Are you feeling overwhelmed by debt and unsure of your rights? The fairness doctrine for debt management can provide clarity and protection when navigating financial challenges. It's essential to understand how this doctrine can help ensure that creditors treat you fairly while you work towards resolving your debts. If you're interested in learning more about this topic and the strategies to effectively engage with your creditors, read on!

Clarity of Terms

Debt fairness doctrine emphasizes the importance of transparency and clarity in financial agreements. Clear terms define the obligations of borrowers and lenders, ensuring that both parties understand their rights and responsibilities. Key elements include interest rates, repayment schedules, and fees associated with the debt. For instance, a fixed interest rate of 5% on a $10,000 loan over five years requires clear delineation of monthly payments amounting to approximately $188.71. Additionally, the disclosure of potential penalties for late payments or default must be explicitly stated to prevent misunderstandings. This transparency fosters trust, enabling borrowers to make informed decisions while allowing lenders to protect their investments effectively.

Empathy and Tone

The Debt Fairness Doctrine emphasizes equitable treatment in financial responsibilities, fostering a sense of empathy for individuals facing economic hardship. This principle advocates for fair practices in debt collection, ensuring that creditors recognize the challenging contexts of borrowers, particularly during economic downturns or personal crises, such as unemployment or medical emergencies. Engaging with this doctrine requires sensitive communication, establishing a tone that balances professionalism with compassion. By acknowledging the burden of debt, creditors can promote positive dialogue, enhancing relationships with clients while reinforcing a commitment to ethical financial stewardship. This approach not only encourages constructive outcomes but also cultivates trust and goodwill in the financial ecosystem.

Legal References

The Engagement of the Debt Fairness Doctrine invites scrutiny into the principles outlining equitable treatment of debtors, rooted in legal frameworks such as the Fair Debt Collection Practices Act (FDCPA) established in 1977 in the United States. Key regulations include stipulations against abusive collection practices ensuring debtor protection. Furthermore, relevant case law, including 'B, Sherwin & Wellesley v. United States' from 2011, elaborates on the court's interpretation of fair treatment. The doctrine emphasizes transparency, enabling debtors to comprehend their rights in the context of financial obligations. Legal counsel may reference state laws, such as California's Rosenthal Fair Debt Collection Practices Act, which reinforces federal protections while tailoring them to local statutes. Such engagement includes consultation of statutes and judicial opinions to assess compliance and advocate for fair resolution.

Payment Options and Flexibility

Payment options for managing debt effectively can greatly alleviate financial burdens faced by individuals or businesses. Flexible repayment plans often include terms such as extended duration, allowing monthly installments to be adjusted based on the debtor's cash flow situation. Loan modification strategies implemented by financial institutions, such as banks and credit unions, can offer reduced interest rates or predetermined payment pauses in specific situations like economic downturns or personal hardships. Utilizing tools from nonprofit credit counseling services, such as budgeting workshops and debt management plans, can empower individuals to navigate repayments with greater ease and address stigmas associated with debt through educational resources and support networks.

Contact Information and Support

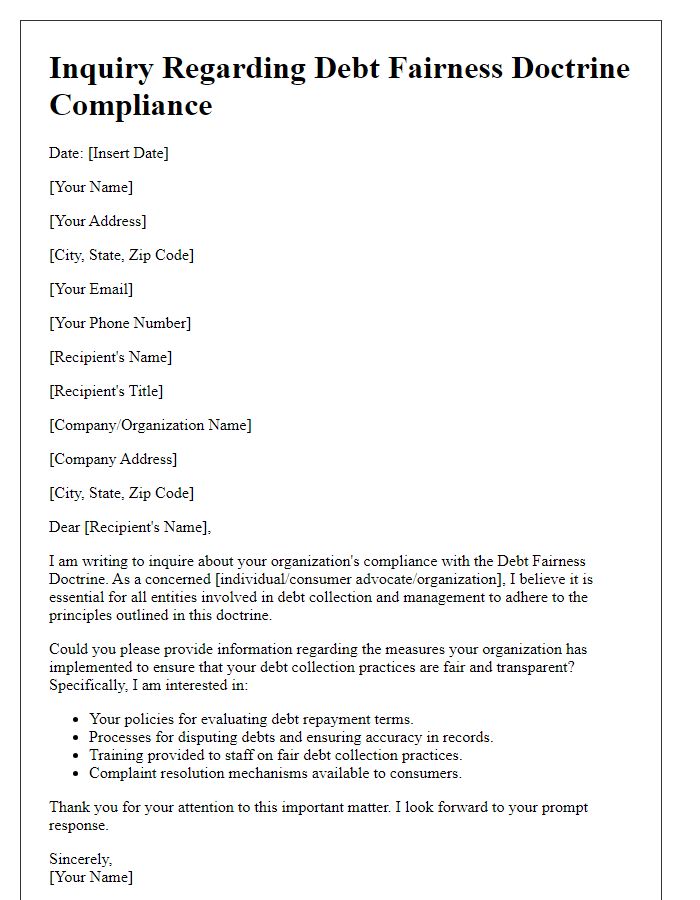

Debt fairness doctrine engagement emphasizes transparency and equitable practices in debt collection processes. Under regulations such as the Fair Debt Collection Practices Act (FDCPA), consumers must receive clear communication from creditors regarding outstanding debts. Various entities, including creditors and collection agencies, are required to provide accurate and honest information about the debt amount, original creditor's name, and validation procedures. Support services, such as consumer advocacy groups and financial counseling agencies, play a crucial role in assisting individuals managing debt, offering guidance and resources to navigate negotiations. Contact information for these support systems is essential for individuals seeking assistance, ensuring access to knowledgeable representatives who can provide relevant advice and help them understand their rights in debt matters.

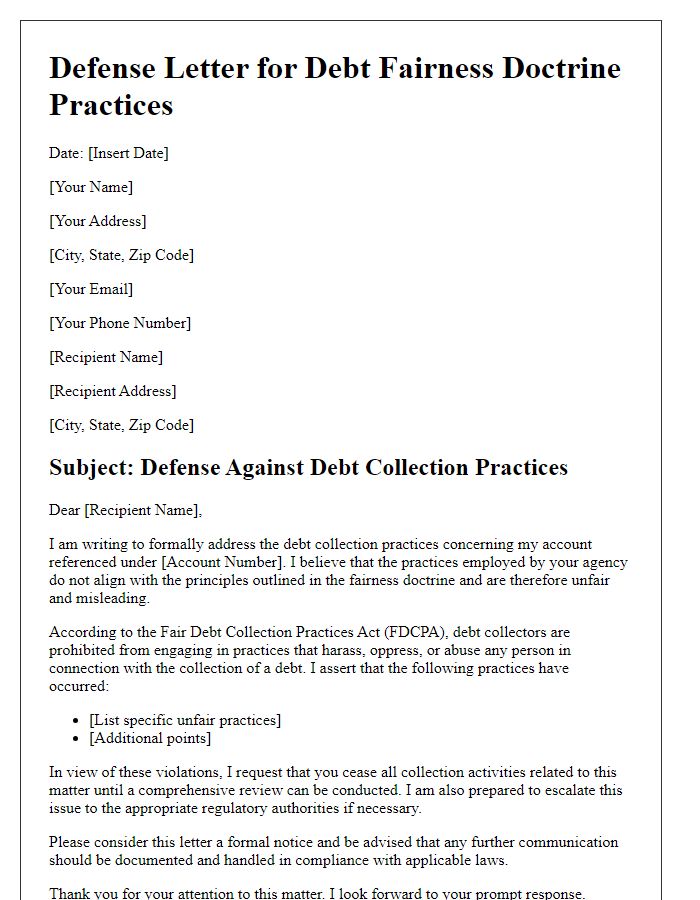

Letter Template For Debt Fairness Doctrine Engagement Samples

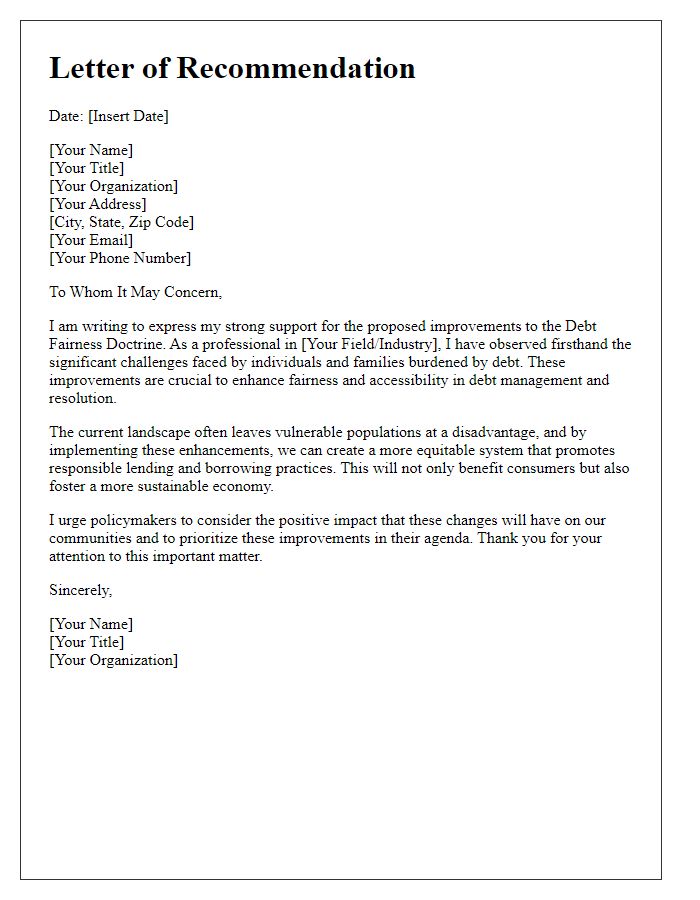

Letter template of recommendation for debt fairness doctrine improvements

Comments