If you've ever found yourself in a financial bind and needed to navigate the intricacies of loan management, you're not alone. Understanding the process of a loan advance rollover can often seem daunting, but it doesn't have to be! In this article, we'll break it down step by step, making it easier for you to grasp your options and take control of your financial future. So, grab a cup of coffee and dive in as we explore the details that could potentially lighten your financial load!

Clear subject line

Loan Advance Rollover Request - Immediate Attention Needed

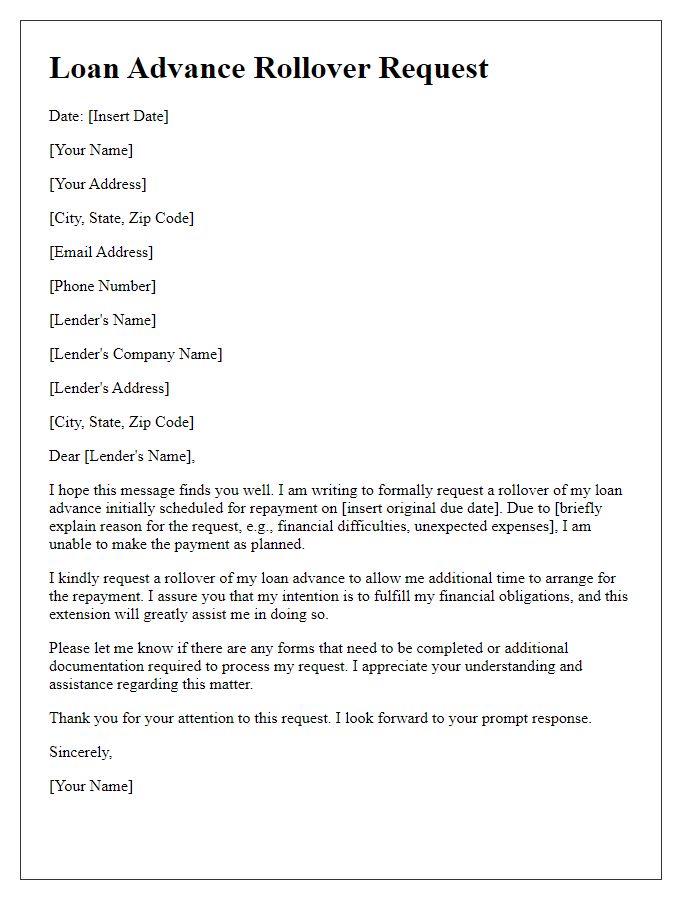

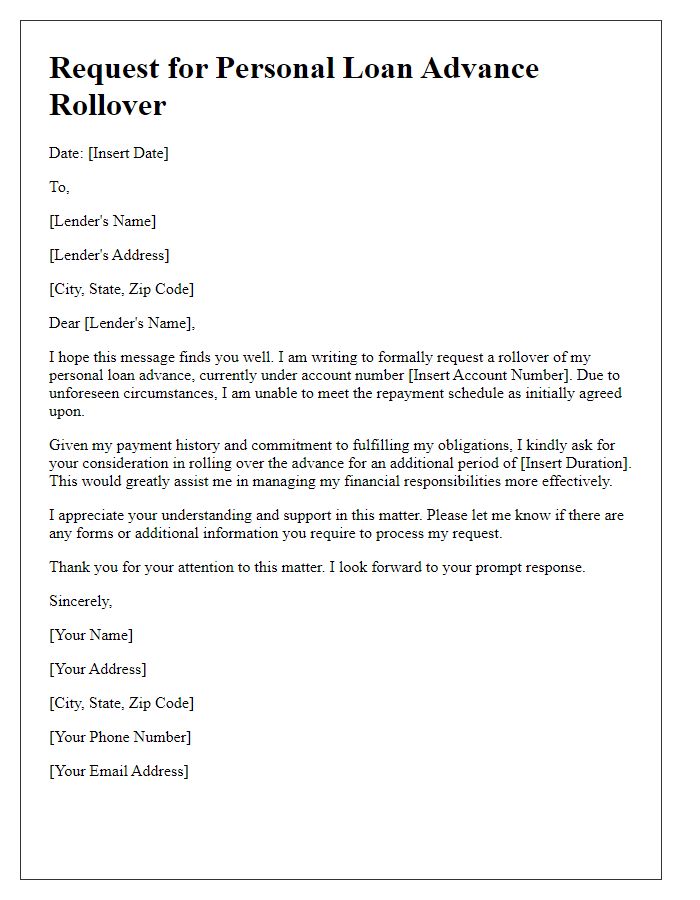

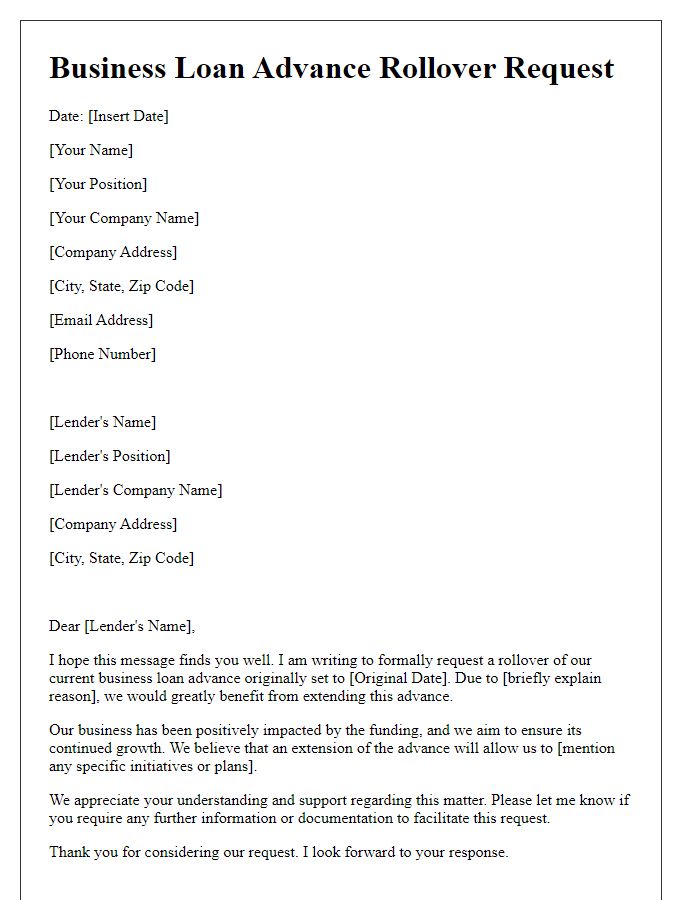

Borrower details

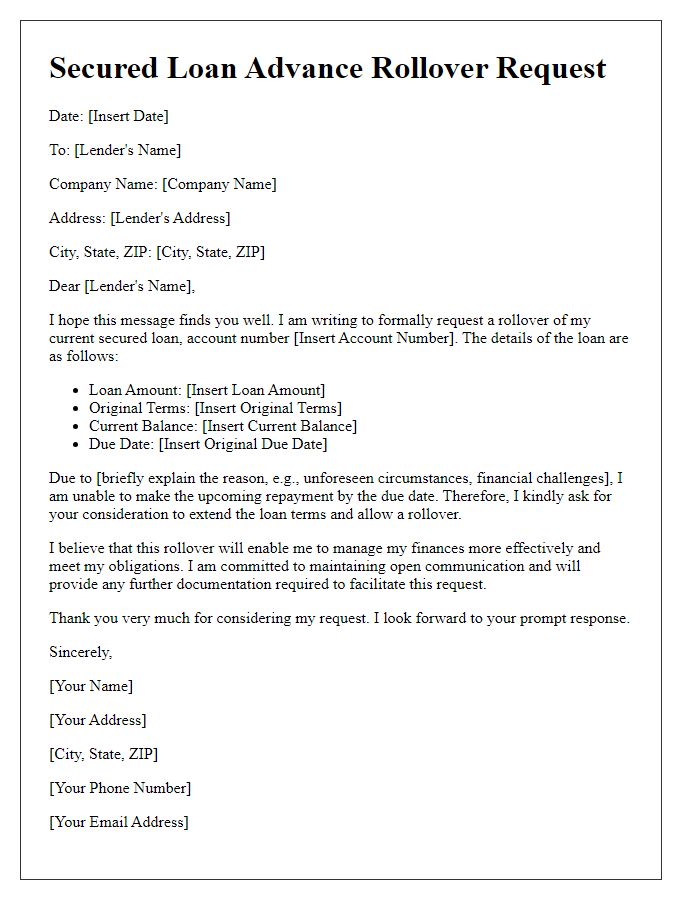

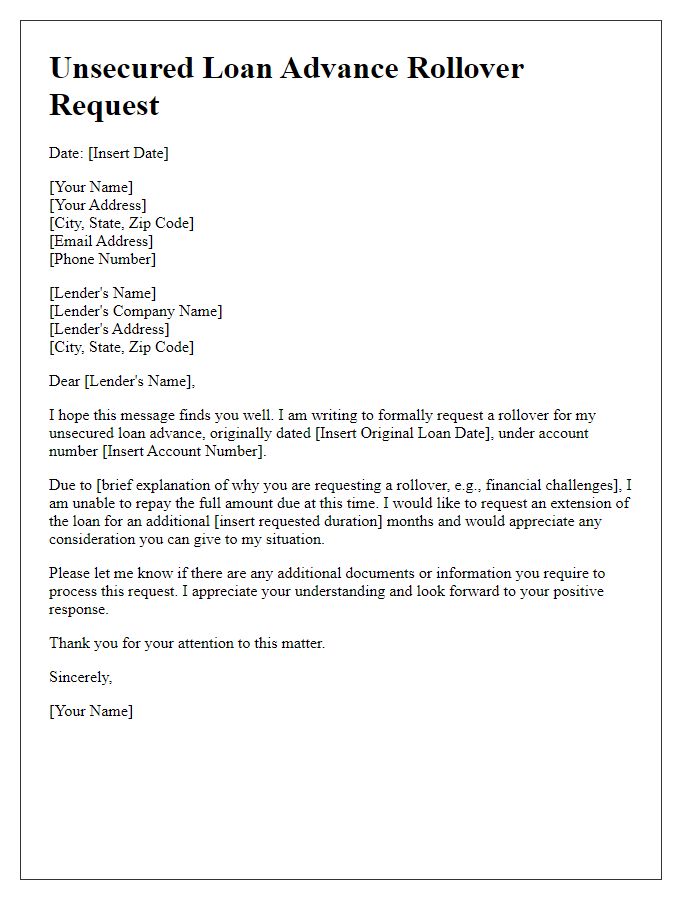

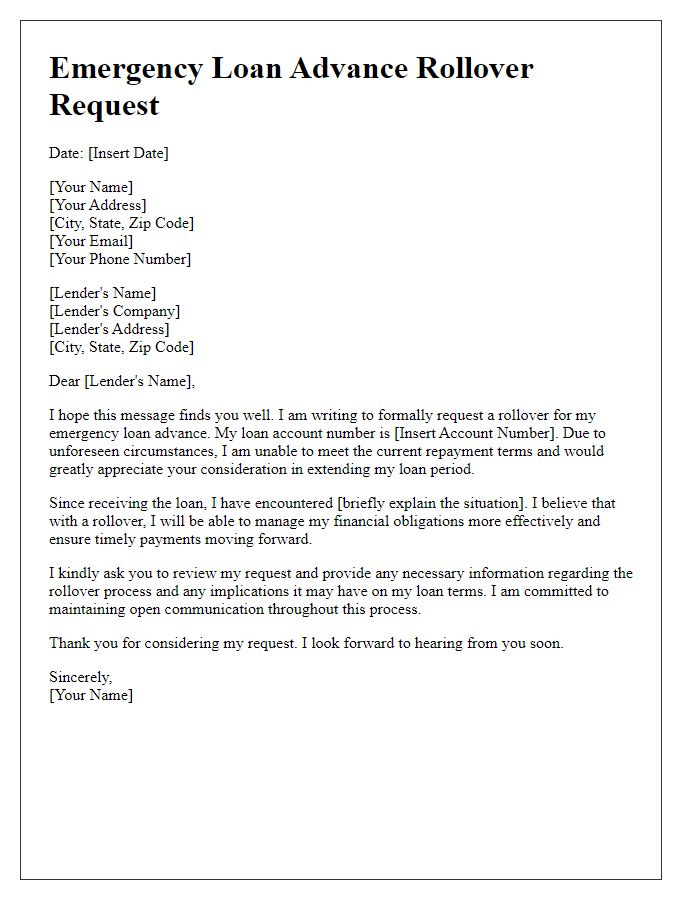

The borrower details section for a loan advance rollover request typically includes essential information that identifies the individual or entity requesting the rollover. Key elements include the borrower's full name, which differentiates them from other applicants; the loan account number, which allows the lender to easily reference the specific loan in question; and the address of the borrower, ensuring accurate documentation and correspondence. Additionally, including contact information such as a phone number and email address allows the lender to reach the borrower for any clarifications or confirmations necessary during the process. Details about the original loan term, the requested rollover term, and the underlying reasons for the rollover provide context for the request, facilitating a better understanding for the lender while evaluating the application.

Loan account information

Loan account information, including account number (such as 123456789), outstanding balance (e.g., $5,000), and original loan amount (e.g., $10,000), is critical for processing a loan advance rollover request. Key events, such as payment history (e.g., on-time payments for 12 consecutive months) and any missed payments (e.g., one missed payment in January 2023), can influence the approval process. The lender's name (e.g., ABC Bank), branch location (e.g., New York, NY), and contact information (such as customer service number) should be clearly listed. Proper documentation, such as identification (like a driver's license or passport) and proof of income (like pay stubs or tax returns), reinforces the request's credibility and facilitates a smoother resolution.

Reason for rollover request

Requesting a loan advance rollover can be necessary when unforeseen circumstances impact financial planning. For instance, unexpected medical bills averaging $2,000 may arise, or home repairs might cost about $5,000 due to urgent plumbing issues. Economic factors, like a decline in income by 20% during a recent job transition or increased living expenses in the city of San Francisco, can also necessitate a rollover to avoid defaulting on payments. Additionally, fluctuating interest rates, currently around 4.5% annually, may make it beneficial to extend repayment timelines. This request for a rollover ensures continued financial stability and avoids potential negative impacts on credit scores.

Contact information

In the context of requesting a loan advance rollover, borrowers must include precise contact information to ensure prompt communication. Essential details include full name, residential address, and email address. Phone numbers should be listed for immediate contact, including both mobile (preferably a cell phone) and landline numbers. Additionally, borrowers should specify the loan reference number related to the transaction for clarity. Providing accurate contact information facilitates efficient processing and helps maintain clear lines of communication with the financial institution.

Comments