Are you feeling overwhelmed by the prospect of filing your capital gains tax report? You're not aloneâmany find the process daunting and complex, but it doesn't have to be that way! In this article, we'll break down the essential components of a capital gains tax report and provide you with a straightforward template to simplify your filing process. Join us as we navigate the ins and outs of capital gains tax, and be sure to read on for helpful tips and insights!

Taxpayer Identification Details

Taxpayer identification details include essential information for filing a capital gains tax report, such as the Taxpayer Identification Number (TIN), issued by the Internal Revenue Service (IRS), which uniquely identifies individuals or entities for tax purposes. The full legal name of the taxpayer must align with IRS records, ensuring accuracy in documentation. Additionally, the address of record, including street, city, state, and ZIP code, establishes residency and may influence local tax obligations. Any relevant business name attached to the taxpayer must also be included if applicable. For entities, details such as incorporation state and date are critical for verifying legitimacy and compliance with federal regulations.

Description of Asset and Acquisition Date

A capital gains tax report typically requires detailed information regarding the assets sold, including a precise description. For example, when reporting a residential property located at 123 Maple Street, Springfield, acquired on January 15, 2015, a brief description would highlight the asset's size (approximately 2,500 square feet), type (single-family home), and notable features (a swimming pool, renovated kitchen). The acquisition date is crucial for determining the holding period for capital gains tax calculations. Detailed records of the purchase price ($350,000) and any associated costs, such as closing fees or substantial renovations, further inform the calculation of potential gains. Accurate documentation of these elements ensures compliance with tax regulations and facilitates a clear assessment of owed taxes based on current market valuation.

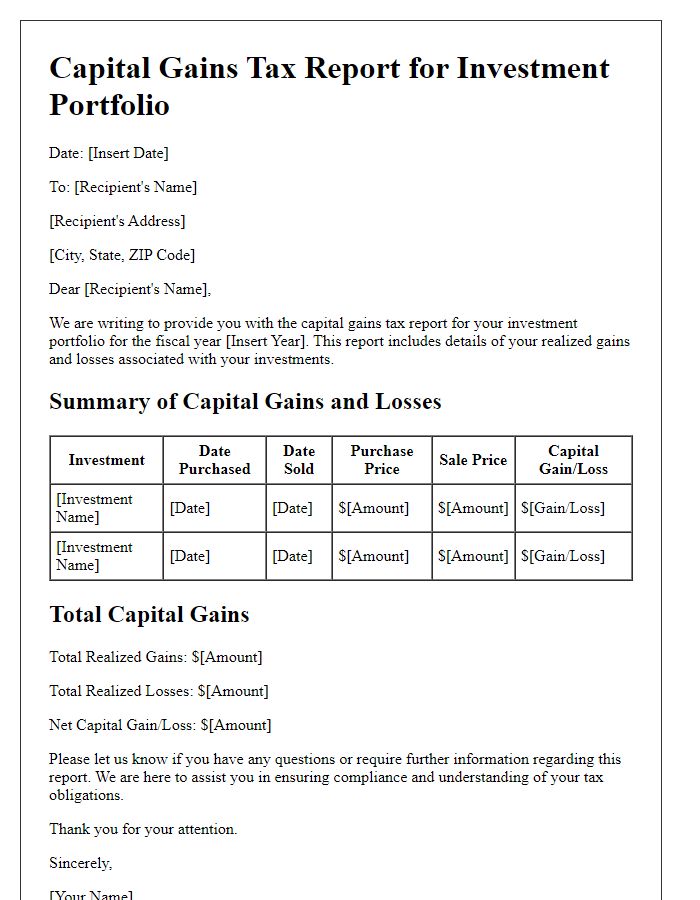

Calculation of Capital Gains

Capital gains tax reporting requires detailed calculations to determine the profit earned from asset sales. The primary focus involves the sale of assets such as stocks, real estate properties, or collectibles. A critical factor is the 'basis,' which represents the original value of the asset, including purchase price and additional costs like transaction fees. For example, if an individual purchased a property in Austin, Texas, for $300,000 and sold it for $400,000, the capital gain would be calculated as $100,000. Tax rates can vary significantly; long-term capital gains (for assets held over one year) typically face lower tax percentages than short-term gains. The reporting process must also account for any deductions or exclusions, such as primary residence exemptions, which could significantly affect the taxable amount. Accurate record-keeping of dates, amounts, and relevant documentation is essential for a reliable capital gains tax report.

Supporting Documentation

Capital gains tax reports require meticulous documentation to ensure compliance with IRS regulations. Essential records include transaction statements from brokerage accounts, which detail purchase and sale dates, as well as prices for specific assets, such as stocks or real estate. Additionally, Form 8949 provides a comprehensive ledger of each transaction, including adjustments like commissions or fees. Supporting documents like closing statements from property sales, also known as HUD-1 statements, help verify the acquisition and disposition costs, safeguarding against discrepancies. Finally, the basis of assets, often delineated in prior year tax returns or acquisition statements, aids in accurately calculating gains or losses, ensuring proper reporting for the tax year.

Compliance and Reporting Deadlines

Capital gains tax reporting is crucial for individuals and corporations in adhering to tax obligations, especially in jurisdictions like the United States, where the Internal Revenue Service (IRS) mandates detailed disclosures. For the tax year 2022, individuals must report their capital gains on Form 1040, with a filing deadline of April 15, 2023. Corporations are similarly required to file their capital gains on Form 1120 by the same date. Additionally, taxpayers must submit Schedule D, which summarizes overall capital gains and losses, along with any necessary attachments such as Form 8949 for reporting sales and exchanges of capital assets. Penalties for noncompliance include hefty fines and interest on unpaid taxes starting from the due date. It is essential to maintain accurate records of transactions, including dates, amounts, and asset descriptions, to ensure precise reporting and to facilitate audit trails if necessary.

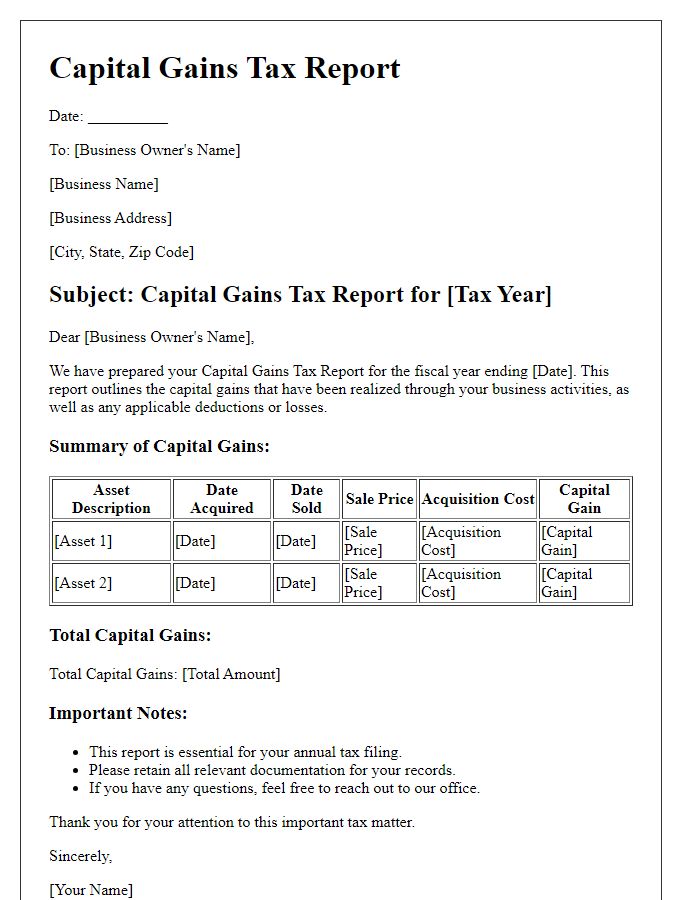

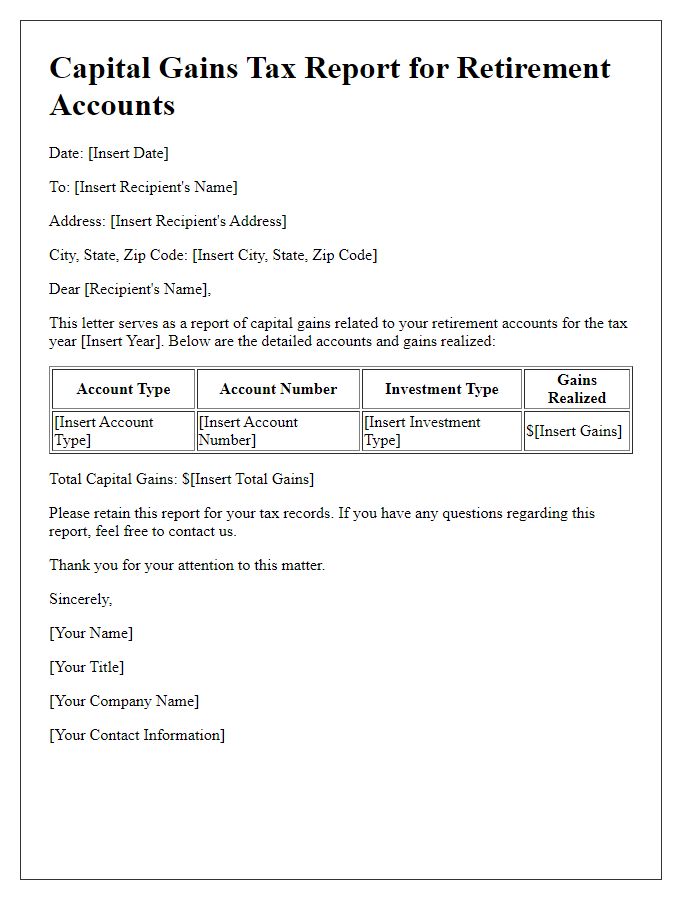

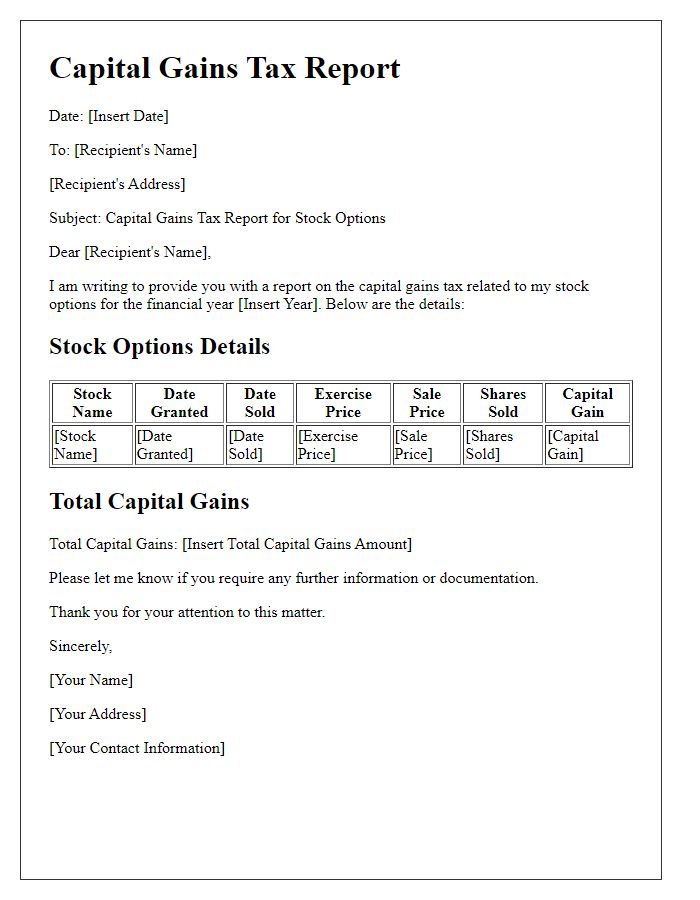

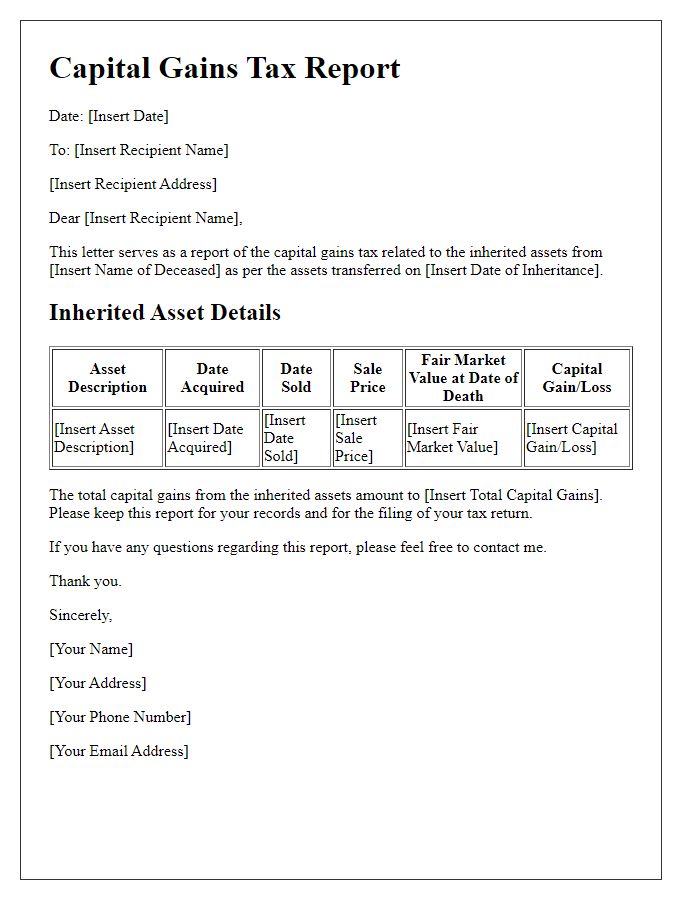

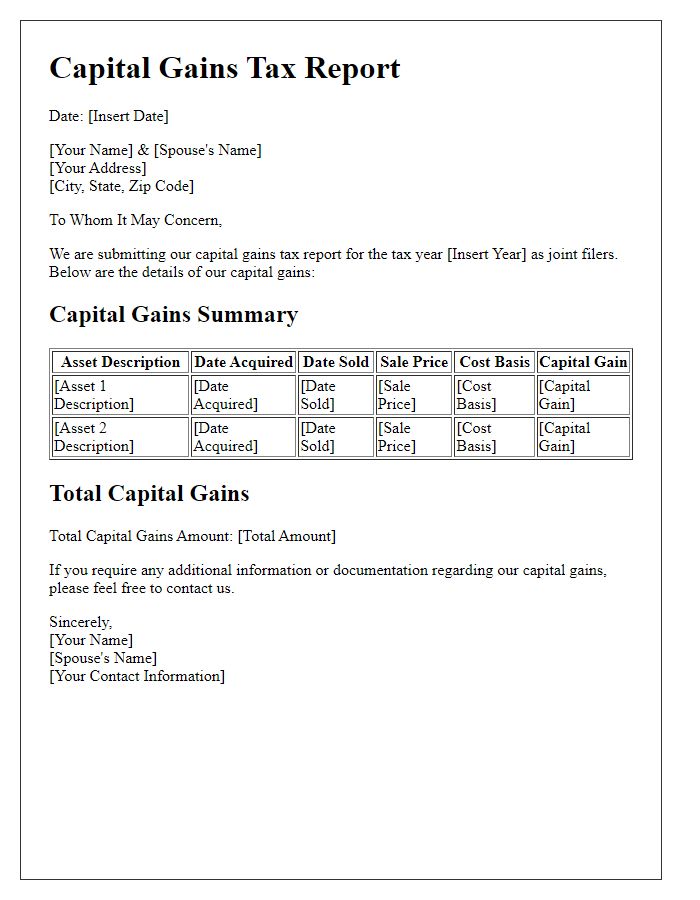

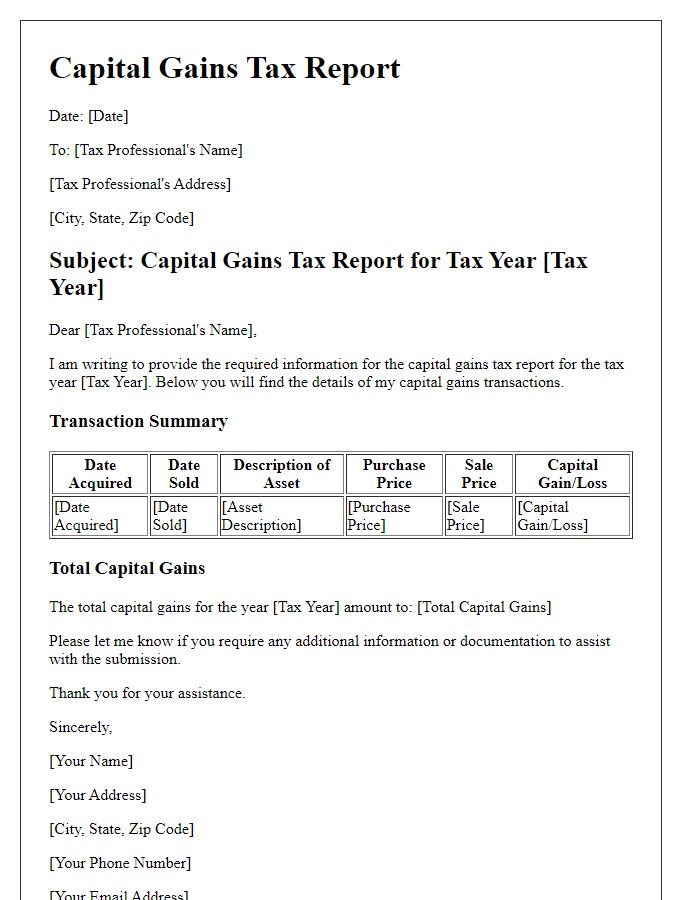

Letter Template For Capital Gains Tax Report Samples

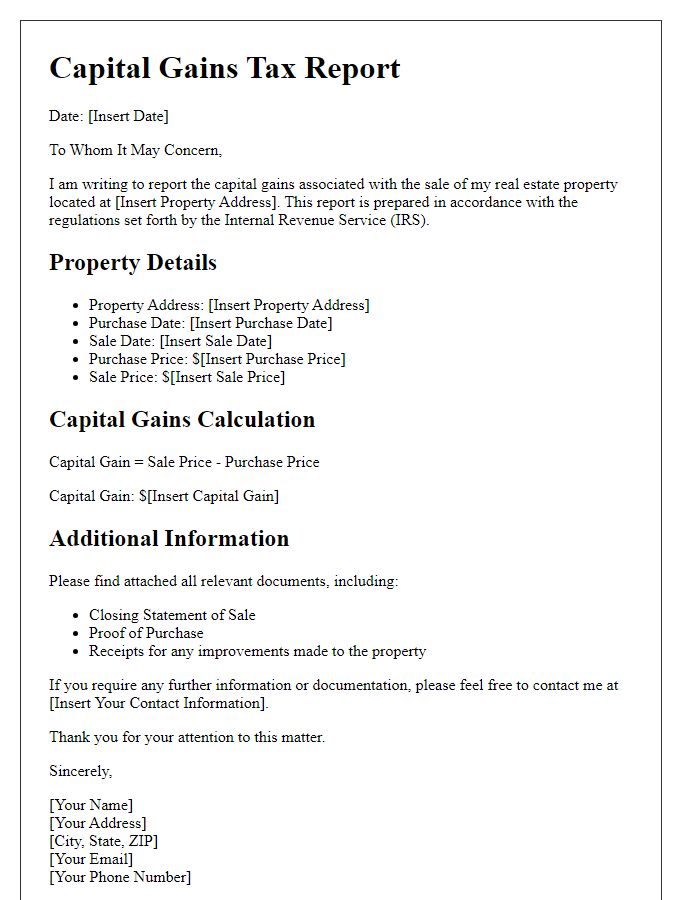

Letter template of capital gains tax report for real estate transactions

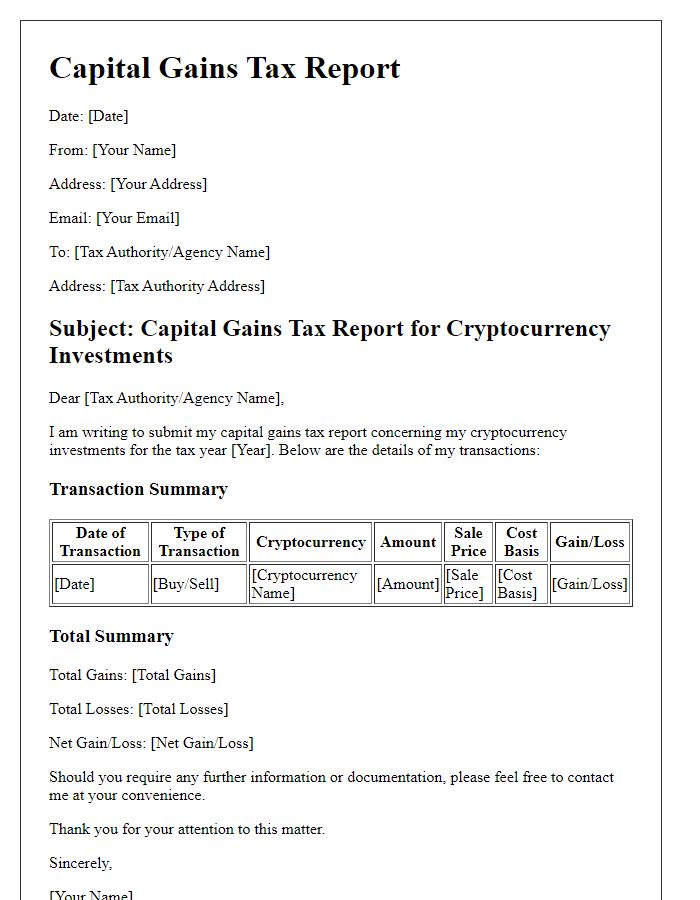

Letter template of capital gains tax report for cryptocurrency investments

Comments