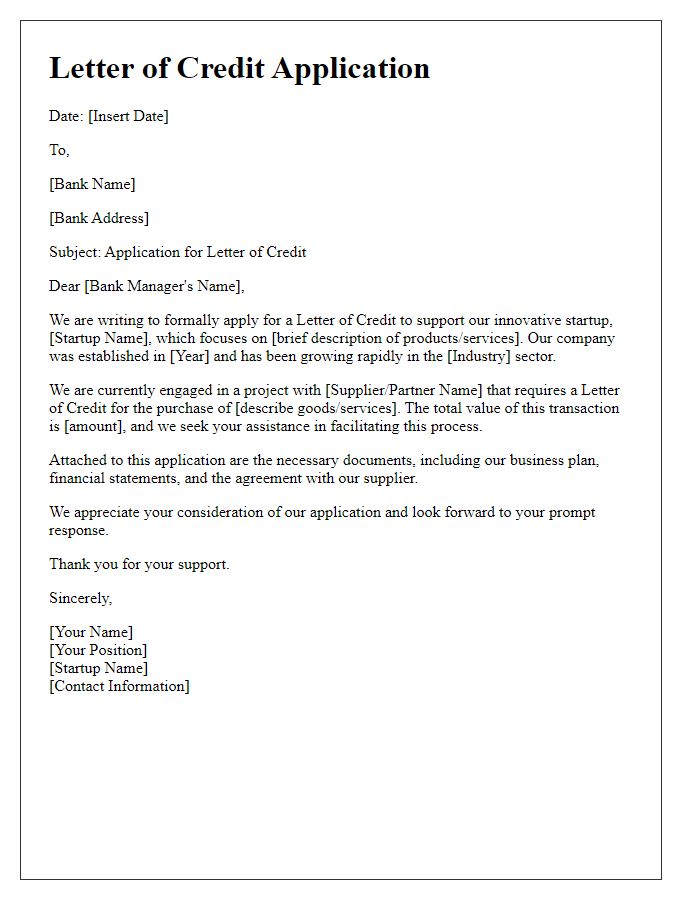

Clear Purpose and Business Overview

A startup business loan application requires a clearly defined purpose and detailed business overview to convey the idea effectively to potential lenders. A solid business overview includes the type of startup, such as a tech company focusing on software development in Silicon Valley, California, which is known for its innovation ecosystem. Key components should include the mission statement expressing the goal of solving specific consumer problems, such as providing affordable meal delivery services for busy professionals in urban areas. Additionally, the application should highlight the target market demographics, such as millennials aged 25-35, who value convenience and technology. Financial projections, such as expected revenue growth reaching $500,000 in the first year, will demonstrate the scalability of the business model and the need for funding. Clear articulation of how the loan will be utilized, such as purchasing inventory, hiring staff, or marketing initiatives, is crucial to showcase the plan's feasibility and enhance lender confidence.

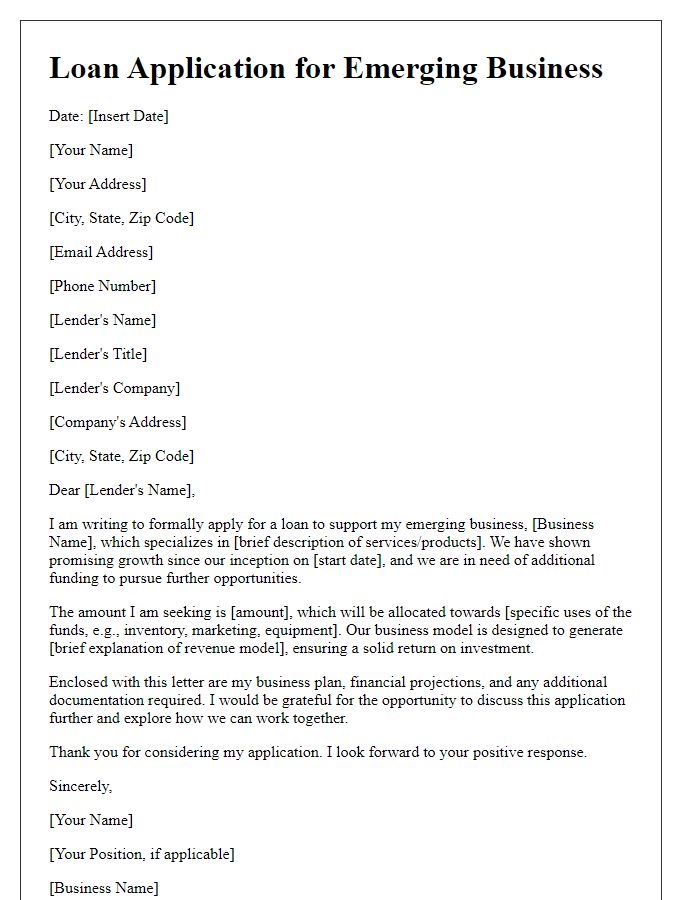

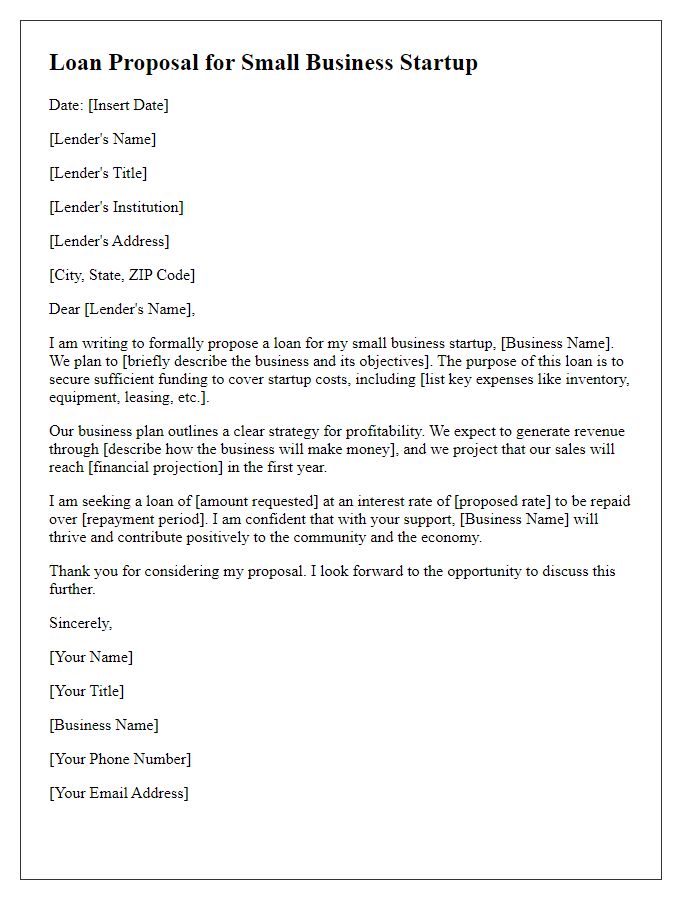

Financial Projections and Revenue Model

Financial projections play a critical role in the viability of a startup business seeking funding. Forecasted revenue, for instance, from product sales can project growth trajectories; for example, a 120% increase in revenue year-over-year is a compelling argument for potential investors. Detailed breakdowns of monthly expenses highlight costs associated with operations, marketing, and salaries, offering insights into smart financial management. A revenue model outlining pricing strategies, such as tiered subscription plans or one-time payments for products, establishes clarity around income streams. Additionally, incorporating industry benchmarks, like customer acquisition cost (CAC), can contextualize projections within the broader market, further enhancing credibility. Market analysis should inform projections, citing significant events or trends and potential market size, which, for tech startups, can reach billions of dollars based on emerging technologies. Overall, a well-structured financial forecast can effectively communicate a startup's potential to secure essential funding for growth and development.

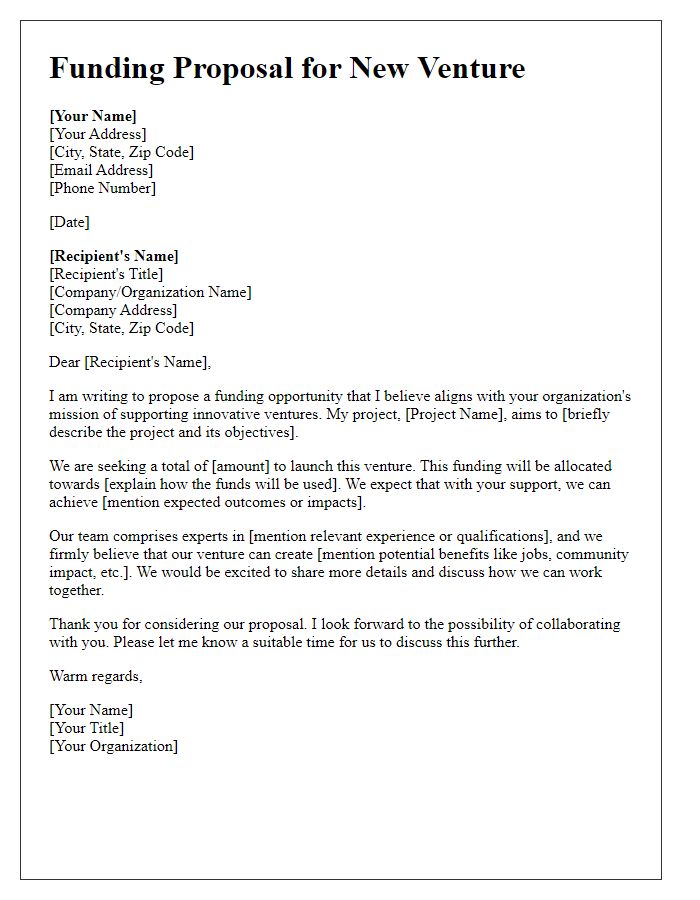

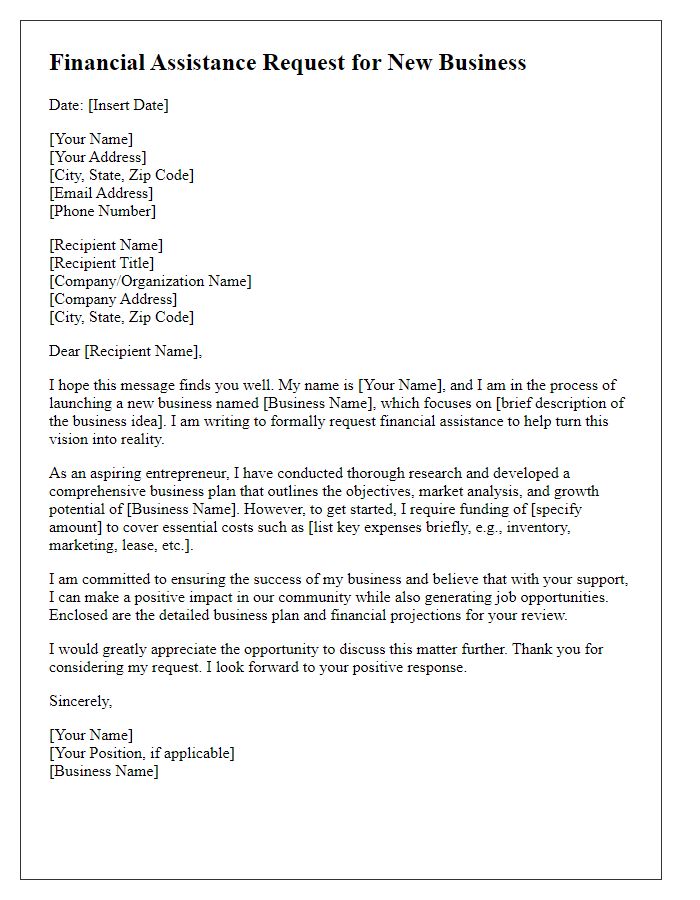

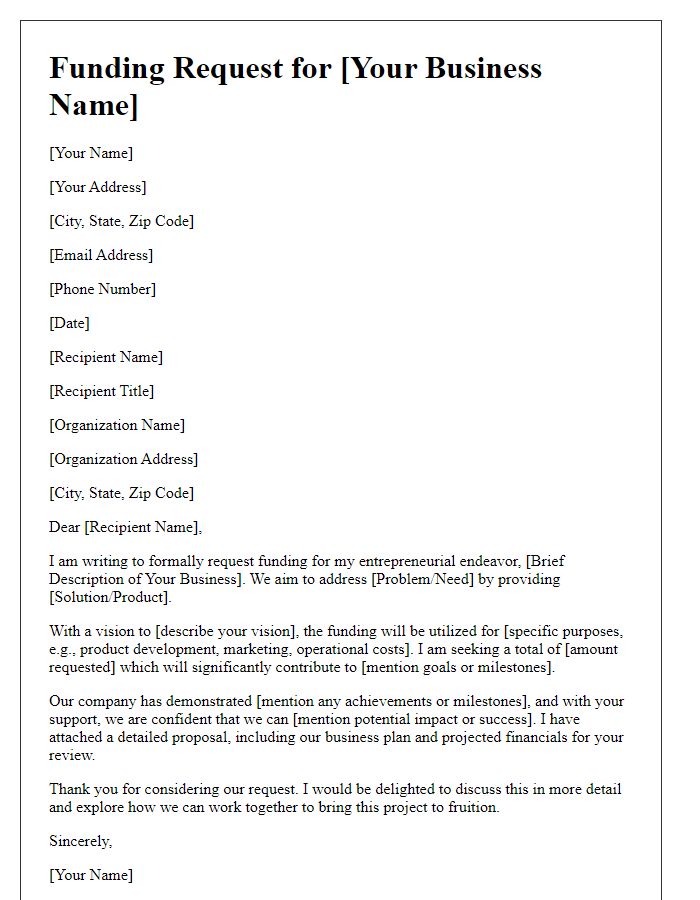

Detailed Loan Amount and Usage Plan

A detailed loan amount request for funding a startup business often relies on a precise breakdown of required capital and its intended usage. For instance, a total loan amount of $100,000 is sought to establish a new cafe in downtown Austin, Texas, a rapidly growing city known for its vibrant food scene. Allocation of the funds includes $40,000 for leasehold improvements, which covers renovation costs to convert a 2,000 square foot space into an inviting dining area. Additionally, $30,000 is earmarked for equipment purchases, including industrial-grade espresso machines and ovens. A further $20,000 will support initial inventory acquisition, featuring organic coffee beans and locally sourced pastries to appeal to health-conscious consumers. The remaining $10,000 will go toward marketing strategies, such as social media advertising and local promotional events, aimed at building community engagement and brand awareness prior to the grand opening. This structured approach demonstrates a clear understanding of financial needs and growth strategies, enhancing the loan application's credibility.

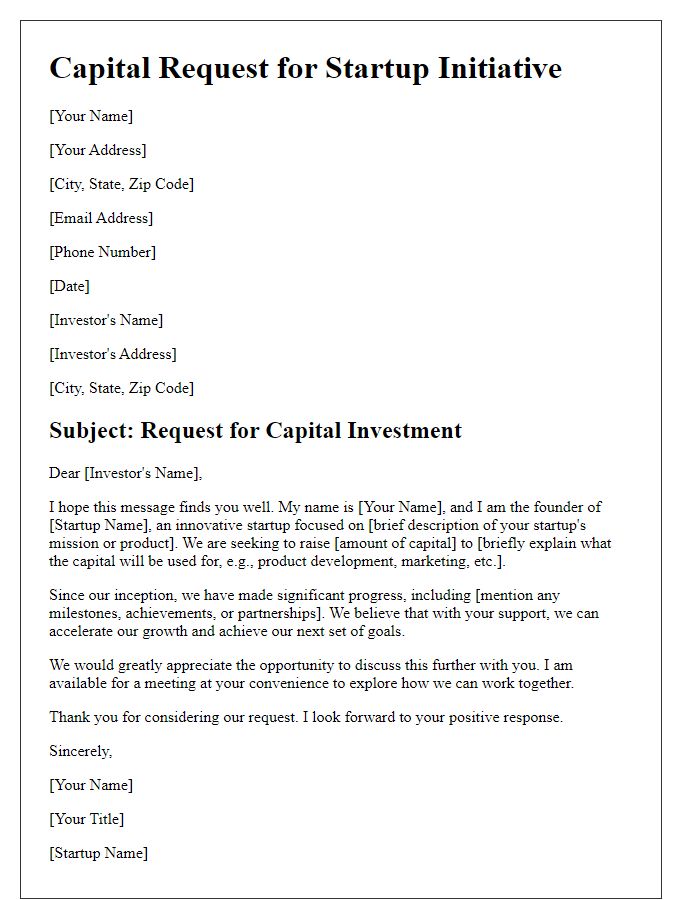

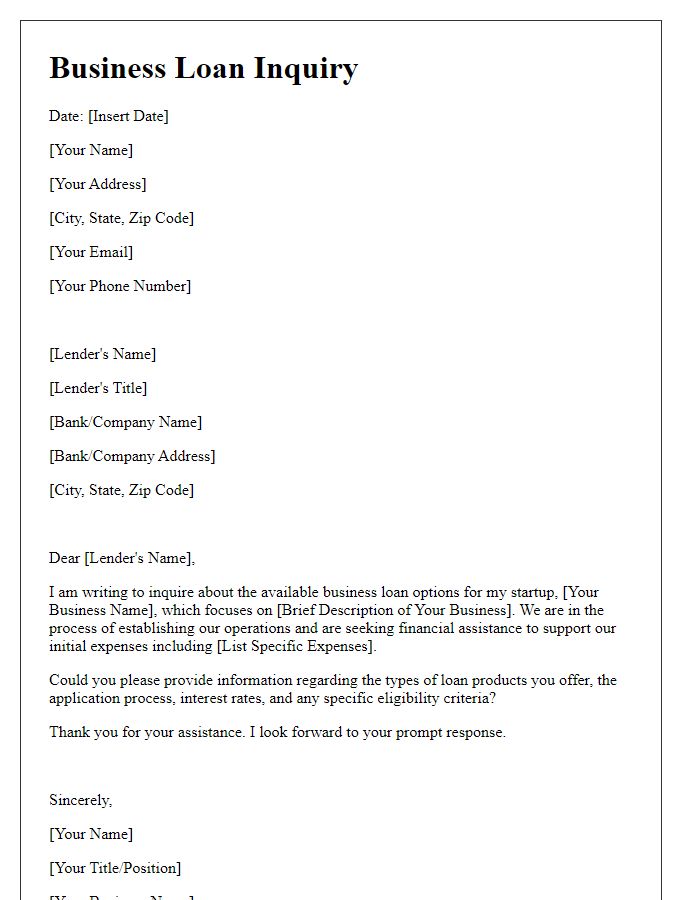

Collateral and Creditworthiness Evidence

A startup business seeking a loan must provide substantial collateral, such as real estate assets like commercial properties located in bustling urban areas, vehicles utilized for business operations, or equipment crucial for production processes. Creditworthiness evidence includes detailed financial statements, showcasing startup revenue projections and cash flow analysis that affirm the viability of the business model. Personal credit scores (above 700 considered favorable for business owners) from major credit bureaus like Equifax and Experian demonstrate responsible financial behavior, while a business plan outlining market analysis and growth strategies further supports the case for loan approval. Additionally, references from reputable industry mentors can enhance credibility and trustworthiness in the eyes of potential lenders.

Market Analysis and Competitive Positioning

Market analysis reveals a dynamic landscape within the technology sector, particularly in software development aimed at small businesses. According to Statista, the global software market is estimated to reach approximately $650 billion by 2025, representing a year-over-year growth rate of about 10%. Target customers reside primarily in urban areas such as New York City, Los Angeles, and Chicago, where small businesses increasingly adopt digital solutions for operational efficiency. Competitive positioning identifies key players including established firms like Intuit and newer entrants like FreshBooks, focusing on user-friendly interfaces and robust customer support. Our unique value proposition emphasizes tailored solutions for niche markets, specifically targeting independent retailers and service providers, ensuring a competitive edge through personalized service and specialized features. This strategic approach not only aims to capture market share but also to establish long-term client relationships, ultimately driving sustainable growth.

Comments