Are you looking to gain peace of mind regarding your prior loan payoff? Understanding how loan settlements work can make a significant difference in your financial journey. In this article, we'll break down the key elements you need to know, from timing to documentation, ensuring you're well-informed on the process. So, grab a cup of coffee and join me as we dive deeper into ensuring your financial clarity!

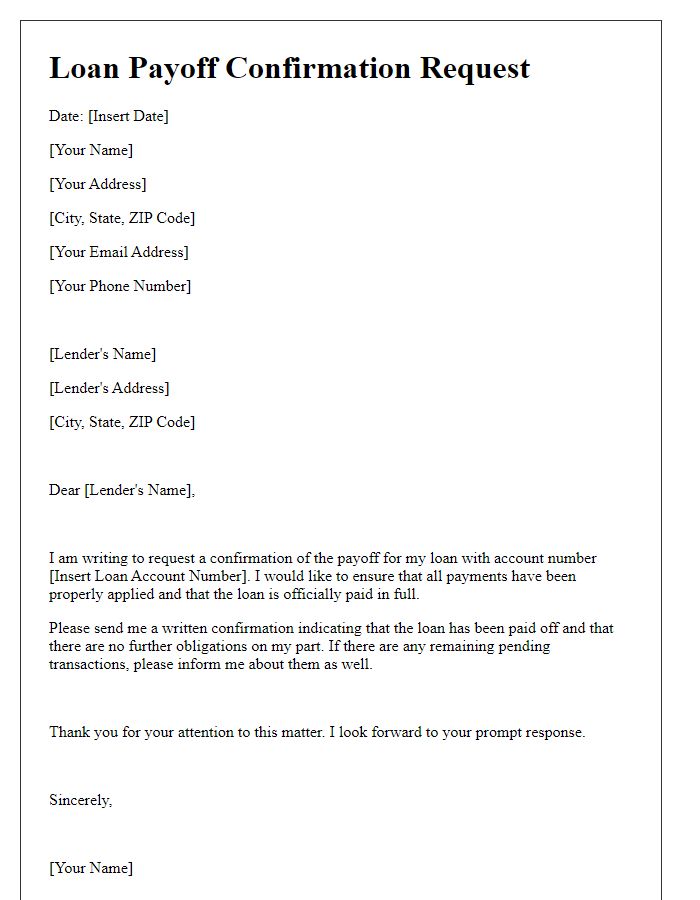

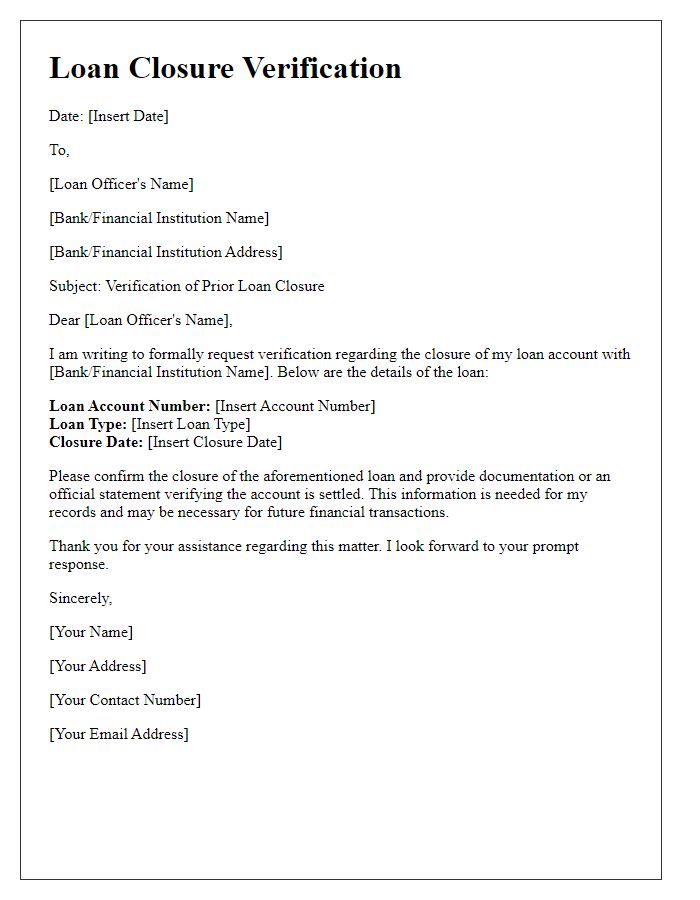

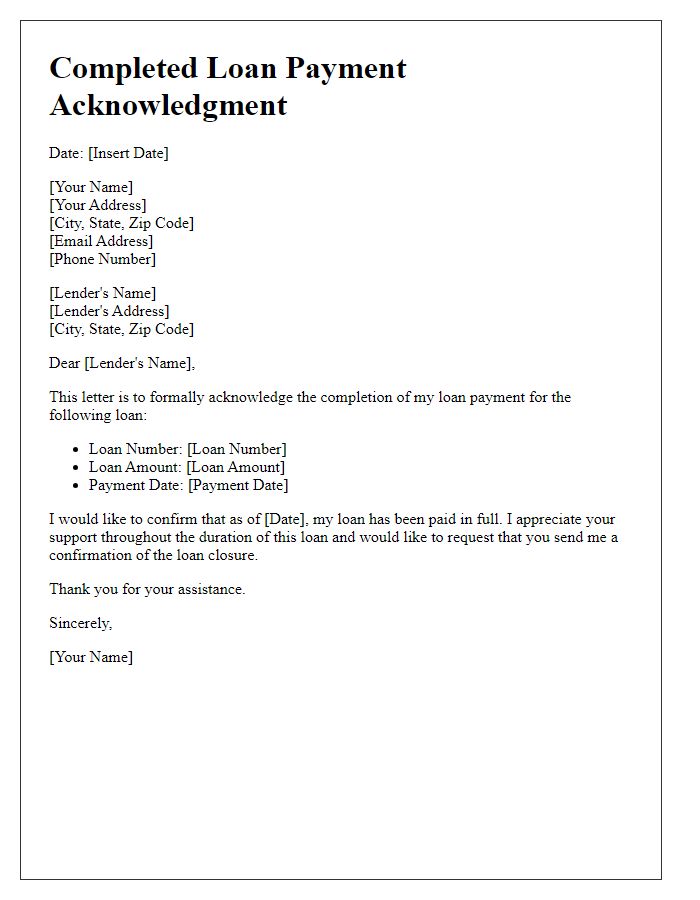

Borrower Information

Loan payoff assurances play a crucial role in financial transactions. The borrower's information, including the name, address, and contact number, is essential for accurately identifying the borrower involved in the loan agreement. Documentation might also include details such as loan number and original loan amount to reference the specific financial obligation being settled. Highlighting the lender's name and contact details ensures clear communication throughout the loan payoff process. A professional tone should permeate the assurance, building trust between the borrower, the lender, and third-party entities involved in the transaction. Proper formatting and inclusion of the date emphasize the urgency and seriousness of the loan payoff assurance.

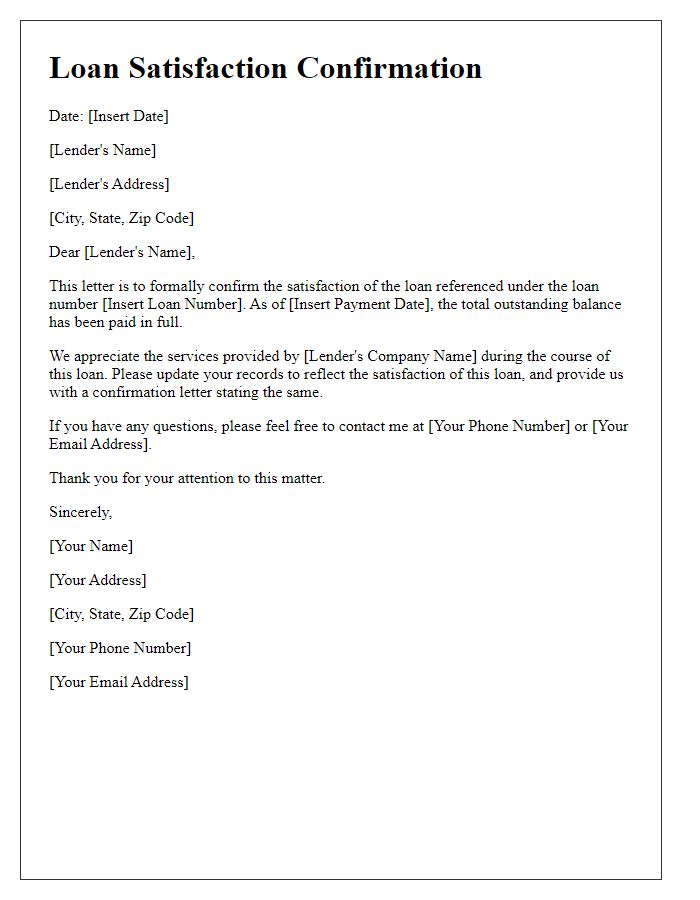

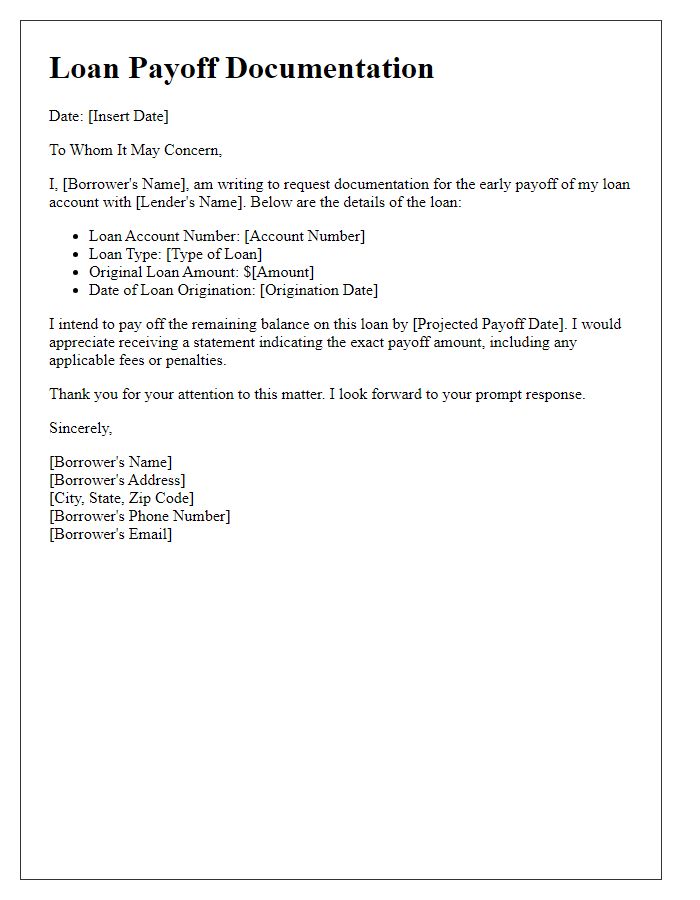

Loan Account Details

Loan accounts with outstanding balances, such as personal loans or mortgage loans, require careful management. Timely payoff assurance is crucial to maintain positive credit scores, with each account number designated for specific repayment terms, interest rates, and penalties for late payments. For instance, financial institutions may offer detailed payoff letters which clarify the remaining balance (including principal and interest), any additional fees, and the confirmed date of loan satisfaction. These letters are essential for records as they can impact future borrowing capacity. Proper documentation ensures accountability in the financial landscape, fostering trust between lenders and borrowers.

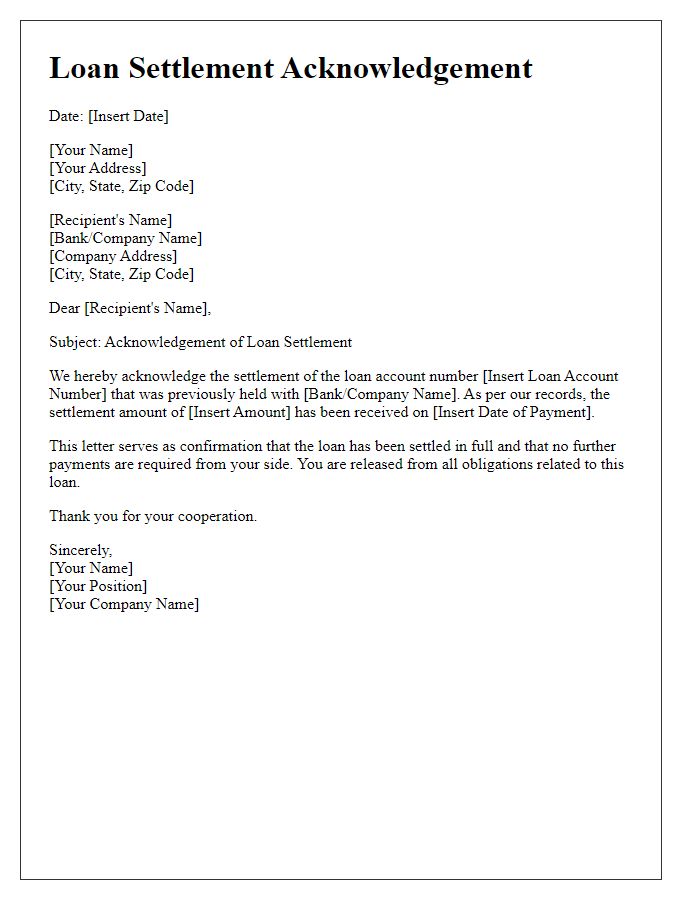

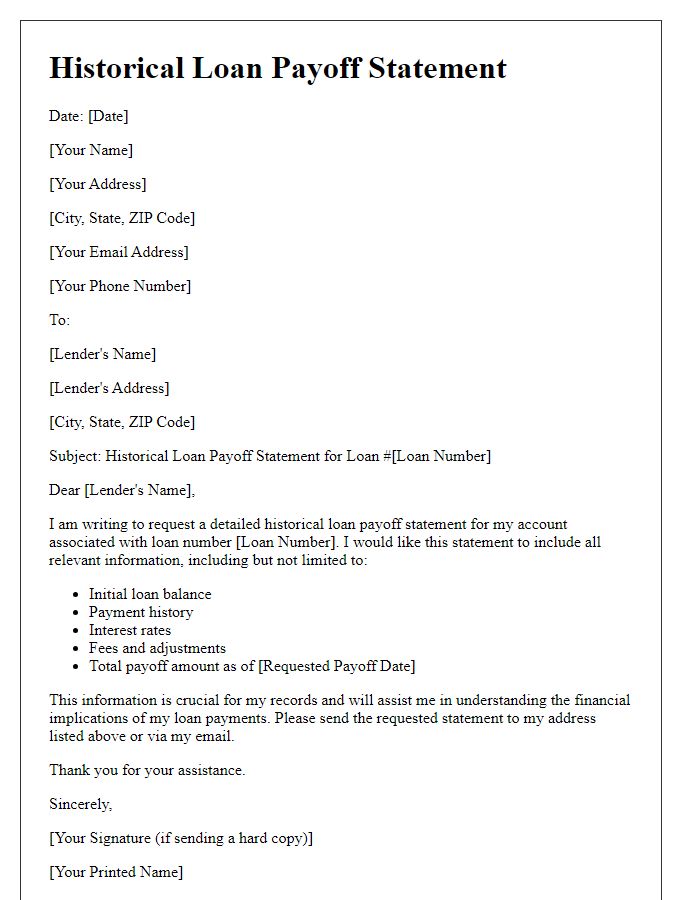

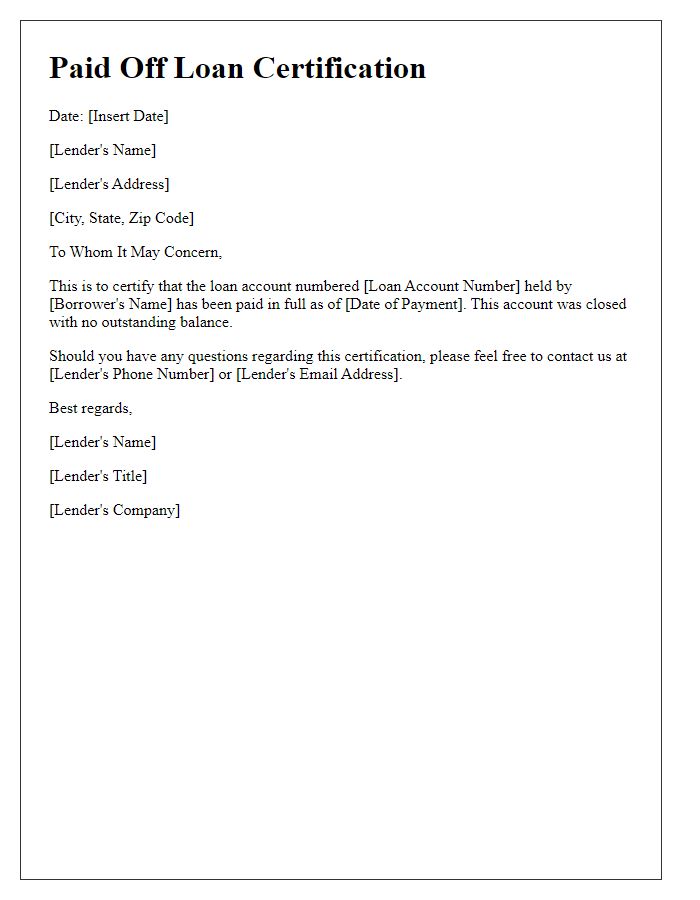

Payoff Amount Confirmation

Borrowers seeking payoff amount confirmation for existing loans should ensure clarity regarding the total balance owed. Accurate payoff statements from financial institutions, such as banks or credit unions, outline the principal balance, interest accrued, and any applicable fees for early repayment. The payoff amount typically may include daily interest calculations, ensuring exact figures for the date of payment. For instance, if a borrower intends to close a personal loan with a remaining balance of $10,000, understanding the full payable amount, including expected interest, is essential. Loan agreements from lenders, accompanied by precise due dates, offer crucial reference points, ensuring that borrowers settle their debts efficiently and avoid additional charges.

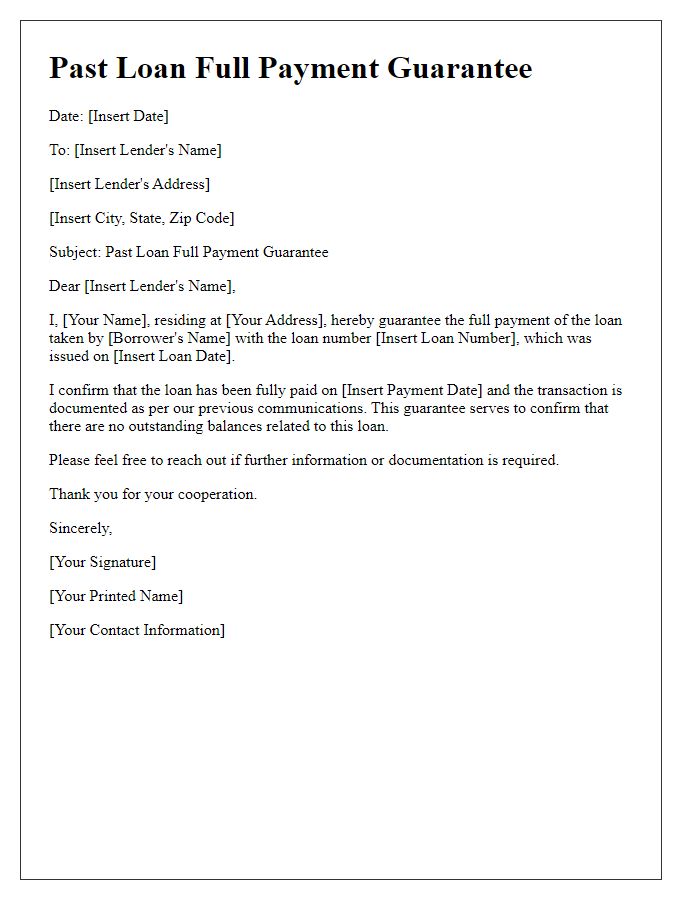

Payment Instructions

Payment instructions for prior loan payoff assurance typically include essential elements aimed at providing clarity and guidance. Borrowers should note account information, such as the loan number and lender's contact details, including mailing address or electronic transfer instructions. Important deadlines must be emphasized, notably the specific date by which payments should be received to avoid late fees. Payment methods accepted by the lender can vary, so detailing options--such as bank wire transfers, checks, or online payment portals--helps streamline the process. Additionally, any required documentation, such as payoff statements or identification, should be explicitly outlined for borrower compliance. Following these instructions accurately ensures proper credit to the loan account and secure loan closure.

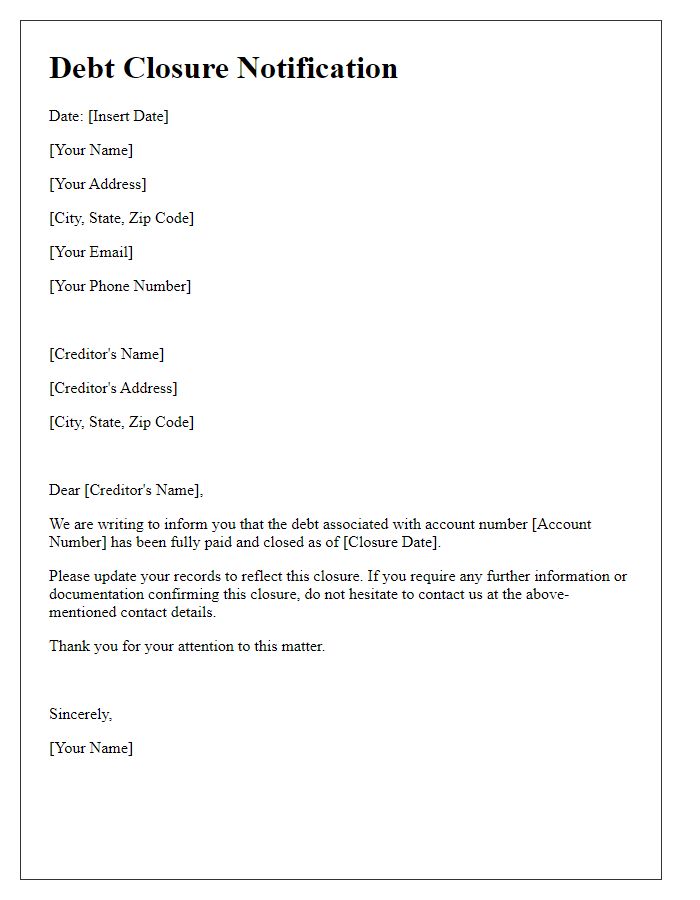

Contact Information for Assistance

Prior loan payoff assurance provides valuable benefits for borrowers. Clear communication of outstanding balances can simplify the payoff process while ensuring all terms from the lending institution (e.g., Bank of America, Wells Fargo) are understood. Accurate payoff amounts, typically including principal, interest accrued, and any potential fees, are essential for closing out loans on the specified date, often provided via written validation. Borrowers may need to contact customer service or their loan officer for specific instructions, especially when dealing with complex loan types such as mortgages or auto loans. Keeping meticulous records of communication and payoff documentation can further aid in ensuring a smooth payoff experience.

Comments