If you're navigating the complexities of loan maturity amendments, you're in the right place. Understanding the ins and outs of this process can seem daunting, but with the right guidance, it becomes much more manageable. Amendments can provide flexibility and help you align your financial goals with your current situation, ultimately leading to a smoother repayment journey. Ready to learn more about crafting the perfect letter for your loan maturity amendment? Let's dive in!

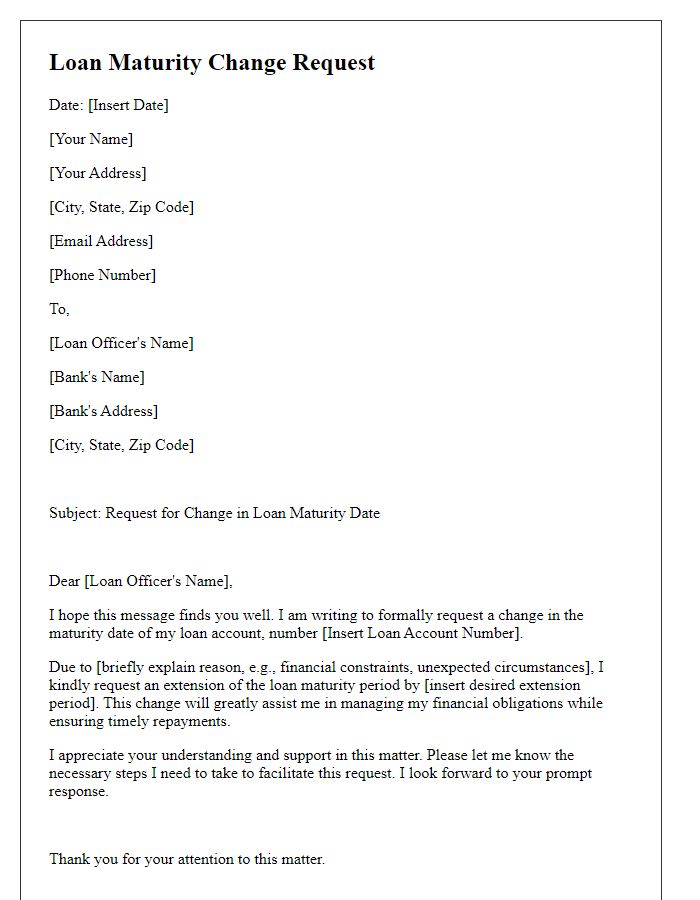

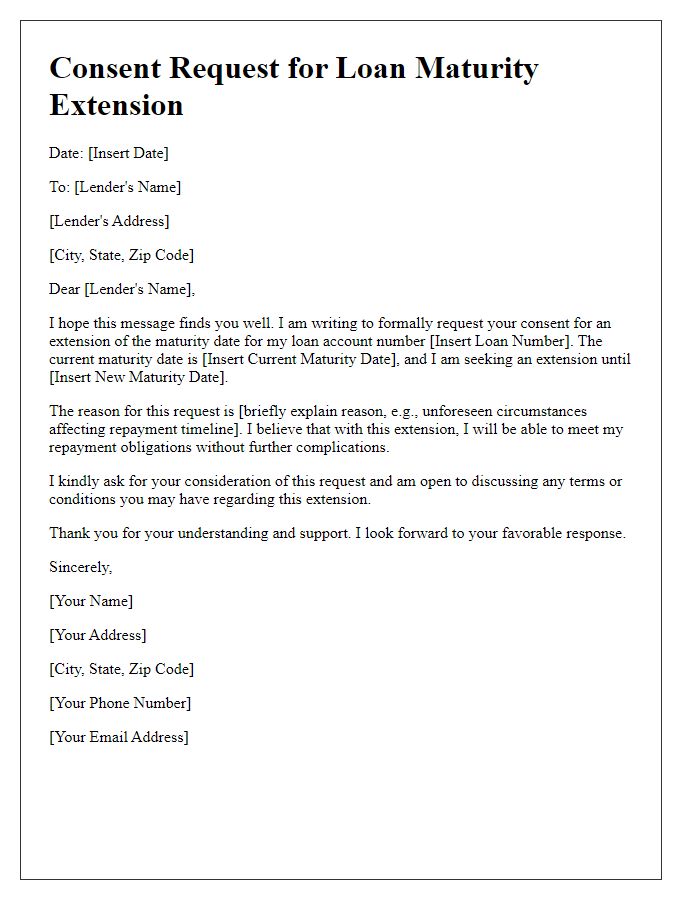

Loan account details

Loan account details, such as the identification number (for example, 123456789), play a crucial role in processing requests for maturity amendments. The loan amount may stand at $50,000, originally set to mature on December 1, 2023, under the terms of a 5-year fixed-rate agreement with an interest rate of 4.5%. Borrowers must specify the reason for the amendment request, which could be due to unexpected personal circumstances, economic factors, or fluctuating interest rates affecting financial capability. Institutions, like banks or credit unions, often require supporting documentation, such as financial statements or income verification, to evaluate the request's validity. Timely submission, at least 30 days before the maturity date, is crucial to ensure uninterrupted loan servicing and avoid penalties.

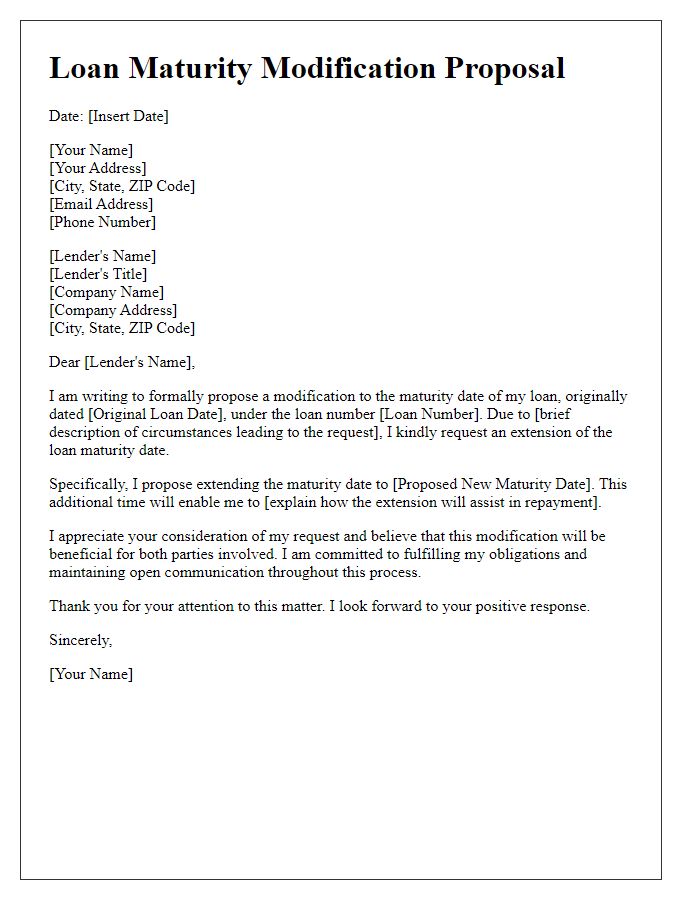

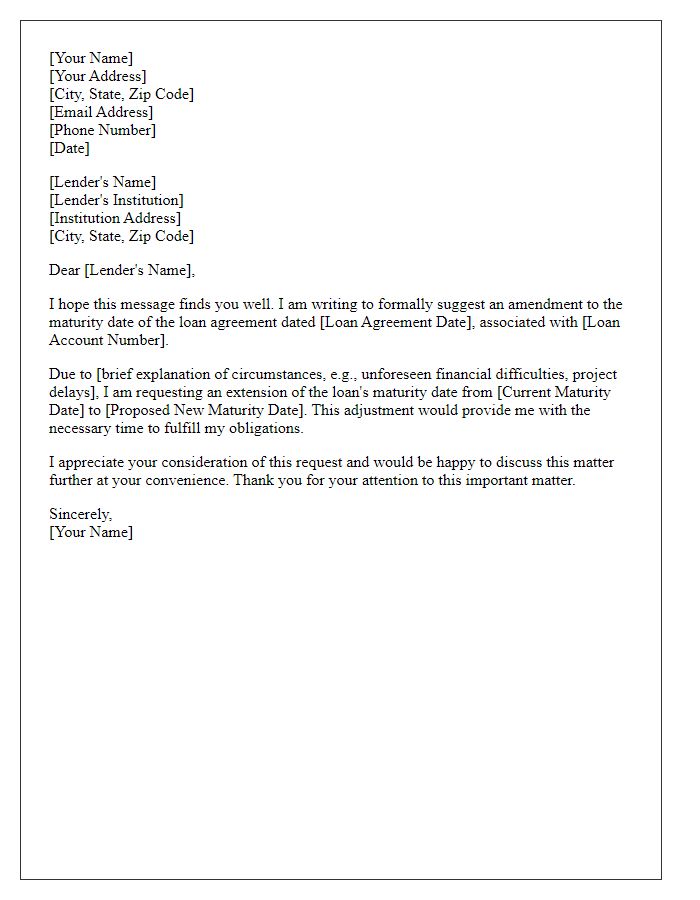

Proposed amendment terms

Proposed amendment terms for loan maturity need to reflect changes in repayment schedules and interest rates. The new maturity date should extend up to a maximum of five years, allowing borrowers to manage financial commitments more effectively. Adjustments may include a reduction of the interest rate to 4.5%, enhancing affordability. Additionally, suggestion to implement quarterly payment intervals instead of monthly can alleviate the burden on cash flow. Specific clauses regarding late payment penalties should be considered, proposing a 1% fee on overdue amounts to maintain accountability while providing leeway for unforeseen circumstances. Detailed documentation should outline these proposed changes for clarity and compliance.

Justification for amendment

Loan maturity amendments can provide essential flexibility for borrowers encountering unforeseen financial challenges. Borrowers, such as small business owners, often face fluctuating cash flows influenced by market conditions, consumer behavior, or unexpected expenses. For example, a retail store located in a high-traffic area may experience a seasonal downturn, affecting revenue during specific months, leading to challenges in meeting loan repayment schedules. An amendment may extend the maturity date to accommodate these fluctuations, enabling the borrower to maintain operations and ensure long-term financial viability. Additionally, and crucially, leveraging an amended loan agreement can prevent defaults, which could severely affect credit scores and access to future financing. Financial stability and positive cash flow recovery are paramount in facilitating a successful loan amendment process.

Borrower's financial information

Borrower's financial information includes critical data such as total annual income (e.g., $75,000), existing debts (for example, a mortgage of $250,000 and a car loan of $20,000), credit score (for instance, 720, indicating good creditworthiness), and current employment status (e.g., employed at Tech Solutions Inc. since 2018). Additionally, monthly expenses such as utilities ($300), groceries ($500), and insurance premiums ($200) should be presented to offer a comprehensive view of financial health. Assets like savings account balances (approximately $15,000) and retirement accounts (value of $50,000) also play a significant role in evaluating the Borrower's capacity to manage the amended loan terms. Accurate and transparent disclosure of these details ensures informed decision-making by the lender, maximizing the potential for a favorable amendment process.

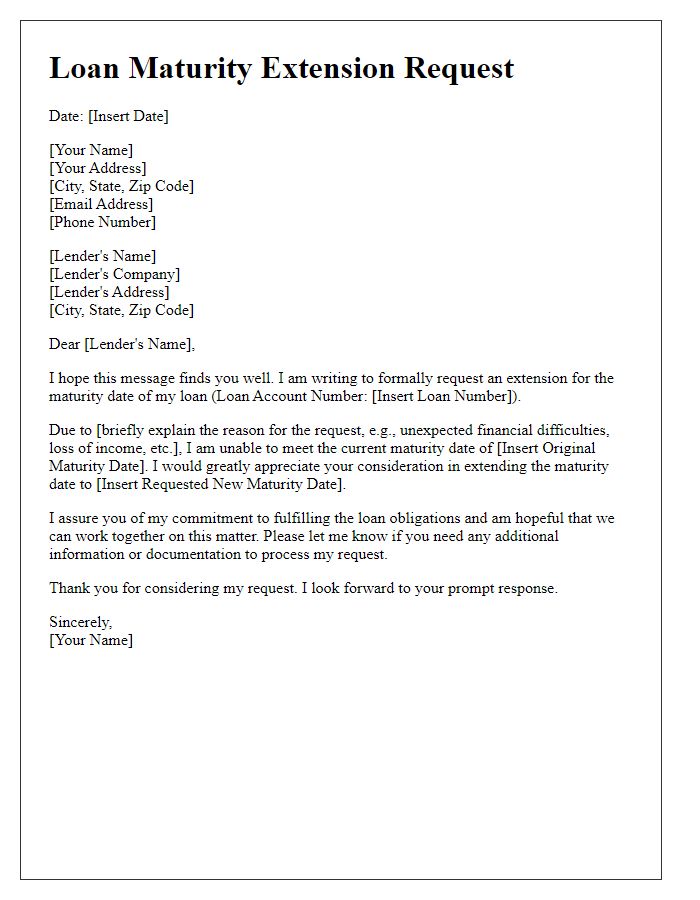

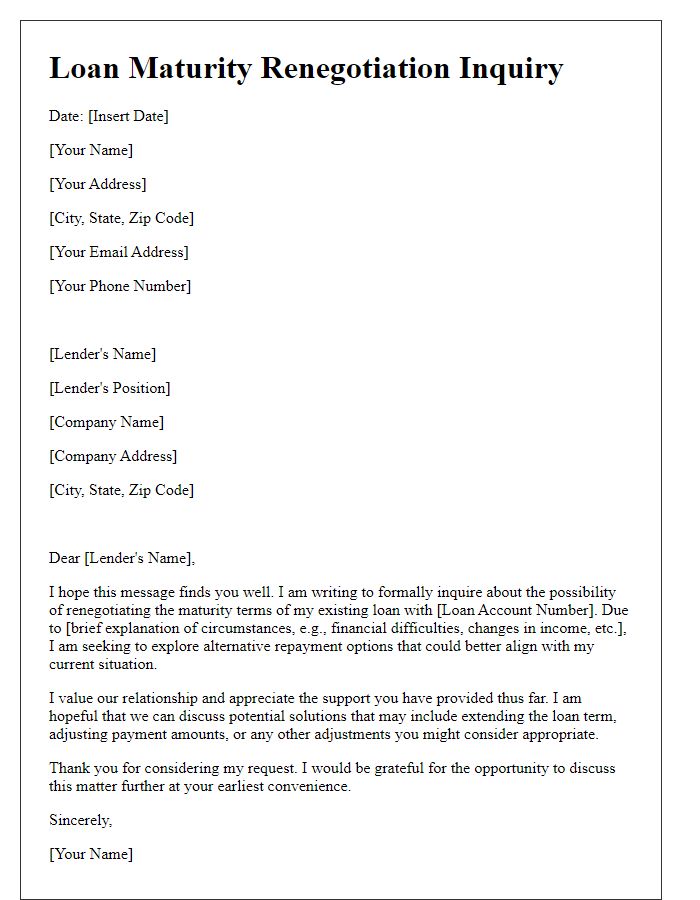

Contact information for follow-up

A loan maturity amendment involves changing the original terms of a loan agreement, particularly the maturity date, which can impact both the borrower and the lender. This process typically requires clear communication and detailed documentation. Essential contact information for follow-up often includes the name of the borrower or their representative, the loan number, a current phone number, and an email address for swift correspondence. Providing these details ensures all parties remain informed and can efficiently address any queries or adjustments regarding the loan terms. Engaging legal or financial advisors may be recommended to ensure compliance with applicable laws and regulations.

Comments