Are you feeling overwhelmed by your auto loan payments? You're not alone! Many people face challenges when trying to manage their finances, and negotiating a settlement on your auto loan can be a daunting but rewarding process. If you're interested in learning how to effectively communicate with your lender and navigate this negotiation, keep reading for valuable insights and helpful tips!

Loan Account Details

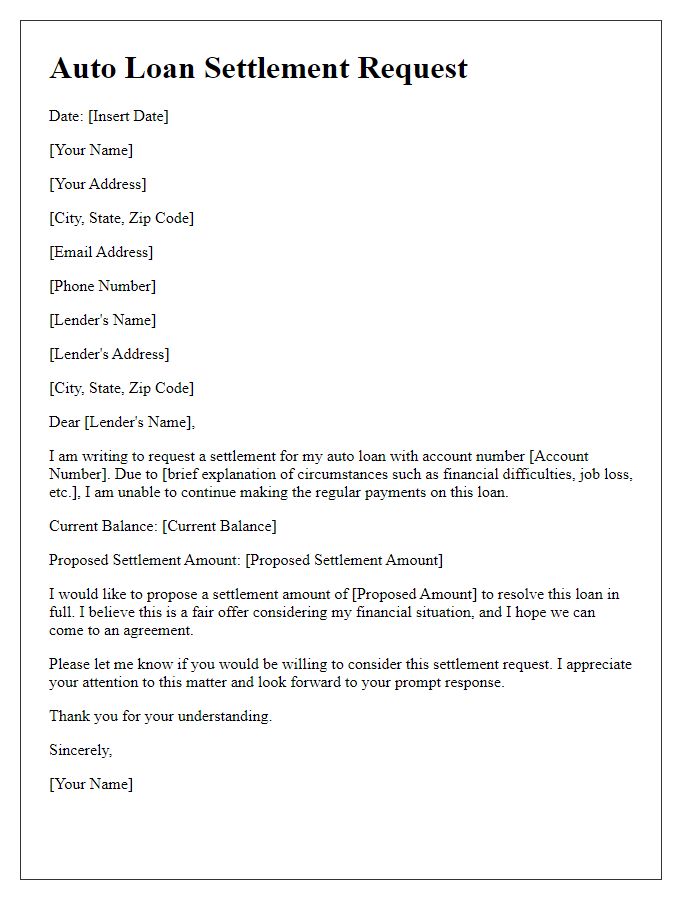

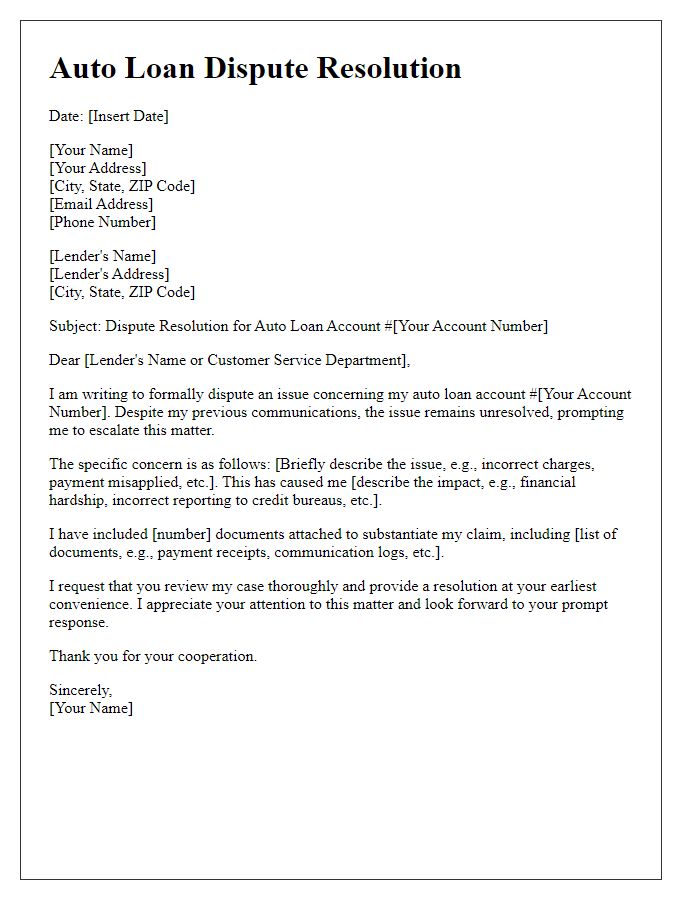

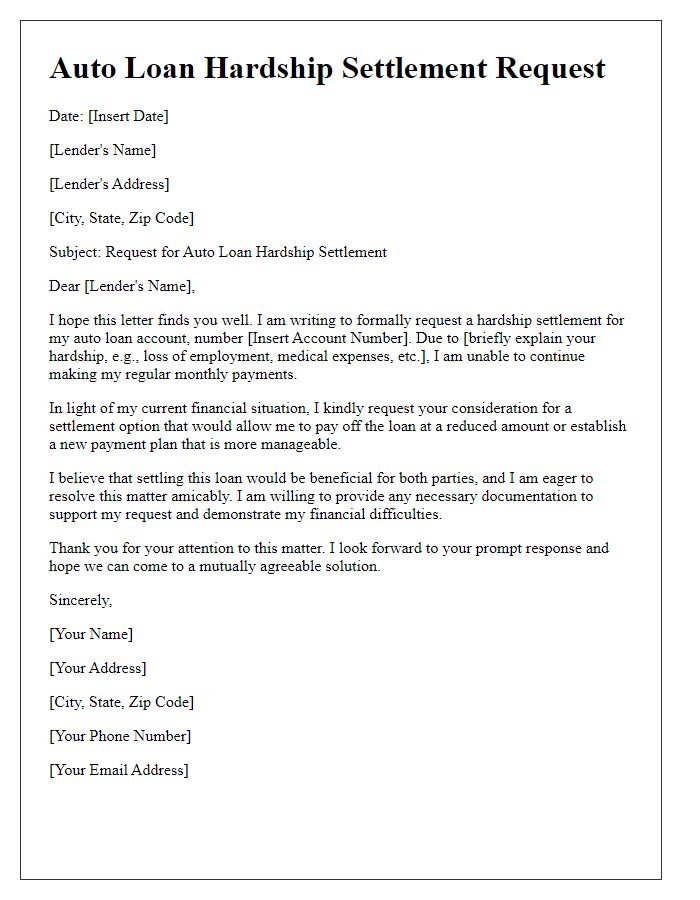

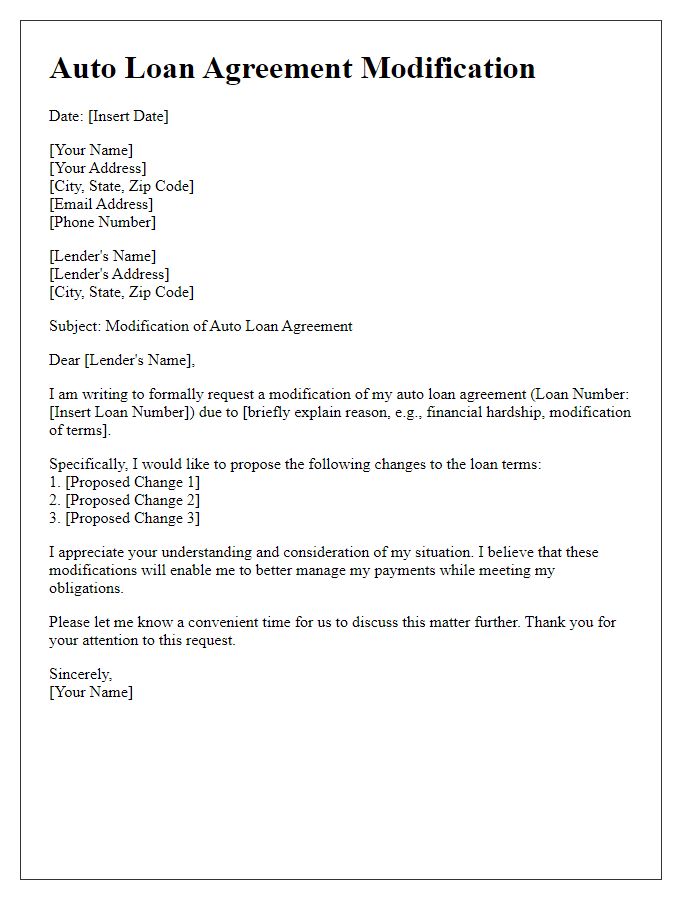

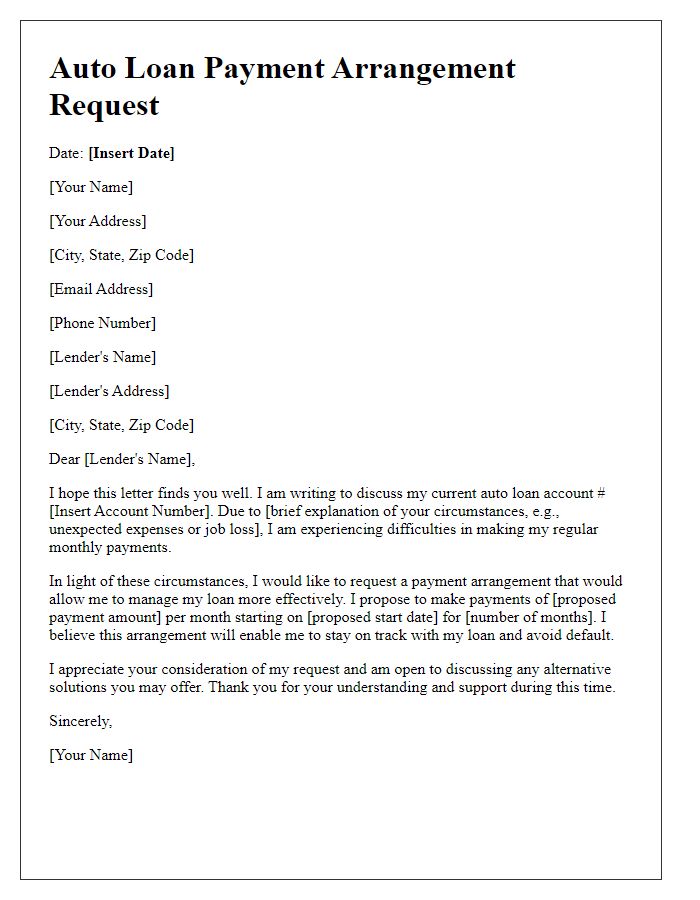

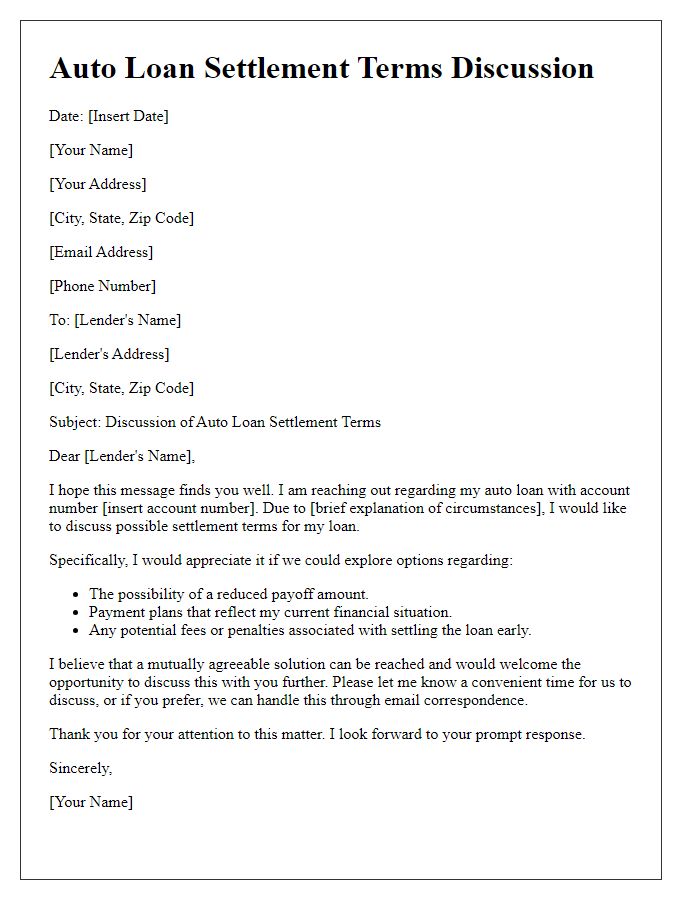

Negotiating an auto loan settlement requires clear communication regarding your loan account details. The loan account number (usually 10-15 digits) serves as an essential identifier for your lender, helping them locate your account accurately. The outstanding principal amount represents the remaining balance owed on the loan, which may include accrued interest from the monthly payments made. Documented evidence of missed payments, along with the dates (for instance, payments due since January 2022), clarifies your current financial situation. Additionally, the original loan amount, typically confirmed in the loan agreement, provides context for negotiations. The current loan term, such as a 60-month or 72-month period, highlights the timeline for repayment obligations. Including your financial hardship details, such as income changes or unexpected expenses, strengthens the case for a favorable settlement outcome.

Current Financial Situation

The current financial situation of individuals seeking auto loan settlement negotiation can be influenced by various factors, including income levels, expenses, and credit scores. For instance, a monthly income of $3,000 may be offset by necessary expenses like rent ($1,200), utility bills ($300), and groceries ($400), leaving limited disposable income. Additionally, credit scores, often ranging between 300 and 850, play a crucial role in determining negotiation power; scores below 600 may indicate a struggle to obtain favorable terms. Economic conditions, such as unemployment rates (currently at 4.8% in the U.S.) and inflation trends (approximately 3% in recent years), can further exacerbate the financial challenges faced by borrowers, making effective negotiation and settlement strategies essential for managing auto loans.

Settlement Offer Amount

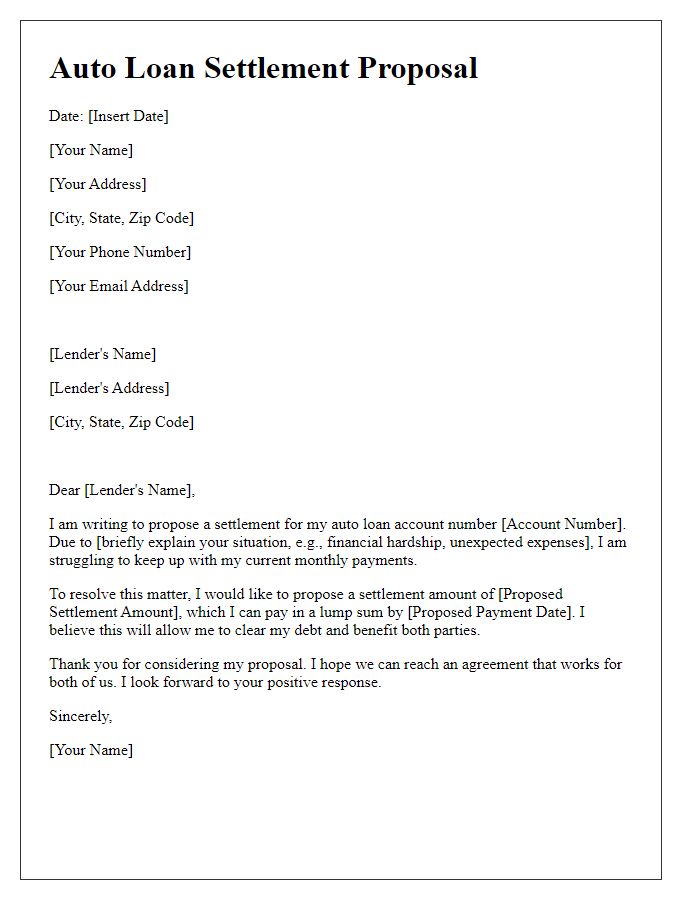

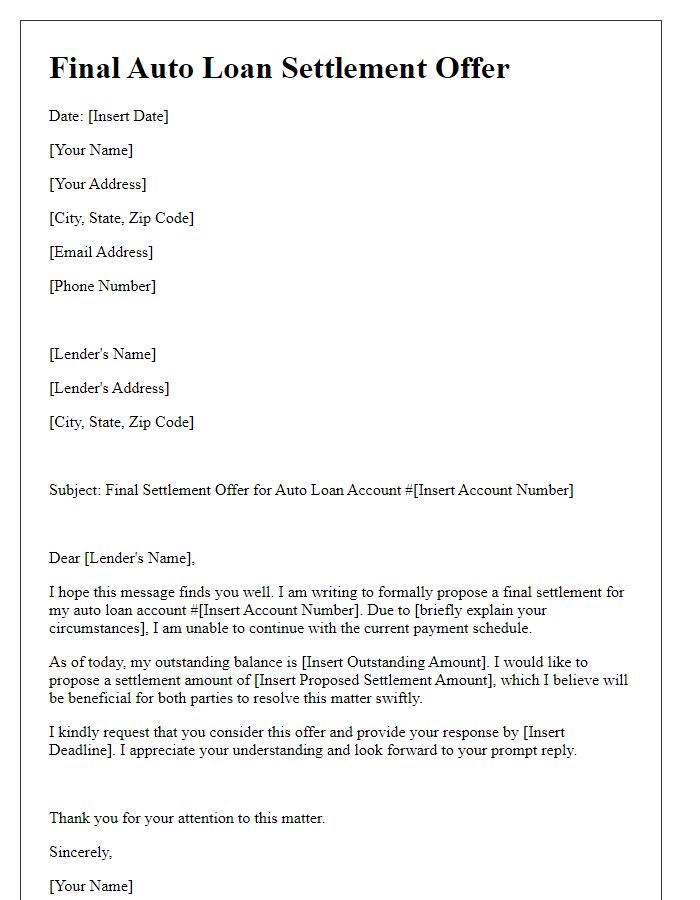

Auto loan settlement negotiations often involve a careful consideration of the remaining balance on the loan, typically ranging from thousands to tens of thousands of dollars. The settlement offer amount should be based on the original loan terms, interest rates (often between 4% to 10%), and the duration of the loan (usually spanning 36 to 72 months). Borrowers may aim to propose a reduced payment, perhaps around 50% of the outstanding balance, contingent upon their financial hardships or changes in personal circumstances. Accurate documentation is crucial; providing proof of income, hardship letters, and expenses can bolster the settlement argument. Furthermore, the negotiation may take place with the lender's representatives or collection agencies that manage defaulted accounts, emphasizing the importance of knowing the lender's policies regarding settlements.

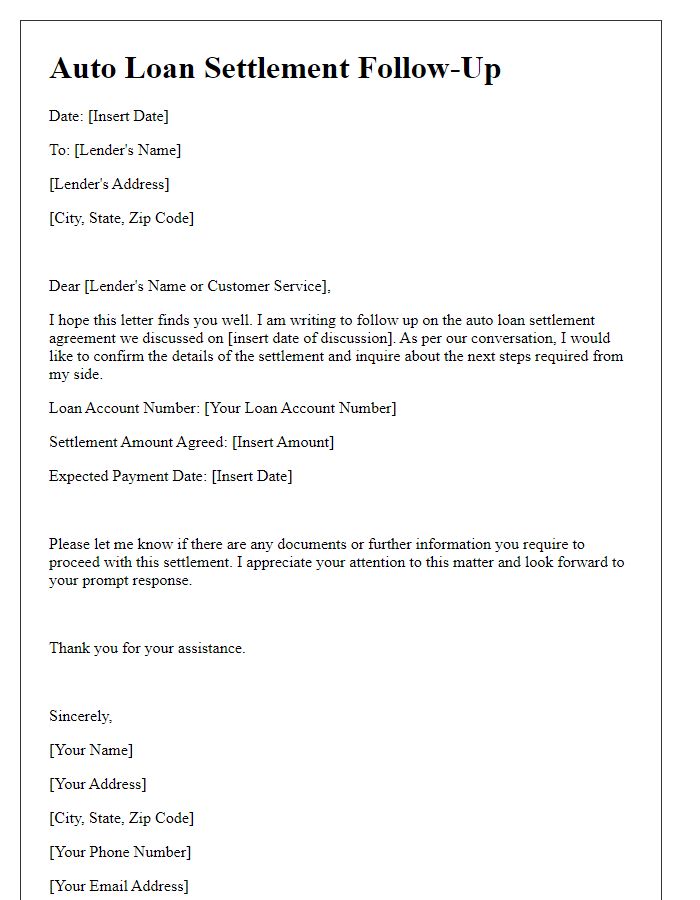

Payment Terms and Timeline

Auto loan settlements require careful negotiation. Payment terms may include a final amount agreed upon between the lender and borrower (often a reduced sum compared to the total outstanding balance). These agreements typically outline a structured timeline for payments, such as a 30-day period to complete the settlement. Borrowers should also consider including specific conditions, such as payment method (e.g., bank transfer, check) and any potential penalties for late payments, to avoid future complications. Clear documentation of both parties' agreement is essential to ensure accountability and prevent misunderstandings throughout the process.

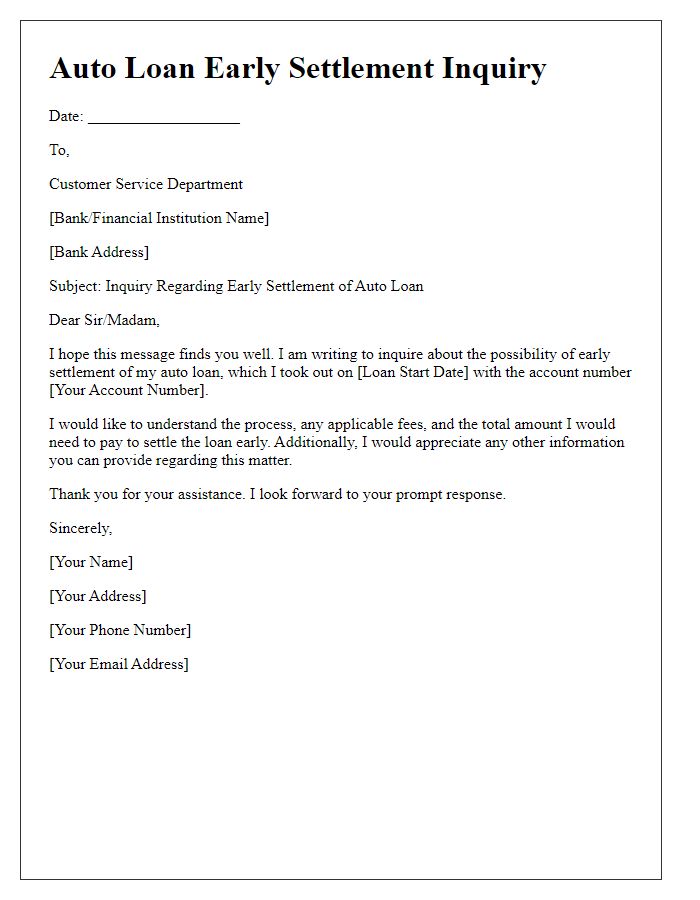

Request for Written Confirmation

Negotiating an auto loan settlement requires clear communication and documentation for a successful resolution. Begin with detailing the loan specifics, including the original loan amount, current balance, and account number for easy reference. Highlight the reasons for seeking a settlement, such as financial hardship or changes in employment status, emphasizing the timeline of events. Explain the proposed settlement amount, ensuring it's realistic compared to the outstanding balance while also being mindful of the lender's policies. Stress the importance of receiving a written confirmation of any agreed-upon settlement terms to formalize the agreement, which is crucial for both parties' protection. This document serves as a safeguard to ensure clarity and prevent any future disputes regarding the settlement.

Comments