Are you curious about reverse mortgages and how they can benefit you? If you've been pondering this financial option, you're not aloneâmany homeowners are seeking clarity on what a reverse mortgage entails and whether it's the right choice for their circumstances. In this article, we'll break down the key elements of reverse mortgages, address common misconceptions, and help you understand the potential advantages and drawbacks. So, let's dive in and uncover the truth behind reverse mortgagesâkeep reading to learn more!

Clear purpose statement

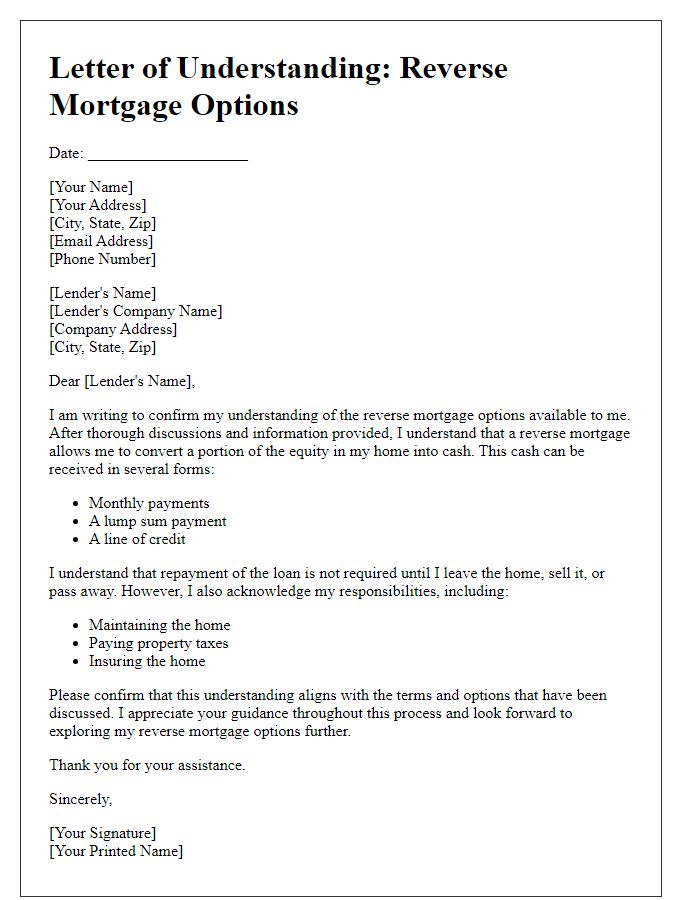

A reverse mortgage allows homeowners aged 62 and older to convert a portion of their home equity into cash while still living in their home. This process is designed to provide financial assistance to seniors who may need extra funds for retirement expenses, medical bills, or home improvements. Unlike traditional mortgages, reverse mortgages do not require monthly payments, and the loan balance is repaid when the homeowner sells the home, moves out, or passes away. Understanding the terms, fees, and potential risks associated with a reverse mortgage is essential for homeowners considering this financial option.

Borrower's personal information

A reverse mortgage, a financial product primarily for seniors, allows homeowners aged 62 and older to convert a portion of their home equity into cash. Essential personal information includes the borrower's full name, social security number, and birthdate, as these details establish eligibility. The property address is crucial, ensuring the loan is secured against the specific residence. Additional required details may encompass income verification documents, homeowner's insurance information, and existing mortgage statements, providing a comprehensive overview of the borrower's financial status. Reverse mortgage agreements may vary by lender and state regulations, emphasizing the need for clarity in understanding terms and obligations.

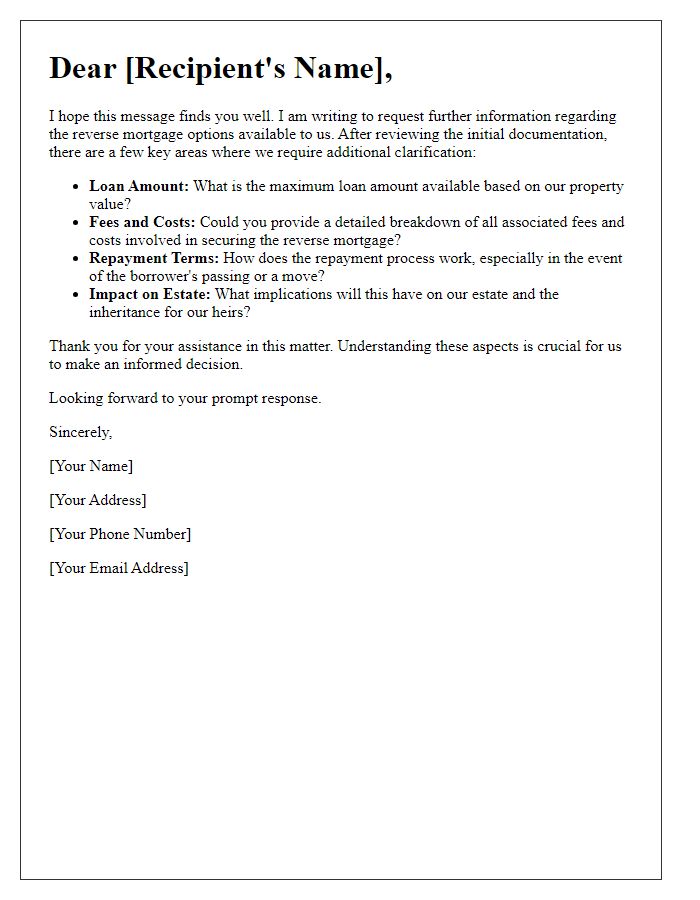

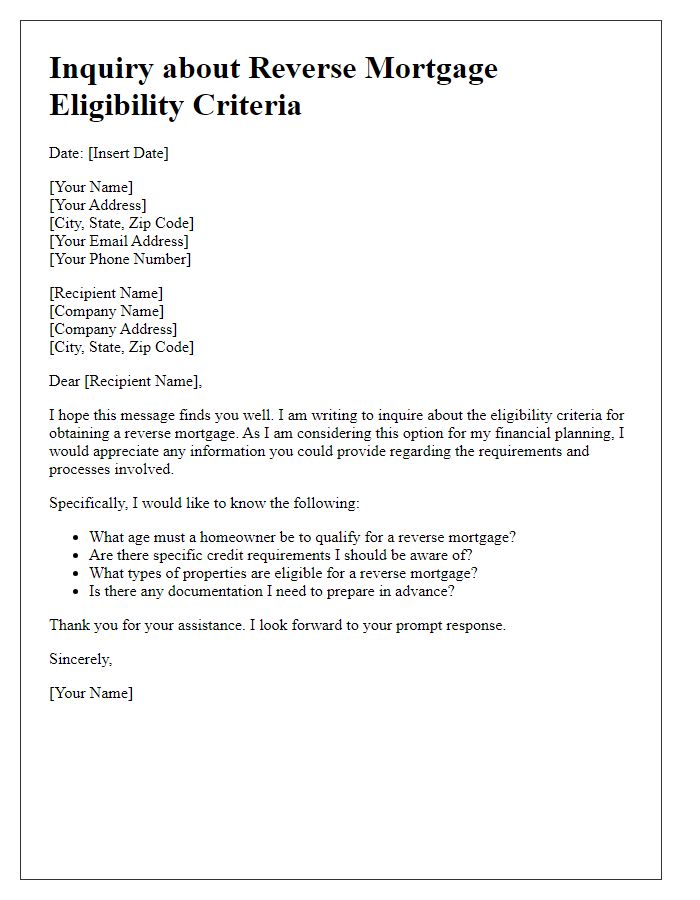

Detailed questions or concerns

Navigating the complexities of reverse mortgages can lead to numerous questions and concerns, particularly regarding eligibility requirements set by entities like the Federal Housing Administration (FHA) and the Home Equity Conversion Mortgage (HECM) program. Borrowers should clarify terms such as the loan-to-value ratio, impacting the maximum loan amount accessible based on the appraised value of the home and current market conditions; understanding how the age of the youngest borrower, typically at least 62 years old, influences these figures is essential. Additionally, inquiries about the implications of ongoing property taxes and homeowner's insurance are crucial, especially since failure to maintain these payments can jeopardize the loan status. Prospective borrowers should also seek clarification around the implications of the reverse mortgage on inheritance and estate planning, as it can affect heirs' equity stake in the property. Understanding the repayment triggers, including the borrower's relocation or passing, is vital for informed decision-making in reverse mortgage scenarios.

Required documentation list

Reverse mortgages, such as Home Equity Conversion Mortgages (HECM), require specific documentation to ensure a smooth application process. Applicants must provide proof of identity, including government-issued photo identification like a driver's license or passport. Financial documentation is crucial; this includes recent bank statements (usually the last two months), income verification such as pension statements or Social Security documentation, and tax returns for the past two years to assess eligibility. Homeowners must supply proof of homeownership, which can be a warranty deed or property tax statement, alongside the current mortgage statement if applicable. Additionally, any outstanding debts or liens against the property should be documented to evaluate overall financial health. Borrowers need to present information regarding their living situation, particularly if a spouse is involved, as both parties' approval often is necessary for a reverse mortgage, particularly in community property states like California. Lastly, an overview of the property's status, such as a recent home appraisal, is essential to determine the available equity.

Contact information for response

Contacting a reverse mortgage specialist is crucial for clarifying terms and conditions related to this financial product. Important information includes the homeowner's name, property address in [City, State, Zip Code], and the loan number, which often consists of 10-12 digits unique to the mortgage. It's advisable to provide a direct phone number, such as [XXX-XXX-XXXX], and an email address, like [example@email.com], to ensure prompt responses. Including a specific request or question about reverse mortgage processes, such as interest rates, repayment terms, or eligibility requirements, can facilitate a more efficient discussion. Time frames for responses may vary, but follow-up is recommended within 5-7 business days if no communication is received.

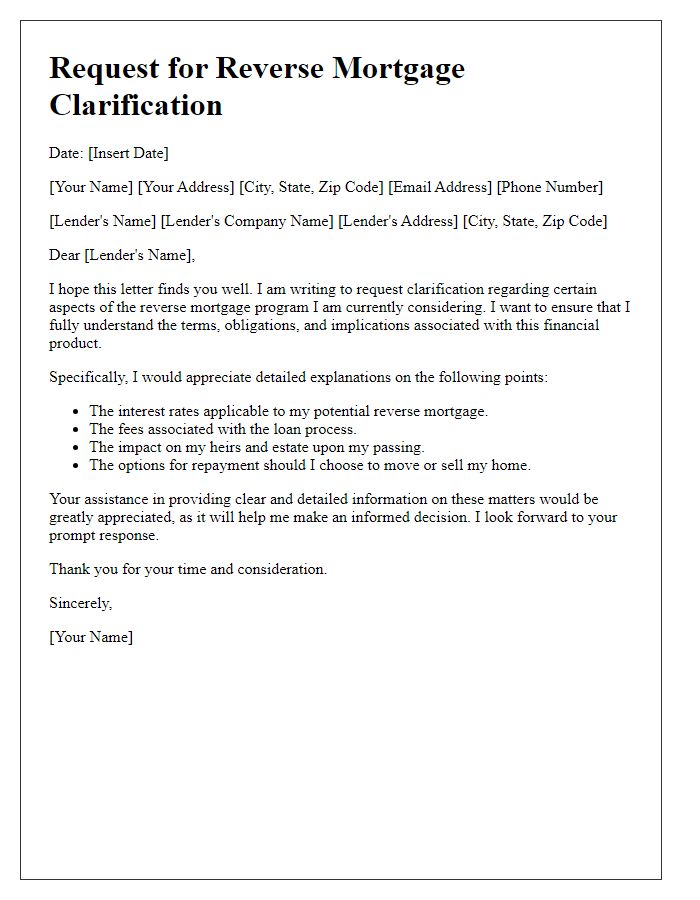

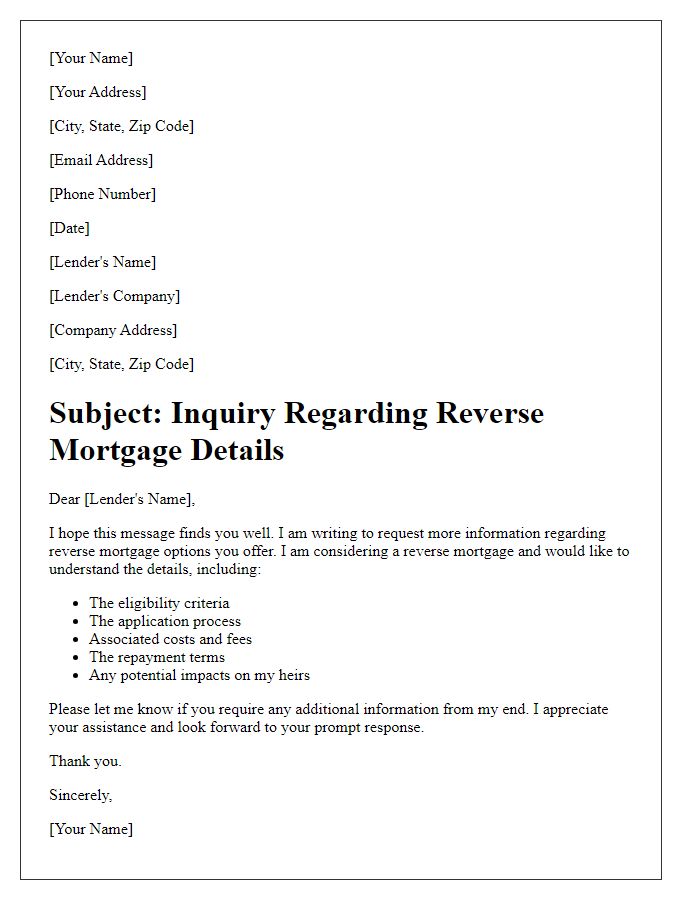

Letter Template For Reverse Mortgage Clarification Samples

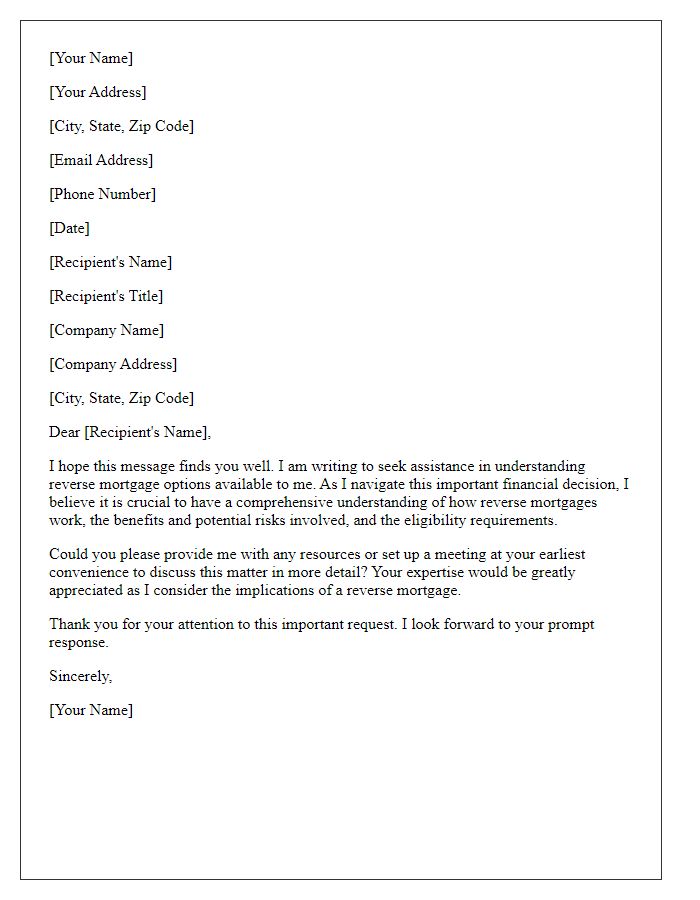

Letter template of assistance needed for reverse mortgage understanding.

Comments