Navigating the world of loan applications can be a rollercoaster of emotions, especially when you find out that your application was not approved. It's common to feel disappointed or even frustrated, but understanding the reasons behind a loan rejection can actually empower you to improve your chances in the future. In this article, we'll break down the most frequent reasons that lenders cite for loan denials and provide practical tips on how to bolster your next application. So, let's dive in and explore how you can turn this setback into an opportunity for growth!

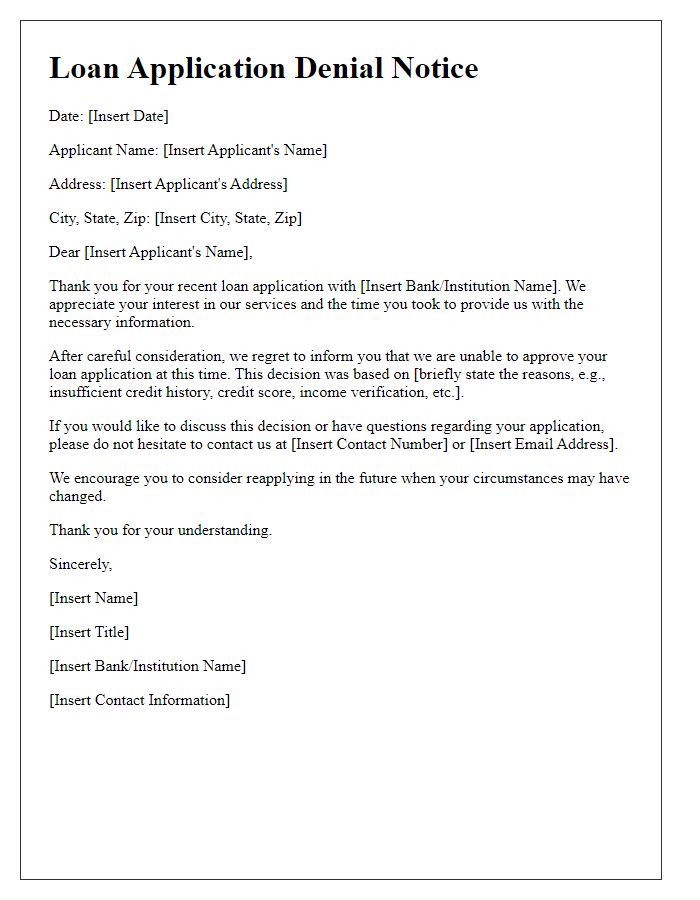

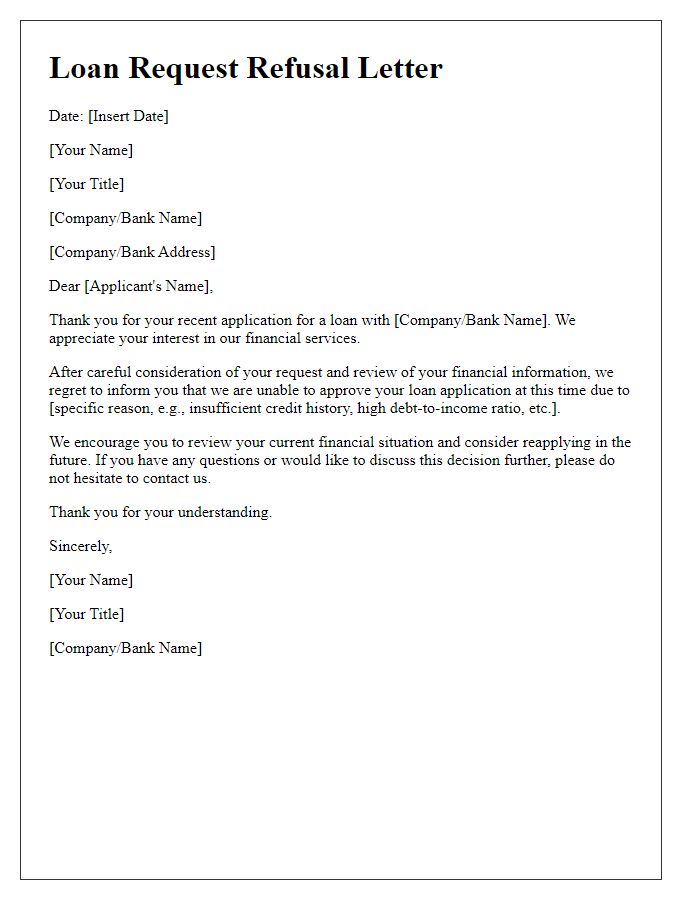

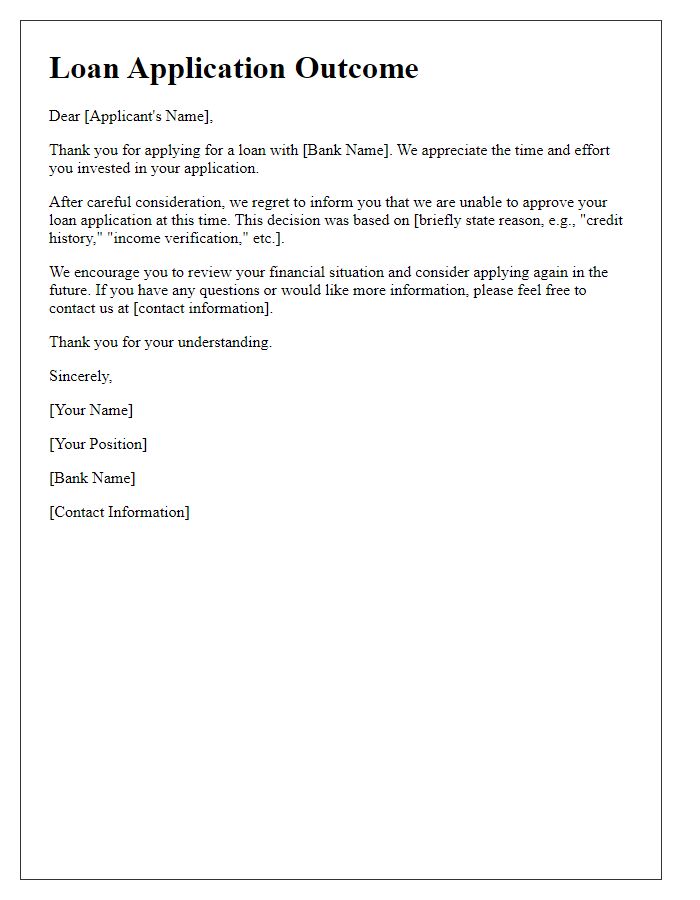

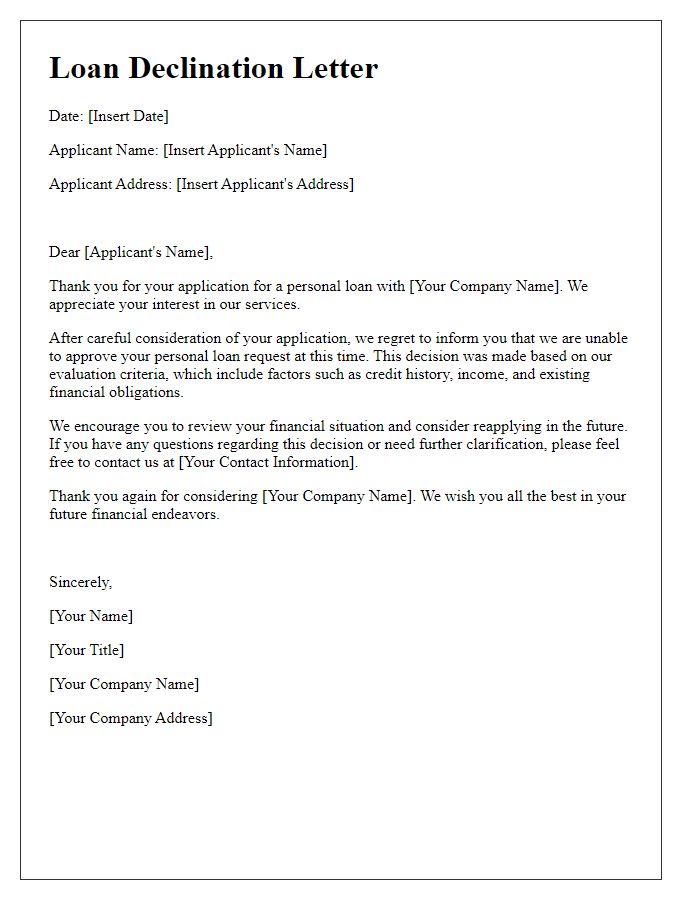

Applicant's Name and Address

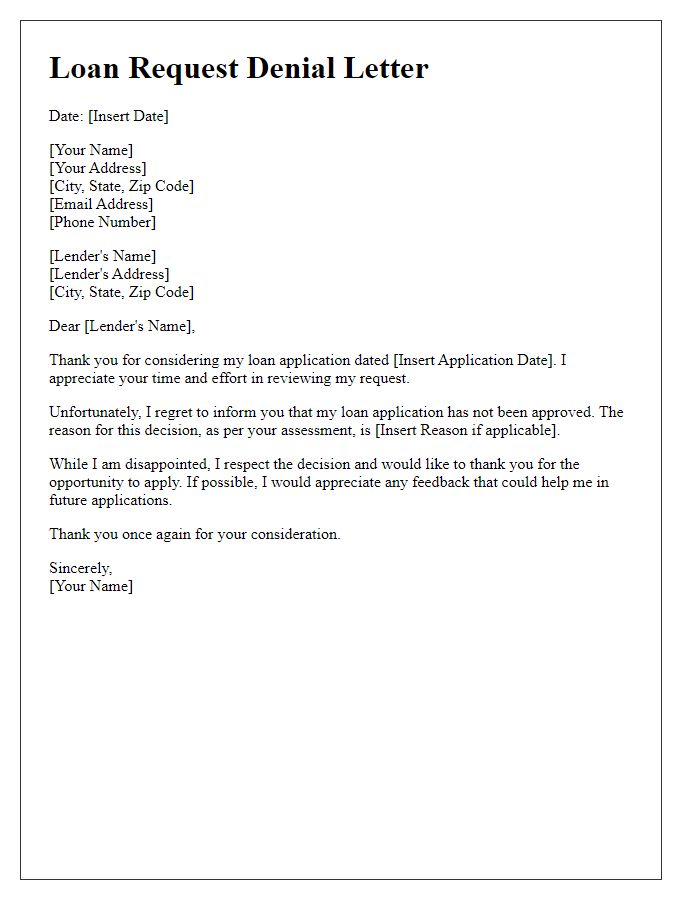

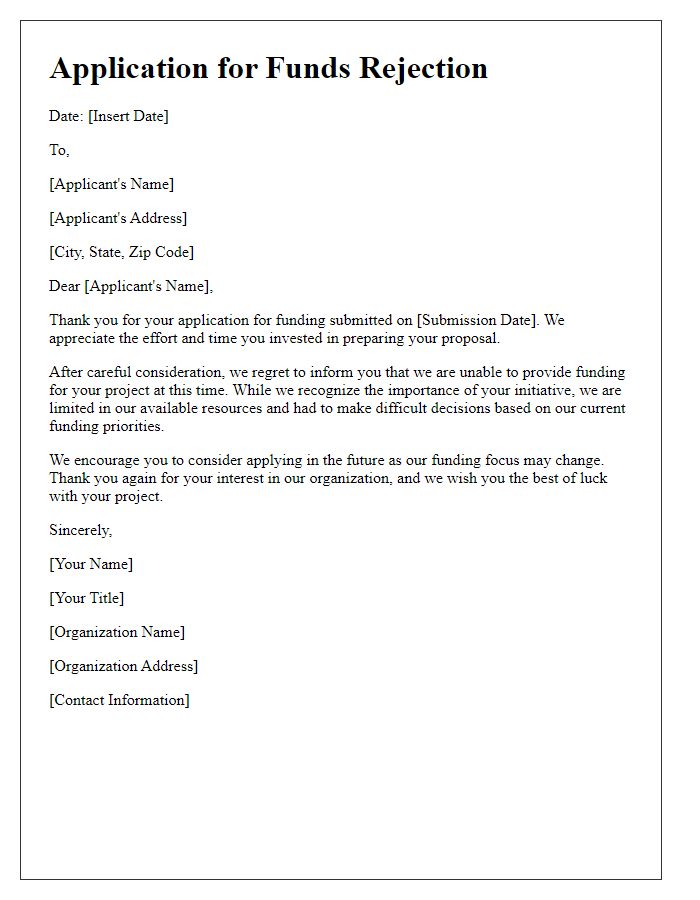

Loan applications often undergo a meticulous evaluation process at financial institutions such as banks or credit unions. An applicant's personal details such as full name, current residential address, and any additional identifying information play a pivotal role in the assessment. This information is essential for verifying identity, credit history, and eligibility. In cases where an application does not satisfy specific lending criteria, institutions must communicate the decision clearly. A rejection letter serves that purpose, providing the applicant with insight into the reasons for denial and offering a pathway for understanding credit standing. Institutions may advise applicants on improving their financial profiles for future endeavors.

Date of the Letter

A loan application rejection can be a disappointing experience for individuals seeking financial assistance. Each institution has its own criteria which can include credit score thresholds (often above 650), income verification processes, and debt-to-income ratios (typically no higher than 43%). Common reasons for rejection may include insufficient credit history, employment instability, or the presence of outstanding debts. For example, a rejected applicant might learn that their credit utilization ratio exceeded the recommended 30%, affecting their overall creditworthiness. Understanding these factors can help applicants improve their chances in future loan applications.

Subject Line (Loan Application Decision)

Loan application rejections, particularly in the context of mortgage or personal loan applications, occur after thorough evaluation processes by financial institutions, such as banks or credit unions. Factors leading to rejection may include credit scores, income verification (especially below $30,000 annually), and outstanding debts exceeding 40% of monthly income. Applicants often receive formal communication detailing reasons, alongside potential next steps. Establishments like the Federal Housing Administration (FHA) assist borrowers with specialized programs; however, applicants might still face hurdles if criteria are not met. It's crucial for applicants to understand their financial histories and seek improvement before reapplying in the future.

Reason for Rejection (e.g., Credit Score, Income Criteria)

Loan applications often face rejection due to various factors such as insufficient credit scores or unmet income criteria. A credit score below 650, which is considered subprime, can result in higher risk assessments by lenders, leading to denial. Additionally, income criteria stipulate that applicants must demonstrate a stable monthly income of at least $3,000 to qualify for a personal loan. If an applicant's income falls short or lacks verification through documented pay stubs, lenders perceive this as inadequate financial stability, prompting rejection. Understanding these benchmarks can help applicants strategize for future applications and improve their financial profiles.

Next Steps and Contact Information for Queries

Loan application rejection often leads to confusion and frustration among applicants. After receiving a decision, individuals should carefully review the rejection letter to identify the specific reasons cited by the financial institution, such as inadequate credit history or insufficient income. Contemplating these factors may provide insights into areas for improvement. Understanding the next steps is crucial, which may include the option to appeal the decision or request clarification from a loan officer. It's advisable to maintain communication with the lender for any additional queries; contact information is usually provided for this purpose. Seeking assistance from credit counseling services can also be beneficial in navigating future loan applications.

Comments