Are you considering an adjustable-rate mortgage and want to understand its terms better? This flexible option can offer lower initial rates compared to fixed loans, making it an attractive choice for many buyers. However, it's crucial to know how the rates can change over time and what factors influence those adjustments. Dive into our detailed article to uncover everything you need to know about adjustable-rate mortgages!

Interest Rate Adjustment Schedule

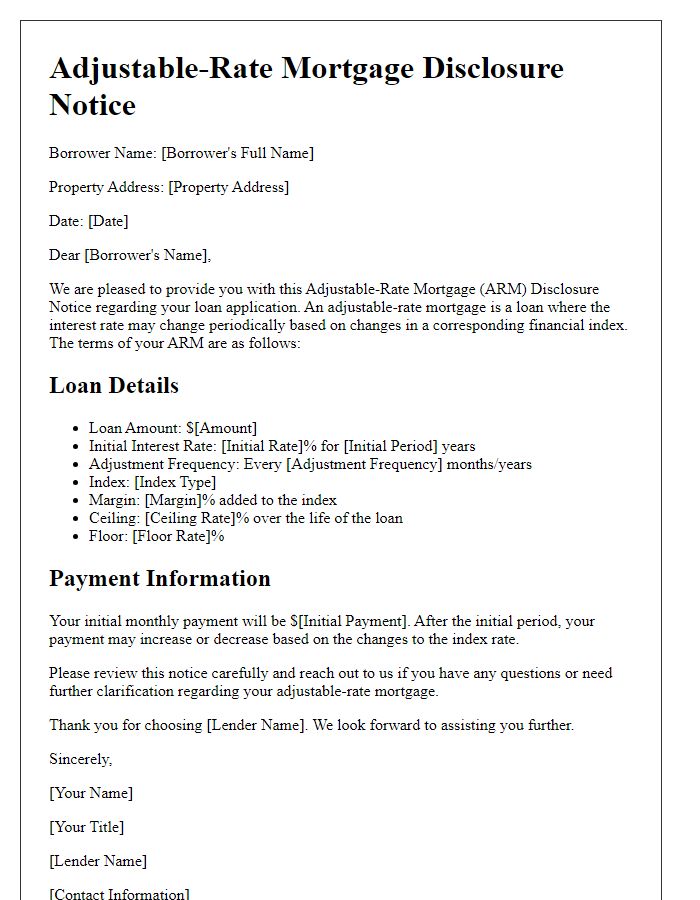

The adjustable-rate mortgage (ARM) typically begins with a fixed interest rate period, such as the initial three, five, seven, or ten years, before transitioning to an adjustable rate based on a specified index, such as the London Interbank Offered Rate (LIBOR). After the initial period, adjustments occur on a predetermined schedule, such as annually or semi-annually, subject to a rate cap, which limits the maximum increase or decrease per adjustment period. The adjustments are calculated based on the current index value plus a margin determined by the lender, often ranging from 2% to 3%. For instance, if the index rate is 1.5% and the margin is 2%, the new interest rate would be 3.5%. Total loan amounts can influence monthly payments, with typical loan sizes varying between $100,000 and $750,000. Borrowers should consider how potential rate fluctuations may impact long-term financial plans, particularly in economic climates characterized by volatility or shifting interest rates.

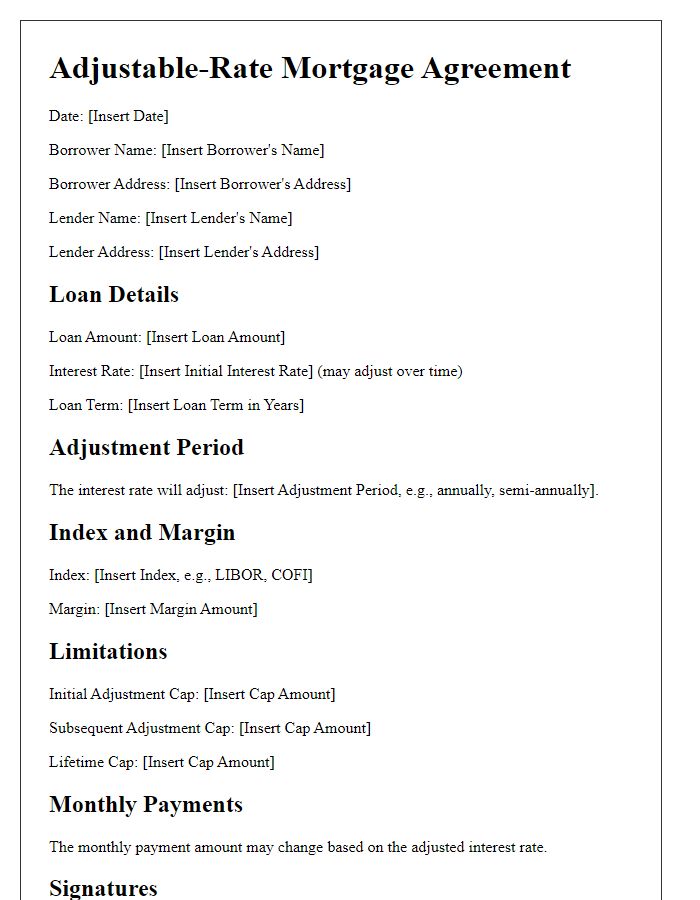

Index and Margin Details

An adjustable-rate mortgage (ARM) is a type of loan that has varying interest rates over time, influenced by an underlying index. The index, such as the 1-Year Constant Maturity Treasury (CMT), serves as a benchmark, reflecting changes in market interest rates. The margin, fixed by the lender, is added to the index to determine the overall interest rate for the loan. Common margins range from 2% to 3%, representing the lender's profit. The initial fixed-rate period typically lasts 5, 7, or 10 years, after which the interest rate adjusts annually based on the prevailing index value plus the margin. Rate adjustments can lead to fluctuating monthly payments, impacting borrowers' financial planning significantly. Understanding these variables is critical for anyone considering an ARM, particularly regarding long-term financial stability.

Caps on Interest Rate Changes

Caps on interest rate changes in adjustable-rate mortgages (ARMs) are critical safeguards that limit how much the interest rate can increase during specified periods. ARMs typically feature two types of caps: periodic caps and lifetime caps. Periodic caps restrict the amount the interest rate can increase at each adjustment period, influencing monthly payments for borrowers. For instance, a periodic cap of 2% allows the rate to jump a maximum of 2% during each adjustment, regardless of market fluctuations. The lifetime cap, on the other hand, sets an absolute ceiling on the interest rate throughout the loan's duration; a lifetime cap of 5% prevents rates from exceeding more than 5% above the initial rate. These caps provide predictable financial planning for homeowners, especially during economic downturns when interest rates may spike unexpectedly. Understanding these caps is crucial for borrowers to assess their potential payment obligations over the loan term.

Payment Adjustment Frequency

Adjustable-rate mortgages (ARMs) feature payment adjustment frequency which defines how often the interest rate can change, impacting monthly payments. Typical adjustment periods range from six months to one year, reflecting market conditions and index benchmarks such as the London Interbank Offered Rate (LIBOR). Interest rate changes can significantly affect affordability, with potential increases causing payment shocks, especially if the loan is linked to volatile indices. Borrowers should consider caps (limits on rate increases) and floors (minimum interest rates) associated with their loans, ensuring an understanding of how changes may affect their long-term financial strategy.

Explanation of Loan Terms and Conditions

Adjustable-rate mortgages (ARMs), such as the 5/1 ARM, feature a fixed interest rate for the initial five years, followed by annual adjustments based on a specified index, such as the LIBOR (London Interbank Offered Rate). After the introductory period, rates may fluctuate, impacting monthly payments. Borrowers should be aware of potential rate caps, limiting adjustments during each reset period, typically two percent per adjustment and six percent over the life of the loan. These features contribute to uncertainty; for example, an initial rate of 3.5% could rise to 5.5%, significantly increasing monthly obligations. It's essential for borrowers to review amortization schedules and consider potential maximum payments. Factors such as market conditions and personal financial stability play critical roles in managing an ARM effectively.

Letter Template For Adjustable-Rate Mortgage Terms Samples

Letter template of adjustable-rate mortgage rate adjustment notification

Comments