Are you feeling overwhelmed by debt and unsure of how to tackle it? You're not alone, and crafting a well-structured debt repayment proposal can provide a clear path forward. In this article, we'll walk you through the essential elements of an effective letter template to communicate your repayment intentions clearly and respectfully. So, if you're ready to take control of your financial situation, keep reading to discover practical tips and helpful insights!

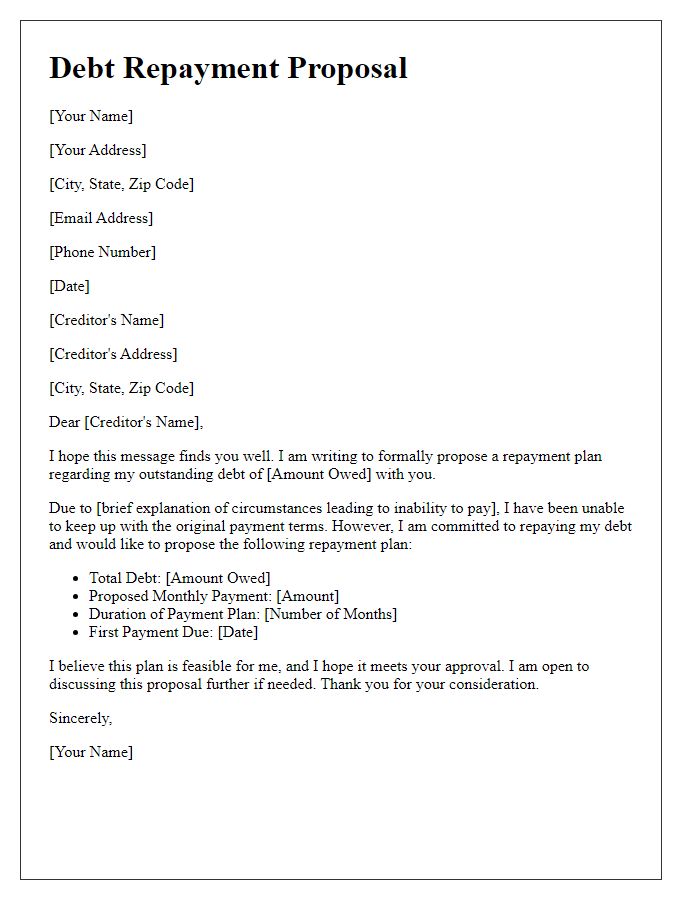

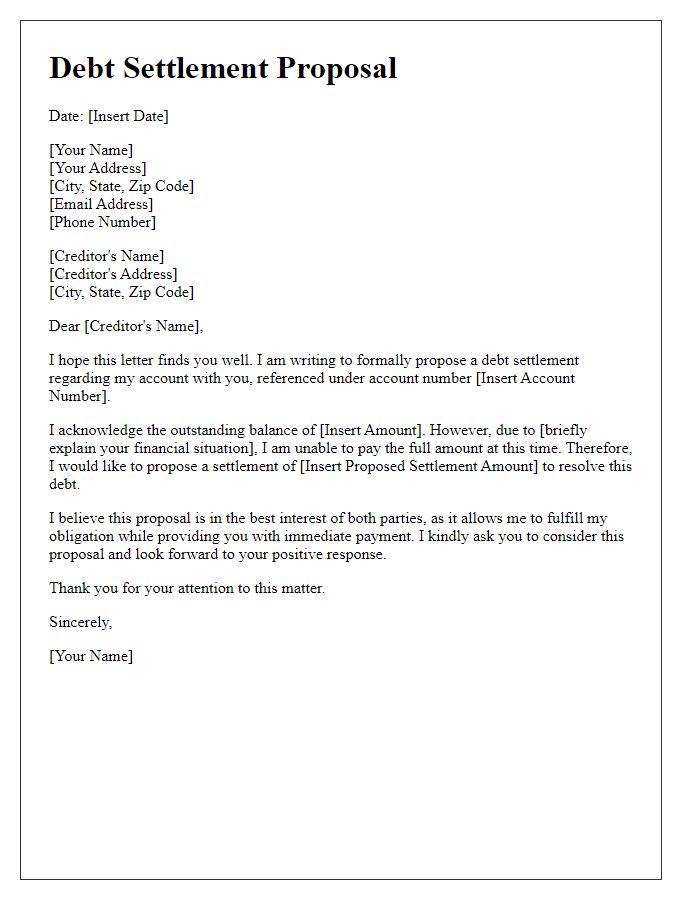

Clear identification of parties involved

In a debt repayment proposal, clear identification of parties involved is essential to establish accountability and transparency. The Debtor, John Smith, residing at 123 Elm Street, Springfield, owes $10,000 to the Creditor, ABC Financial Services, headquartered at 456 Oak Avenue, Metropolis. The agreement details the obligation, specifying the original loan date of March 15, 2022, and the interest rate of 5% per annum. Both parties must ensure that their respective responsibilities are clearly defined, including payment schedules and potential consequences for non-compliance, to maintain a professional and respectful relationship throughout the repayment period.

Detailed breakdown of outstanding debt

A debt repayment proposal requires careful attention to the detailed breakdown of outstanding debt. The total amount owed, such as $15,000, needs to be clearly itemized. This includes credit card debt, particularly from institutions like Visa and MasterCard, which may have high-interest rates exceeding 20%. Additionally, any personal loans from banks, like Chase or Wells Fargo, should be listed, highlighting remaining balances and payment terms. Include overdue amounts, typically accumulating late fees due to missed payments, which can increase the original debt by approximately 15%. It is also essential to specify any payment arrangements that have already been made, such as a previous agreement to pay $500 monthly until December 2023. Furthermore, a proposed repayment plan that details a reduced monthly payment, perhaps $300 for 24 months, offers a structured approach that maintains regular communication about progress. Transparency on the total interest paid throughout the repayment period should also be highlighted, as it can amount to thousands of dollars if the debt remains unpaid long-term.

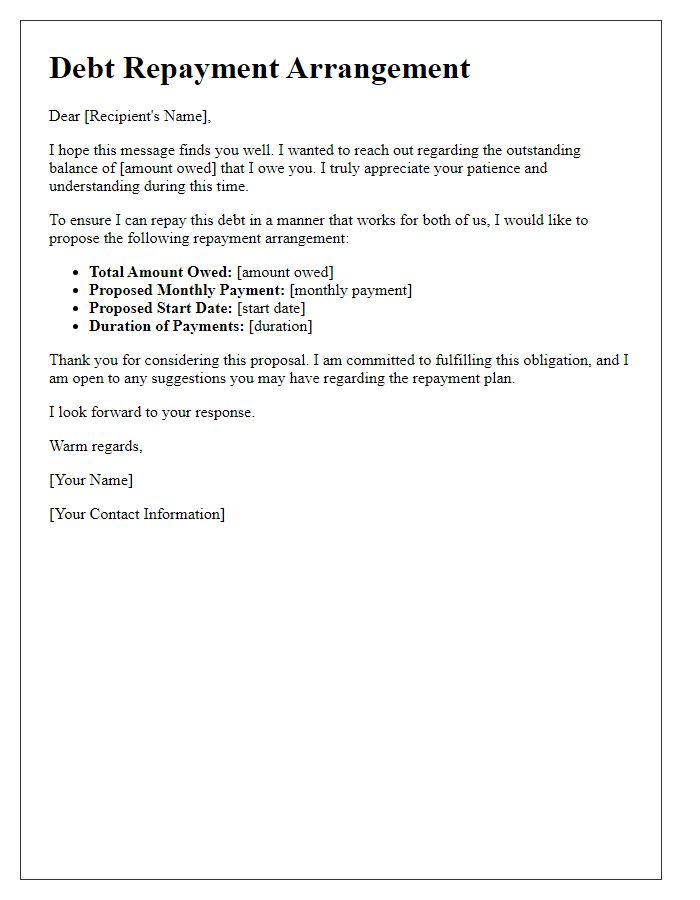

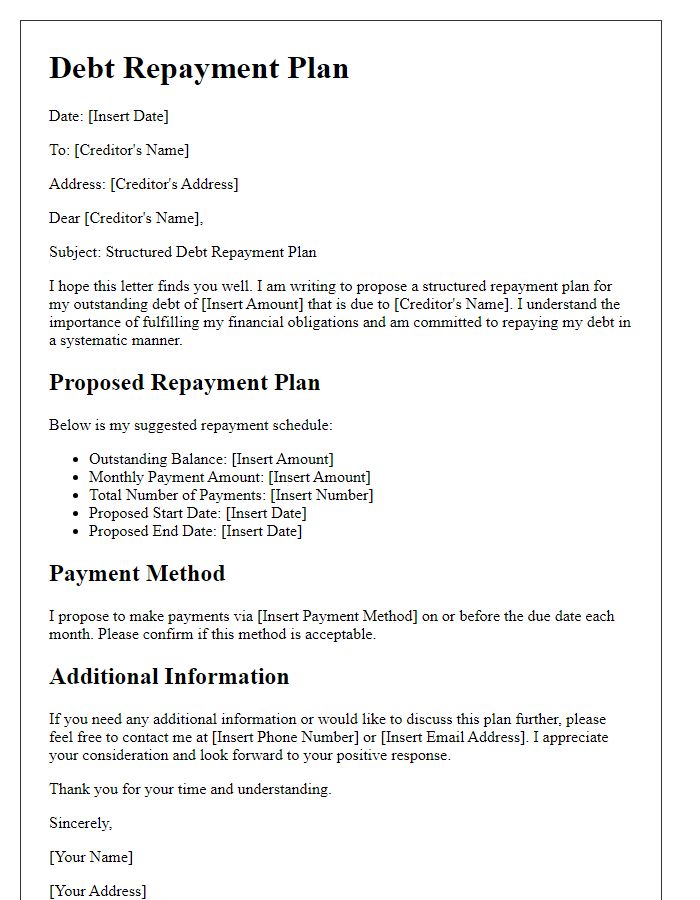

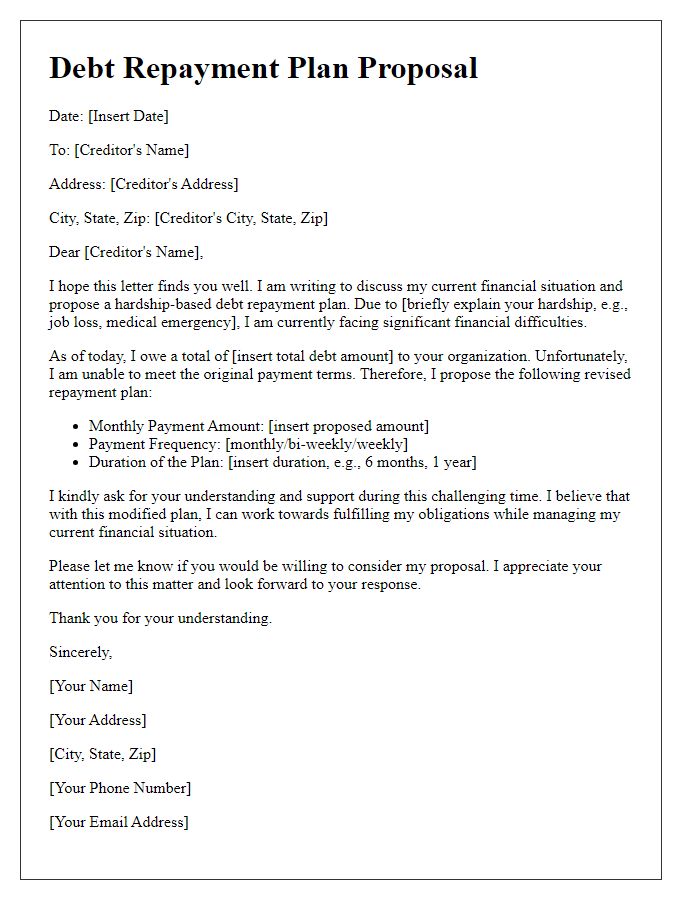

Proposed repayment schedule and terms

A debt repayment proposal typically outlines a structured plan to repay borrowed funds, often addressing the current financial situation of the debtor, the total amount owed, and a realistic timeline for payments. The proposal often includes specific payment amounts, frequency (weekly, monthly), and any interest rate adjustments. Clear terms are essential to ensure transparency and mutual understanding. For example, a debtor might suggest a repayment schedule over 24 months, proposing monthly payments of $500 towards a debt of $12,000, possibly with an interest rate of 5%. Providing a detailed breakdown fosters trust and demonstrates a commitment to meeting obligations while considering the debtor's financial capacity to avoid future defaults.

Justification and affordability analysis

A debt repayment proposal should include a comprehensive analysis of the borrower's financial situation, highlighting key components such as total outstanding debt amount, monthly income figures, and essential living expenses. The justification for the proposed repayment plan should detail specific financial challenges faced, such as job loss or unexpected medical expenses, that warrant a revision of initial repayment terms. Affordability analysis must illustrate monthly surplus after subtracting necessary expenses (housing costs, food, utilities), ensuring that proposed payment amounts remain sustainable. This thorough breakdown helps build credibility, demonstrating commitment to honoring debts while also maintaining financial stability.

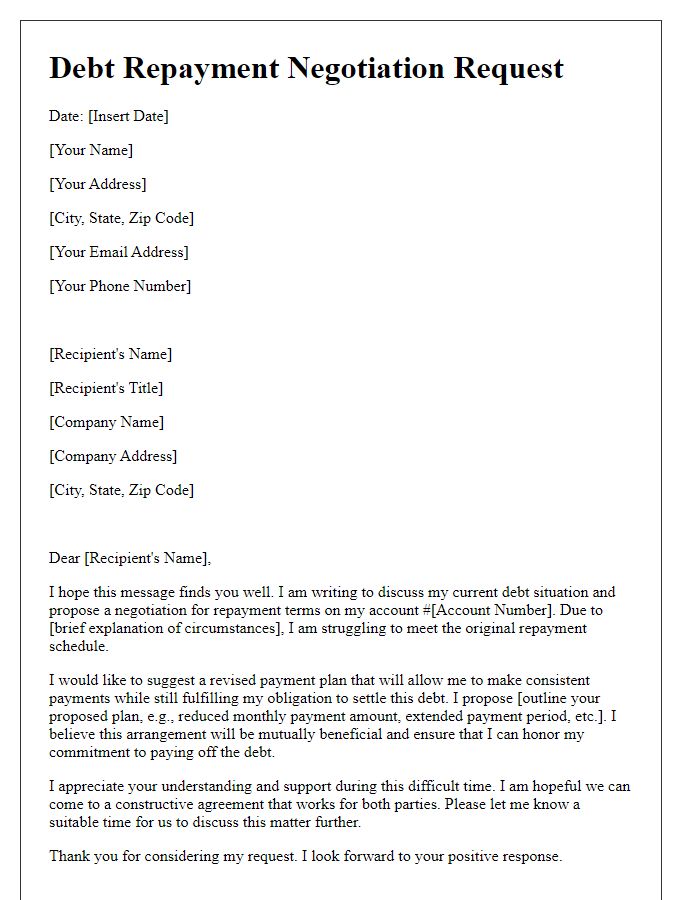

Consequences for non-compliance and benefits of adherence

A debt repayment proposal outlines the terms of settling outstanding obligations, emphasizing the importance of adhering to agreed-upon conditions. Non-compliance may lead to harsh consequences, including legal action (potential civil lawsuits), negative impacts on credit scores (decreases in credit rating by significant points), and increased interest rates (adding additional financial burden). On the opposite end, compliance offers several benefits, such as improved financial standing (restoration of credit scores over time), avoidance of legal disputes (reducing stress and financial strain), and potential for future credit opportunities (increased chances of loan approval for purchases like homes or cars). The proposal aims to establish a mutually beneficial agreement between debtors and creditors, fostering a responsible pathway towards financial recovery.

Comments