Are you considering applying for a second loan but unsure how to approach it? Crafting the perfect letter can make all the difference in getting your application noticed and approved. In this article, we'll guide you through a simple yet effective template that includes essential details and personal touches to make your case compelling. Stick around to learn how to elevate your second loan application and increase your chances of success!

Personal financial summary.

A personal financial summary presents a detailed account of an individual's financial status, encompassing income, assets, liabilities, and expenses. Key financial metrics include monthly income, which might average $5,000 after taxes, and total assets valued at approximately $150,000, including properties, vehicles, and savings accounts. On the liabilities side, it is crucial to note outstanding debts, such as a mortgage of $100,000 and a car loan amounting to $15,000, resulting in an overall net worth of approximately $35,000. Additionally, regular monthly expenses, such as rent or mortgage payments (around $1,500) and utility bills (approximately $300), provide insight into cash flow. This financial overview aids in evaluating the individual's ability to manage additional loans and demonstrate financial responsibility for lenders.

Purpose of the loan.

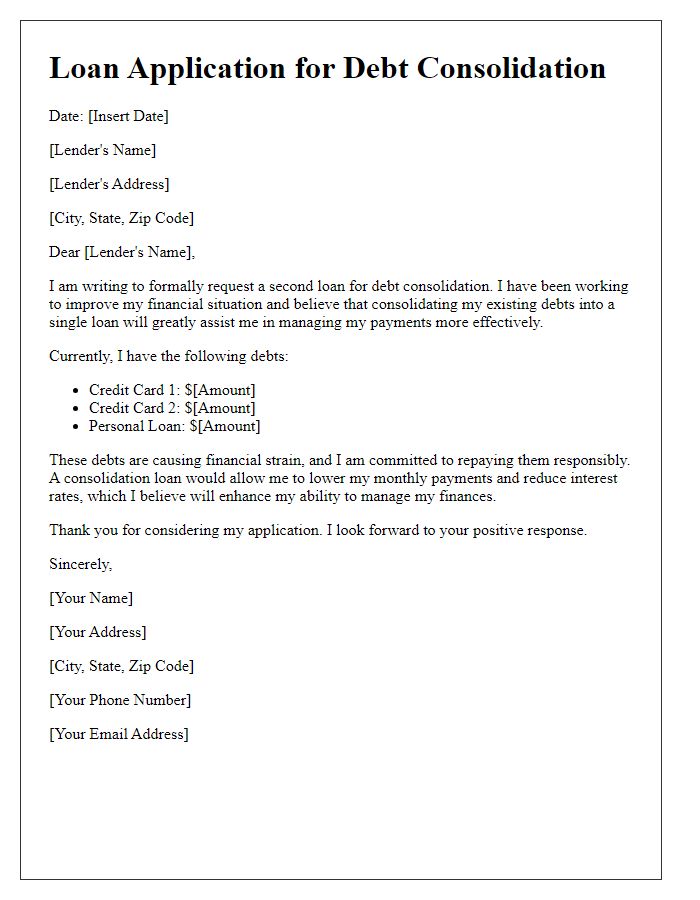

Securing a second loan can provide necessary funding for various purposes, such as home renovations, debt consolidation, or starting a small business. In the case of home renovations, borrowers often seek amounts ranging from $10,000 to $50,000 to enhance property value through upgrades like kitchen remodels or energy-efficient windows. For debt consolidation, individuals frequently request loans to combine high-interest debts into a single manageable payment, reducing their financial burden. Small business startups generally require loans around $25,000 to $100,000 to cover initial costs like equipment purchase, marketing, and operational expenses. Each type of loan carries specific requirements and impacts the borrower's financial landscape significantly.

Repayment plan.

A well-structured repayment plan is crucial for a second loan application, especially for amounts exceeding $10,000. The plan often includes a timeline (typically 36 to 60 months) detailing monthly payments, interest rates, and the total loan amount (principal plus interest) due at the end of each term. A positive credit history (including on-time payments) enhances credibility, demonstrating an ability to manage finances effectively. Potential lenders may also request a breakdown of monthly expenses (like rent, utilities, and groceries) to assess disposable income. An emergency fund (ideally covering three to six months of expenses) evidences financial stability, indicating preparedness for unexpected job loss or expenses. This comprehensive financial overview strengthens the likelihood of approval for the second loan.

Credit history overview.

A credit history overview reveals an individual's borrowing and repayment behaviors, crucial for loan applications. Factors such as credit score, calculated between 300 and 850, signify creditworthiness. Timely payments on previous loans, including personal and mortgage loans, enhance the score. Negative marks, such as late payments or defaults, remain on the report for up to seven years. Lenders also assess the debt-to-income ratio, which compares total monthly debt payments to gross monthly income for a comprehensive financial picture. The credit report includes information from credit bureaus, like Experian, TransUnion, and Equifax, detailing account status, credit inquiries, and public records, ultimately influencing loan approvals and interest rates.

Supporting documents.

A comprehensive second loan application includes critical supporting documents that enhance its credibility and substantiation. Essential financial statements should comprise income verification forms, recent pay stubs, and tax returns for the last two fiscal years (2021, 2022) to showcase financial stability. Personal identification, such as a government-issued photo ID or driver's license, reaffirming identity and address, is crucial. Bank statements for the last three months (July, August, September 2023) should be included to demonstrate cash flow and savings. Credit reports from agencies like Experian or TransUnion provide lender insights into creditworthiness. Additionally, documentation regarding existing debts, such as mortgage statements or auto loan agreements, reveal the total debt obligations. Any relevant asset documentation, such as property appraisals or investment account summaries, supports the application further. These documents together create a solid case for the additional funding request.

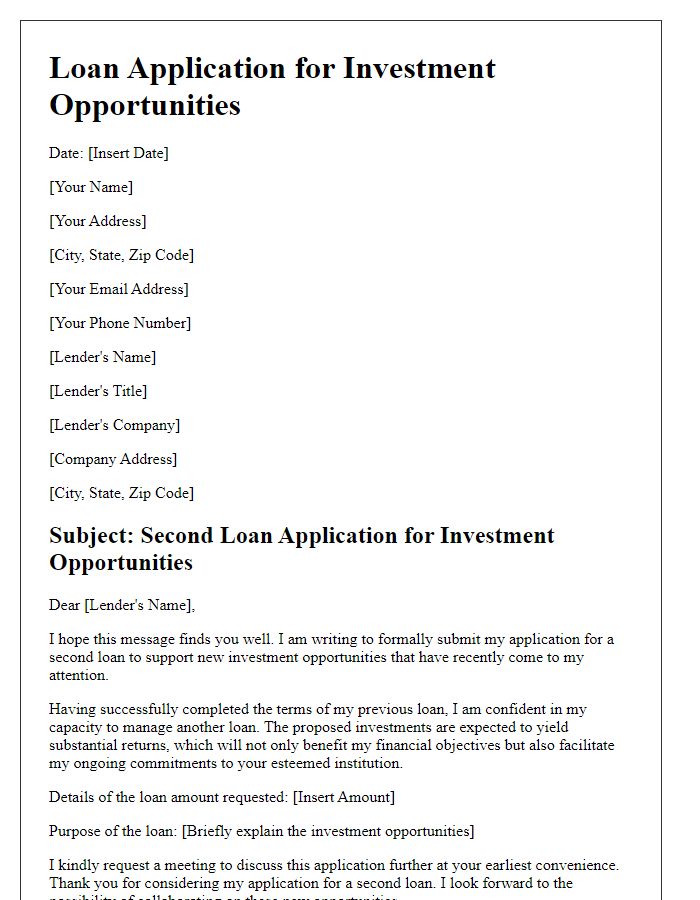

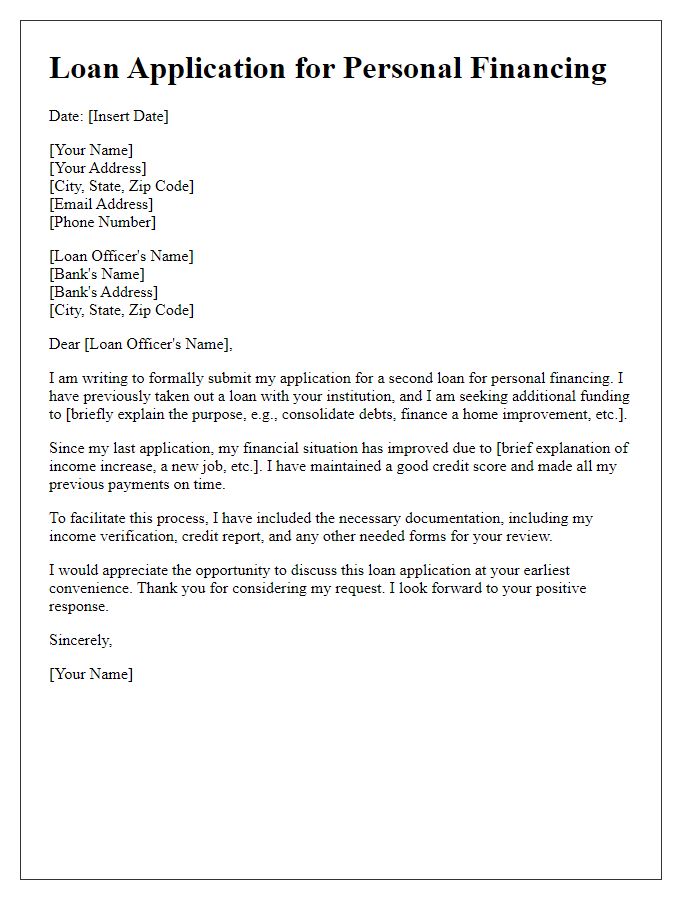

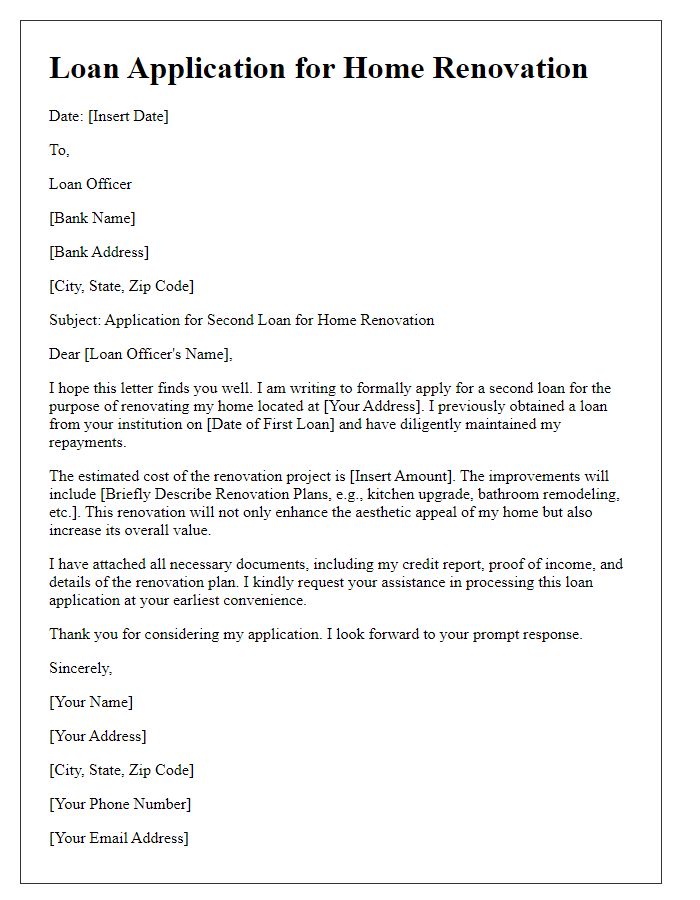

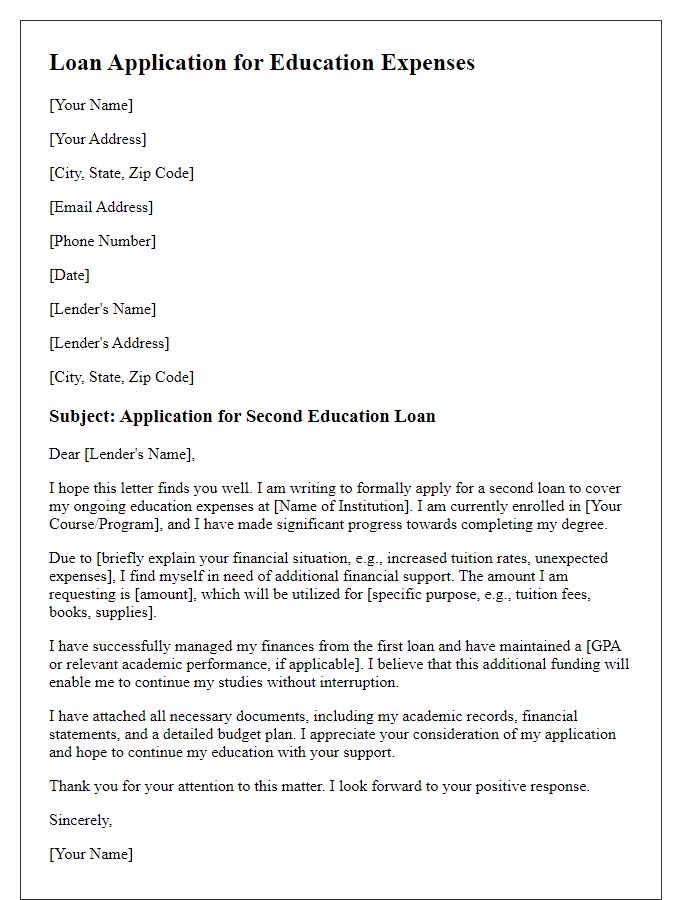

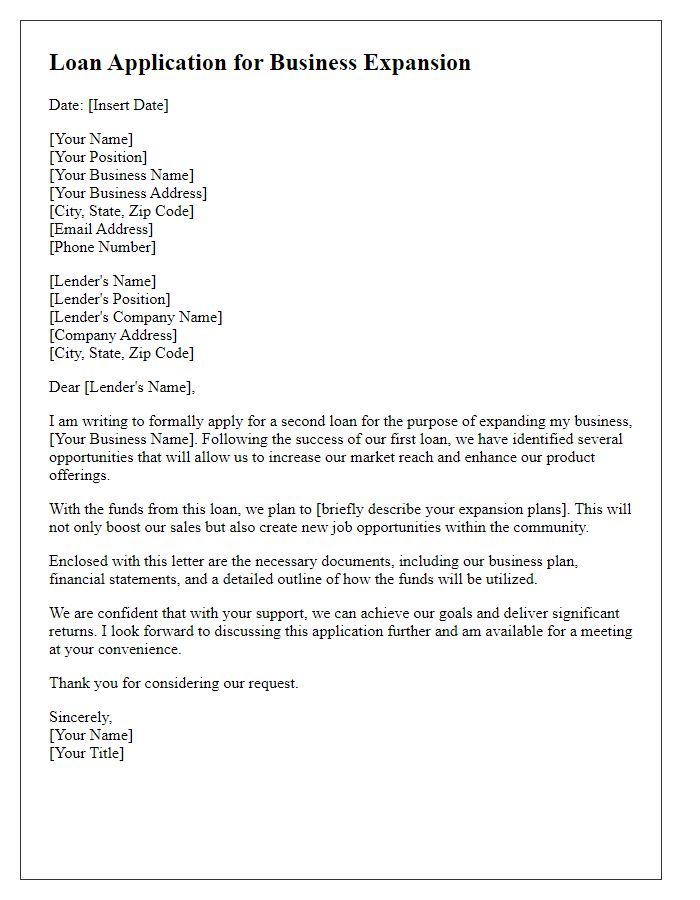

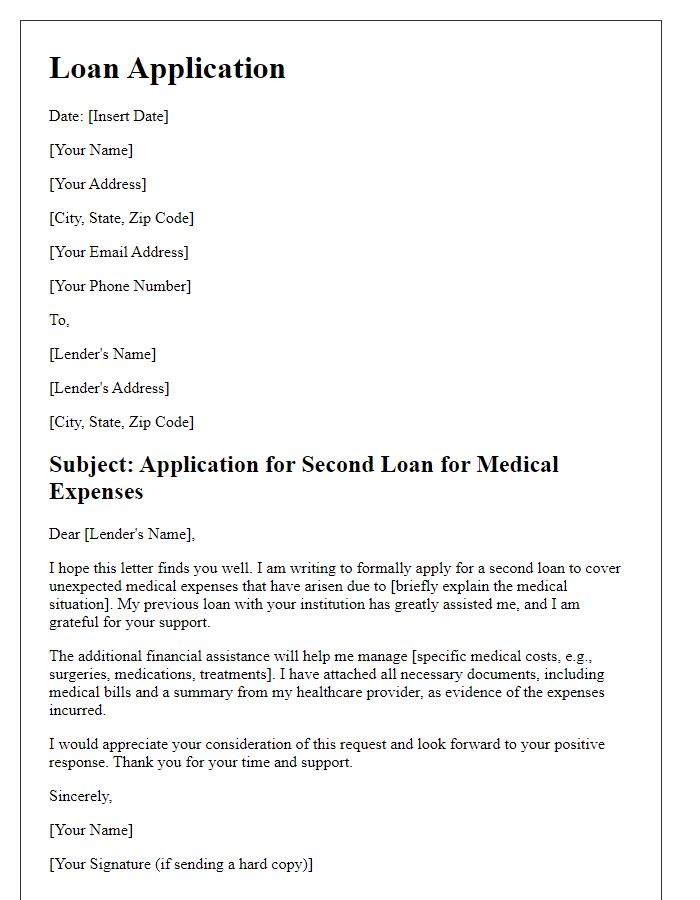

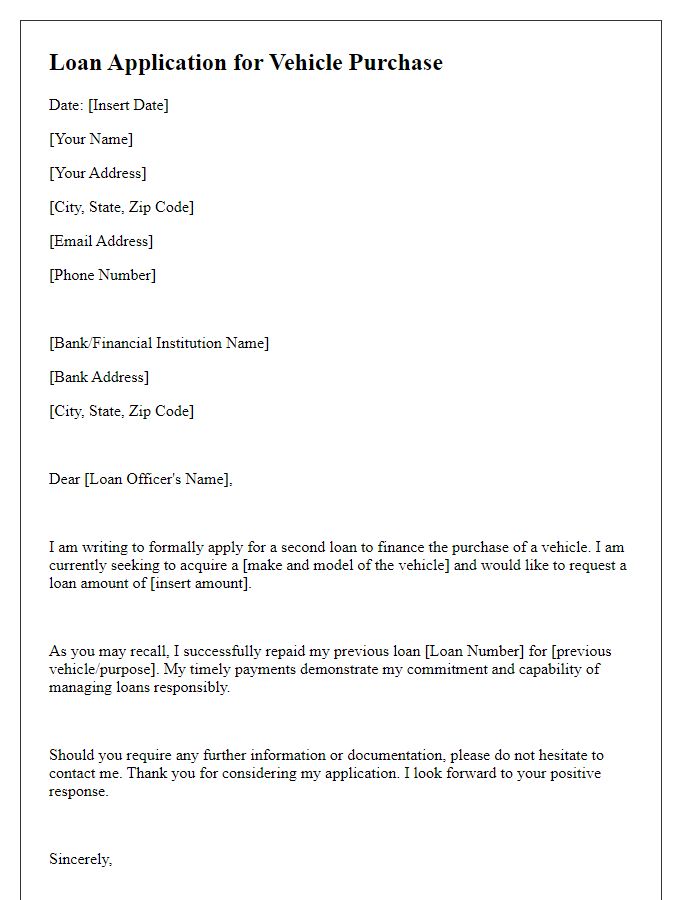

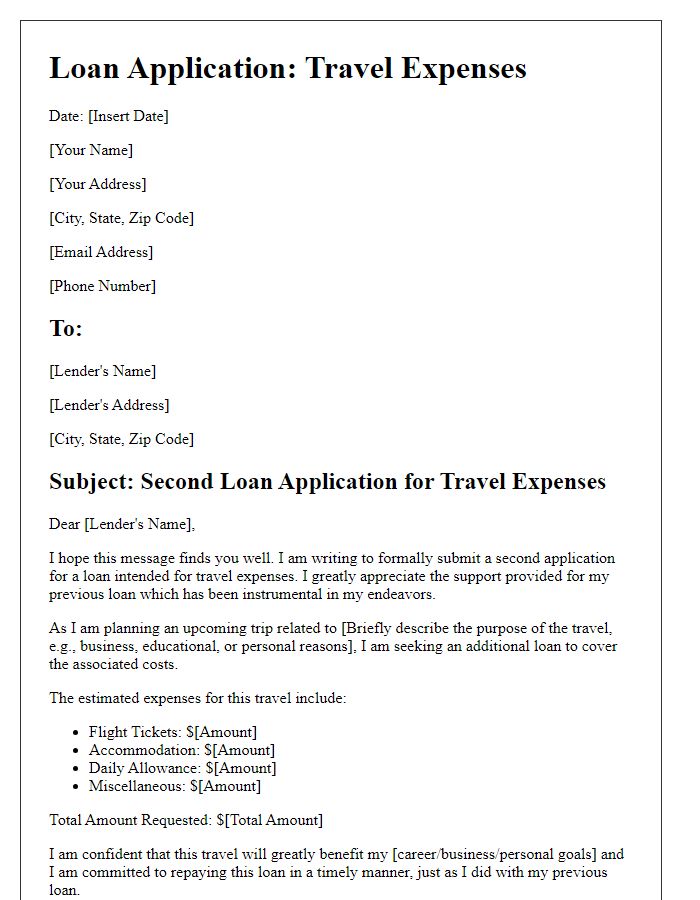

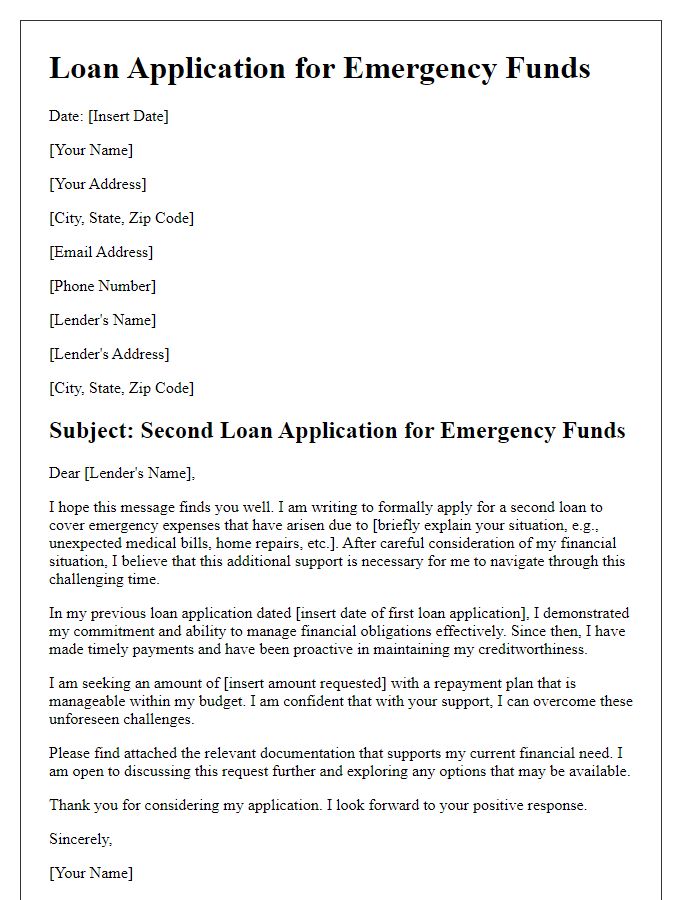

Letter Template For Second Loan Application Samples

Letter template of second loan application for investment opportunities.

Comments