Applying for a financial aid loan can feel daunting, but it doesn't have to be! In this article, we'll walk you through a simple letter template that captures your needs and aspirations effectively. By crafting a clear and concise request, you can increase your chances of securing the financial support you need for your education. So, let's dive in and empower you to take this important step towards your future!

Personal identification and contact information

Completing a financial aid loan application necessitates clear and accurate personal identification. Essential details include full name (for legal identification), date of birth (to verify age eligibility, typically 18 years or older), social security number (unique identification in the United States), and current residential address (must include city, state, and ZIP code for correspondence). Contact information must comprise at least one phone number (to reach you directly regarding application status) and an email address (for electronic notifications). Academic details, like school name and expected graduation date, may also be pertinent. Ensure accuracy in all entries to avoid delays in processing.

Detailed financial situation and needs explanation

A financial aid loan application entails a thorough explanation of the applicant's financial circumstances, including details such as monthly income, outstanding debts, and essential living expenses. For instance, an applicant earning $3,000 monthly may face rent costs of $1,200 for a one-bedroom apartment in a metropolitan area like Los Angeles, alongside utility bills averaging $300. Additionally, other financial obligations, such as student loans or credit card debt totaling $15,000, can significantly impact disposable income. Furthermore, unexpected expenses like medical bills, averaging $200 monthly, highlight the unpredictability of maintaining financial stability. These factors collectively illustrate the necessity for financial aid support to ensure uninterrupted access to education and essential resources.

Academic and career goals

In pursuing higher education, students often aim to achieve specific academic and career goals that define their future pathways. For instance, aspiring educators may target a Bachelor's degree in Education from prestigious institutions such as Harvard University or Stanford University, intending to shape young minds. Similarly, students studying Computer Science at notable universities like the University of California, Berkeley, may plan to enter the tech industry, aiming for software engineering roles in leading companies such as Google or Microsoft. Professional aspirations often include pursuing advanced degrees, like a Master's in Business Administration (MBA) from institutions such as Wharton, with goals such as starting a business or climbing the corporate ladder in finance. Financial aid plays a critical role in transforming these goals into reality, ensuring students can access quality education and training necessary for their desired careers.

Demonstration of financial responsibility and repayment plan

Demonstrating financial responsibility is crucial for securing a financial aid loan. Borrowers should analyze their income sources, such as employment wages, scholarships, and family contributions, ensuring consistency in cash flow management. A detailed repayment plan should outline expected graduation dates, projected starting salaries based on chosen professions, and monthly budget allocations to meet loan obligations. Establishing an emergency fund, ideally covering three to six months of living expenses, showcases preparedness for unforeseen circumstances. Additionally, maintaining a strong credit score, typically above 700, indicates reliability to lenders, enhancing the chance of approval. Engaging in financial literacy programs or budgeting workshops can also reflect commitment to sound financial practices, further solidifying the applicant's position in the eyes of lenders.

Polite closing statement and request for consideration

Submitting a financial aid loan application often requires a polite and respectful closing statement. A well-crafted closing acknowledges the reader's time and consideration, while also reinforcing the applicant's need for support. Express gratitude for the opportunity to present the application and respectfully request the committee to consider the situation with empathy and understanding. Highlight any specific details about the applicant's background, such as academic achievements or financial hardships, to enhance the request's impact. Ending on a hopeful note can also reflect optimism regarding the outcome of the application process.

Letter Template For Financial Aid Loan Application Samples

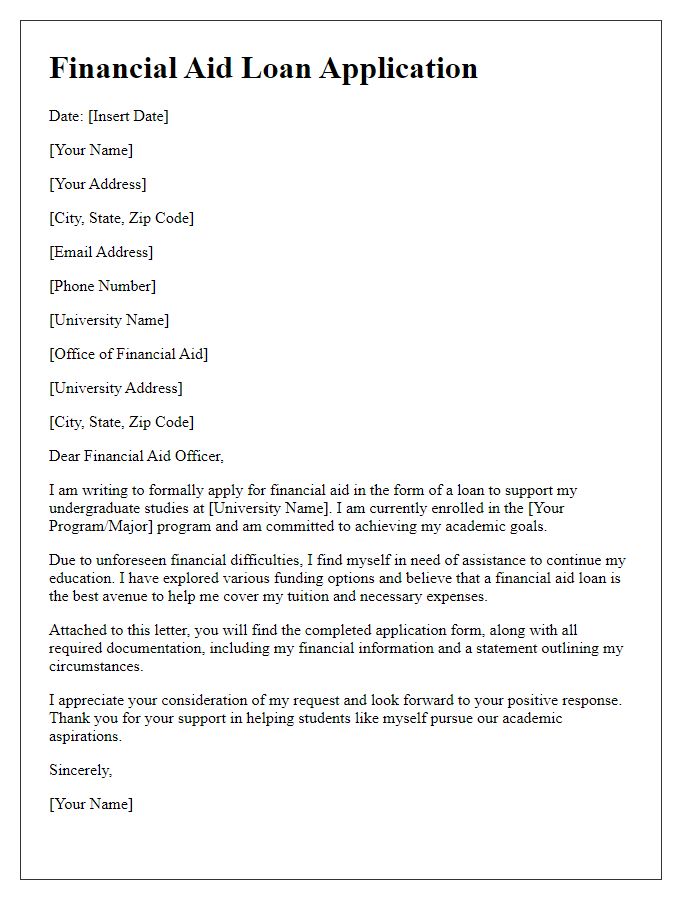

Letter template of financial aid loan application for undergraduate studies

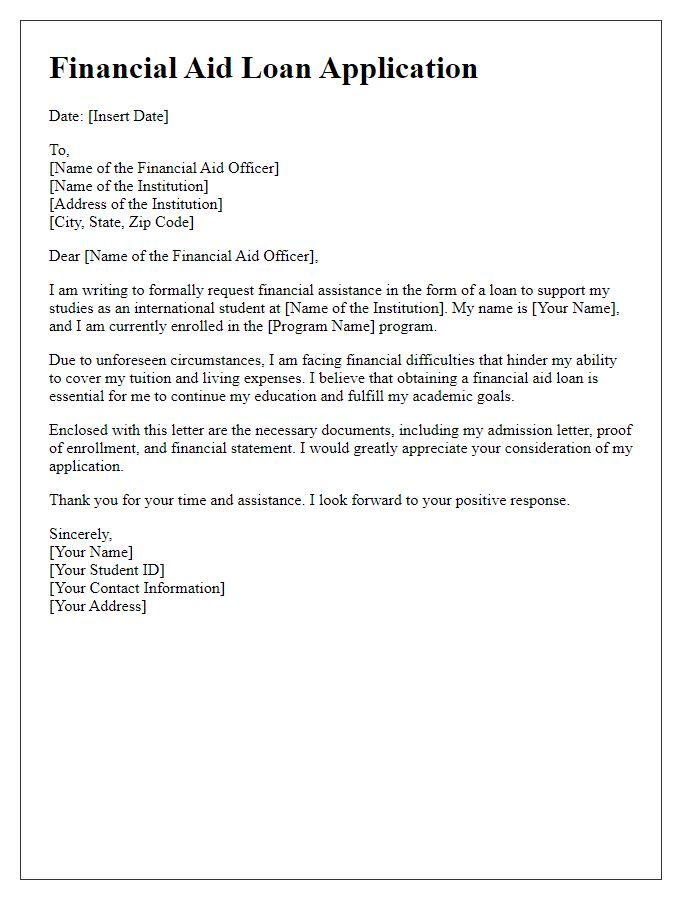

Letter template of financial aid loan application for international students

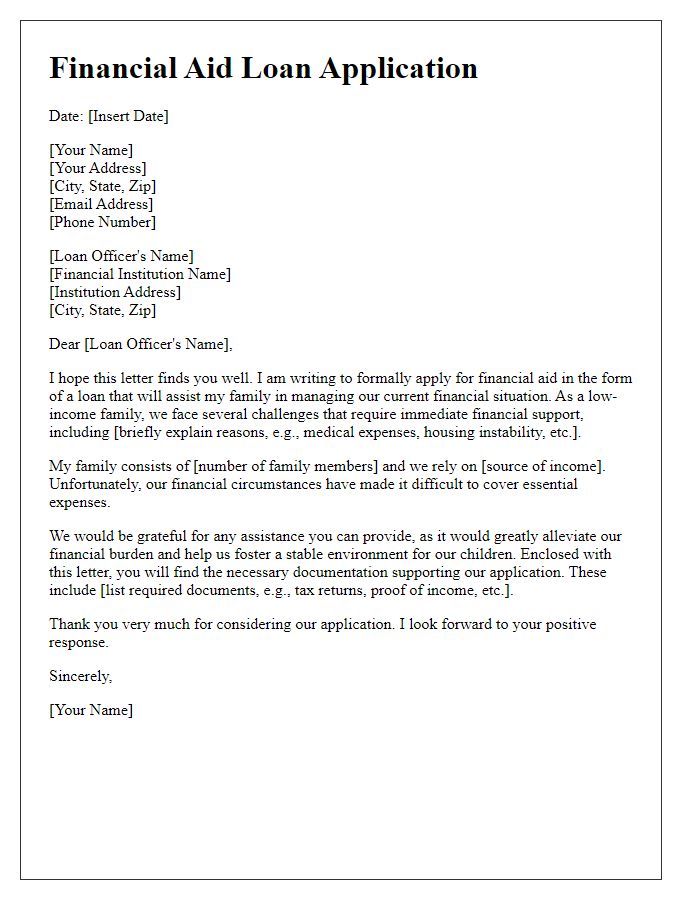

Letter template of financial aid loan application for low-income families

Letter template of financial aid loan application for part-time students

Letter template of financial aid loan application for specialized courses

Letter template of financial aid loan application for community college enrollment

Comments