Hey there! If you're looking for a straightforward way to update your loan insurance premium, you've come to the right place. This article will guide you in drafting a clear and concise letter that effectively communicates your need for a premium adjustment. So, let's dive in and explore the essential steps to ensure your financial peace of mindâread on to find out more!

Accurate Recipient Information

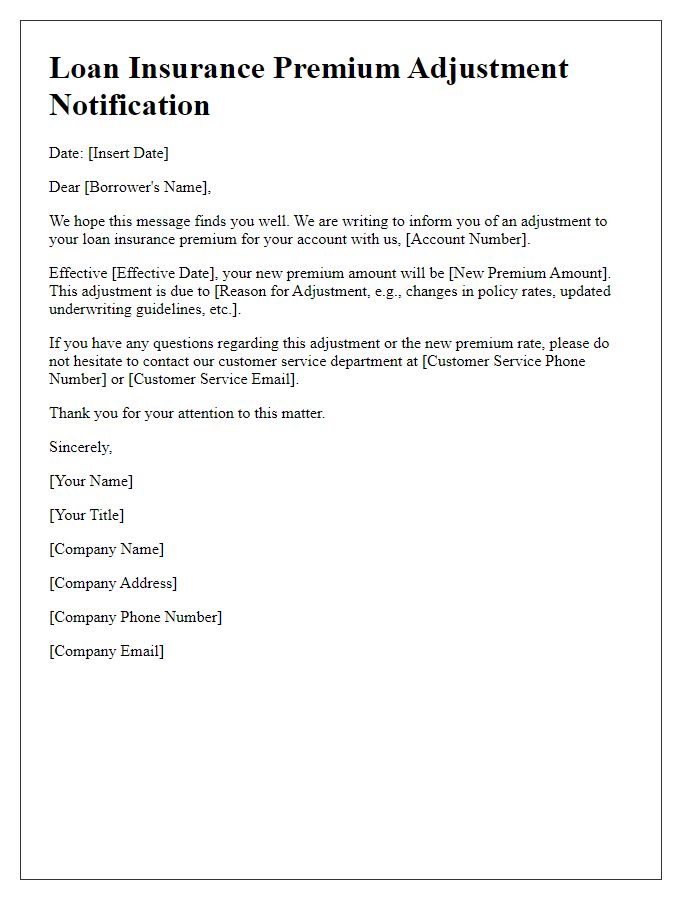

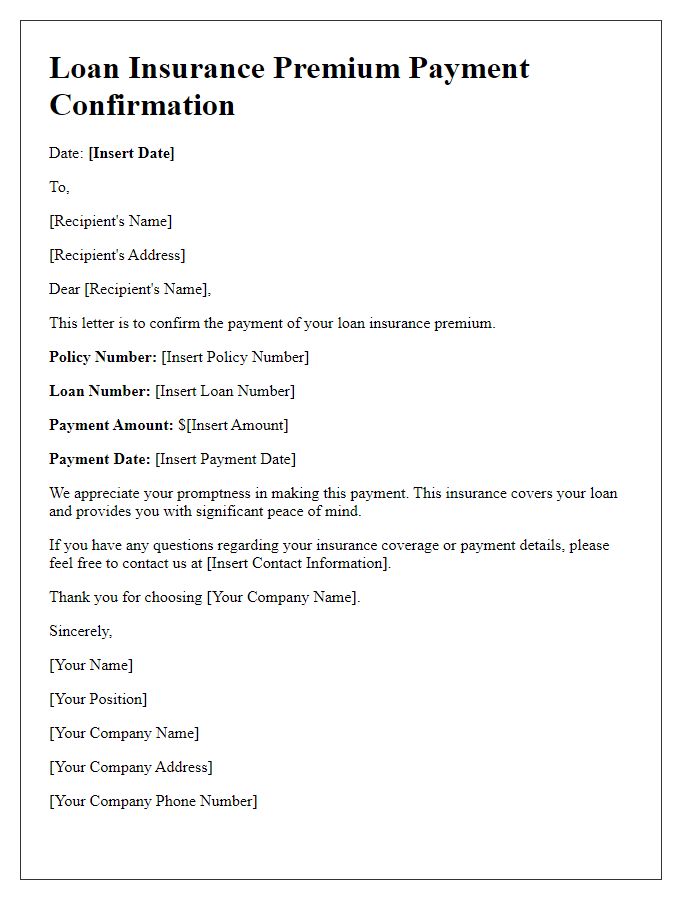

Accurate recipient information is crucial for successful communication in loan insurance premium updates, especially when distributing sensitive financial details. Ensuring correct names, addresses, and contact numbers prevents delays and enhances customer service. For example, a mortgage provider in the United Kingdom must have precise recipient details like those with postcodes (e.g., SW1A 1AA) to ensure timely delivery of insurance premium notifications. Incorrect information can lead to misdirected documents and dissatisfaction, highlighting the importance of regular data verification processes. Keeping accurate records reflects professionalism and fosters trust in financial institutions.

Clear Subject Line

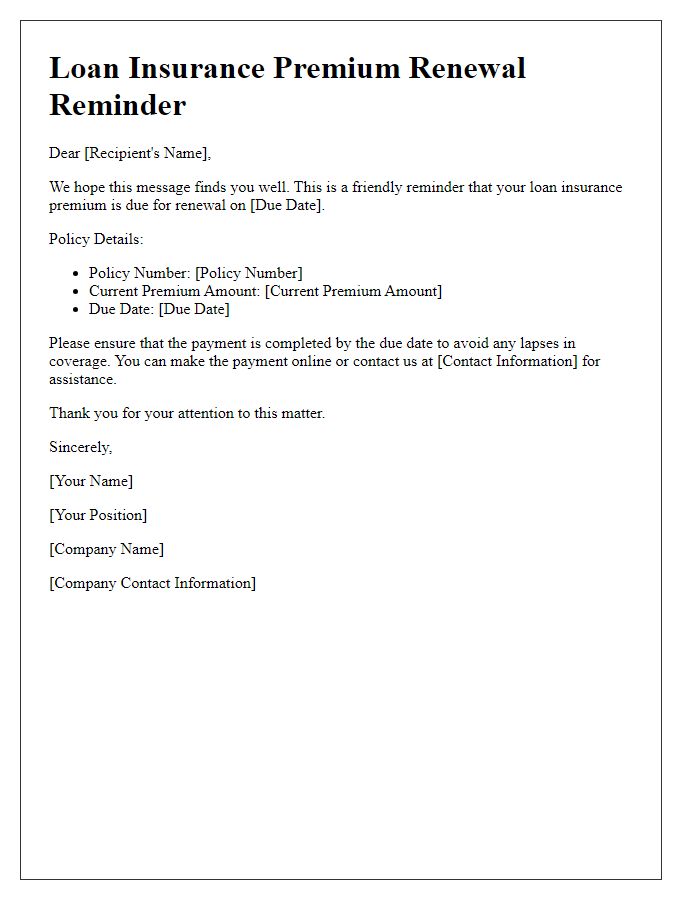

Loan insurance premium updates are crucial for homeowners seeking financial security. Changes to premium rates can occur due to various factors such as market conditions, lender policies, or individual credit scores. Homeowners should regularly monitor their insurance documents for updates, paying attention to the annual statements that itemize premium adjustments. Staying informed about deadlines for payment adjustments is essential to avoid lapses in coverage, which can occur if payments are not received on time. Engaging with an insurance adviser can provide insights into potential savings or necessary adjustments based on current policy conditions.

Policy Details

In the realm of financial security, loan insurance premiums play a critical role in protecting borrowers against unforeseen circumstances such as job loss or disability. The policy details--specifically encompassing coverage limits, premium amounts, and terms--vary significantly between insurance providers. For instance, a standard monthly premium might range from 0.5% to 1% of the loan amount, influencing the overall financial obligation. Companies like XYZ Insurance often provide tailored policies with unique features tailored for specific loans, such as home mortgages or auto loans. Understanding these nuances is essential for policyholders to ensure adequate protection and to navigate adjustments effectively, maintaining peace of mind in any financial endeavor.

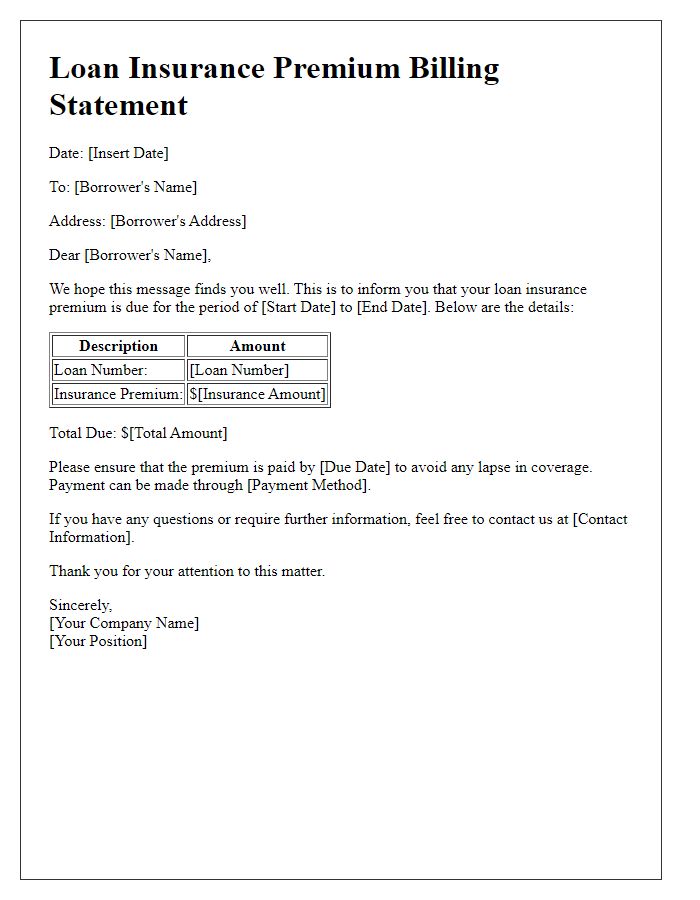

Updated Premium Amount

Loan insurance premiums can significantly affect borrowers' overall loan costs, adjusting regularly according to market conditions and policy changes. An updated premium amount, reflecting both an increase and a decrease, informs clients of their financial responsibilities. Policyholders must review their insurance terms, as factors such as loan amount (often ranging from $5,000 to $1,000,000), loan term (common durations include 15, 20, or 30 years), and borrower risk profile can influence premium calculations. Moreover, periodic updates encourage clients to reassess coverage needs and stay informed about their obligations to avoid potential lapses in coverage.

Contact Information for Queries

Loan insurance premiums may undergo periodic updates, influenced by various factors such as policy adjustments, interest rate changes, or individual risk assessments. Prompt communication assists clients in understanding these alterations. Clients are encouraged to reach out with queries regarding their insurance premium adjustments. They can contact customer service representatives available via phone at 1-800-555-1234 or email at support@loaninsurance.com. Business hours span weekdays from 9 AM to 5 PM EST, ensuring professional assistance. Detailed inquiries enable informed decision-making regarding continued coverage and financial planning.

Comments