If you've ever received a letter informing you about a decrease in your credit card limit, you know how concerning it can be. These notifications can often come as a surprise, leaving you wondering what factors led to this decision. Understanding the reasons behind these changes is crucial, as they can impact your financial strategy and credit score. Join us as we delve deeper into the intricacies of credit card limit management and what it means for you.

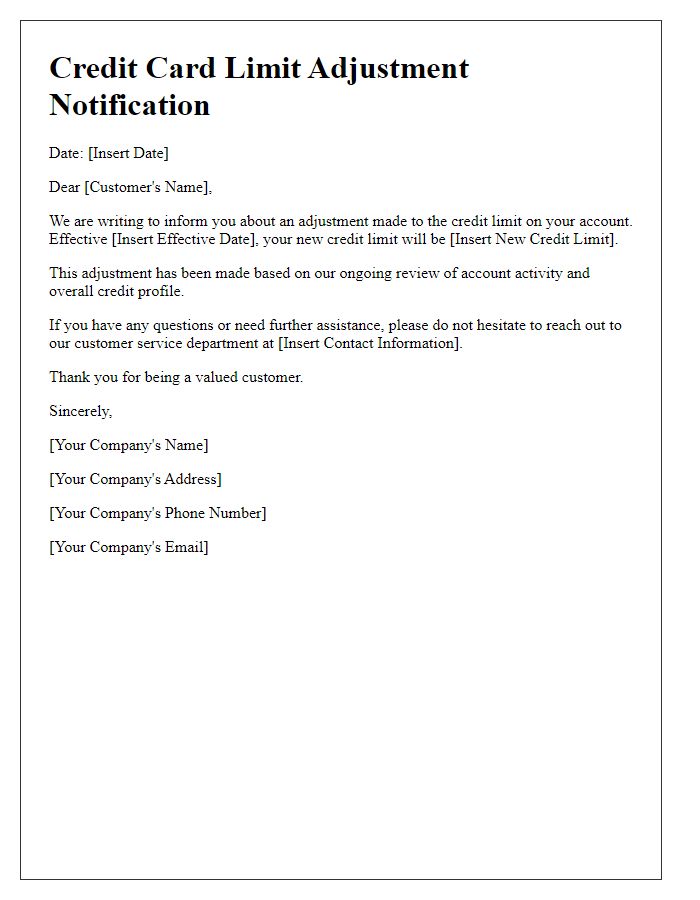

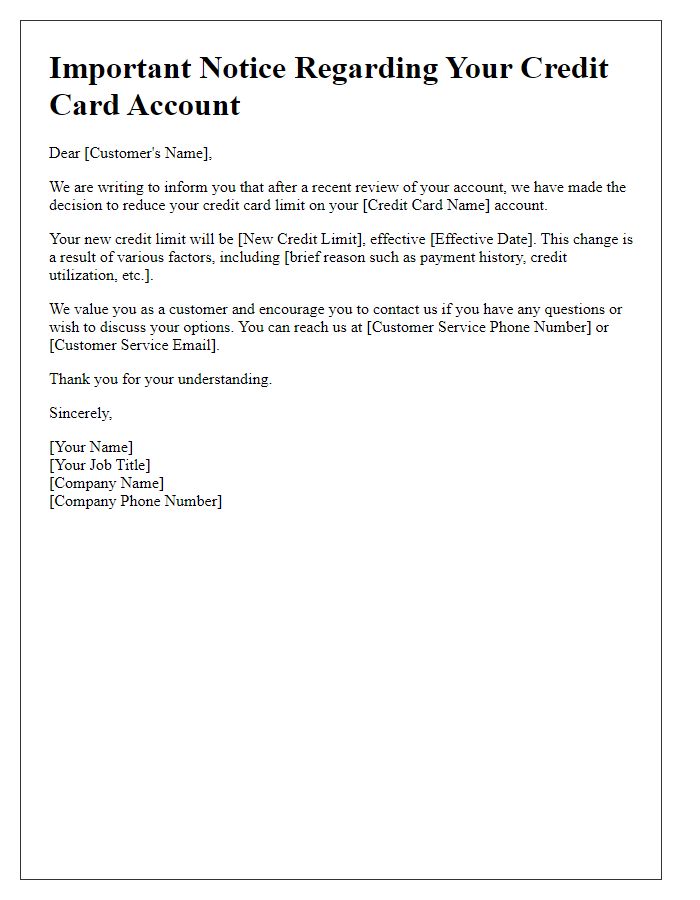

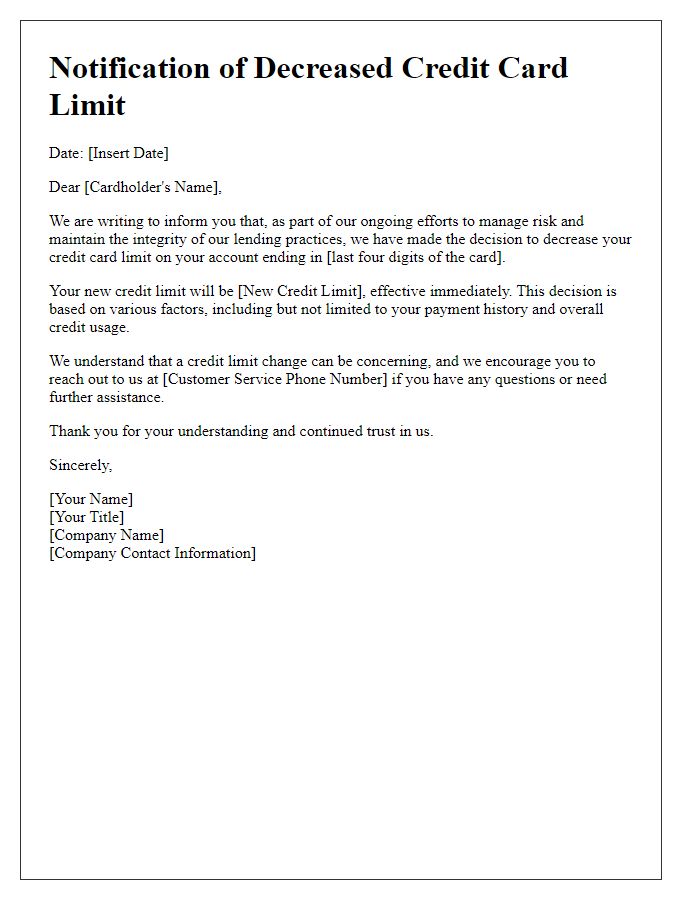

Account holder's name and information

Credit card limit adjustments can significantly impact an individual's purchasing power and financial management. One common reason for a decrease in credit card limits is a change in the account holder's credit score (FICO score adjustments typically range from 300 to 850). Lenders often reassess creditworthiness periodically, especially after missed or late payments, which can negatively affect the credit score. Additionally, factors such as increased credit utilization ratio (above 30%) or significant changes in income can trigger a limit reduction. This adjustment may occur without prior notice to the account holder, potentially leading to unexpected declines during transactions. It is vital for consumers to regularly monitor their credit reports and manage credit responsibly to avoid such situations.

Explanation of credit limit decrease

A credit card limit decrease can significantly impact a customer's financial flexibility and overall credit utilization. Credit card issuers, such as Visa or MasterCard, often evaluate customer behavior, payment history, and outstanding debt. Factors leading to a decrease might include payment delinquency, an increase in total credit utilization (above 30 percent is common), or changes in the customer's income or employment status. These policies aim to manage risk and ensure responsible lending practices, especially during economic downturns. A notification of this nature typically specifies the new credit limit, hypothetical examples of credit utilization implications, and advice regarding maintaining a healthy credit score, with proactive suggestions for managing current financial obligations effectively.

Effective date of change

Notification of credit card limit decrease affects cardholders significantly, indicating a change in credit availability. Effective date of change is essential, often communicated 30 days prior to adjustment. Reasons for decrease may include factors such as missed payments, changes in credit score, or increased debt-to-income ratio. Cardholders must review account terms on provider's website for detailed information. Reduced limit impacts purchasing options and overall credit utilization ratio, potentially affecting credit scores. Understanding these elements helps in making informed financial decisions moving forward.

Contact information for inquiries or disputes

Credit card limit adjustments can affect consumer spending capabilities, impacting financial planning and budgeting. Notifications typically include details on the adjusted credit limit, the reasons behind the decrease, such as payment history or credit utilization ratio. Important contact information is provided for inquiries, including a customer service phone number (usually a 24-hour helpline) and email address for dispute resolutions. Consumers are encouraged to reach out for clarification or to discuss potential options to reverse the decrease. Documentation may outline consumer rights under regulations such as the Fair Credit Reporting Act, ensuring transparency.

Steps for requesting a limit review or appeal

Credit card limit decreases can significantly impact personal finances, often leading to increased credit utilization ratios. Customers, particularly those holding accounts with major financial institutions such as Chase or American Express, may experience this adjustment unexpectedly. To address concerns regarding potential limit reductions, customers can initiate a limit review or appeal by following a structured process. First, gathering relevant documentation (including credit score reports from agencies like Experian or TransUnion) is crucial for supporting claims. Secondly, contacting customer service directly through established channels--either via phone or secure messaging on banking apps--will facilitate the discussion regarding individual situations. Finally, providing a clear explanation of personal financial stability, recent income growth, or responsible credit usage can enhance the probability of a successful appeal for retaining or increasing credit limits.

Comments