Are you feeling overwhelmed by your current loan agreement? You're not alone; many borrowers find themselves in need of a loan contract modification to better align with their financial situation. This process can provide relief by adjusting your loan terms, making payments more manageable. If you're curious about how to navigate this modification process effectively, keep reading for a step-by-step guide!

Borrower Information

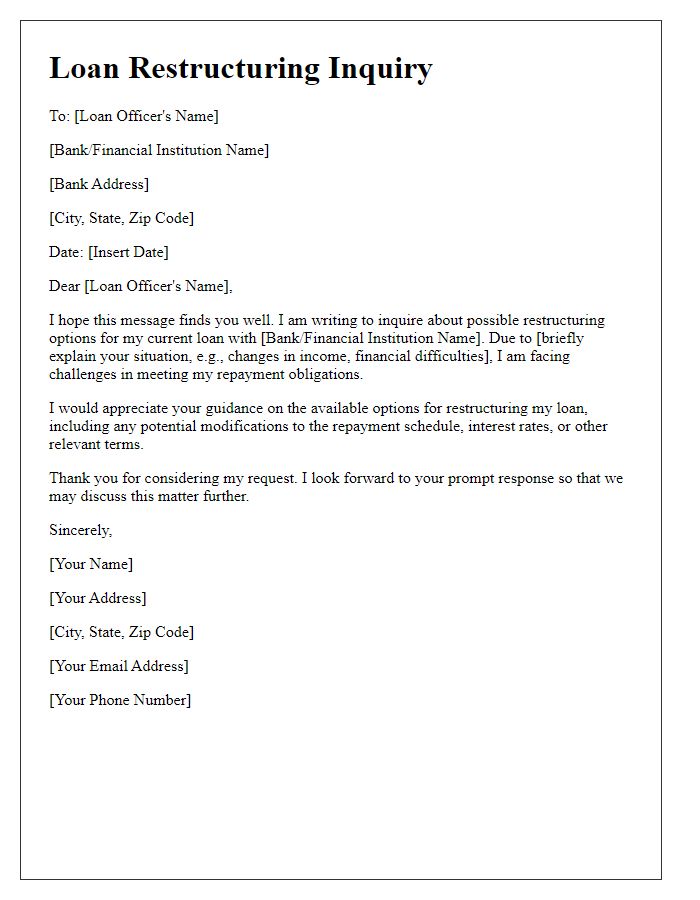

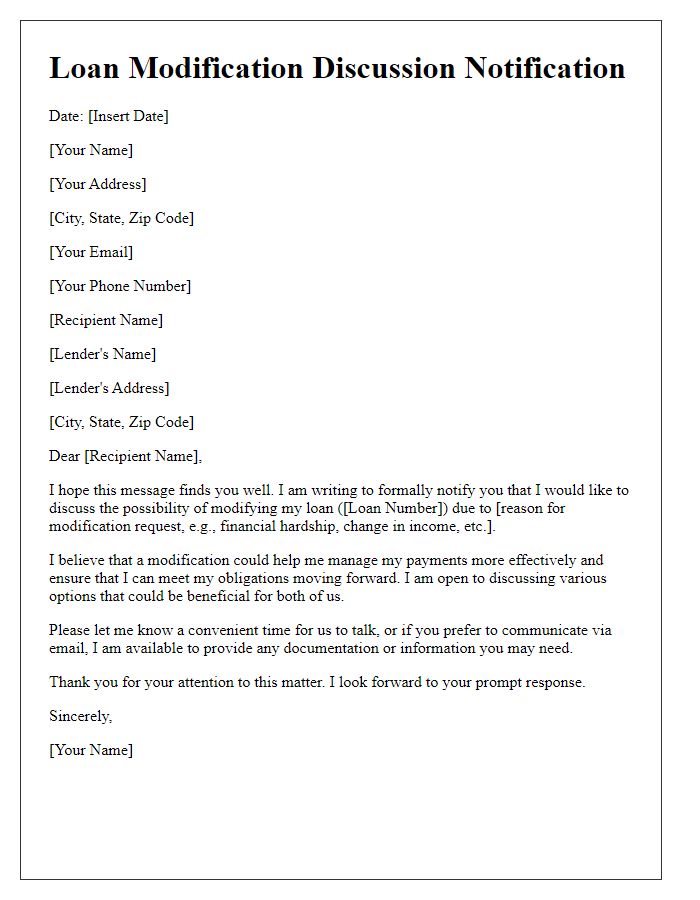

The borrower information section of a loan contract modification typically includes detailed personal and financial information critical to the agreement process. This includes the full legal name of the borrower, including any middle initials, associated Social Security Number (SSN), and current residential address (street, city, state, zip code). Additional elements may comprise the borrower's contact number and email address for effective communication, along with the original loan number associated with the borrowing transaction. It may also be beneficial to include the employment status, employer's name, and income details to provide context for the modification request. The clarity and accuracy of this information are vital to ensure proper identification and to facilitate the modification process in accordance with the terms set forth by the lending institution, which could involve changes to interest rates, payment schedules, or loan durations.

Loan Details

Loan modification involves changes to the original terms of a financial agreement, typically regarding personal loans, mortgages, or business loans. Essential loan details include principal amount (the original amount borrowed, for example, $200,000 for a mortgage), interest rate (fixed or variable percentage, such as 3.5% annually), payment schedule (monthly payments due on the 1st of each month), and maturity date (the date when the loan must be fully repaid, often 15 or 30 years after the loan commencement). Modifications may address different aspects, including extending the repayment period, lowering the interest rate, or altering payment amounts to accommodate borrower's financial changes. This process is often initiated due to factors such as unemployment, medical emergencies, or economic downturns, significantly impacting the borrower's ability to maintain original loan terms. Lenders typically require documentation to support the modification request and approve any alterations made to the initial agreement.

Modification Terms

Loan contract modifications involve adjusting existing terms of a financial agreement. Key elements include interest rates, repayment schedules, and loan amounts, which can greatly impact borrower obligations. For example, a reduced interest rate of 4.5% instead of the original 5.5% significantly lowers monthly payments for a $100,000 loan over 30 years. Additionally, changes to the repayment schedule, such as extending the term from 15 years to 20 years, can improve cash flow for the borrower by reducing monthly outlays. It is crucial to document all modifications formally, ensuring both parties agree to the updated conditions to maintain legal clarity and prevent future disputes.

Legal Compliance

Loan contract modifications often require careful consideration of legal compliance to ensure adherence to applicable regulations and laws. These modifications, typically documented in formal agreements, must align with federal regulations such as the Truth in Lending Act (TILA) and state-specific lending laws. For instance, modifications in the United States may require proper disclosures and documentation to inform borrowers of changes in terms, interest rates, and payment schedules. Additionally, modifications may involve negotiation with financial institutions governed by the Office of the Comptroller of the Currency (OCC), necessitating clear communication about any adjustments to loan servicers. Proper legal review and consideration of consumer protection laws ensure that both parties fulfill their obligations and protect their rights during the modification process.

Signatures and Date

Loan contract modifications often require signatures and dating to ensure mutual agreement. Each party involved includes their full name and signature on the designated line. The date section is important, indicating when the modification takes effect. Typically positioned under the signature, exact month, day, and year should be clearly written. Witness signatures may also be necessary, especially for larger financial agreements, depending on jurisdictional requirements. Notarization, in some cases, adds an extra layer of authenticity and legal validity to the document.

Comments