When it comes to managing debts, the process of transferring a loan to a collection agency can feel overwhelming. However, understanding the necessary steps and knowing how to draft an effective letter can make all the difference. In this article, we'll walk you through a simple letter template that you can use to initiate this process smoothly and professionally. So, let's dive in and explore how you can take control of your financial situationâread on to learn more!

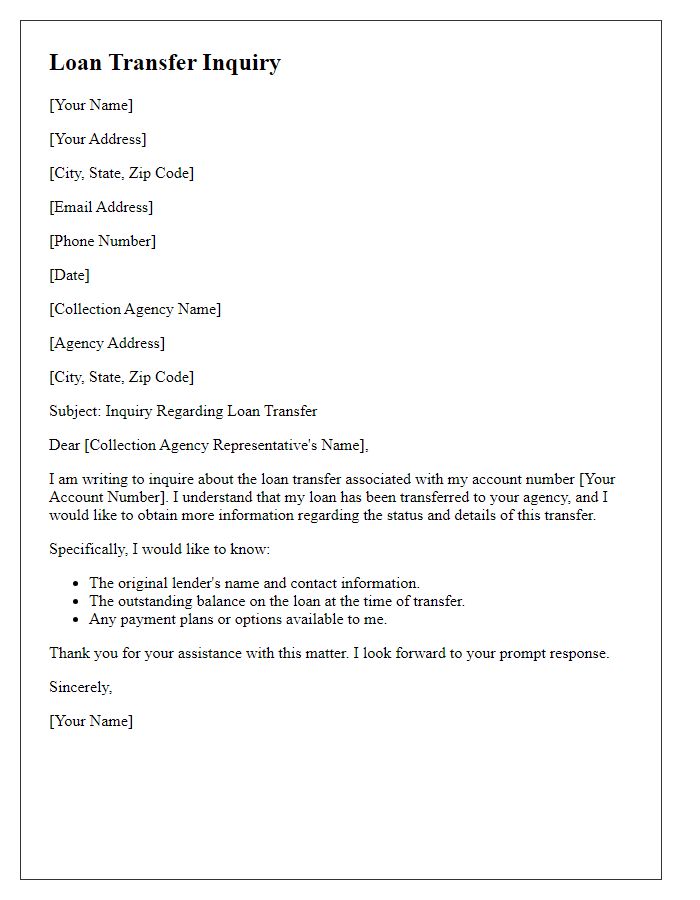

Borrower's Contact Information

Loan transfers to collection agencies occur when borrowers default on their obligations. Essential details regarding the borrower include full name, address, email, and phone number to ensure accurate communication. The collection agency, often a specialized firm, will manage the outstanding debt collection process. Proper identification of the loan, such as account number, original loan amount, and outstanding balance, is crucial. Accurate records of past payment attempts and any relevant correspondence must be included to provide context for the transfer. This ensures the collection agency has all necessary information for pursuing the debt effectively.

Loan Account Details

Loan account details must be accurately documented and communicated. Important elements include the loan account number, which serves as the primary identifier for tracking the loan within the lending institution. Borrower information should include the full name, address, and contact number of the individual responsible for repayment. The balance due reflects the total amount outstanding, which can include principal, interest, and any applicable fees. The original loan amount denotes the initial sum borrowed, while the loan type specifies whether it is a personal loan, mortgage, or auto loan. Additionally, details on the payment history need inclusion, showcasing late payments or defaults, which may pertain to collection agency policies. Lastly, the loan transfer date signifies when the account will officially move to the collection process, crucial for organizing subsequent actions.

Justification for Transfer

Loan transfers to collection agencies often occur due to various justifiable reasons related to delinquency and borrower behavior. Accounts exceeding 90 days past due (over $1,000) typically represent significant financial risk, making transfer necessary. Documentation such as payment history and communication records demonstrate the borrower's inability to meet repayment obligations. Collection agencies specialize in recovering debts, employing resources and strategies tailored to handle delinquent accounts effectively. Legal implications, including potential lawsuits for recovery, necessitate this transfer to ensure compliance with federal regulations, such as the Fair Debt Collection Practices Act. This strategic move aims to minimize further losses while maximizing recovery potential for financial institutions.

Collection Agency Contact Information

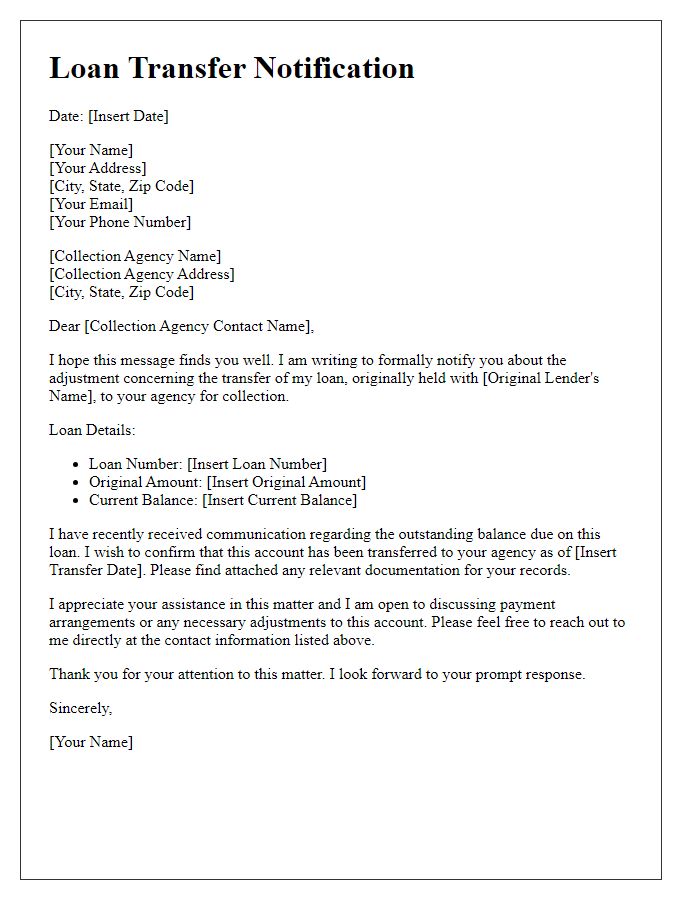

Collection agencies often play a vital role in the recovery of debts owed to companies. Essential contact information for collection agencies, including agency name, physical address, email address, and telephone number, is crucial for effective communication. For example, agencies like Transworld Systems may have a contact number such as (800) 214-1543 and an address located at 5600 W. 83rd St., Suite 300, Bloomington, MN 55437. Additionally, a professional tone in written correspondence can facilitate smoother transactions, along with adherence to regulations established by the Fair Debt Collection Practices Act (FDCPA). Ensuring that all relevant details about the debtor, such as account number and outstanding balance, are accurately presented is key to an efficient transfer process.

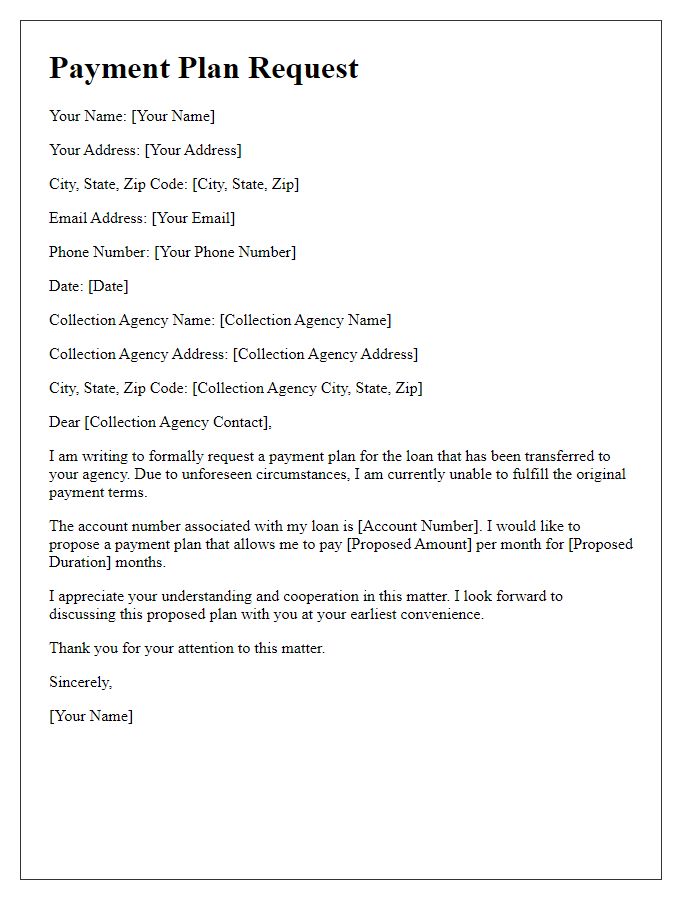

Terms and Conditions of Transfer

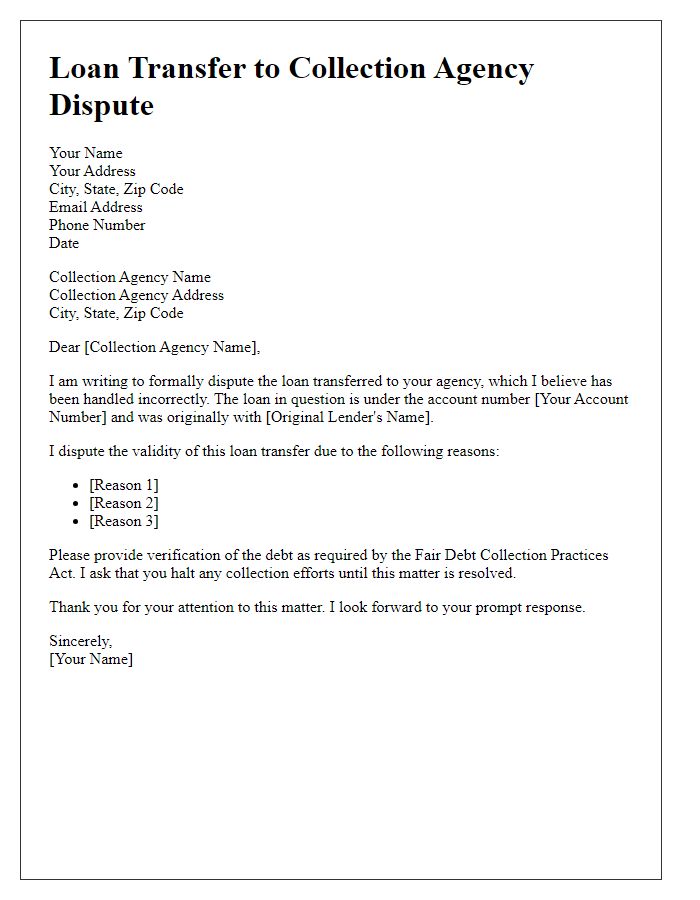

A loan transfer to a collection agency often involves several critical factors that outline the responsibilities of both parties. It typically includes the outstanding balance, which can range significantly based on the initial loan amount and payment history, specific terms of transfer such as the agreed percentage of the debt that the agency will retain from recovered funds, and notice periods that are generally stipulated in the original loan agreement. Furthermore, the deadline for repayment, which might range from 30 to 90 days, can impact the urgency of collection efforts. This transfer frequently adheres to federal regulations, including the Fair Debt Collection Practices Act (FDCPA), which governs the conduct of debt collectors, ensuring that the rights of borrowers are protected during the collection process. In cases of dispute, the terms may also detail mediation procedures, stipulating a preference for resolution through arbitration before proceeding to litigation.

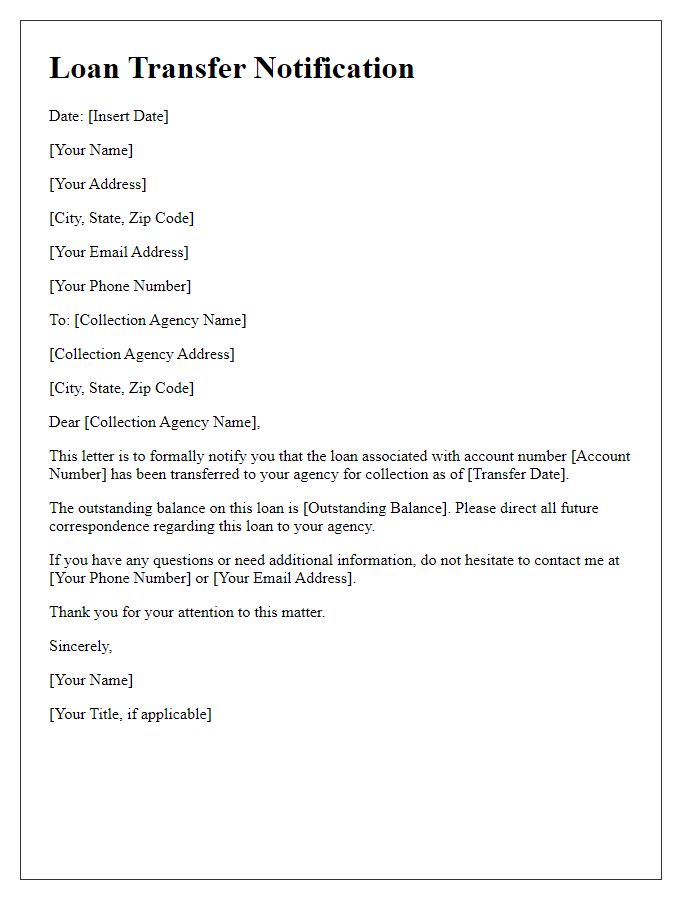

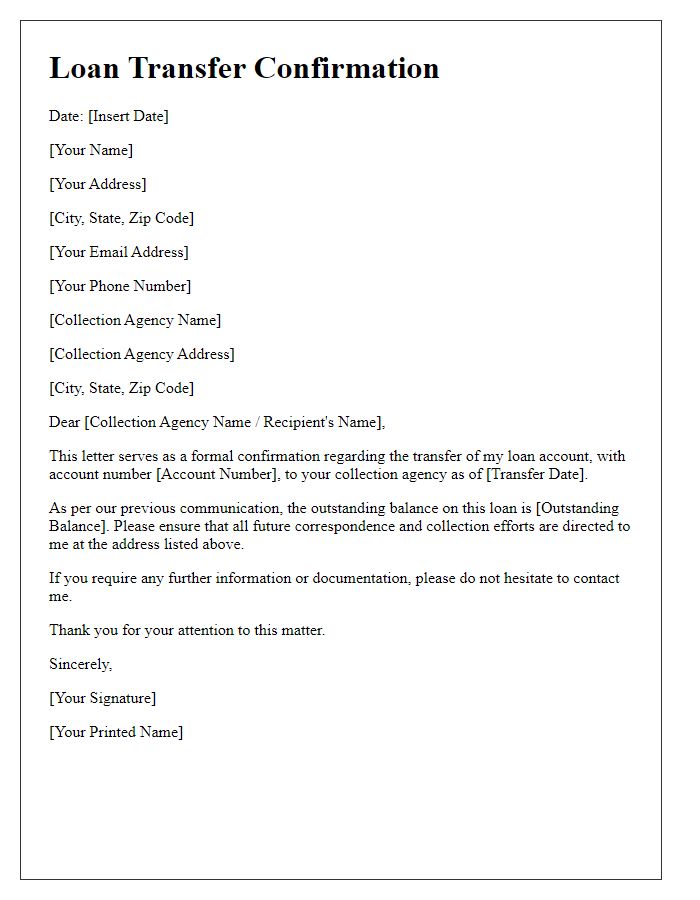

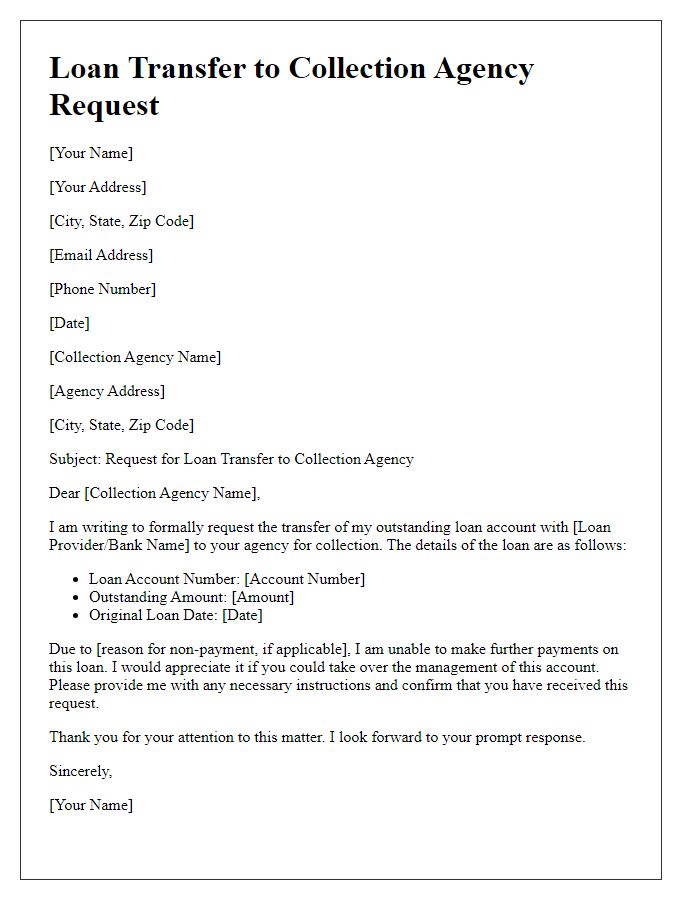

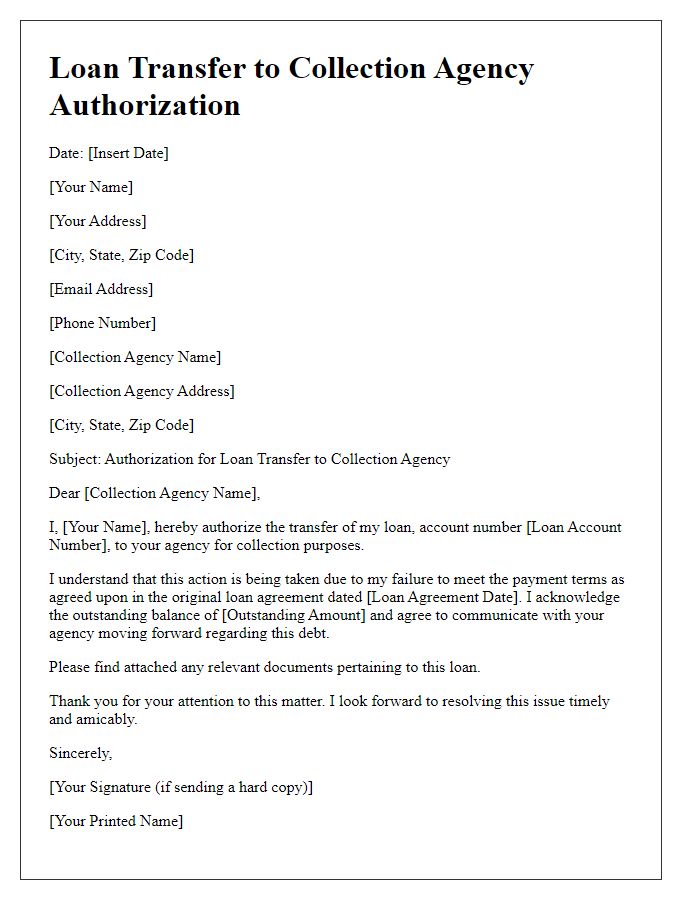

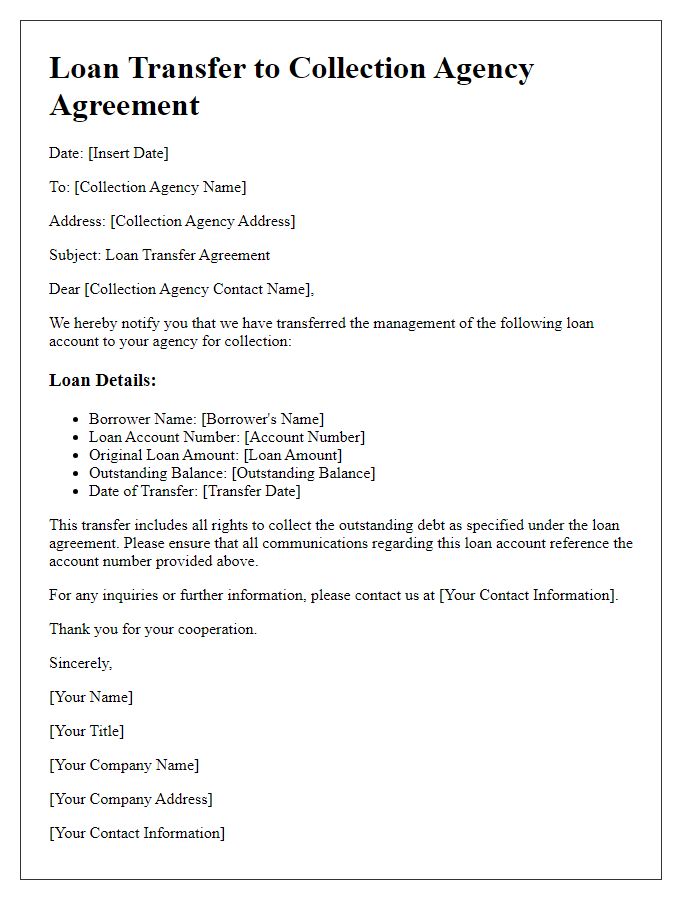

Letter Template For Loan Transfer To Collection Agency Samples

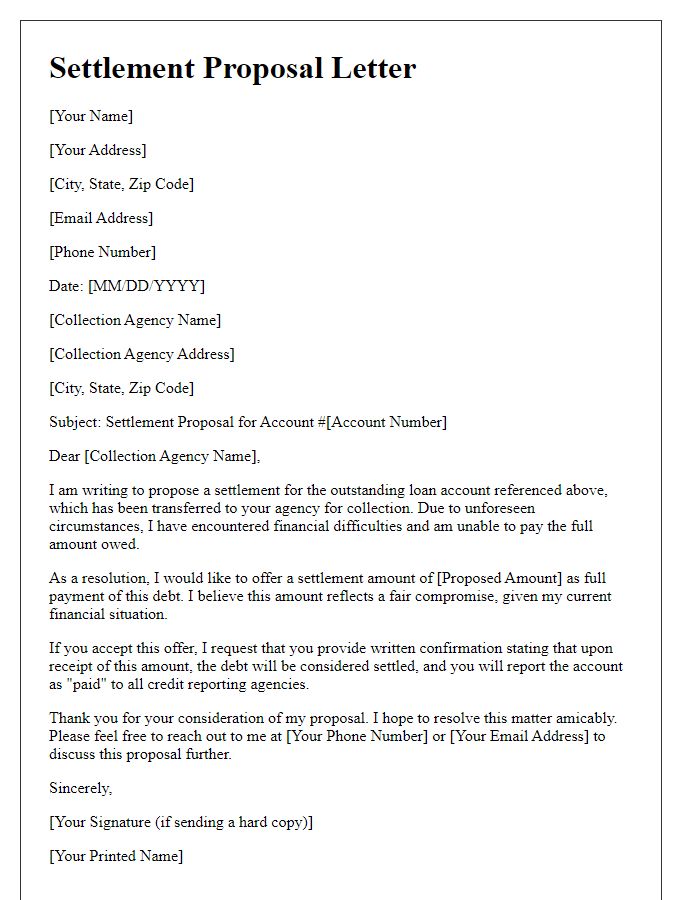

Letter template of loan transfer to collection agency settlement proposal.

Comments