Have you ever felt overwhelmed by the relentless phone calls and letters from a collection agency? If you're grappling with the stress of persistent harassment, you're not alone. Many individuals face similar challenges, and it's essential to know how to document these experiences effectively. Join us as we discuss the best practices for creating a comprehensive letter template that can help you address collection agency harassment head-on.

Incident Detail Summary

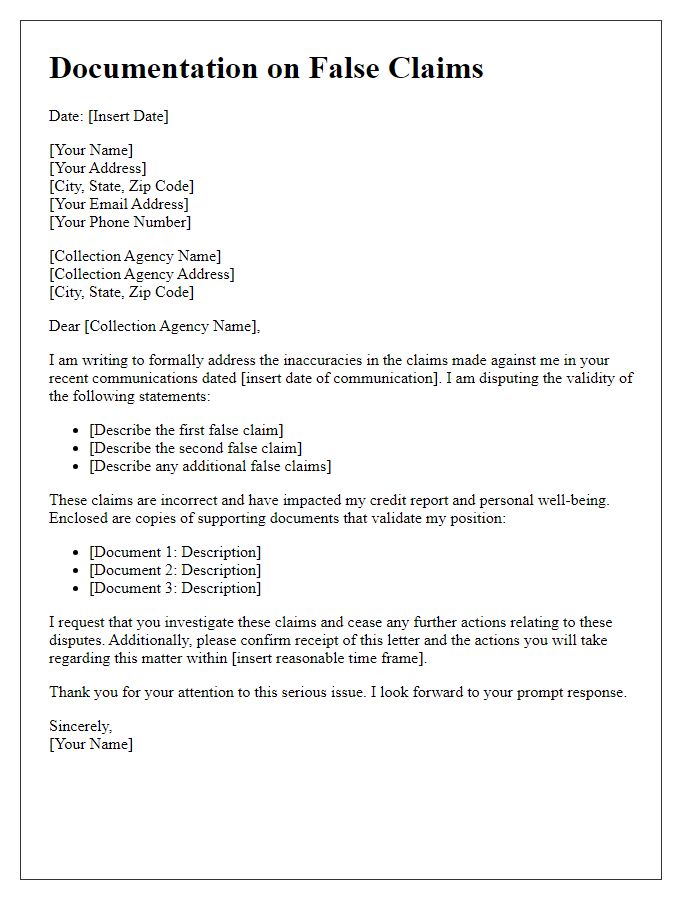

Collection agency harassment can significantly impact individuals' mental and emotional well-being. Frequent phone calls (often exceeding 10 times a day), aggressive language, and threats of legal action are common tactics used by agencies like Midland Funding LLC or Portfolio Recovery Associates. These interactions can occur at inappropriate times, such as late evenings or early mornings, violating the Fair Debt Collection Practices Act (FDCPA). Documenting incidents includes recording the date, time, and content of the conversations. Collectors may misrepresent debts, fail to validate claims, or disclose personal information to third parties, leading to potential violations. Keeping a log of these experiences is crucial for individuals seeking to file complaints or take legal action to protect their rights.

Chronological Contact Log

Collection agencies often engage in persistent contact with debtors, resulting in significant stress. Maintaining a chronological contact log serves essential documentation purposes. Record key information like date, time, method (phone call, letter), and representative name for each interaction. For instance, on October 5, 2023, at 3:15 PM, a representative named John Smith from ABC Collections called regarding an overdue balance of $1,200, referencing account number 456789. On October 10, 2023, a follow-up letter was received postmarked from Dallas, Texas, exhibiting aggressive language with bolded deadlines. This detailed log provides critical evidence if legal action becomes necessary, enabling assessment of compliance with the Fair Debt Collection Practices Act (FDCPA), which prohibits harassment and deceptive practices by collection agencies.

Recorded Communication Evidence

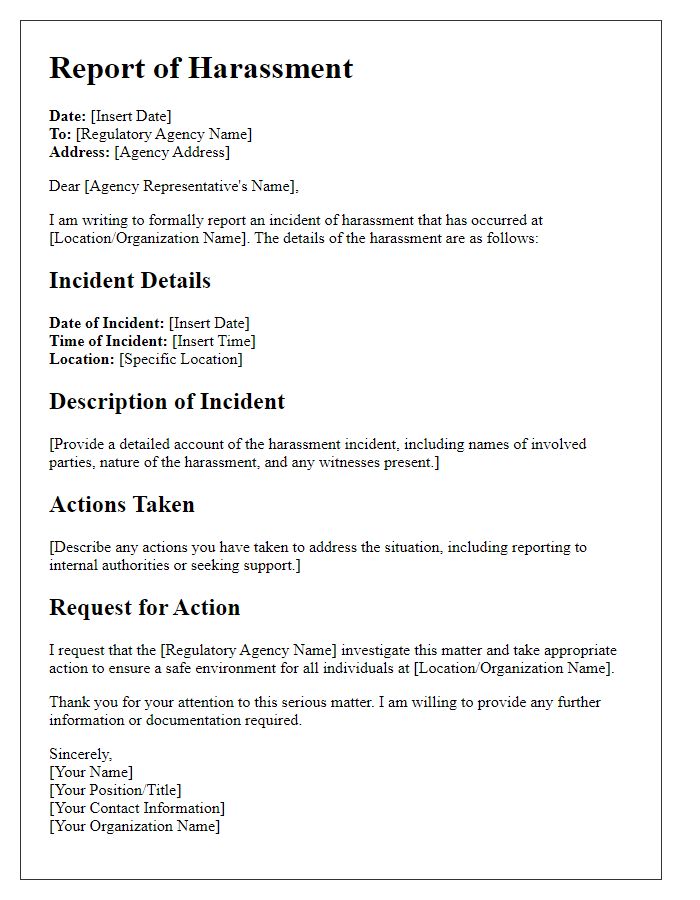

Harassment from collection agencies can have serious implications for individuals facing financial difficulties. Documenting recorded communications, such as phone calls or voicemails, becomes crucial in establishing a pattern of abusive behavior. Evidence should include specific details like dates, times, and duration of each interaction, along with the names of representatives involved. Notable incidents may include threats of legal action or misrepresentation of debts. Maintaining an organized file with this information can provide vital support for potential complaints to regulatory bodies like the Consumer Financial Protection Bureau. Transparency in communication practices is essential for both consumers and debt collectors in order to uphold ethical standards and ensure fair treatment under the Fair Debt Collection Practices Act.

Impact Statement on Personal Well-being

Facing persistent harassment from collection agencies can severely impact personal well-being. Increased anxiety levels often manifest as sleepless nights or heightened stress responses, leading to physical symptoms such as headaches or digestive issues. Emotional distress may arise as individuals frequently worry about their financial situations, affecting relationships with family and friends, particularly during social gatherings or family events where discussions about finances occur. The fear of derogatory credit reports or diminishing credit scores can create a sense of hopelessness, obstructing opportunities for loans, housing, or subsequent financial stability. Furthermore, the pressure from repeated phone calls or letters can lead to a feeling of constant vigilance, eroding a person's sense of safety and security in their home environment, essential for mental health and well-being.

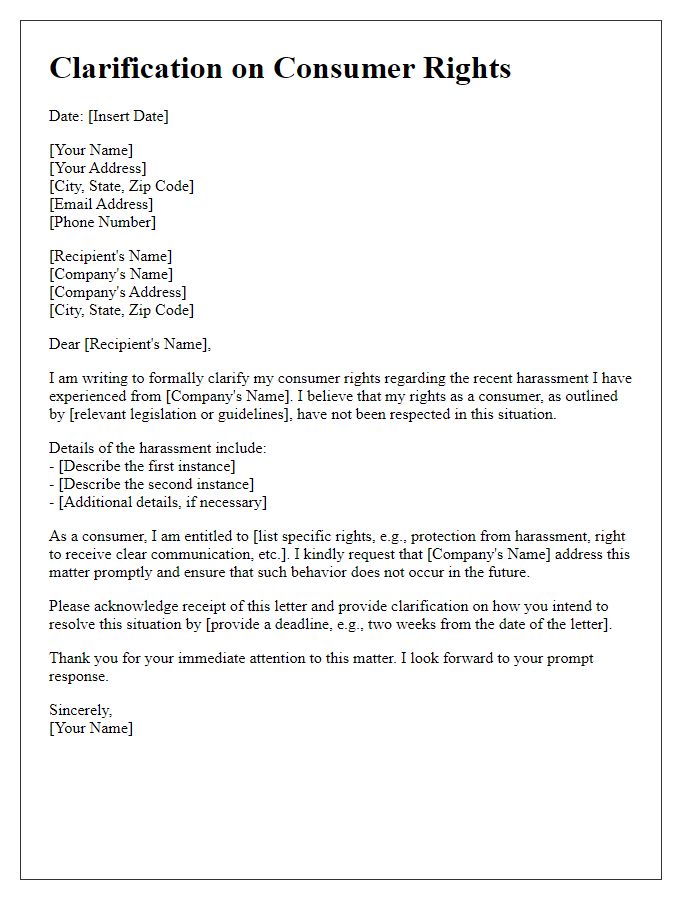

Legal References and Consumer Rights

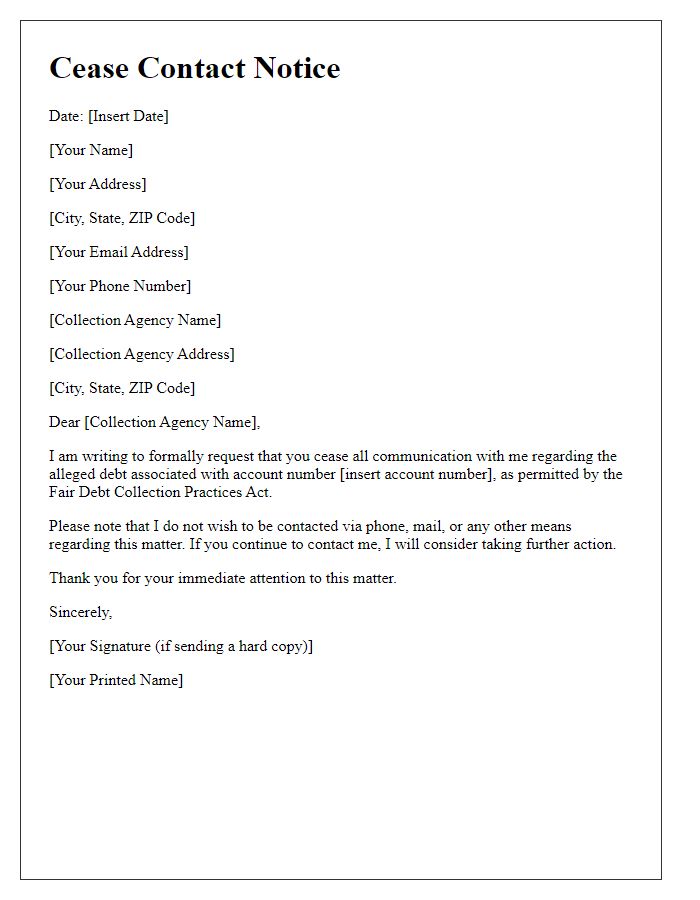

Collection agencies often engage in aggressive tactics that may violate consumer rights under the Fair Debt Collection Practices Act (FDCPA), which protects individuals from abusive debt collection practices. Consumers experiencing harassment should document specific details like dates, times, and content of the communications received from debt collectors. These communications may include threatening language, frequent phone calls (more than once a day), or misinformation regarding the debt owed. It is crucial to note any violations such as failure to identify themselves or misinformation about the implications of non-payment. Additionally, consumers have the right to request validation of the debt and to cease communication by sending a written request under FDCPA guidelines. Collecting this information can be instrumental in filing complaints with the Consumer Financial Protection Bureau (CFPB) or pursuing legal action against the collection agency.

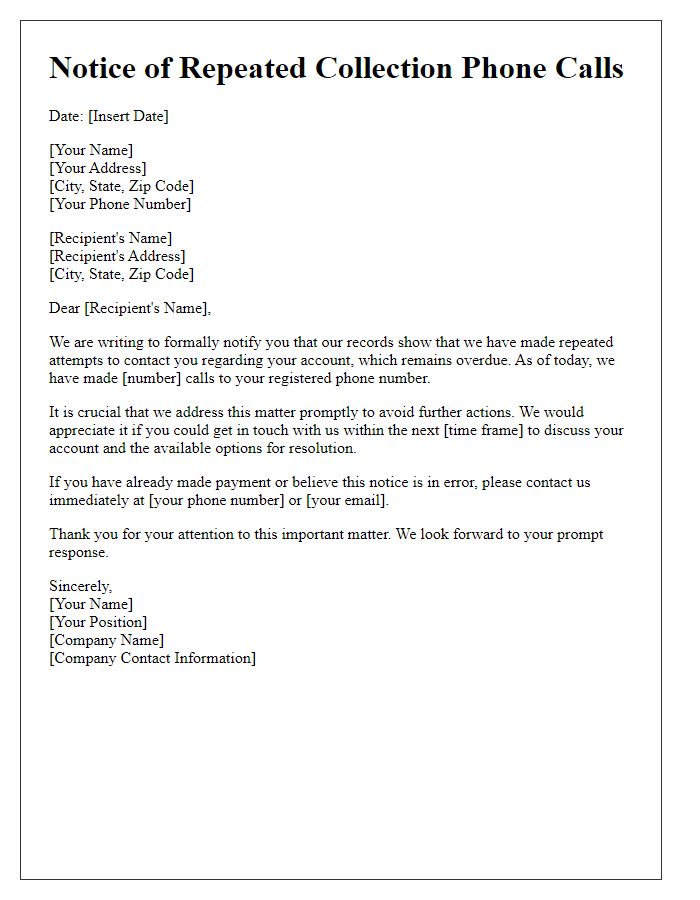

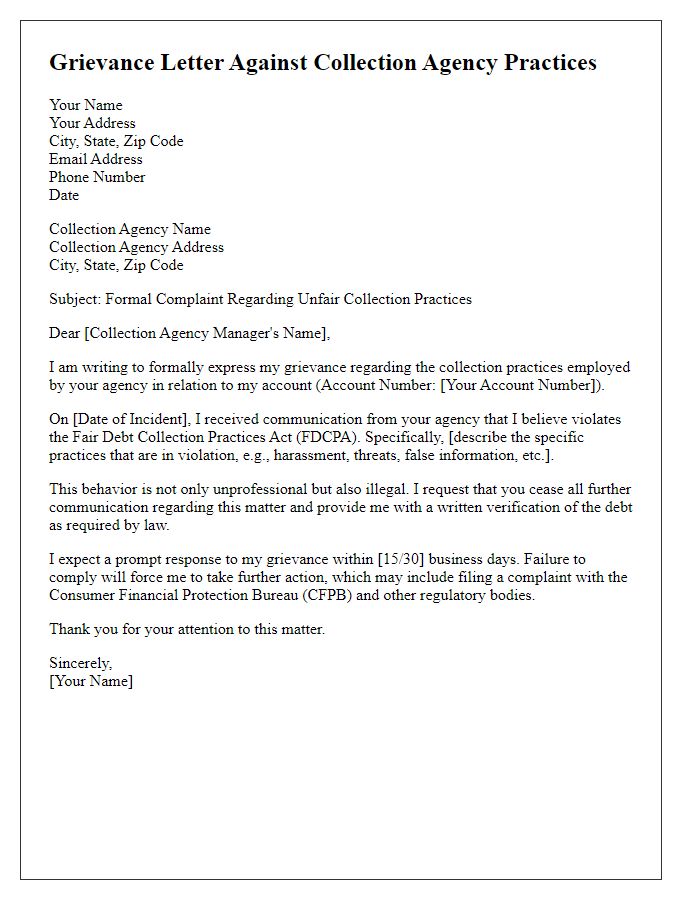

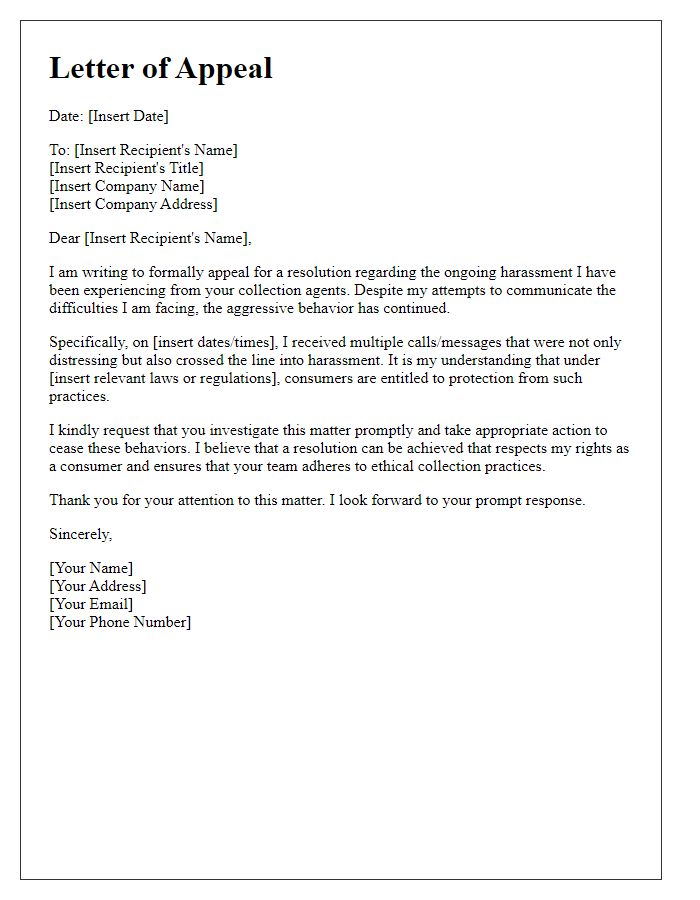

Letter Template For Collection Agency Harassment Documentation Samples

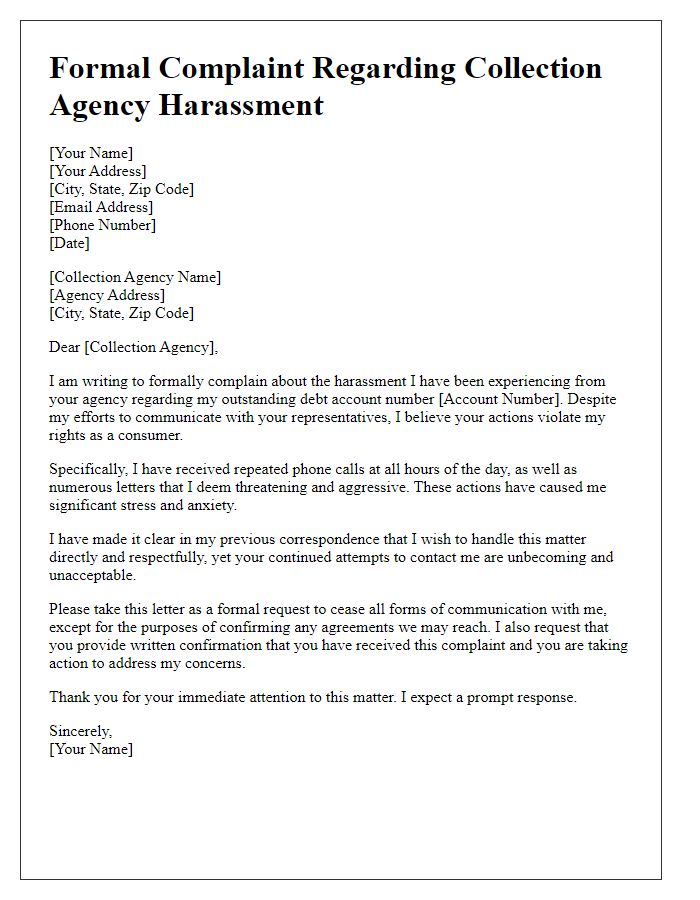

Letter template of formal complaint regarding collection agency harassment

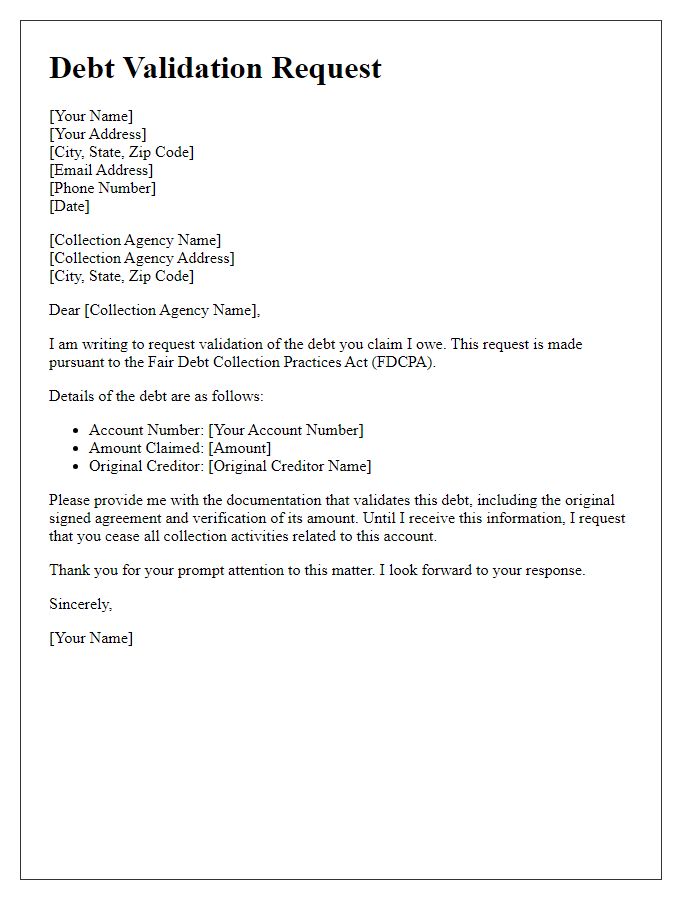

Letter template of request for validation of debt from collection agency

Comments