Are you looking for a way to communicate important loan information to your clients? A well-crafted loan maturity notice letter can ensure that your message is clear and concise while maintaining a professional tone. In this article, we'll dive into the essential elements of a loan maturity notice and provide you with a ready-to-use template. So, stick around to discover how you can effectively notify borrowers about their loan maturity and what steps they need to take next!

Clear subject line

Loan Maturity Notice: Important Information Regarding Your Loan Status This Loan Maturity Notice serves to inform you that your loan, originating on February 15, 2020, with a total principal amount of $50,000, is set to mature on February 15, 2024. At this time, it is crucial to review your repayment options, including full payment of the balance, potential refinancing opportunities, or renewal discussions. Ensure timely communication to avoid any late fees or negative impacts on your credit score. Please prepare the necessary documentation if you wish to discuss these options well before the maturity date. Your prompt attention to this matter is appreciated.

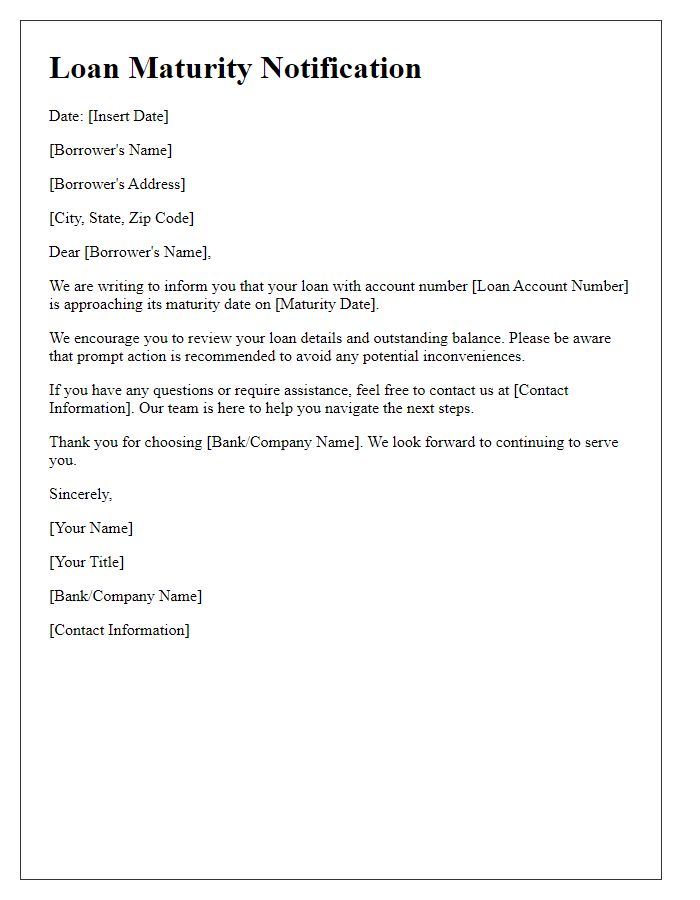

Borrower details

In a loan maturity notice, the borrower details include critical information such as the borrower's full legal name, residential address including street, city, state, and zip code, as well as the loan account number which uniquely identifies the agreement for the lender. The notification should specify the maturity date clearly, indicating the exact date when the loan terms expire and full repayment is required. Additionally, any outstanding balance at that date should be outlined, providing insight into the total amount owed as well as any applicable interest rates or fees that may affect the final payment. This communication serves as an essential reminder for the borrower, ensuring they are aware of their obligations and timelines associated with the loan agreement.

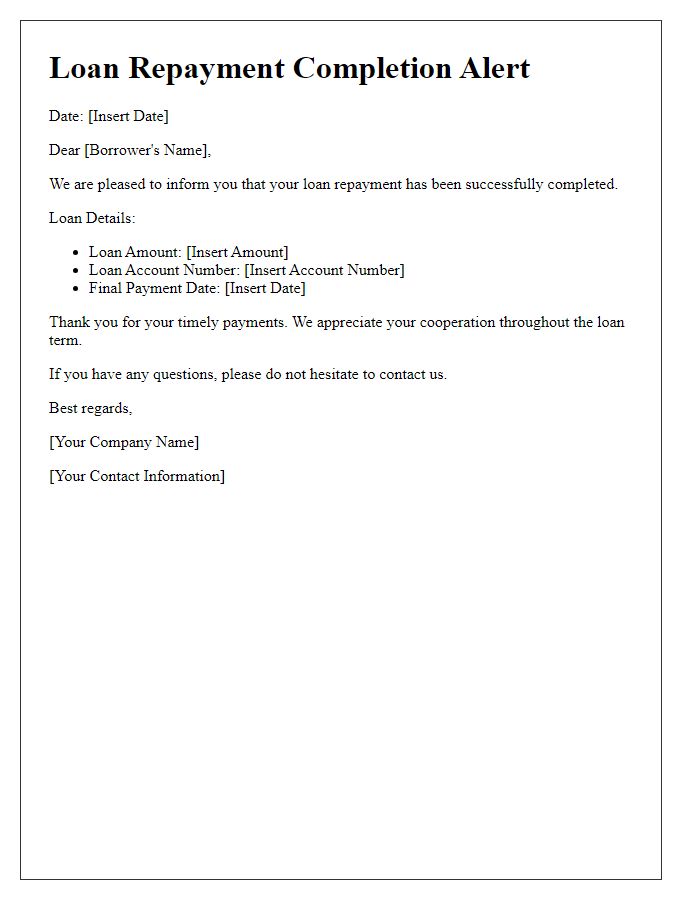

Loan information

Loan maturity notices play a vital role in financial communication between lenders and borrowers regarding the conclusion of loan agreements. Typically issued 30 to 90 days prior to the loan's expiration, these notices include key information such as the loan amount (e.g., $50,000), interest rate (e.g., 5.5% per annum), and the maturity date (e.g., December 15, 2023). The notice outlines repayment structures, required final payments, and any outstanding balances. It also highlights the importance of timely payments to avoid penalties. Furthermore, it may provide options for loan renewal or refinancing, encouraging proactive engagement by the borrower before the maturity date. Such notices ensure both parties are aligned on the terms and facilitate financial planning.

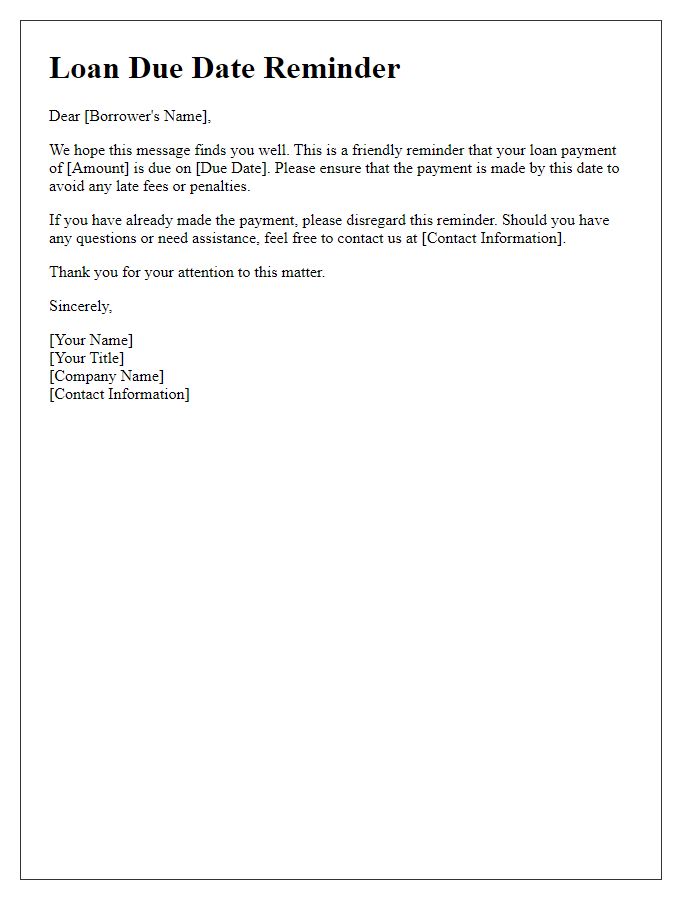

Maturity date reminder

The upcoming loan maturity date, set for December 15, 2023, requires your attention for final payment arrangements. Loan Agreement Number 1234567, originally secured for $50,000, mandates a full repayment by this date. Please review the terms established by XYZ Bank, located in Chicago, Illinois, to ensure compliance and avoid any additional fees or penalties. Complete payment instructions and account details can be located within your loan documentation. Ensuring the full payment is received on or before the specified date will close this financial obligation.

Contact information

A loan maturity notice serves as an official communication to borrowers, informing them of the upcoming due date for loan repayment. This notice typically includes essential details such as the loan amount (e.g., $50,000), interest rate (e.g., 5% per annum), and the loan maturity date, which might be set for a specific day, such as December 31, 2023. The notice should prominently display the lender's contact information, including the name of the financial institution (e.g., First National Bank), a customer service phone number (e.g., 1-800-555-0199), and an email address dedicated to loan inquiries (e.g., loans@firstnationalbank.com). It may also highlight any outstanding balance or the total due at maturity, pushing borrowers to take the appropriate action before the deadline.

Comments