Are you grappling with old debts that seem to have resurfaced out of nowhere? It can be both frustrating and overwhelming when you receive notices about debts you thought were settled or even expired. Understanding the legality of these debts is crucial for protecting your financial well-being. In this article, we'll provide insights and a template to help you effectively dispute any questionable debtsâso you can reclaim your peace of mind.

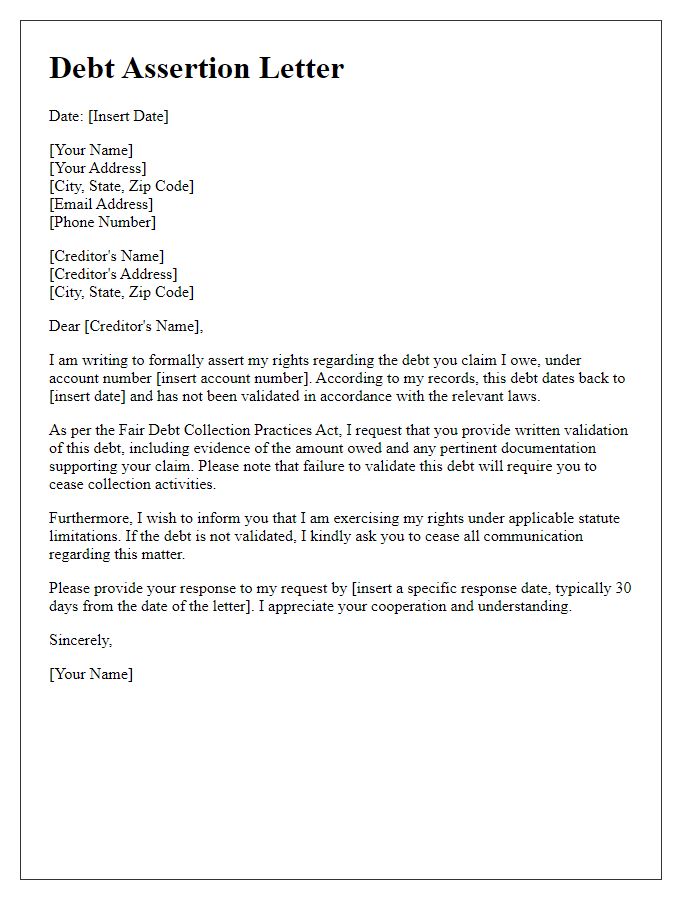

Identification Information

Disputing old debt legality requires clear identification information to establish the debtor's identity. This includes full name, social security number (last four digits only), date of birth (month, day, year), and current address. Providing documentation such as previous account statements or correspondence can support the claim. Additionally, belonging to a specific debt collection agency like XYZ Collections can impact the legal standing of the debt, especially if it dates back several years, potentially violating statutes like the Fair Debt Collection Practices Act. Noting the original creditor's name, the amount owed, and the date of the original debt is crucial for accurate records. Context such as state laws regarding debt collection and legal time frames (like the statute of limitations) can further substantiate the argument for disputing the legitimacy of the debt.

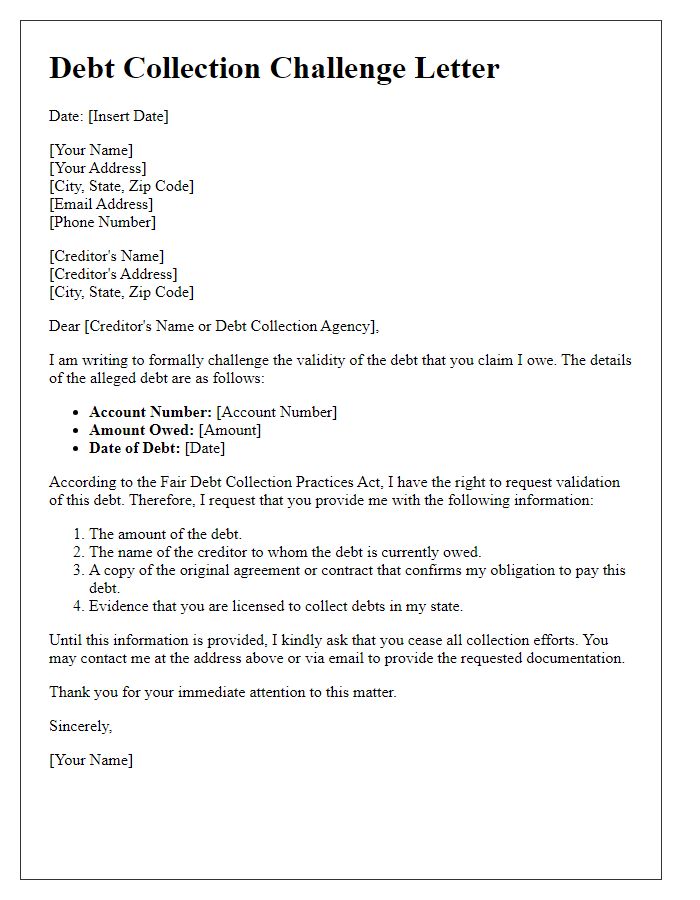

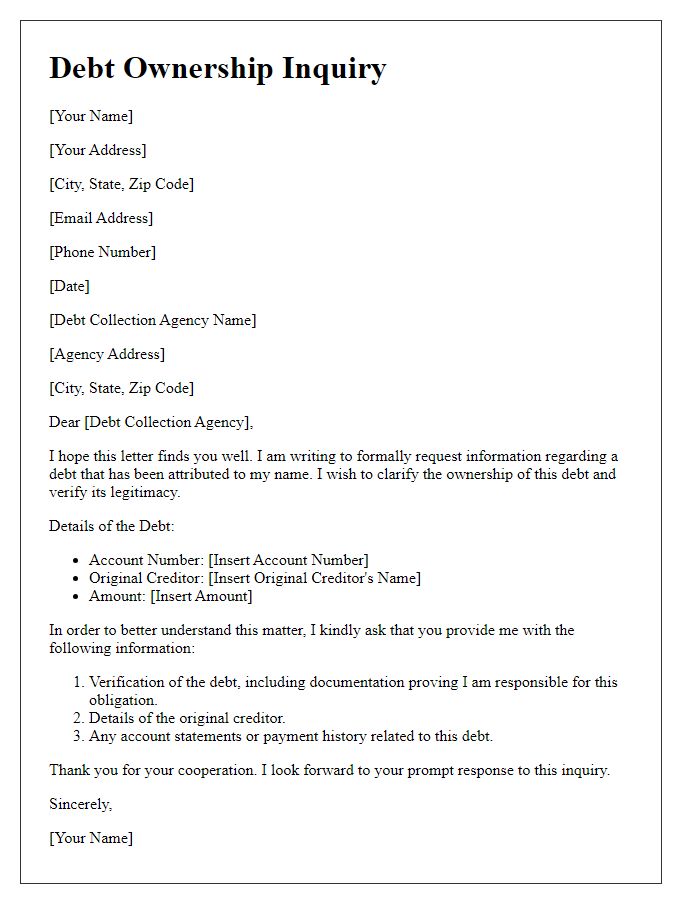

Debt Details

Debts often have legal implications, especially when they become old or disputed. In 2023, many consumers face issues with creditors claiming debts that may be stale under the Fair Debt Collection Practices Act. For disputes, it is crucial to gather details about the debt in question. The debt amount, the original creditor's name, the date of the last payment (often pivotal in determining the statute of limitations, which varies by state, such as 4-6 years), and any communication history are essential. Additionally, if the debt collector is a third-party agency (like Midland Funding), it is vital to confirm whether they possess proper documentation proving ownership of the debt. Keeping accurate records can strengthen the legal standing against potentially unenforceable debts.

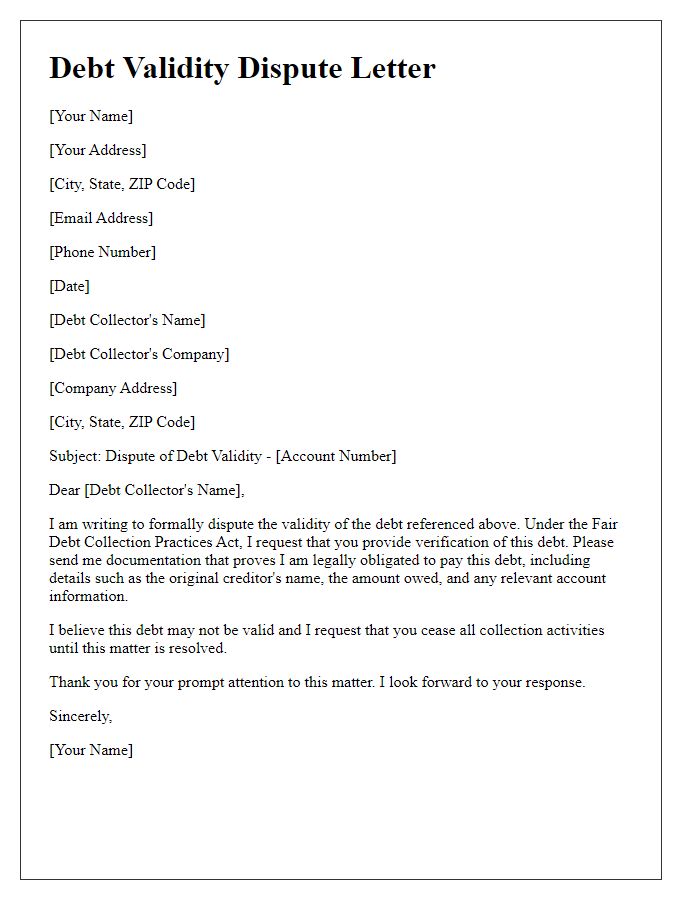

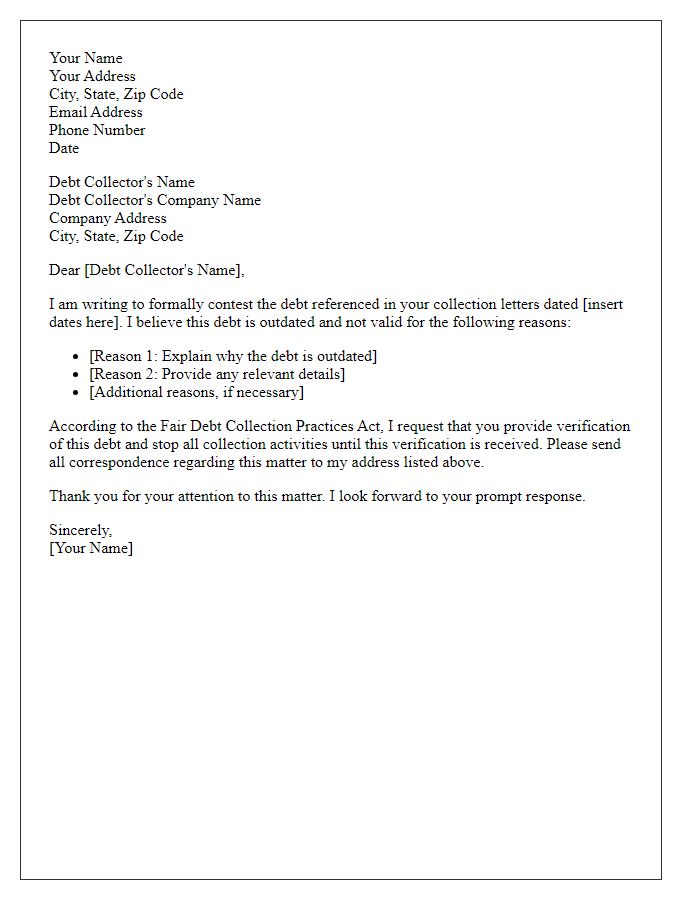

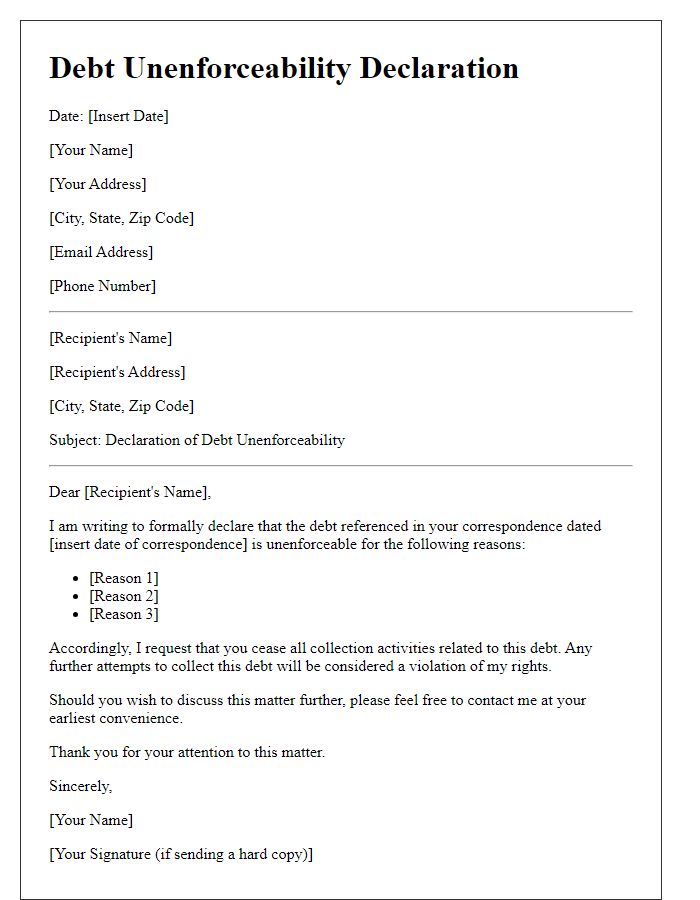

Dispute Statement

Old debts often raise questions regarding their legality and validity. Debts exceeding the statute of limitations (varies by state; commonly between 3 to 10 years) may no longer be enforceable in court. Furthermore, collection agencies (companies that specialize in recovering unpaid debts) must adhere to the Fair Debt Collection Practices Act (FDCPA), which requires them to provide specific documentation supporting the claim of the debt. If the debt was charged off (written off as a loss) by the original creditor, it must be properly documented. Seeking verification of the debt through a written request can reveal inaccuracies, such as incorrect amounts or missing documentation, which might strengthen your dispute. Prompt response to collection notices, often received via mail, is essential to preserving consumer rights and ensuring proper resolution.

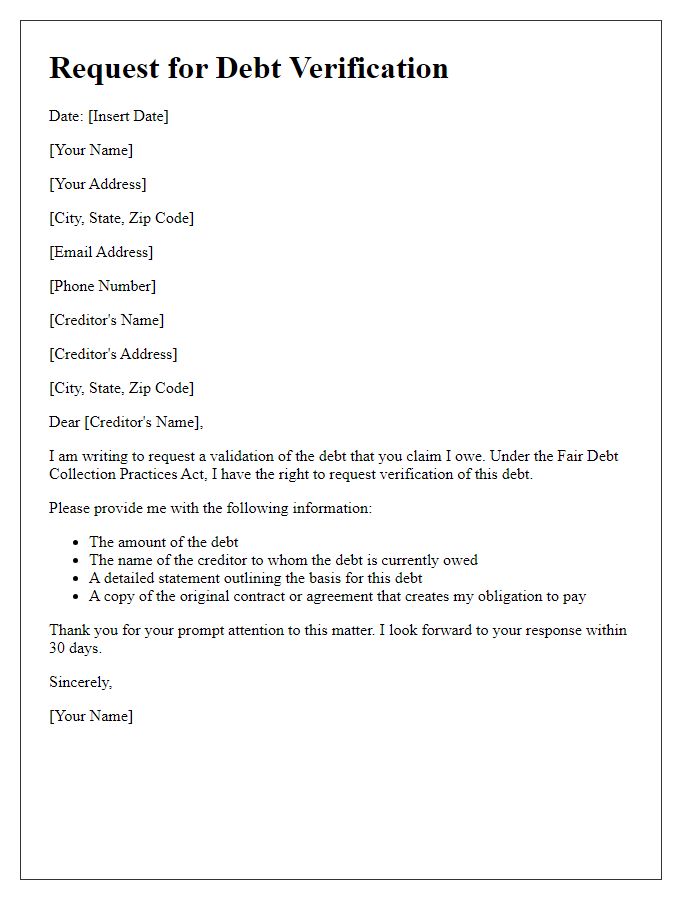

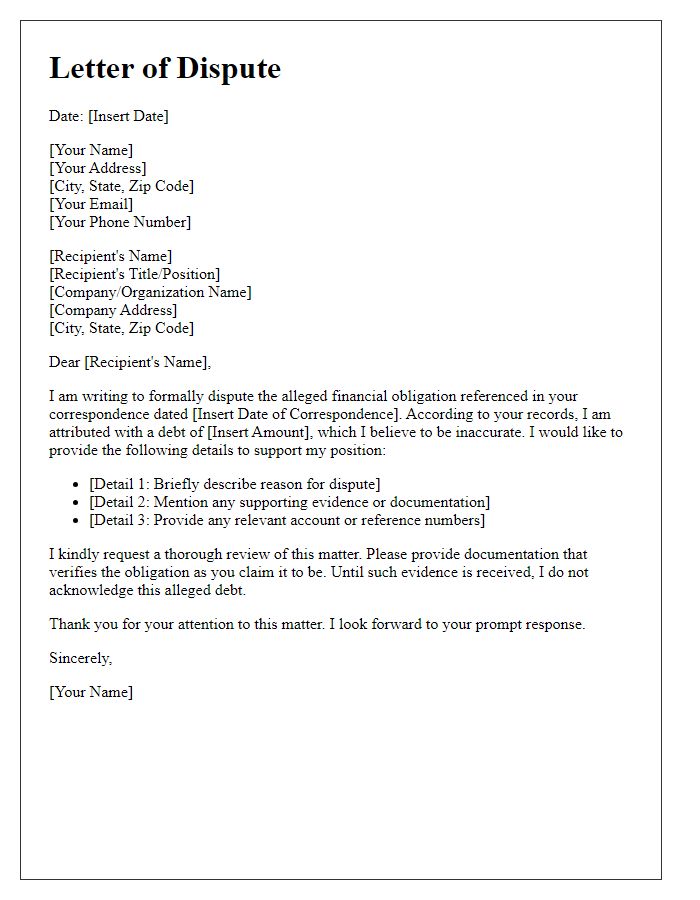

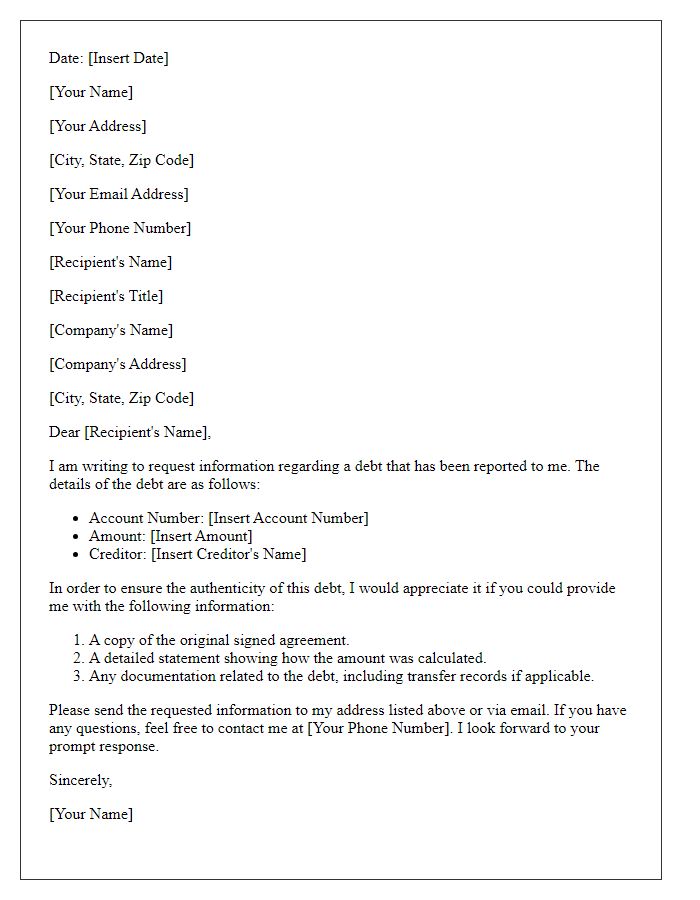

Request for Verification

Old debt disputes can involve various legal aspects. The Fair Debt Collection Practices Act (FDCPA) allows consumers to request validation of debts. This is crucial when debts are over five years old, as state statutes of limitations, varying by state, may affect debt collection legality. In a request for verification, it's essential to include specific details such as the debt amount, original creditor information, and any dates associated with the original transaction. Providing clear documentation, like past correspondence and account statements, strengthens the request for verification. The process may also involve contacting credit bureaus, such as Experian or TransUnion, to dispute inaccuracies in credit reporting related to the old debt.

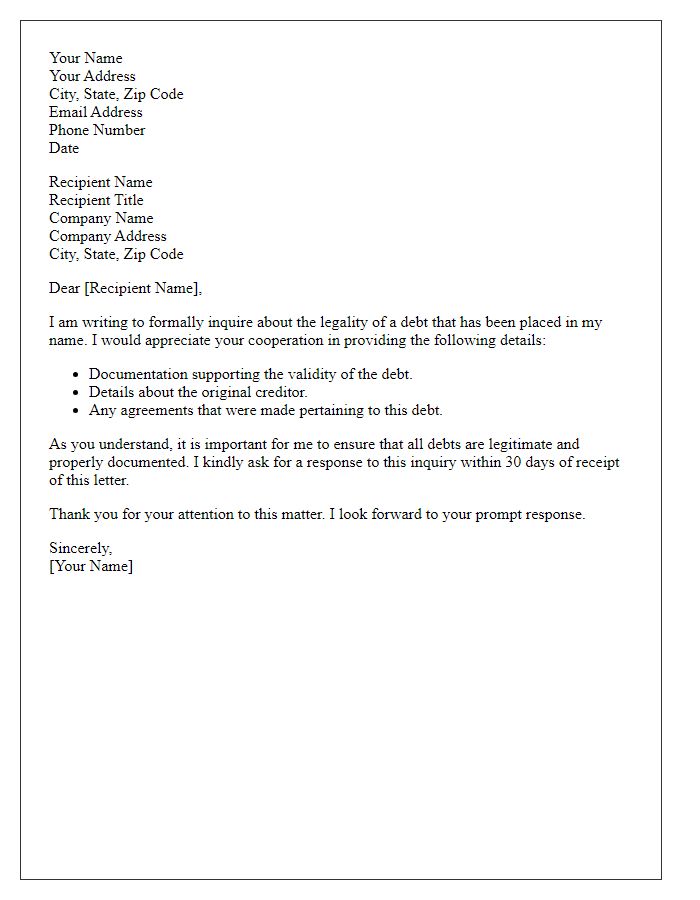

Contact Information

Disputing old debts often requires clear communication and proper documentation. A debt verification letter should include essential contact information for both parties, including the sender and the collection agency. The sender's full name, mailing address, phone number, and email address must be stated clearly, establishing a professional tone. Similarly, the collection agency's name, address, and any reference or account number related to the debt must be included. This provides clarity regarding the parties involved, ensuring that the dispute process is direct and effective, while also addressing any potential legal concerns surrounding the debt in question. Additionally, using certified mail serves to confirm receipt of the correspondence, enhancing the credibility of the sender's claim.

Comments