Are you considering applying for a joint loan with a partner or co-borrower? Navigating the world of finance together can be both exciting and daunting, but having a well-crafted letter can make all the difference. This letter serves as your introduction, showcasing your financial goals and intentions clearly. Ready to dive deeper into crafting the perfect joint loan application letter? Read on for a comprehensive guide!

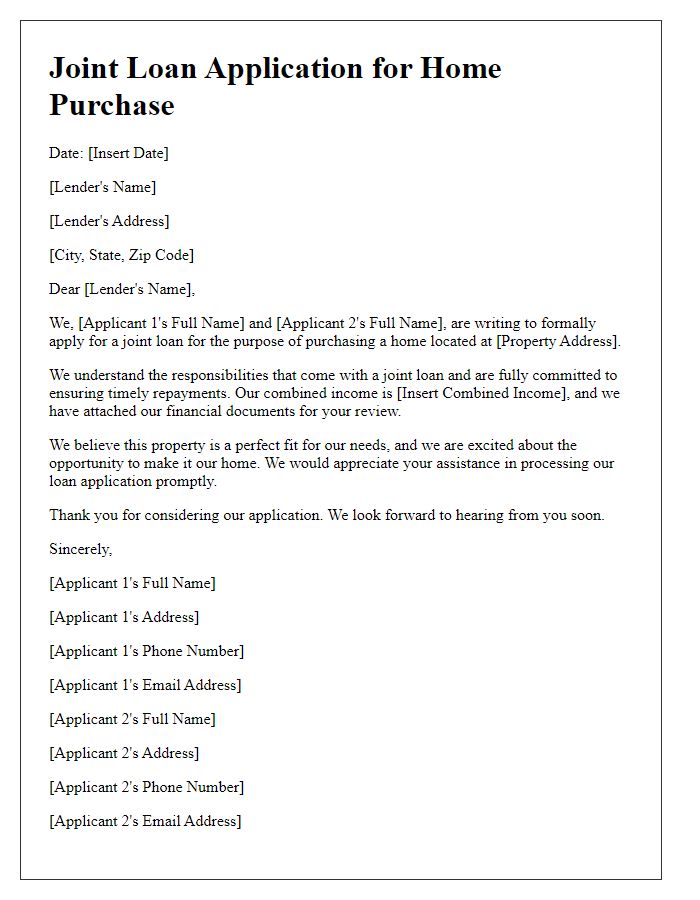

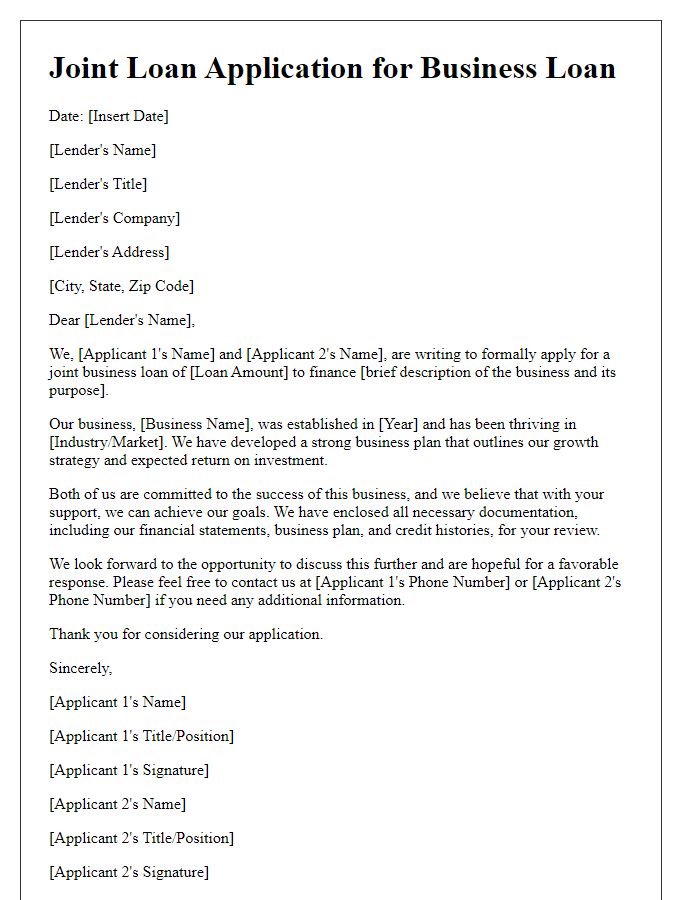

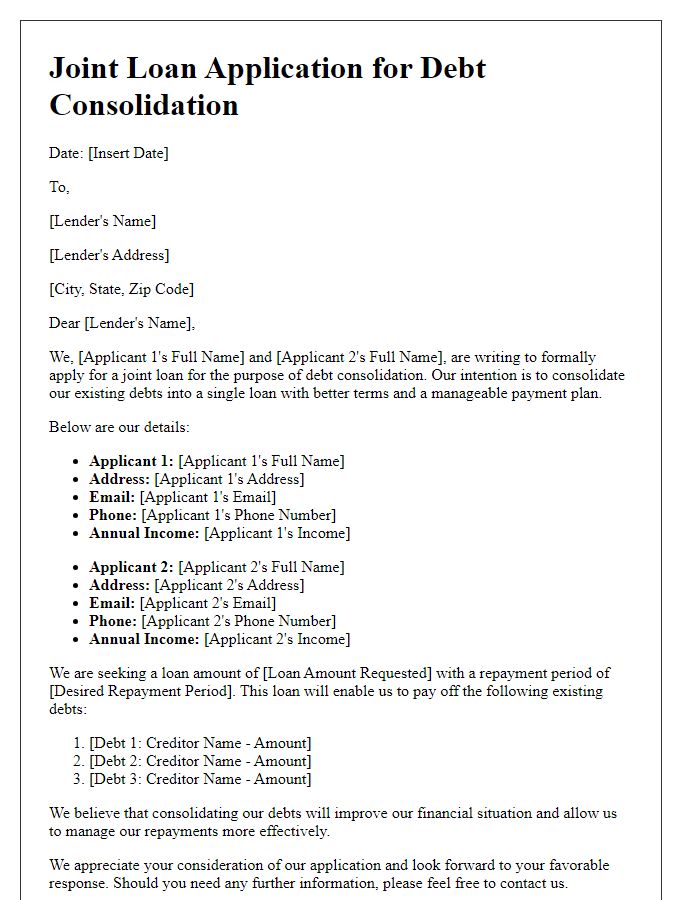

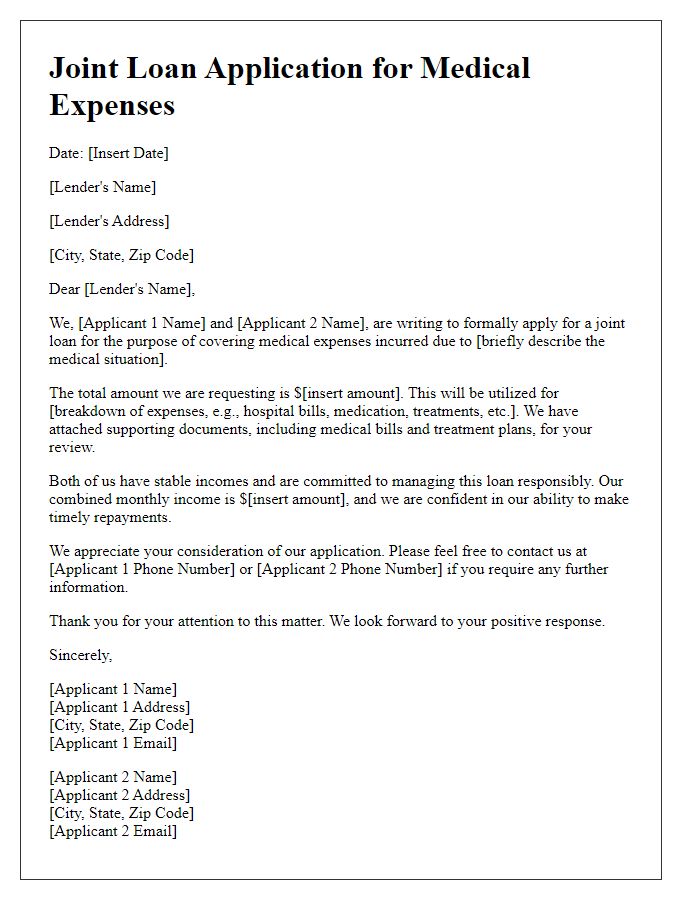

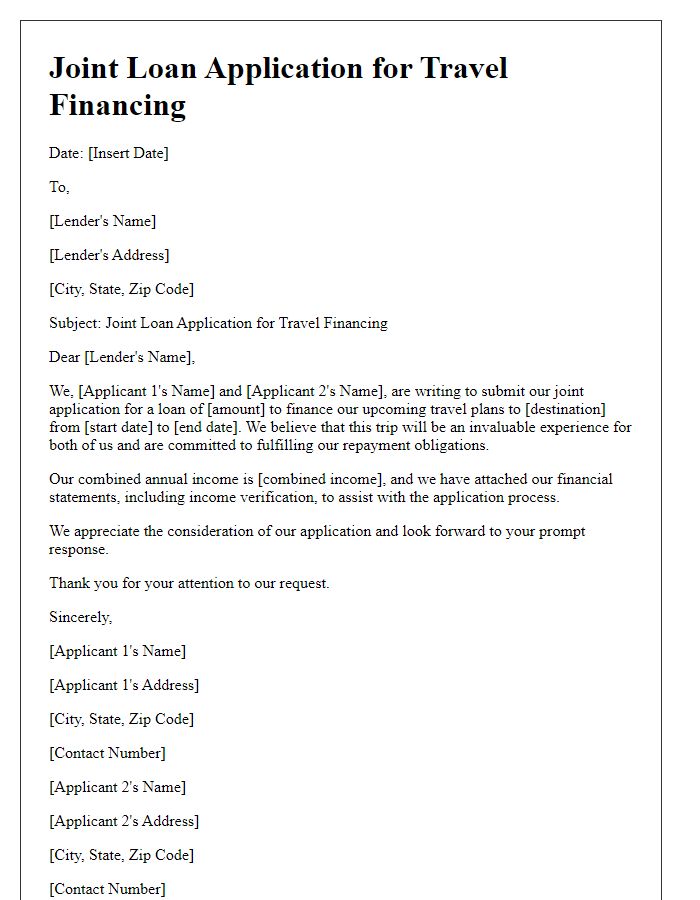

Applicant Information and Purpose

Joint loan applications often stem from significant financial endeavors. Applicants generally include entities such as couples or business partners seeking funds for substantial purchases, like homes or vehicles. For a home loan, applicants may include individuals with strong credit scores, often above 700, seeking to secure funding from institutions like Bank of America. The purpose of the loan typically revolves around acquiring real estate in locations with growing property values, such as Austin, Texas, where median prices have surged over 20% in recent years. This financial collaboration aims to enhance their purchasing power, combining incomes and assets to qualify for higher loan amounts, demonstrating shared responsibility for repayment.

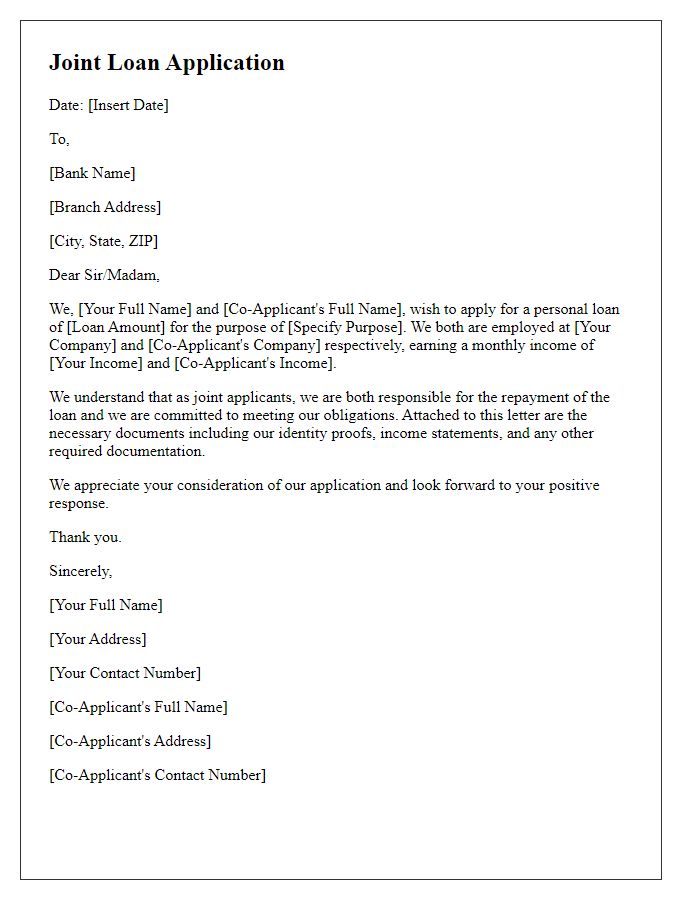

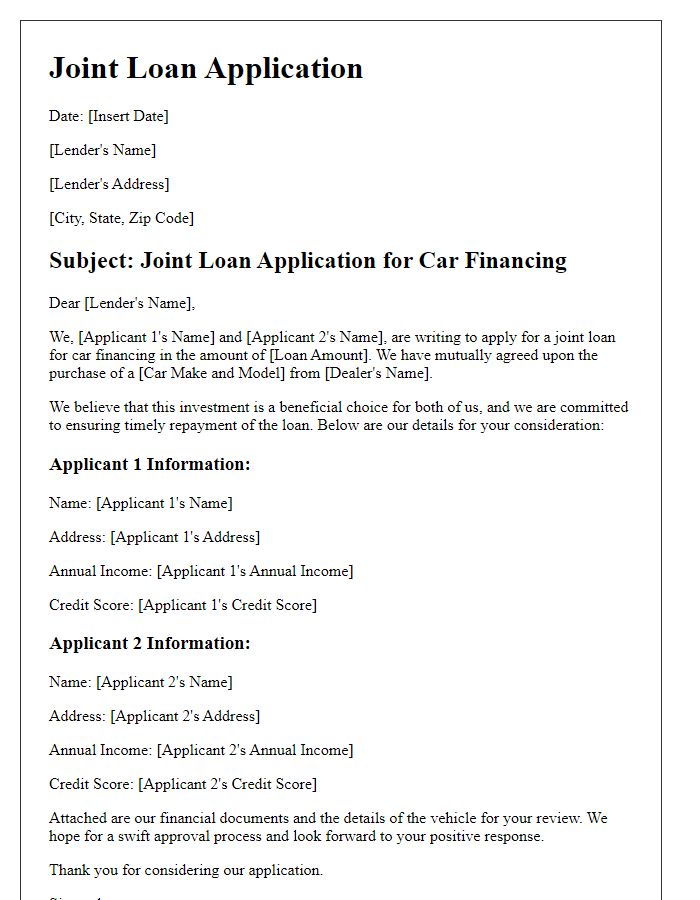

Loan Details and Amount

When applying for a joint loan, individuals typically provide specific details about the financial requirements. The total loan amount often ranges from $10,000 to $500,000. The purpose of the loan could include home renovations, consolidation of debt, purchasing a vehicle, or financing education. Lenders may require information regarding employment and income, often requiring a combined income of $50,000 or more to ensure repayment ability. Additionally, the loan term might vary from five to thirty years, influencing monthly payment amounts and total interest paid over time. Individuals should also include information on credit history, typically looking for a combined credit score above 650 to qualify for favorable interest rates. This comprehensive approach helps in presenting a strong joint application to financial institutions.

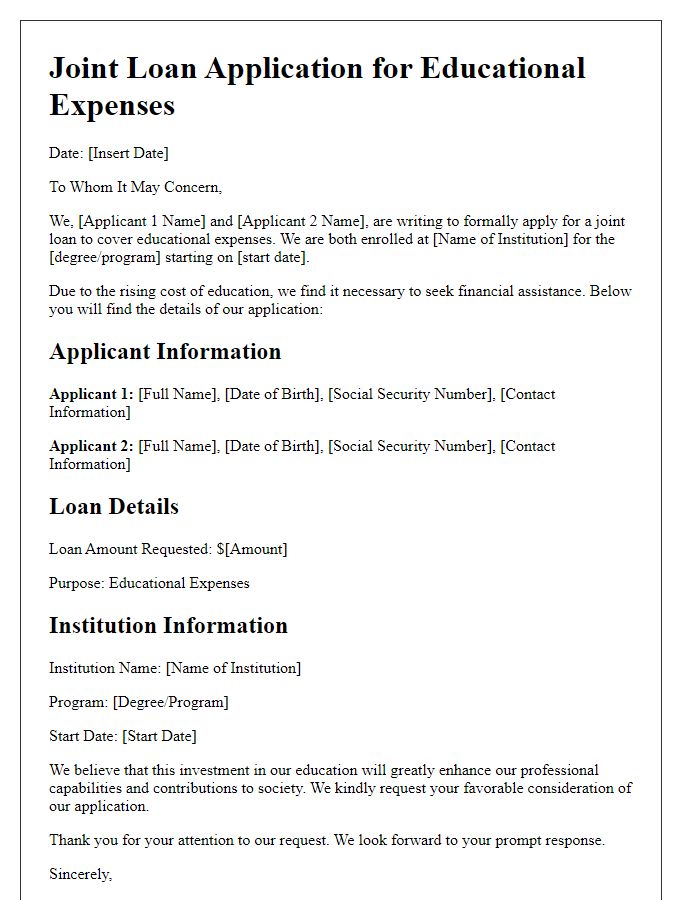

Joint Applicant Information

Joint loan applications involve multiple parties, often seeking large sums for significant purchases like homes or vehicles. In such instances, financial entities usually require detailed information from each applicant. Essential information may include full names, Social Security Numbers (SSNs), current addresses, and employment details. Both incomes must be disclosed, reflecting steady employment and financial health. Credit scores from major bureaus, such as Experian or TransUnion, are evaluated to assess creditworthiness. Lenders often look at the combined debt-to-income ratios to determine the overall financial burden. Property details, if applicable, including purchase amounts and locations, play a crucial role in the assessment process. Clear documentation is essential for a smooth application experience.

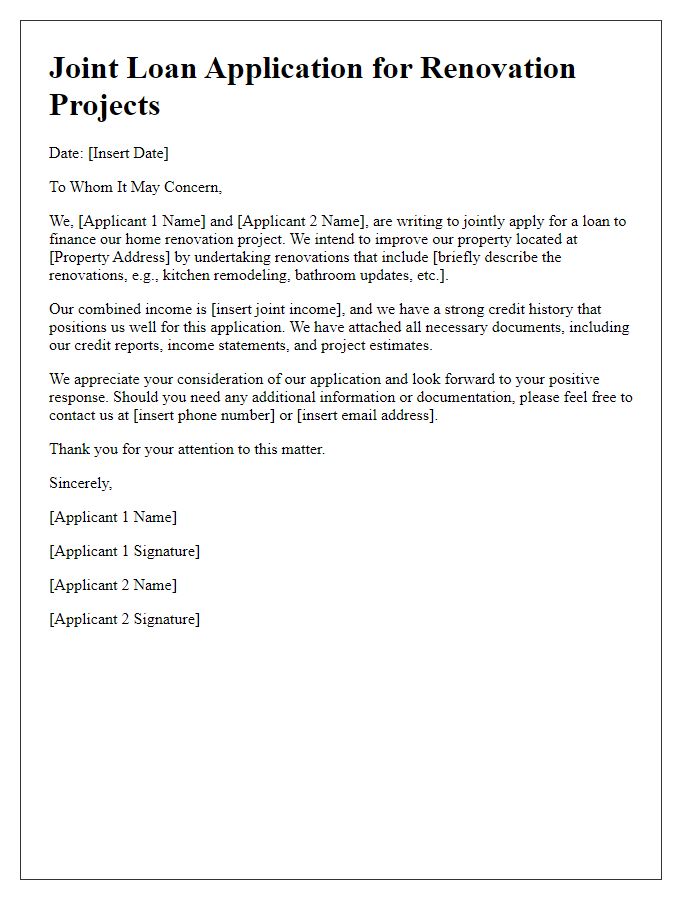

Financial Background and Creditworthiness

A joint loan application requires a comprehensive assessment of both applicants' financial backgrounds and creditworthiness. Income stability plays a crucial role, with salaried individuals typically needing documentation like pay stubs or W-2 forms from the last two years to verify annual income levels (often exceeding $50,000 for favorable loan terms). Self-employed applicants should provide tax returns and profit-loss statements, reflecting consistent earnings over similar periods. Credit scores serve as a critical indicator, with scores above 700 generally categorized as strong, indicating reliable payment history and low credit utilization. Additionally, outstanding debts, such as student loans or credit card balances, are evaluated through the debt-to-income ratio, ideally maintained under 36%. Lastly, the length of credit history is important, with a longer duration often suggesting responsible credit management. Key financial documents and an organized snapshot of both applicants' financial landscapes can enhance the likelihood of loan approval from financial institutions.

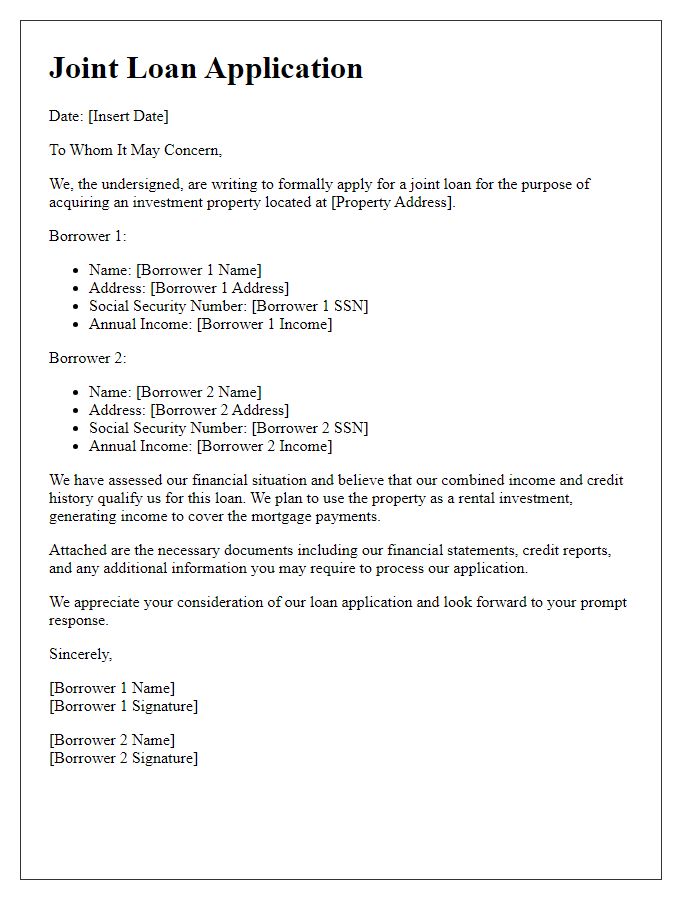

Repayment Plan and Commitment

A joint loan application requires a comprehensive repayment plan to ensure both parties can fulfill financial obligations. A well-structured repayment plan outlines the loan amount, interest rates (typically ranging from 3% to 7% depending on credit profiles), and the total repayment term (commonly 15 to 30 years for mortgages). It also includes monthly payment calculations based on the principal balance and amortization schedules. Both applicants must demonstrate stable income sources, such as employment at recognized companies (e.g., Fortune 500 firms) or consistent freelance income, to showcase their financial commitment. Additionally, a commitment clause reinforces accountability, stipulating how unexpected financial challenges (like job loss or medical emergencies) will be addressed, ensuring that both parties remain dedicated to the repayment timeline. Proper documentation, including credit scores (which can greatly impact interest rates), savings accounts, and asset declarations, solidifies the applicants' commitment to repaying the loan responsibly.

Comments