Are you ready to streamline your banking experience? Well, getting access to mobile banking can make managing your finances easier and more convenient than ever before. In this article, we'll walk you through a simple letter template that you can use to request mobile banking access from your bank. So, let's dive in and discover how to enhance your banking journey!

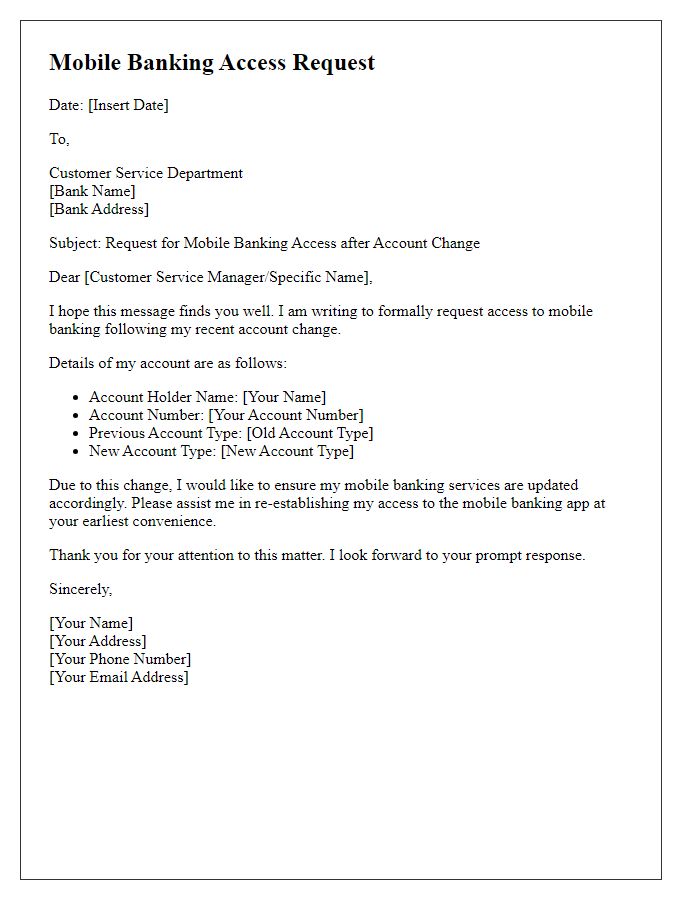

Clear Subject Line and Purpose

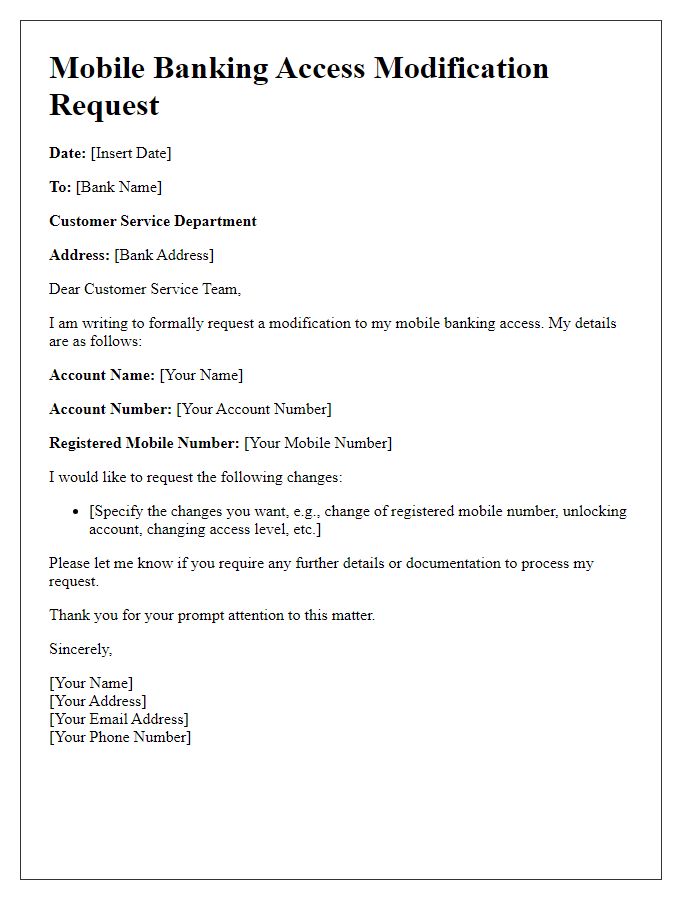

A request for mobile banking access should include a clear subject line, such as "Mobile Banking Access Request" indicating the intention directly. The purpose of the request outlines the necessity for accessing mobile banking services, which facilitates managing financial transactions efficiently via a smartphone application. This request may specify personal information such as account number (e.g., 1234567890), the type of access needed (e.g., viewing account balance, transferring funds), and any specific security measures necessary to authenticate the user, like a two-factor authentication code. The note should highlight the urgency or importance of gaining access to mobile banking for real-time financial management, especially in today's fast-paced digital economy.

Account Holder Information

Account holders seeking mobile banking access must provide essential information to facilitate the process. Required details typically include full name, account number (such as the unique identifier for banking transactions), email address linked to the account, and phone number (often used for verification purposes). The financial institution may request the date of birth for identity verification and proof of residence, might require a government-issued identification number, like a driver's license number, to ensure accurate validation. Providing this comprehensive information ensures secure access to mobile banking services, promoting convenience in managing finances directly from smartphones or tablets.

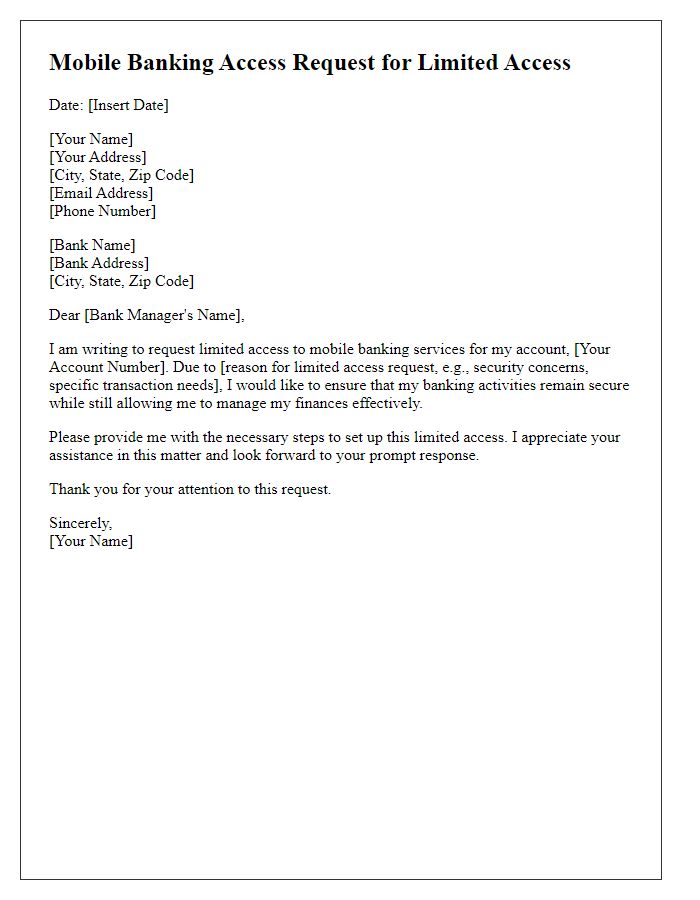

Request Details for Mobile Banking Access

Mobile banking access enables users to manage financial accounts conveniently through applications on smartphones or tablets. A secure application process typically requires user identification, such as social security numbers or account IDs, especially for institutions like Bank of America or Citibank. Additionally, verification steps may involve sending codes via text or email, enhancing security protocols. Users need to provide personal details, including full names, addresses, and phone numbers, ensuring accurate account linking. Examination of terms and conditions is fundamental, explaining fees or potential limitations. Regulatory compliance aligns with standards established by the Federal Deposit Insurance Corporation (FDIC). Access request processing times can vary from a few hours to several days, based on the bank's internal procedures.

Security and Authentication Measures

Mobile banking applications implement a variety of security and authentication measures designed to protect user data and financial transactions. Multi-factor authentication (MFA), requiring something a user knows (password), something a user has (smartphone), or something a user is (biometric data), ensures additional layers of security. Encryption protocols, such as AES-256, safeguard information during transmission, making it unreadable to unauthorized parties. Push notifications alert users of account activity, providing real-time monitoring of transactions and potential fraud detection. Security features assess device health and location, often flagging unusual access attempts from unknown devices or locations, enhancing user protection. Routine security updates and user education on phishing tactics further mitigate risks associated with mobile banking.

Contact Information and Preferred Response Method

Mobile banking access requests often require detailed personal information and preferred communication methods for security and efficiency. Users typically include their full names, residential addresses, and contact numbers to verify identity. Email addresses serve as a primary channel for communication, with many users opting for secure messaging apps like WhatsApp or direct phone calls for immediate responses. Security measures, such as two-factor authentication (via SMS or email), enhance account safety during the access request process, ensuring that sensitive financial information remains protected while allowing banks to streamline customer support.

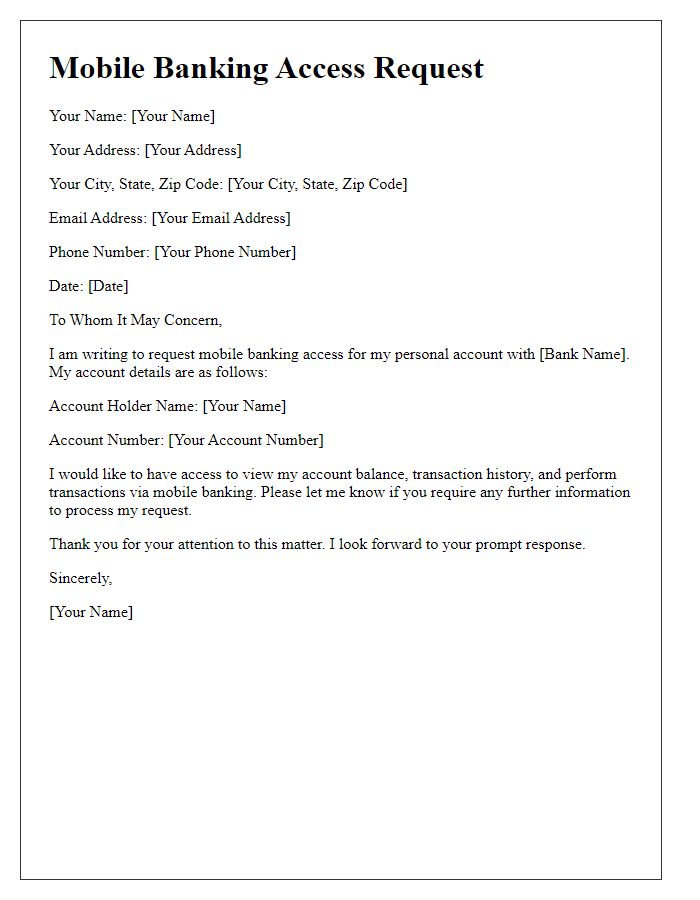

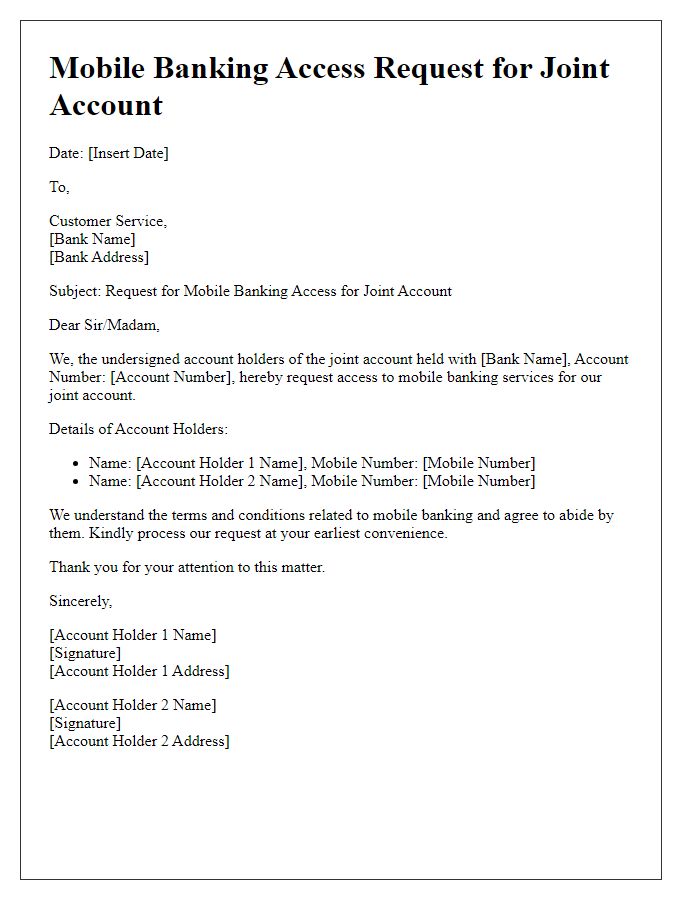

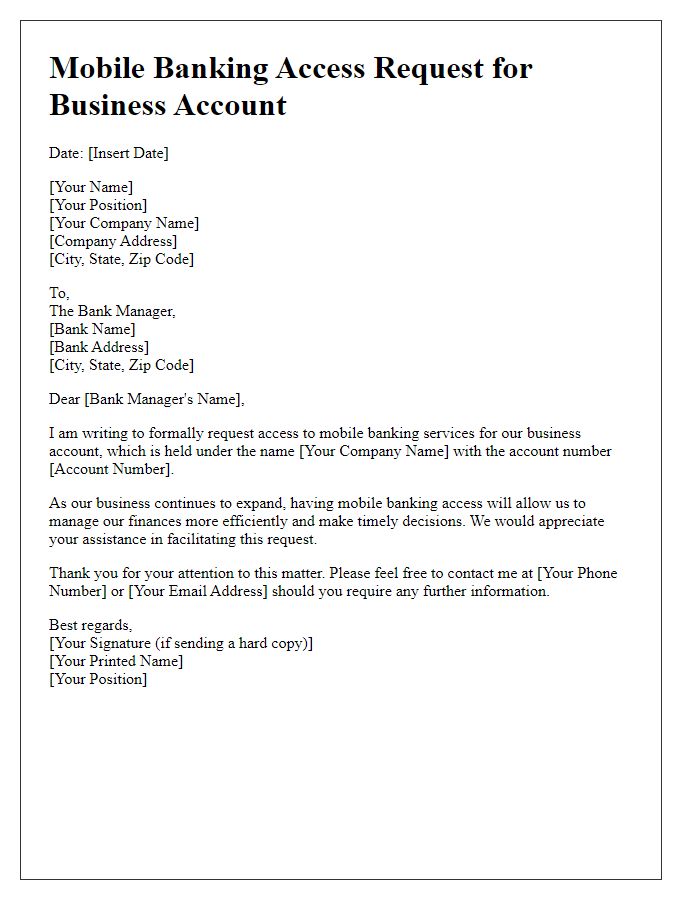

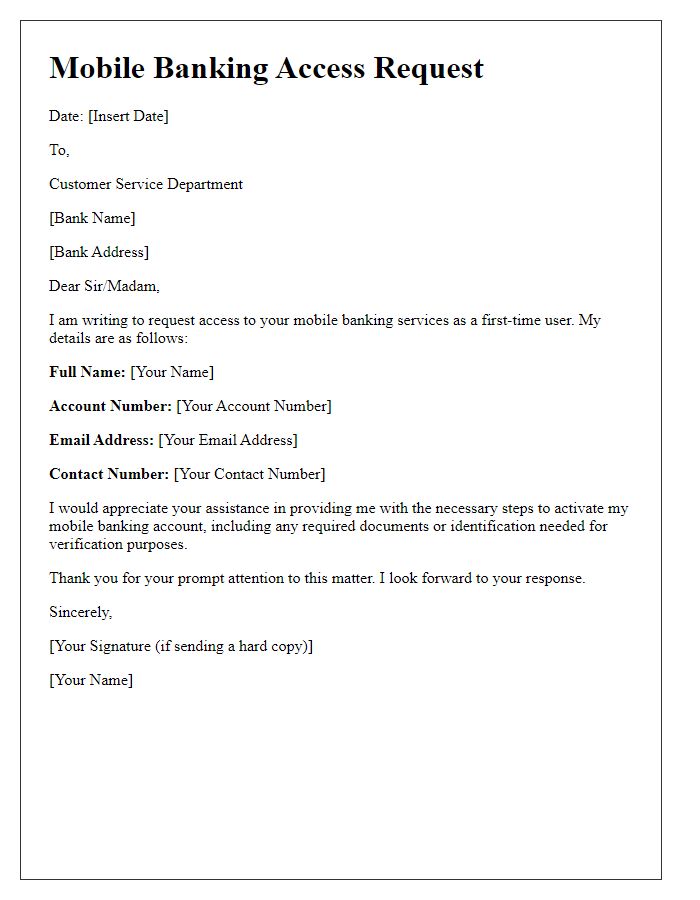

Letter Template For Mobile Banking Access Request Samples

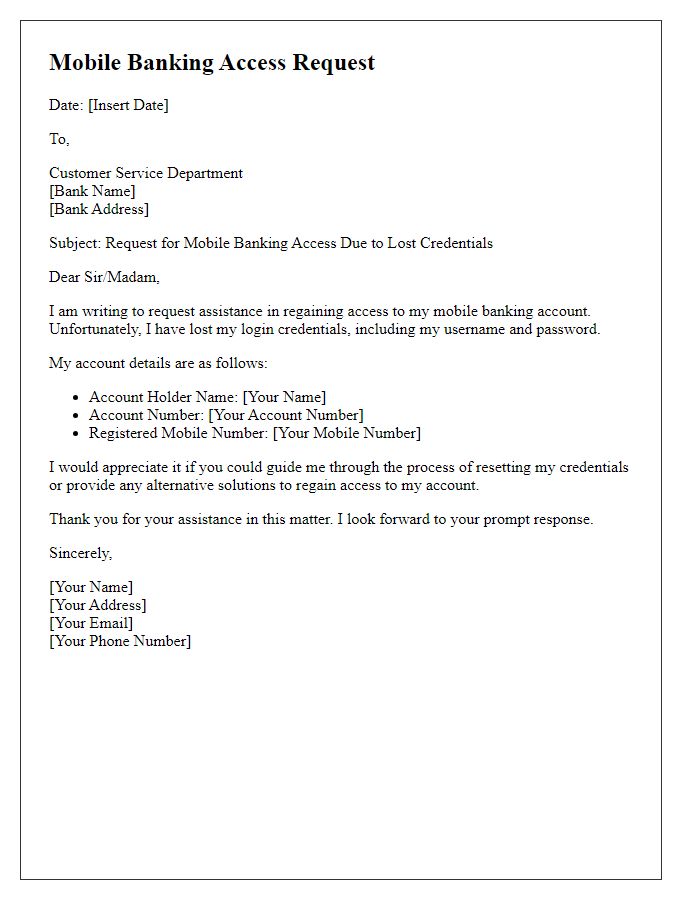

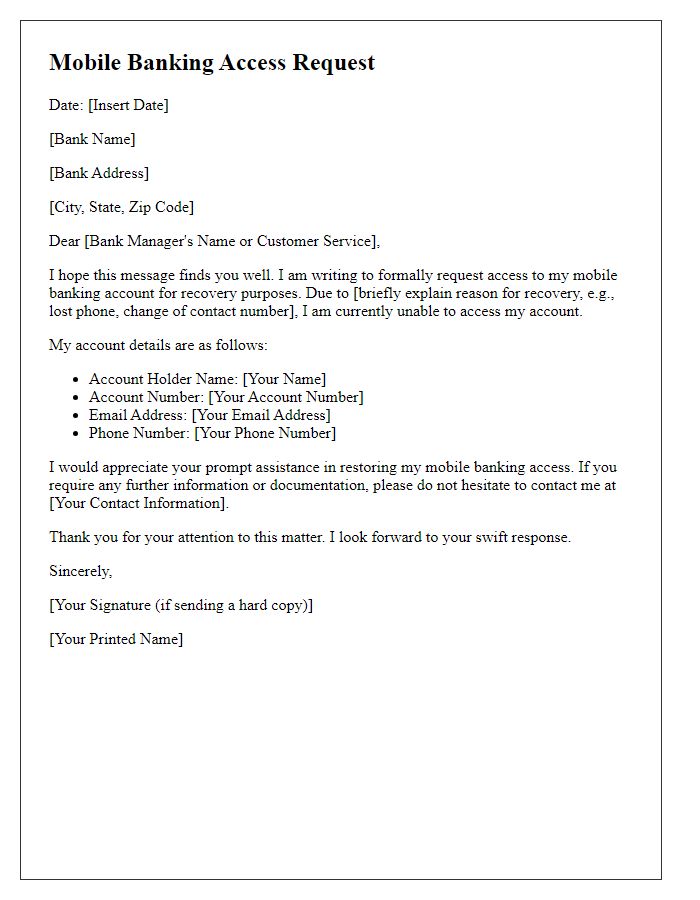

Letter template of mobile banking access request due to lost credentials

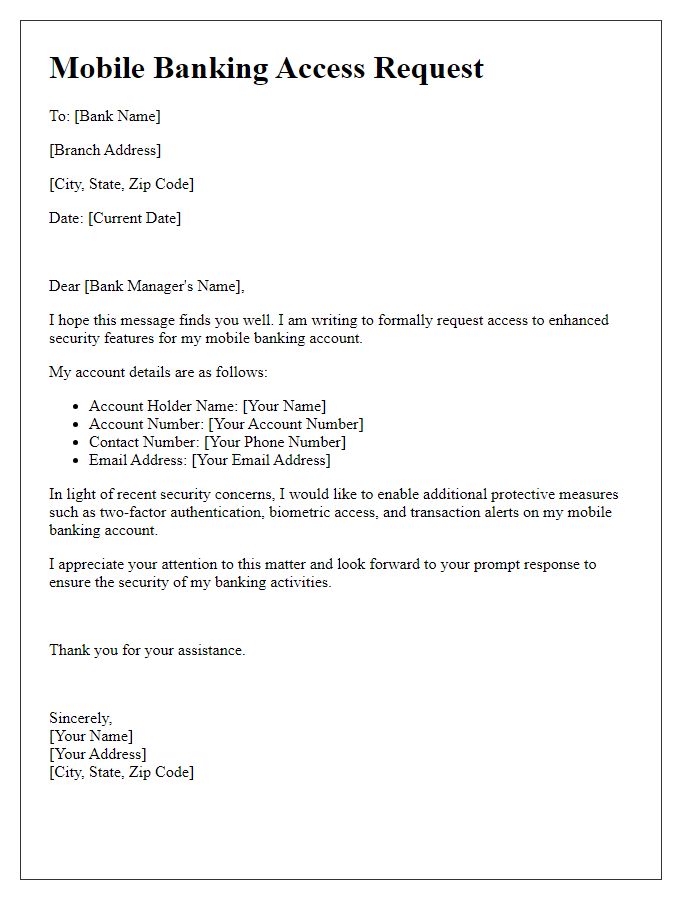

Letter template of mobile banking access request for enhanced security features

Comments