Are you feeling overwhelmed by appliance finance debts? You're not alone; many people face challenges managing their payments amid rising living costs. Fortunately, there are effective strategies to negotiate and potentially lower your debt, making your financial burden feel a lot lighter. Dive into our guide to discover practical tips and expert advice on negotiating appliance finance debts.

Concise Introduction

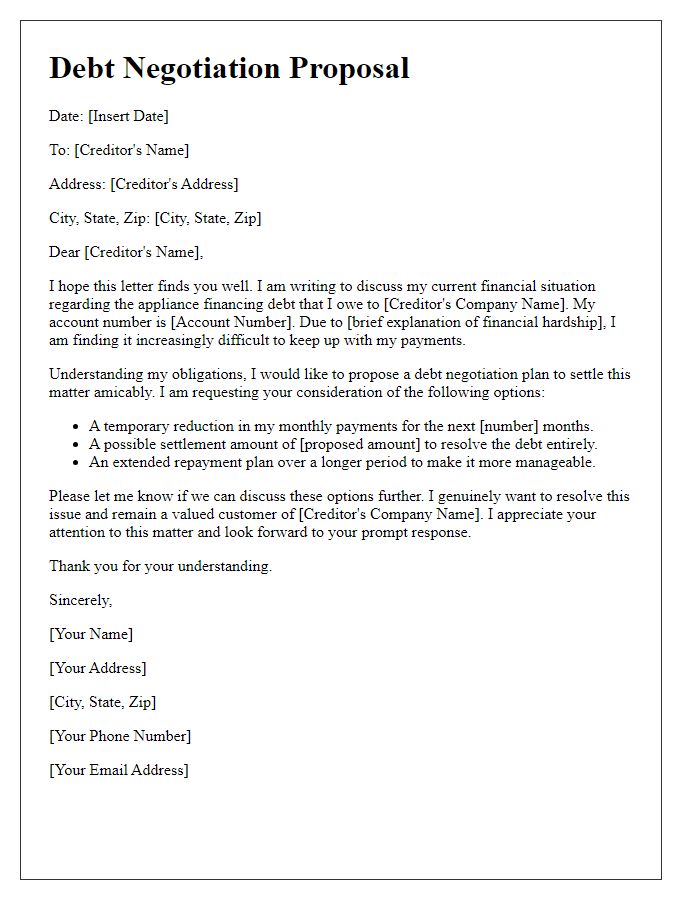

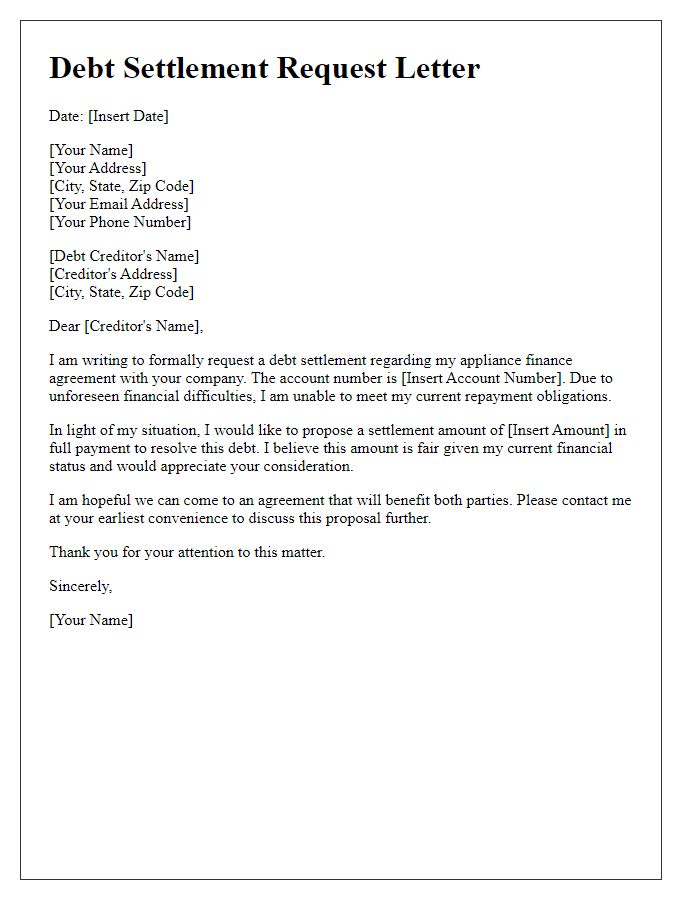

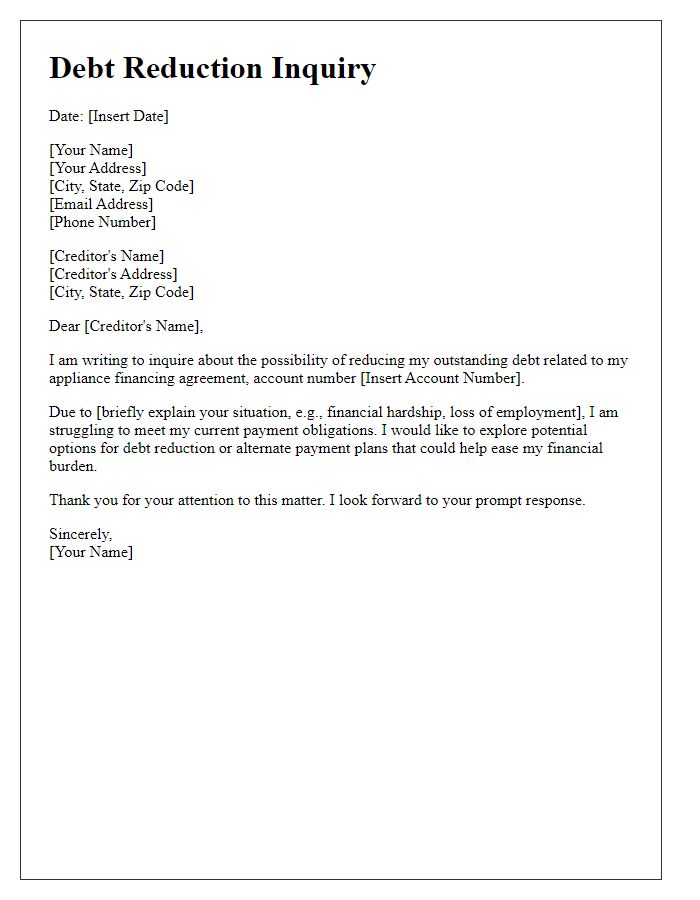

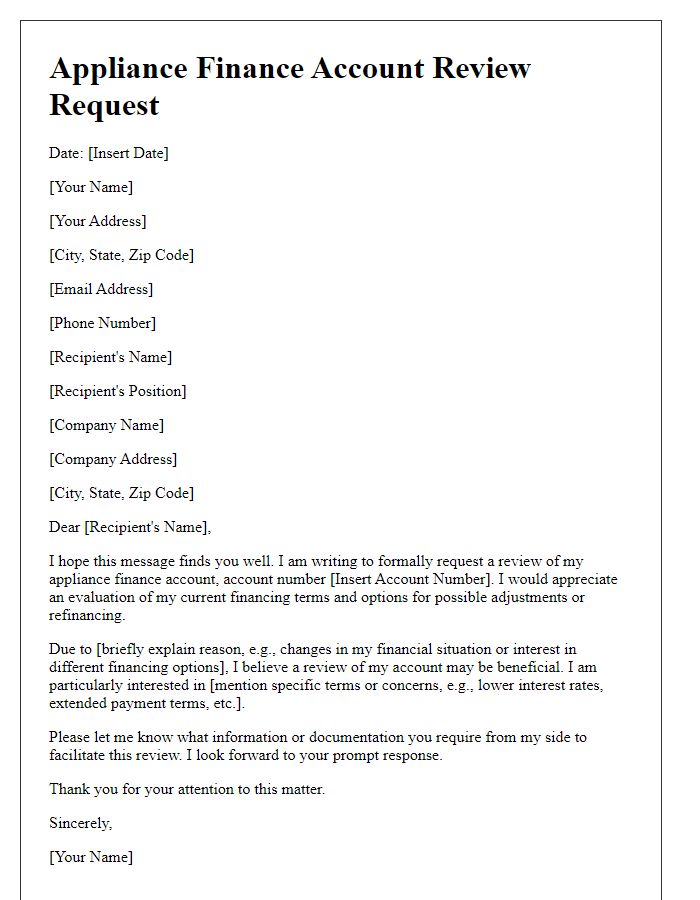

Appliance finance debt negotiation often requires a succinct and effective introduction to set the tone for a productive discussion. Financial institutions and service providers, such as banks and credit unions, typically seek to resolve outstanding balances on consumer electronics or home appliances, like refrigerators or washing machines. The introduction should emphasize the intent to discuss repayment options, possibly referencing specific debt amounts and terms. Clarity and professionalism are key to ensuring both parties engage in a constructive dialogue.

Clear Financial Overview

A comprehensive financial overview is crucial for negotiating appliance finance debt, especially for individuals facing significant financial strain. Detailed information should include total outstanding balances, payment history illustrating any missed payments or defaults, and current interest rates associated with the debt. It is essential to present monthly income figures, such as wages from employment or any other sources like freelance work, alongside fixed expenses including rent or mortgage payments, utilities, and living costs. Incorporating an analysis of disposable income will help to illustrate the capacity for future payments. Documenting communication history with lenders, including previous negotiation attempts or offers made, provides context and may strengthen negotiation positions. Finally, including recent appliances financed--like refrigerators, washing machines, or ovens--alongside their respective costs will offer a clearer picture of the overall financial responsibility and aid in crafting a reasonable repayment plan.

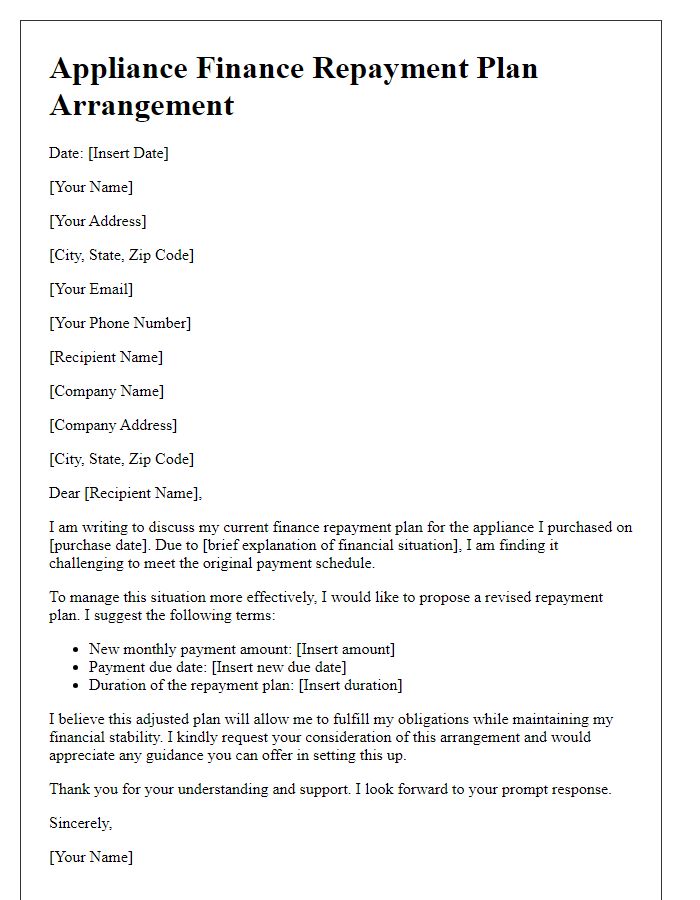

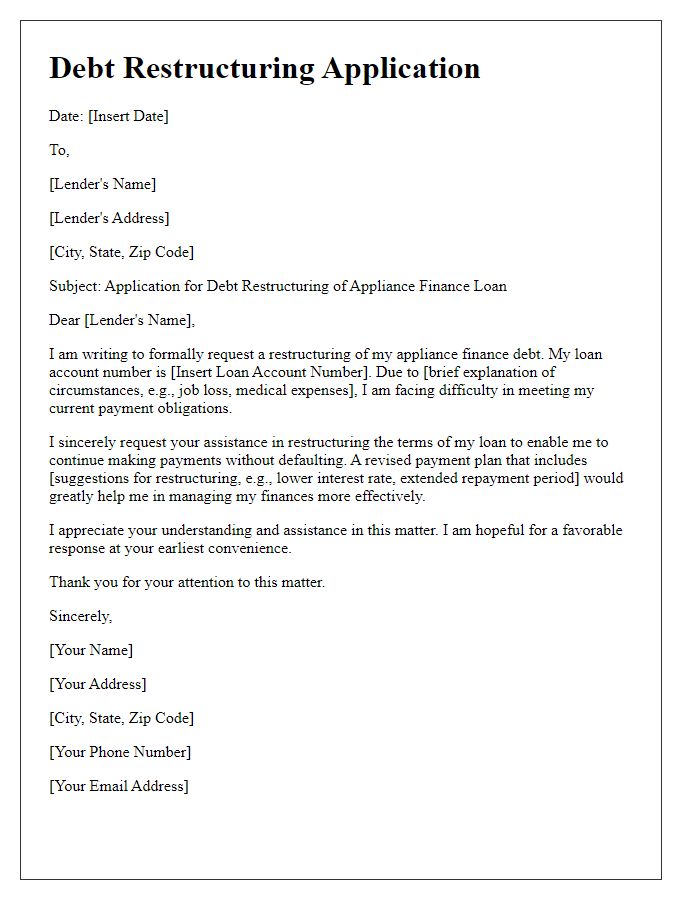

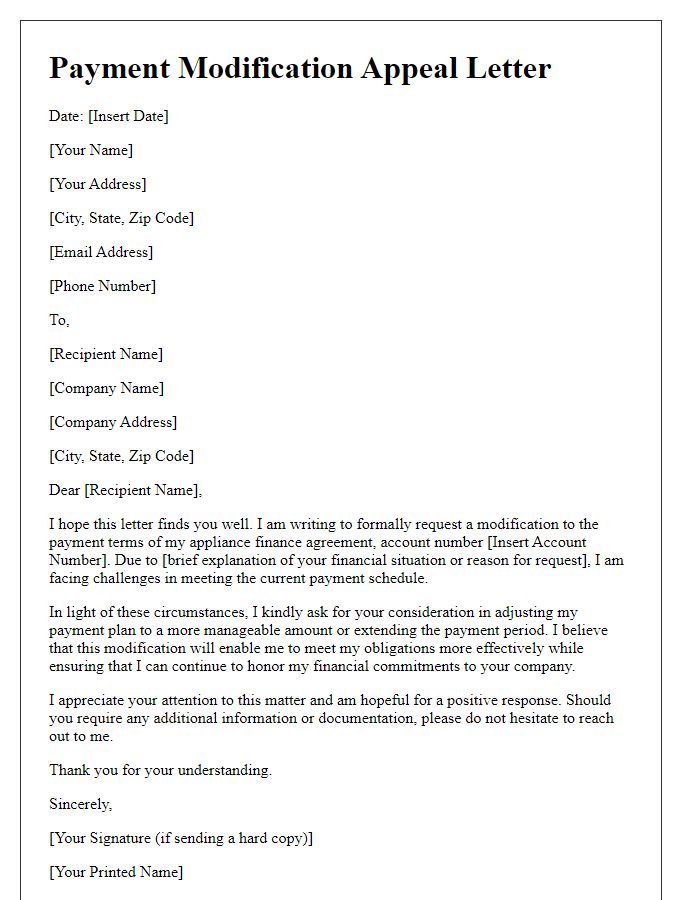

Proposed Repayment Plan

Appliance finance debt negotiation can lead to successful repayment agreements, emphasizing the importance of clear communication regarding terms. In a proposed repayment plan, details include the total owed amount, typically averaging $2,000 for appliances like refrigerators, washers, and dryers. Offering a reasonable monthly payment--around $150 to $200--helps demonstrate commitment while ensuring financial feasibility. Highlighting a specific repayment duration, often suggested at 12 to 18 months, is beneficial. Additionally, considerations for interest rates and potential waivers can enhance negotiations. Providing personal financial details, like monthly income and expenses, allows for a transparent dialogue to foster mutual understanding and reach a satisfactory agreement.

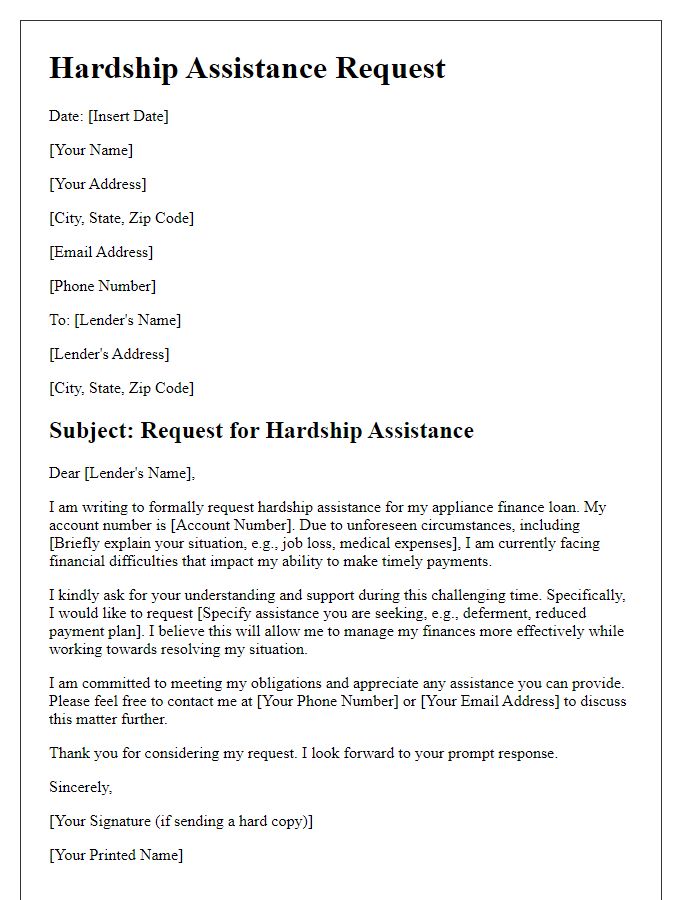

Justification for Proposal

Appliance financing debt negotiation seeks to address outstanding balances related to essential household items such as refrigerators, washing machines, and microwaves. Many consumers face financial hardship due to unexpected events like job loss or medical emergencies, leading to difficulty in maintaining monthly payments. According to the Federal Reserve, household debt in the United States reached $15 trillion in 2023, with a significant portion attributed to installment loans for appliances. In proposing a structured repayment plan or a reduction of interest rates, borrowers can regain financial stability while ensuring lenders receive consistent payments. Successful negotiations might involve adjusting the repayment term or offering a one-time settlement amount that is less than the total owed. These strategies can ultimately benefit both parties by minimizing defaults and enhancing long-term customer relationships.

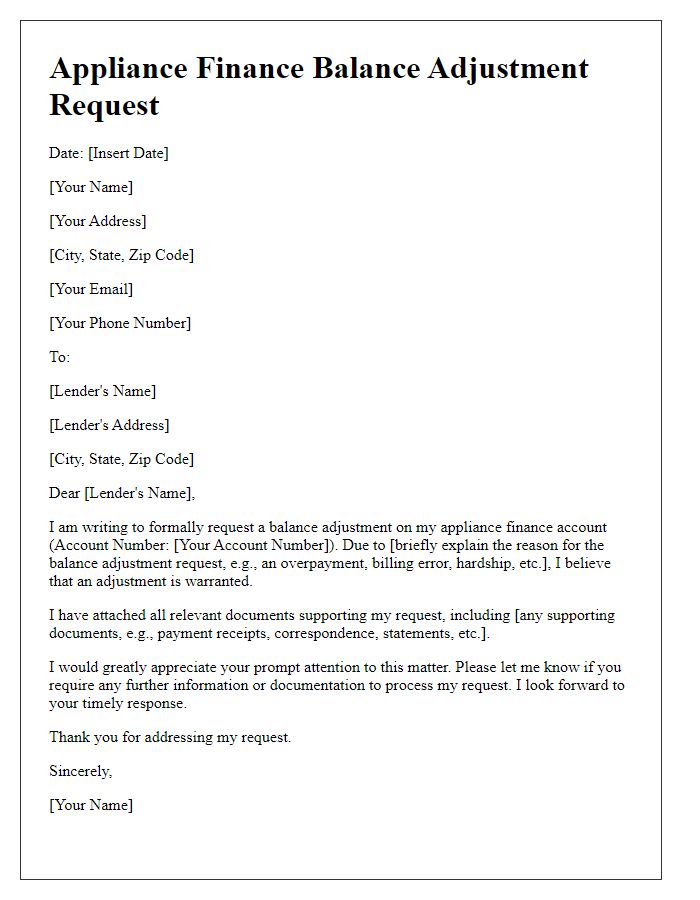

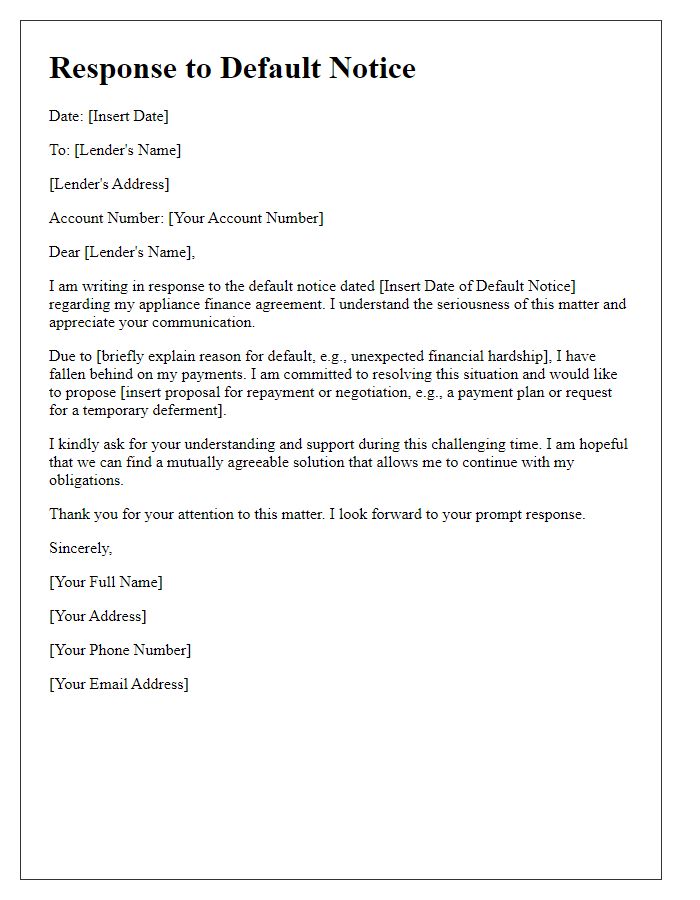

Request for Written Agreement

Appliance finance debt negotiation involves engaging with lenders to potentially restructure or forgive debt associated with appliance purchases. Clearly outlining financial concerns can facilitate communication. Providing details like the lender's name (e.g., ABC Finance), account number, outstanding balance (e.g., $1,500), and previous payment history can enhance the negotiation process. Including specific terms desired, such as a lower interest rate (e.g., from 15% to 5%) or an extended repayment period (e.g., from 12 months to 24 months), can also clarify expectations. Requesting a written agreement ensures all parties achieve mutual understanding and transparency regarding the debt resolution.

Comments