Are you facing financial challenges and seeking relief? Navigating borrower hardship assistance can feel overwhelming, but it's essential to understand that help is available. Whether it's unexpected medical expenses or job loss, there are steps you can take to alleviate some of the burden. Join me as we explore useful tips and resources to assist you during these tough times!

Personal Information

When borrowers face financial difficulties, they may seek hardship assistance from lenders to alleviate their burden. Key personal information such as full name (reflective of legal documentation), address (including city, state, and ZIP code for accurate identification), phone number (for contactability), and email address (for digital correspondence) play a crucial role in processing their applications. Furthermore, information about the nature of their financial hardship, such as job loss (specifying employer and date), medical emergencies (detailing expenses incurred), or unexpected major repairs (mentioning vehicle or home context), is essential in evaluating their situation. Providing documentation such as bank statements (to illustrate current financial status), pay stubs (to confirm income changes), and tax returns (for verification of financial history) strengthens their claim for assistance, allowing lenders to understand the context and urgency of their request effectively.

Financial Situation Overview

Financial hardship can significantly impact an individual's ability to meet repayment obligations, particularly concerning mortgages and personal loans. Current economic conditions, such as inflation rates reaching over 8% in 2023 and rising unemployment figures exceeding 6% in certain regions, have increased financial strain. Borrowers may face unexpected medical expenses, loss of income due to job layoffs in sectors like retail or hospitality, or higher living costs in urban areas like San Francisco or New York City. This unstable financial situation often leads to missed payments, accumulation of debt, and an increased risk of foreclosure or default. Notably, seeking hardship assistance programs sponsored by federal entities like the U.S. Department of Housing and Urban Development can provide temporary relief and resources to navigate these challenging times.

Explanation of Hardship

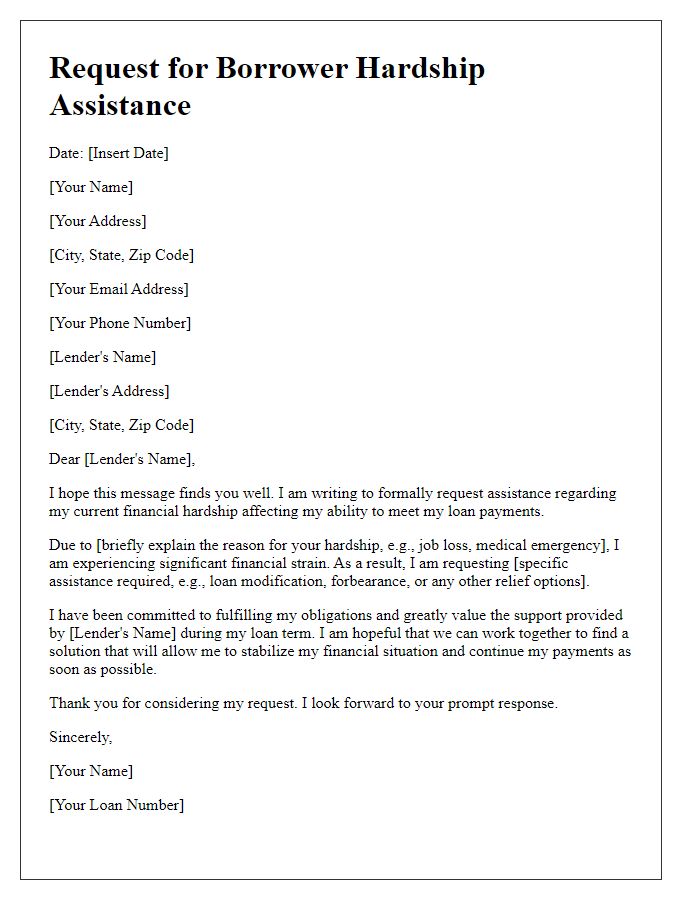

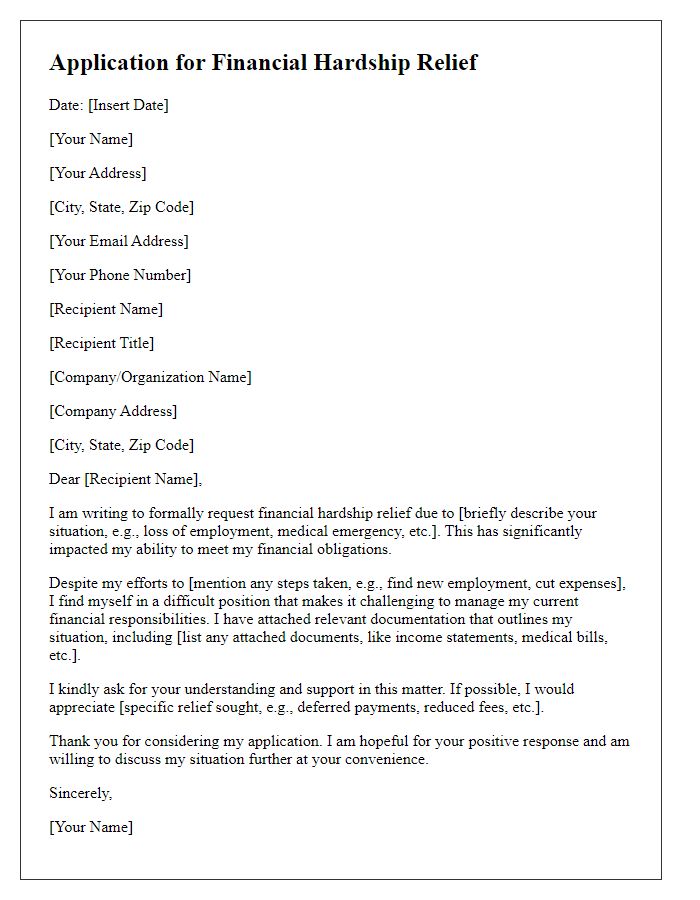

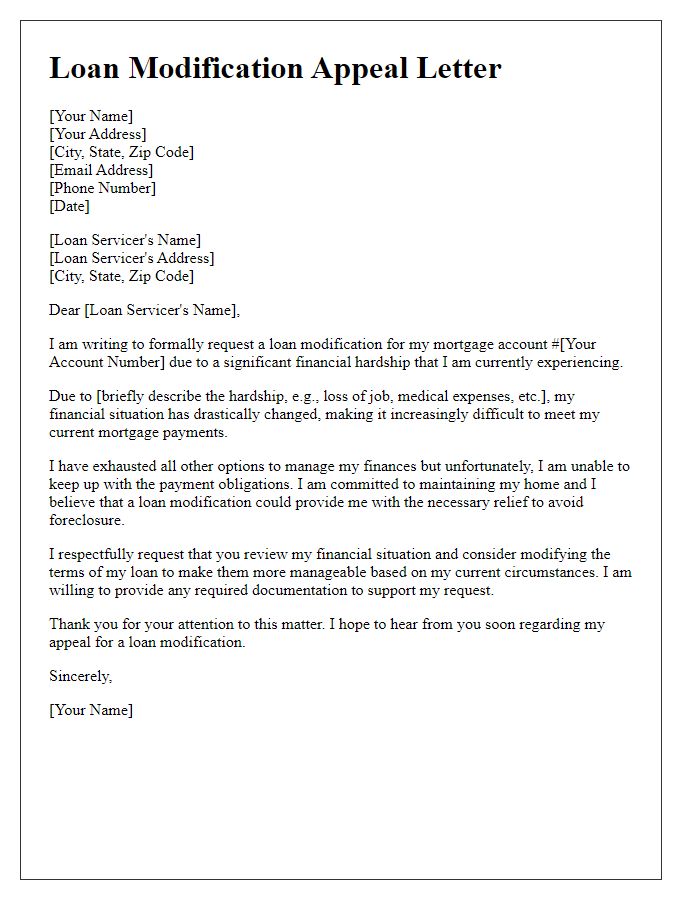

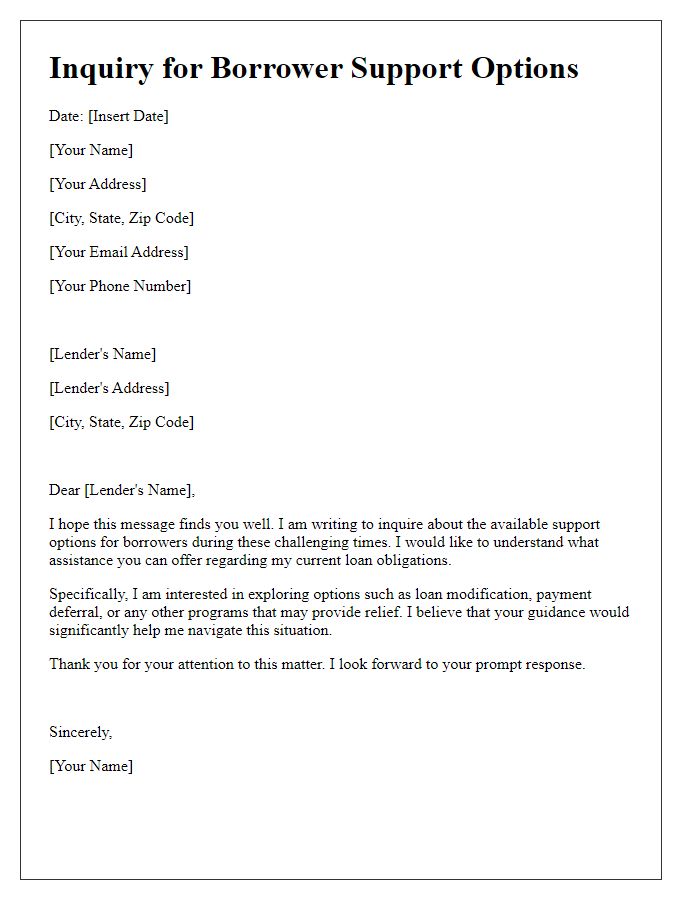

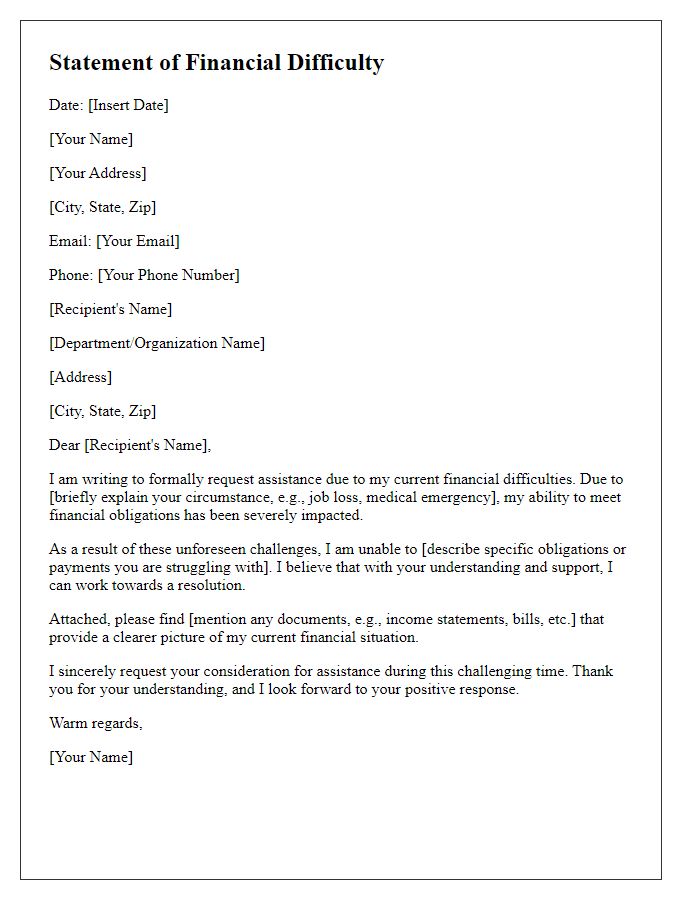

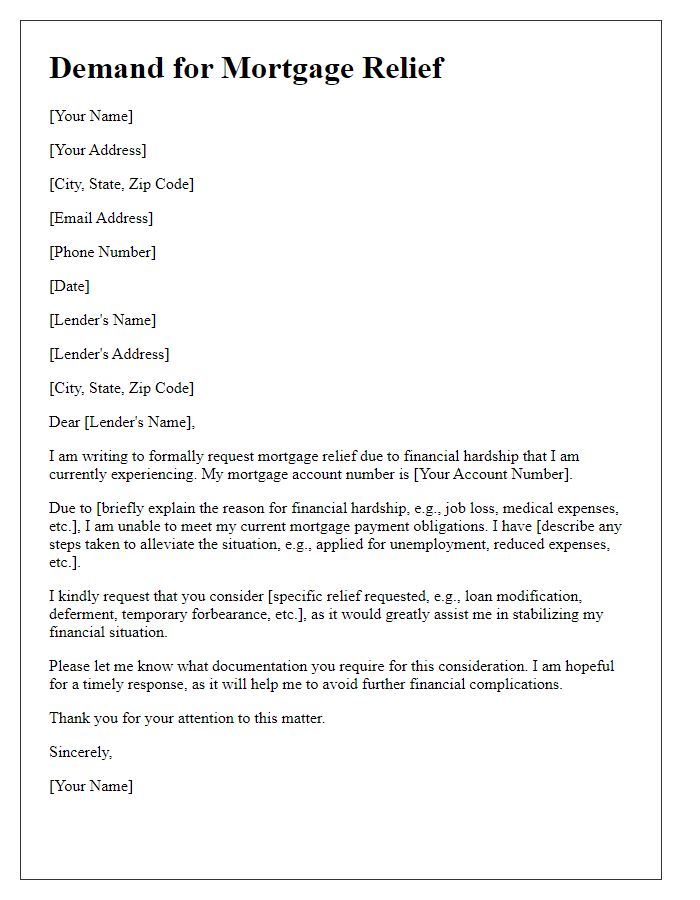

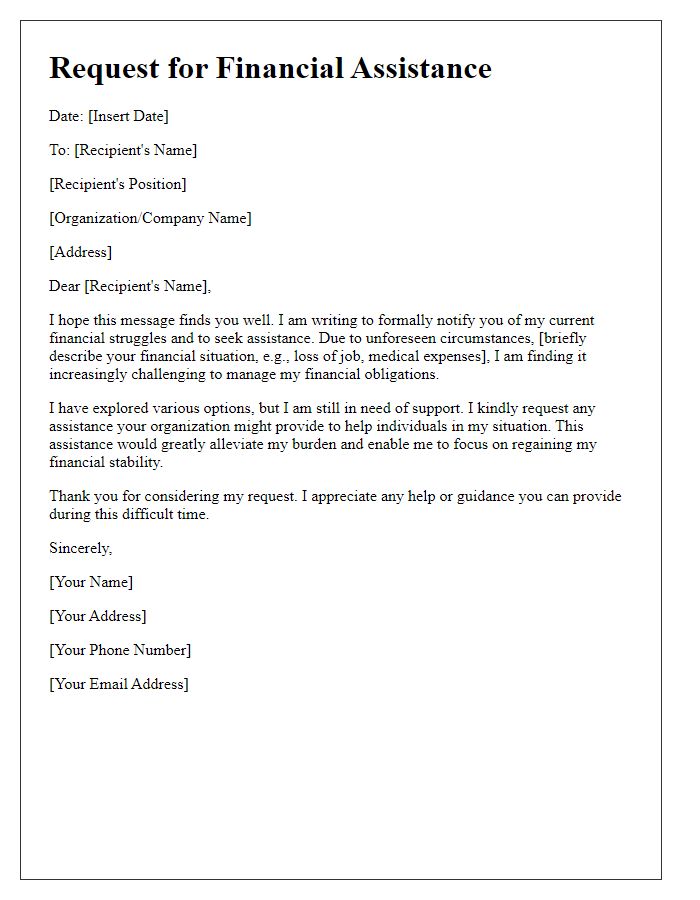

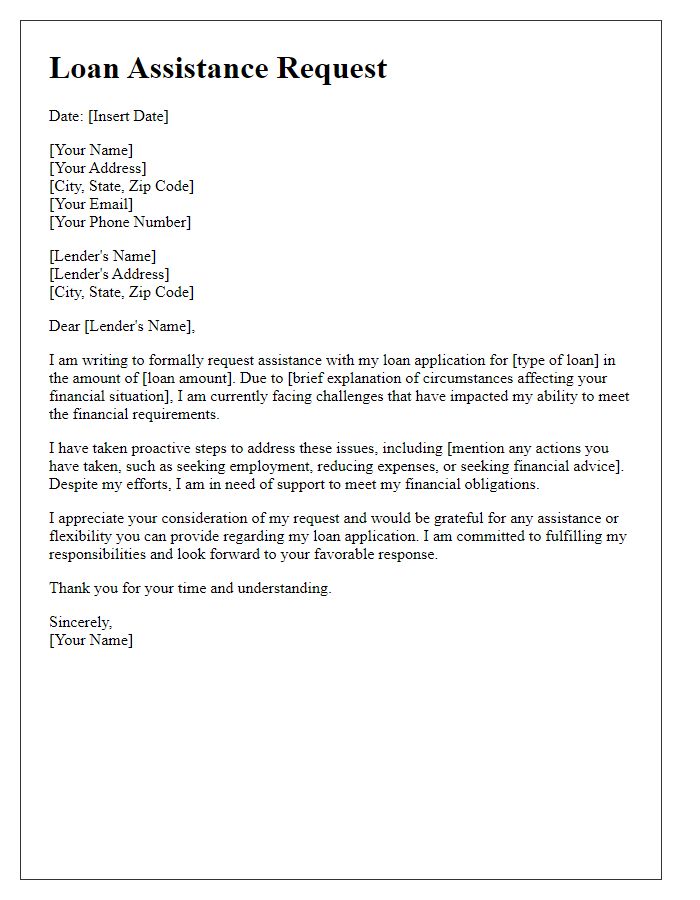

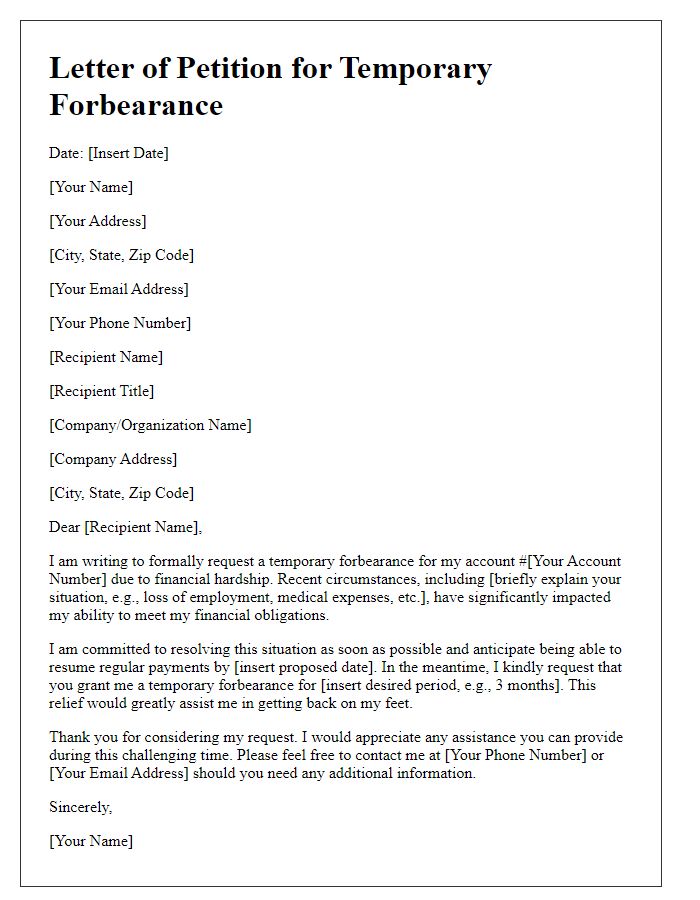

A letter template for borrower hardship assistance serves as an essential document for individuals facing financial difficulties. Hardship, which refers to significant challenges such as job loss, medical emergencies, or unforeseen expenses, necessitates formal communication with lenders. This template guides borrowers in articulating their unique circumstances, detailing the nature of the hardship, and requesting support such as loan modification or temporary forbearance. Essential components include personal identification, a clear statement of financial challenges, documentation of income changes, and a proposed solution to alleviate the burden. This structured approach facilitates understanding and empathy from lenders, fostering cooperative solutions tailored to the borrower's situation.

Requested Assistance Details

Borrowers experiencing financial hardship due to unforeseen events, such as job loss or medical emergencies, often seek assistance to manage their loans. Many institutions offer programs specifically designed to address these situations, including mortgage relief options, temporary forbearance, or modified payment plans. Important details include the amount of requested assistance, duration of the relief period, and any supporting documentation, such as proof of income loss or medical bills. For example, a borrower affected by the COVID-19 pandemic may request a six-month forbearance for their home mortgage under programs initiated by government agencies like the Federal Housing Administration (FHA). Ensuring accurate and timely submission of assistance requests can significantly impact a borrower's financial stability.

Contact Information for Follow-up

Borrowers experiencing financial difficulties often seek hardship assistance from financial institutions. Important contact information for follow-up includes the direct phone number (such as 1-800-555-1234 for customer service) and email address (for example, hardship@bankname.com) specific to the hardship department. Additionally, the mailing address for submitting hard copies of documents might be relevant, such as 1234 Finance St., Suite 100, Financial City, State, ZIP code. Furthermore, designated hours for assistance (like Monday to Friday, 9 AM to 5 PM) can clarify when borrowers can expect support. Understanding response timeframes (e.g., 7 to 10 business days for initial reviews) can enhance communication and streamline the process of obtaining assistance.

Letter Template For Borrower Hardship Assistance Samples

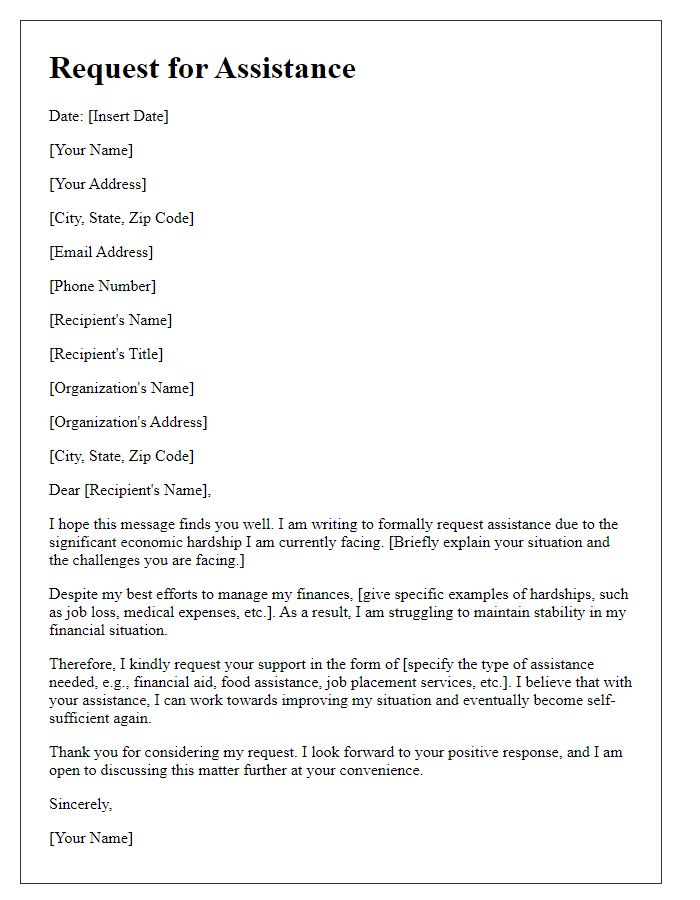

Letter template of formal request for assistance during economic hardship

Comments