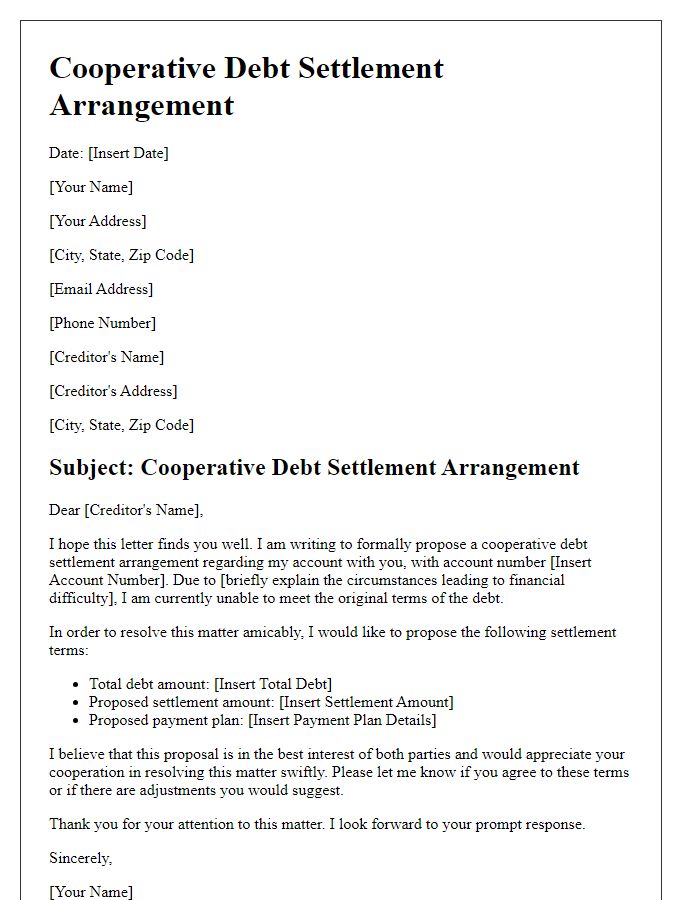

Are you finding it challenging to manage your finances due to a split debt payment situation? You're not alone; many people face this issue, and establishing a clear agreement can make all the difference. In this article, we'll guide you through creating a letter template for a split debt payment agreement that ensures both parties are on the same page. So, let's dive in and explore how you can address this financially sensitive topic with ease!

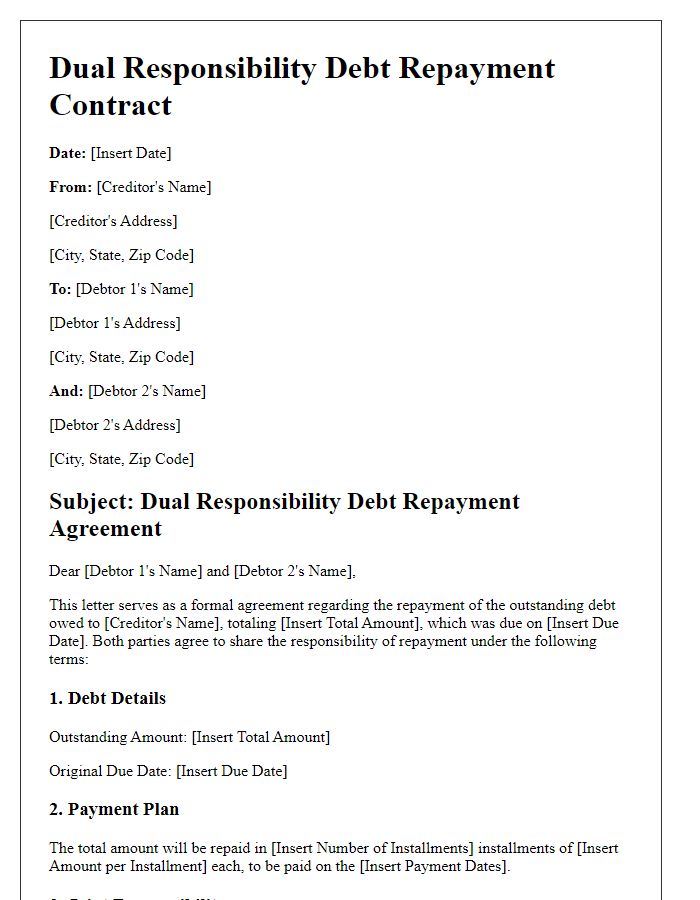

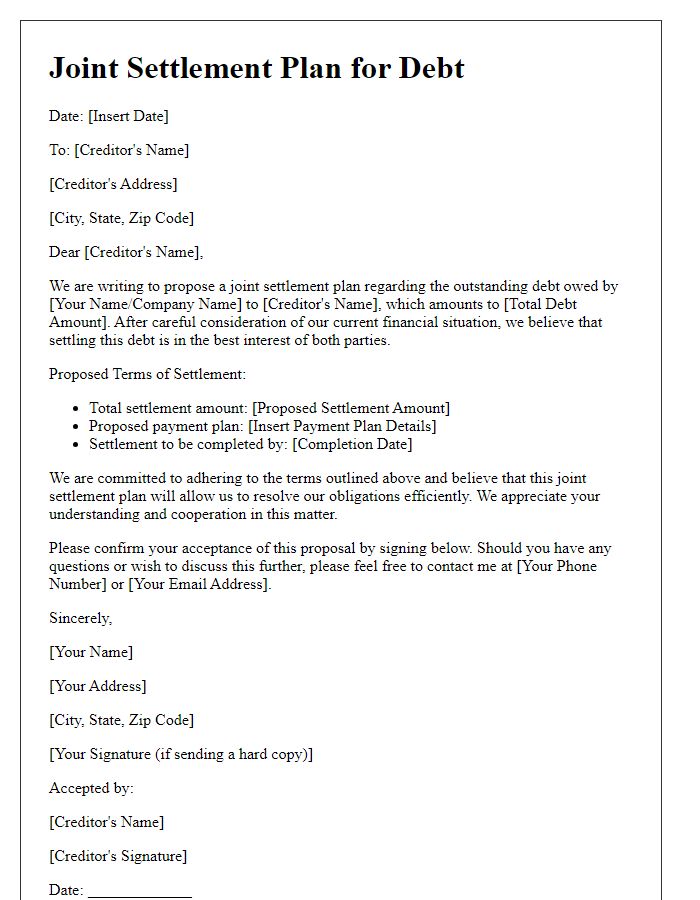

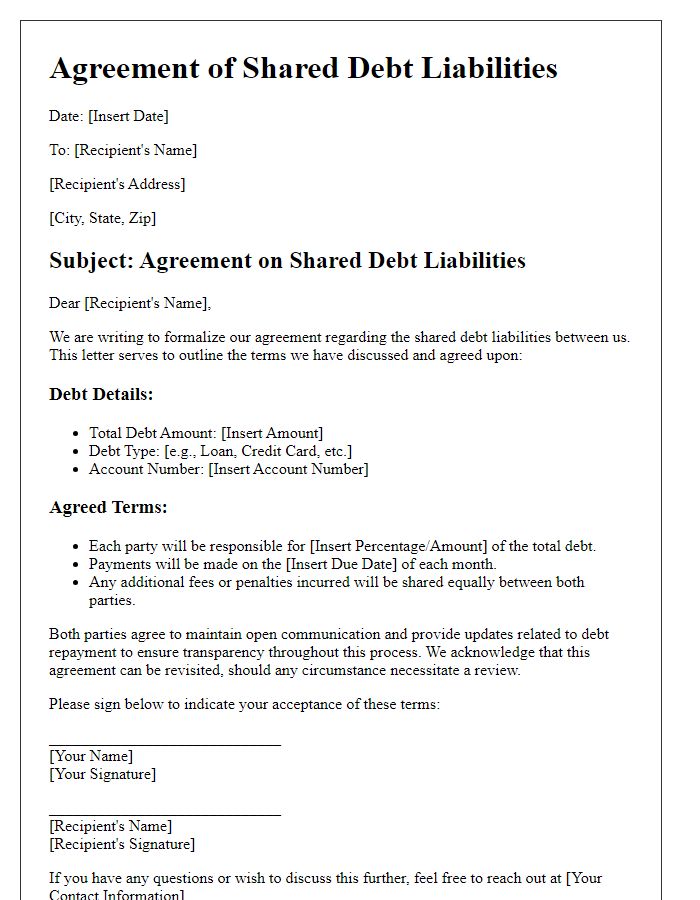

Debt Amount and Terms

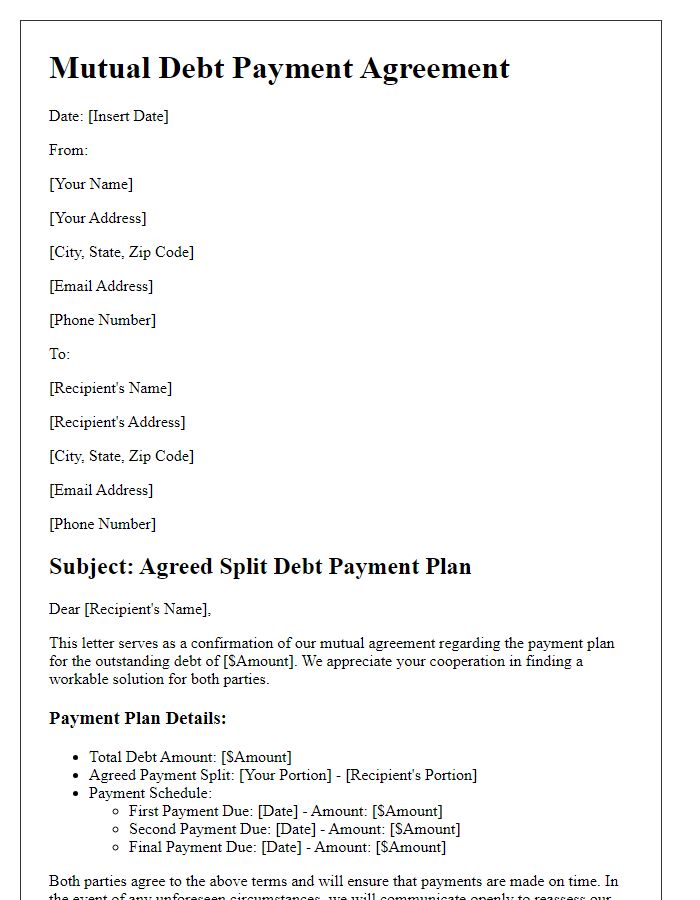

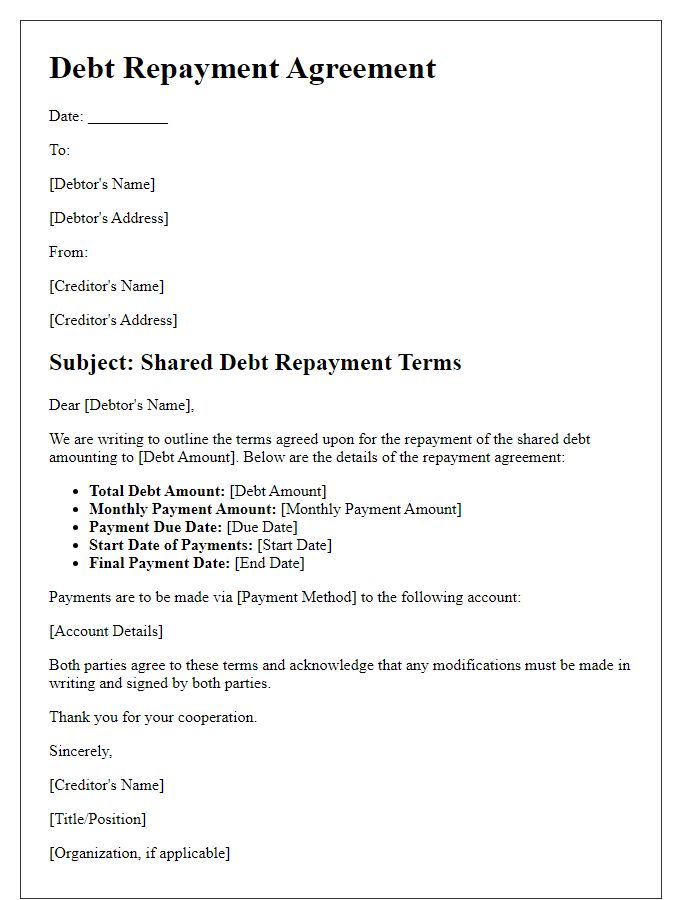

A split debt payment agreement outlines the specific terms under which multiple parties will share repayment responsibilities for an outstanding debt. The total debt amount, for example, $15,000, can be divided among the parties involved, typically denoted as 50/50 or other proportional shares. Payment terms, such as monthly installments, could be set at $500 per month for a period of 30 months. The agreement should specify due dates, methods of payment (such as bank transfers or checks), and any late payment penalties. Additionally, clarity on responsibilities, such as who will manage the payments and track reimbursements, is vital for all parties involved to ensure financial accountability.

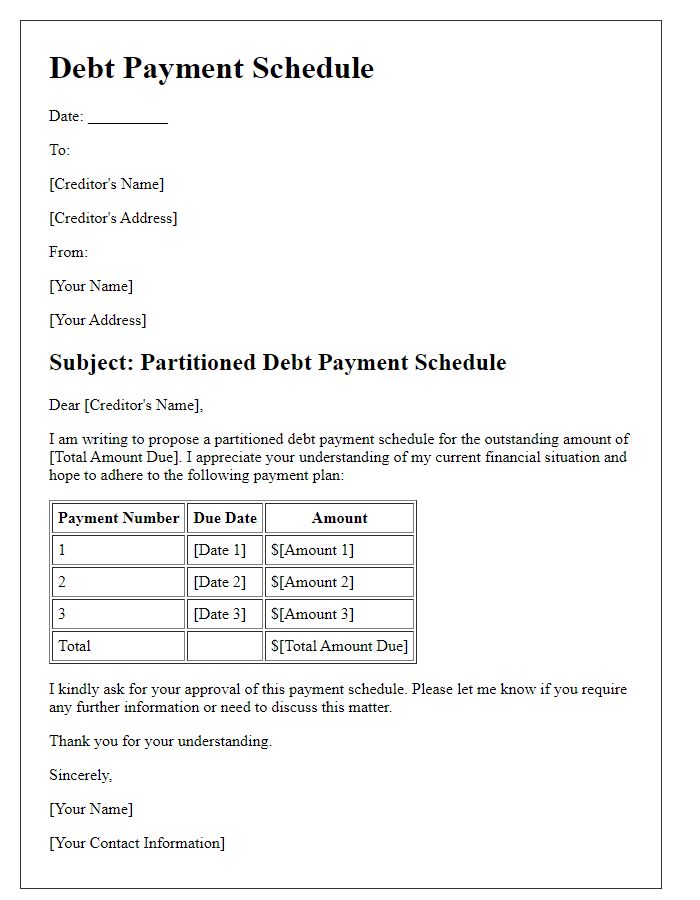

Payment Schedule and Method

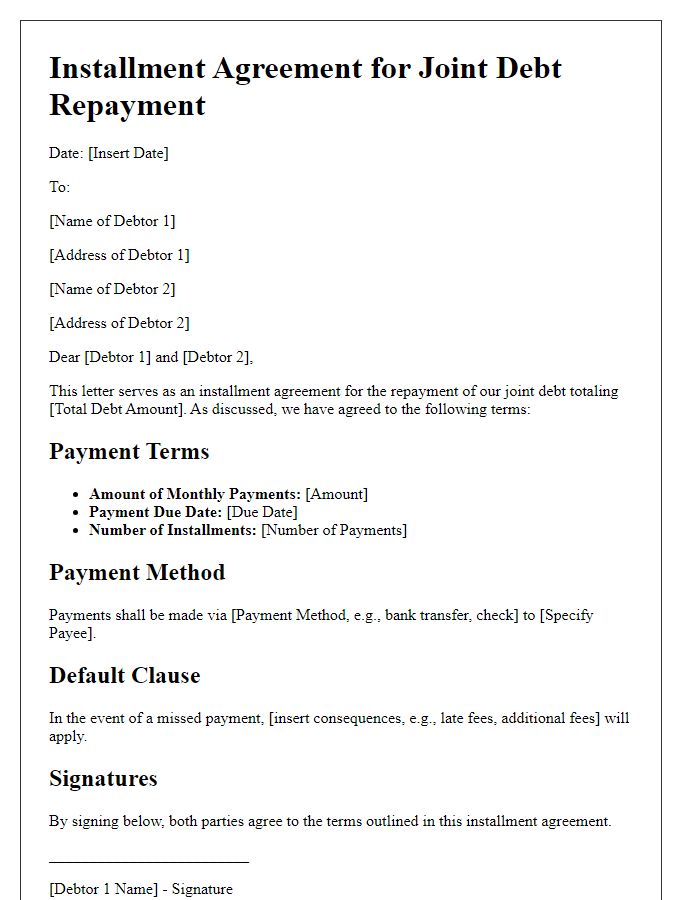

A split debt payment agreement outlines the specific terms and conditions under which multiple parties agree to collectively manage a shared financial obligation. This document typically includes a detailed payment schedule specifying the due dates, amounts, and frequency of payments, such as monthly installments or lump sums. The method of payment may involve various options, including bank transfers, checks, or online payment platforms. Parties may also include provisions for handling late payments or defaults to ensure mutual accountability. Additionally, clear identification of each party, including names, addresses, and the total debt amount being divided, is crucial for legal clarity and future reference.

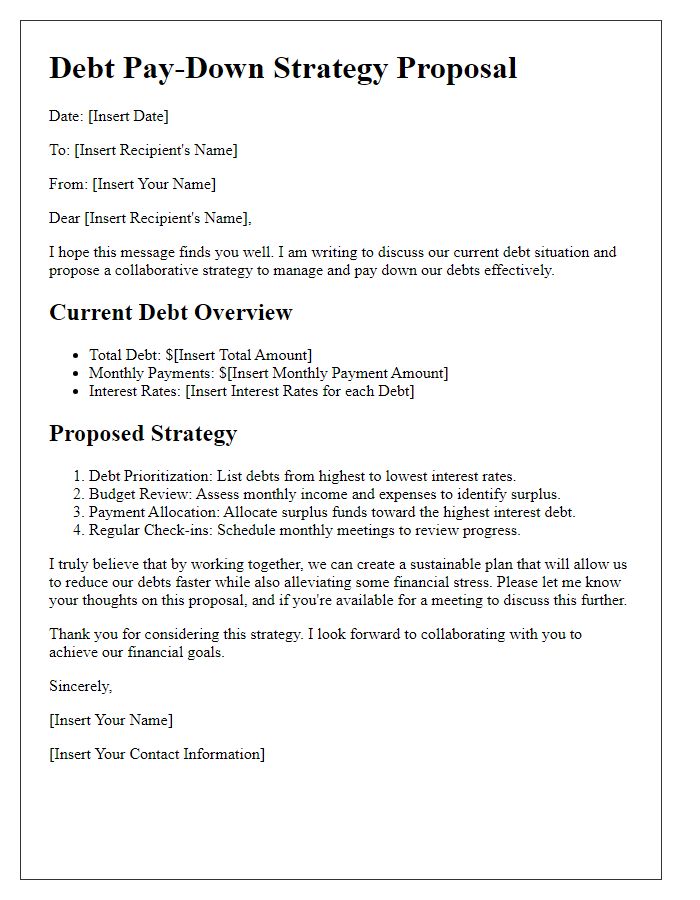

Interest Rates and Fees

A split debt payment agreement outlines the terms for dividing financial responsibilities among parties involved in a debt, often specifying interest rates and associated fees. Clarity in interest rates, applicable fees, and their respective percentages (e.g., 5% annual interest) is crucial for transparency. Entities such as financial institutions may impose additional charges (late fees, processing fees) if payments are not made on time. The agreement should detail payment schedules, including due dates (e.g., 15th of each month), and conditions regarding early repayment or penalties for default. Proper documentation ensures each party understands their responsibilities, promoting accountability and minimizing disputes.

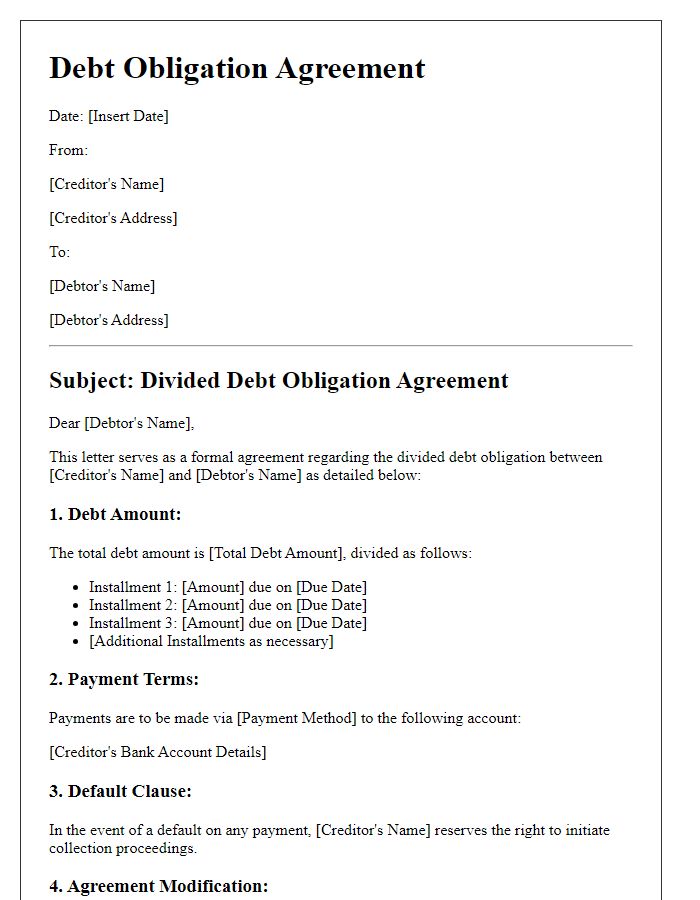

Default and Late Payment Consequences

A split debt payment agreement is a formal arrangement that delineates the responsibilities of two or more parties regarding the repayment of a shared debt, typically arising from expenses like travel, joint purchases, or loans. Defaulting on this agreement can lead to serious consequences, including legal actions that may result in loss of assets or wage garnishment. Late payments are often subject to additional fees (commonly ranging from 5% to 10% of the overdue amount), further complicating financial situations for the involved parties. It is crucial to maintain open communication about payments to avoid misunderstandings. Furthermore, consistent late payments may affect credit scores, impacting the ability to secure loans or credit in the future. Careful documentation of all transactions and agreements strengthens accountability and transparency among all parties involved.

Signatures and Agreement Date

A split debt payment agreement outlines the responsibilities of each party involved in managing a shared financial obligation, such as loans or bills. This document typically includes key elements like the total debt amount (e.g., $5,000), individual payment responsibilities, payment due dates, and conditions for default. Signatures from all parties signify consent and the date of the agreement formalizes the commitment to the outlined terms. A mutual understanding is essential, ensuring accountability and clarity in the distribution of payments during the debt repayment period.

Comments