Are you considering a cash-out refinance and wondering what conditions you need to meet? Navigating the world of mortgage options can be daunting, especially with terms and terms that may seem overwhelming. Understanding the key requirements can empower you to make informed financial decisions. So, let's dive in and explore the specifics of cash-out refinance conditions that will help you unlock the equity in your home!

Loan Purpose and Amount

A cash-out refinance allows homeowners to access equity in their property while obtaining a new mortgage. Homeowners typically choose this option for various purposes, such as home renovations, debt consolidation, or funding educational expenses. Loan amounts can vary significantly, generally ranging from $50,000 to $500,000, depending on the equity in the home. Lenders typically require that homeowners have at least 20% equity to qualify for this type of refinance. Interest rates influenced by market conditions also play a critical role in determining the overall cost of the loan. In many cases, cash-out refinance options can provide homeowners with lower interest rates compared to conventional loans, making this an attractive financial decision.

Property Details

When considering a cash-out refinance, it is crucial to assess specific property details, such as the type of property: single-family home, condominium, or multi-unit investment property. The appraised value plays a significant role, as lenders typically allow a cash-out of up to 80% of the home's current market value, determined by a licensed appraiser, usually within a two to four-week timeframe. The existing mortgage balance also impacts the cash-out amount, with specific requirements for loan-to-value (LTV) ratio, which should ideally remain below 80%. Moreover, property condition must meet minimum standards set by lenders to qualify for refinancing, including any necessary repairs to preserve the home's value. Additionally, the location, particularly in areas experiencing market fluctuations or high foreclosure rates, may affect eligibility and loan terms.

Borrower's Creditworthiness

Borrower's creditworthiness plays a crucial role in determining the terms of cash-out refinance agreements, particularly for single-family residential properties. Lenders typically evaluate credit scores, with many requiring a minimum score of 620 for conventional loans, indicating a moderate level of risk. Additionally, the borrower's debt-to-income ratio (DTI), often capped at 43%, assesses financial stability by comparing monthly debts to gross income. The current loan-to-value (LTV) ratio, calculated by dividing the remaining mortgage balance by the appraised home value, is also a significant factor; lenders often prefer an LTV ratio below 80% to mitigate risk. Furthermore, the borrower's employment history and documented income sources, including pay stubs or tax returns, provide insight into long-term financial reliability. Overall, robust creditworthiness can lead to favorable interest rates and terms, benefiting borrowers seeking to access equity through cash-out refinancing.

Existing Mortgage Information

An existing mortgage can significantly impact cash-out refinance conditions, including interest rates, loan-to-value (LTV) ratios, and credit score requirements. For instance, homeowners with mortgages through major lenders, like Wells Fargo or Bank of America, often face different evaluation criteria based on their payment history, current interest rate (typically ranging from 2.5% to 5.5%), and remaining balance. Additionally, the property appraisal, which determines current market value, plays a crucial role in calculating the maximum cash amount available, usually capped at 80% of the home's value as per lender guidelines. Each detail related to the existing mortgage influences the refinancing process, ultimately affecting the overall financial strategy of homeowners seeking to tap into their home equity for further investments.

Verification of Income and Employment

Cash-out refinance conditions often require verification of income and employment to ensure borrower eligibility and loan repayment capability. Lenders typically review recent pay stubs, W-2 forms, and tax returns for the past two years to assess steady income levels. Employment verification may involve contacting employers directly to confirm current job status, duration of employment, and salary details. This process is crucial to mitigate risks associated with lending and to align with guidelines set by entities like Fannie Mae or Freddie Mac, which oversee conforming loans. A significant change in income or employment status can affect loan approval and terms, hence the importance of thorough documentation in the refinancing process.

Letter Template For Cash-Out Refinance Conditions Samples

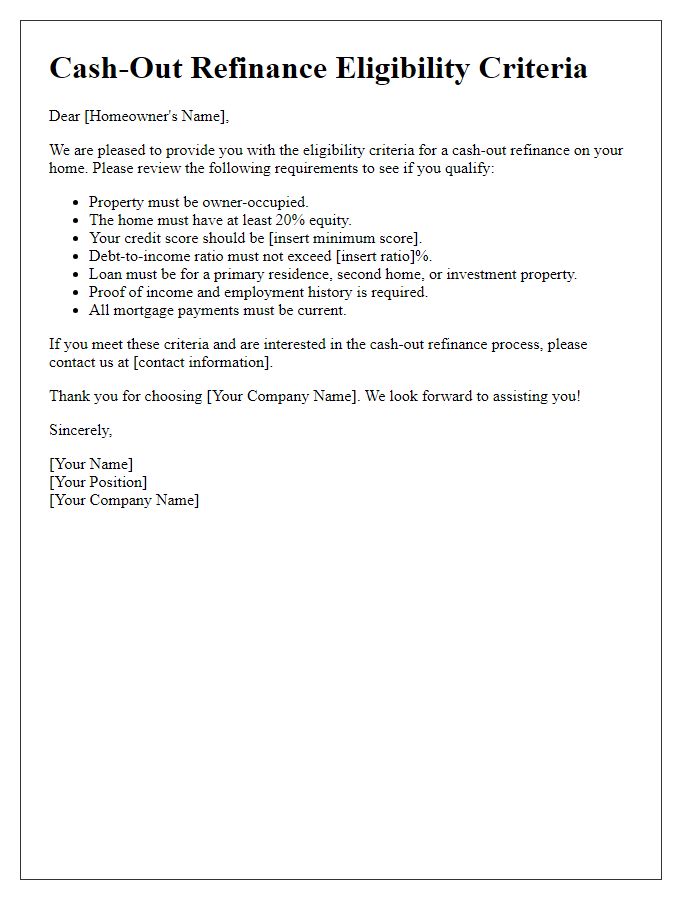

Letter template of cash-out refinance eligibility criteria for homeowners.

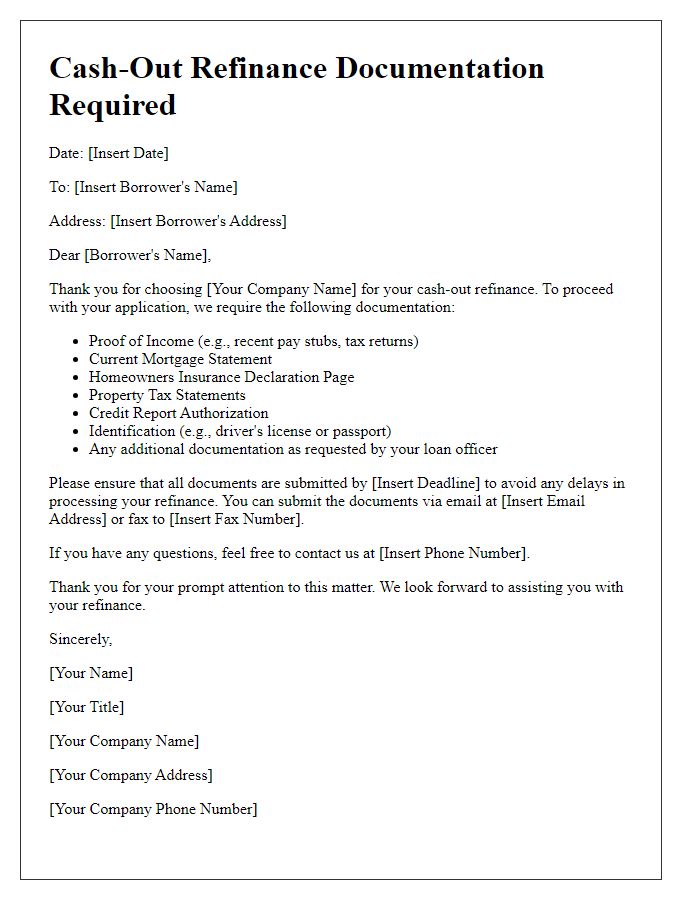

Letter template of cash-out refinance documentation needed for processing.

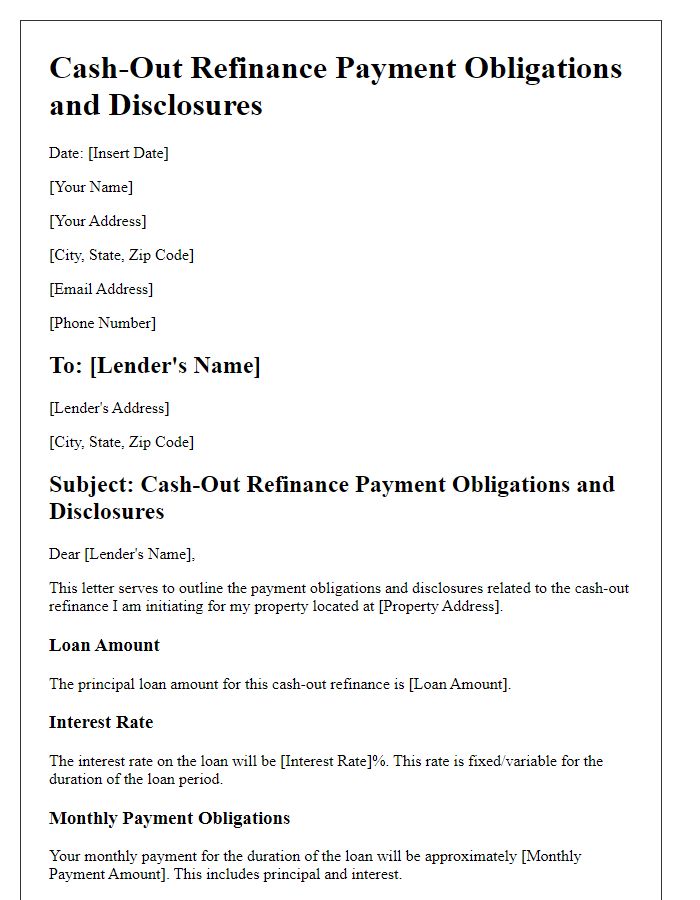

Letter template of cash-out refinance payment obligations and disclosures.

Comments