Are you feeling overwhelmed by debt and looking for a fresh start? Crafting a revised debt payment plan is an essential step to regain control of your finances and pave the way for a brighter future. In this article, we'll explore how to create a personalized plan that can ease your stress and put you back on the path to financial stability. Join us as we dive into the steps you can take to transform your financial situation and feel empowered again!

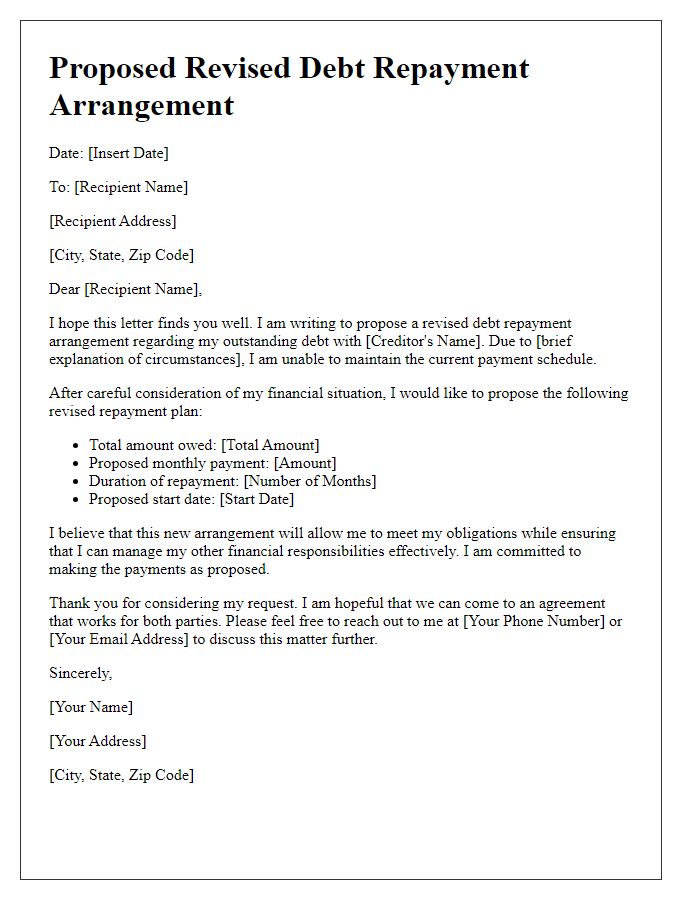

Introduction and Personal Details

Creating a revised debt payment plan requires careful attention to personal circumstances and creditor expectations. Provide essential personal details such as name, address, contact number, and account number associated with the debt. Outline the current financial situation, including income sources like salaries or any government assistance received, and total outstanding debt figures. Specify the nature of the debt, such as credit cards, personal loans, or medical bills, and mention any significant life events that may have impacted financial stability, such as job loss or medical emergencies. This detailed introduction sets a clear context for the restructuring of the debt repayment plan.

Current Financial Situation Description

This revised debt payment plan addresses the current financial situation marked by rising living costs and fluctuating income. Recent data shows inflation rates at approximately 6.2% in the United States, impacting essential expenses such as housing, utilities, and groceries. Monthly income has experienced instability due to job-related changes, with a decrease of 15% in earnings reported over the past two quarters. Additionally, outstanding debts have accumulated, totaling around $15,000 across multiple credit lines, leading to increased stress and anxiety. The combination of these factors necessitates a reassessment of payment schedules, aiming for more manageable monthly contributions while maintaining essential living standards.

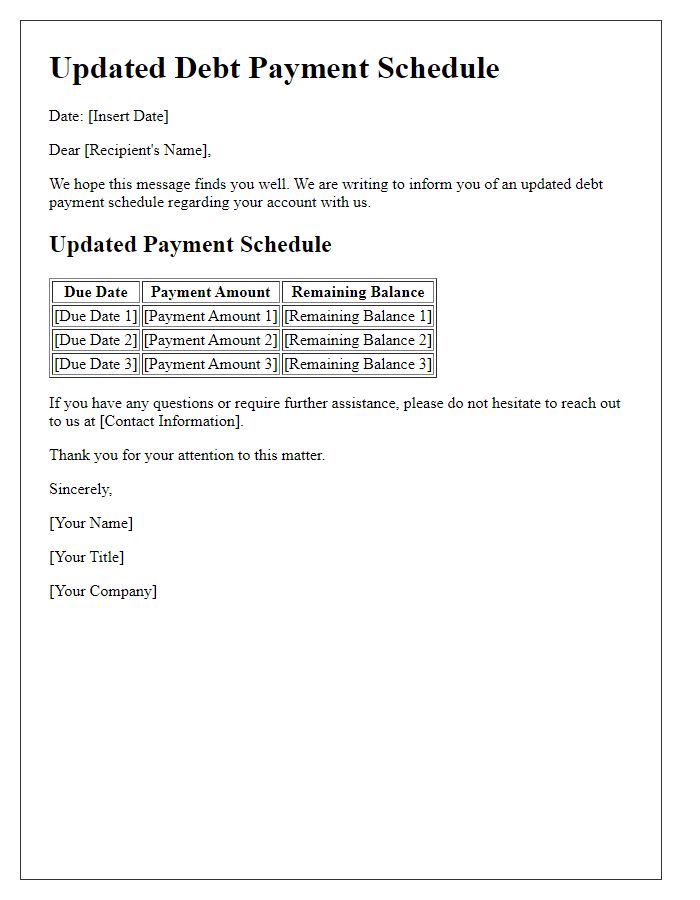

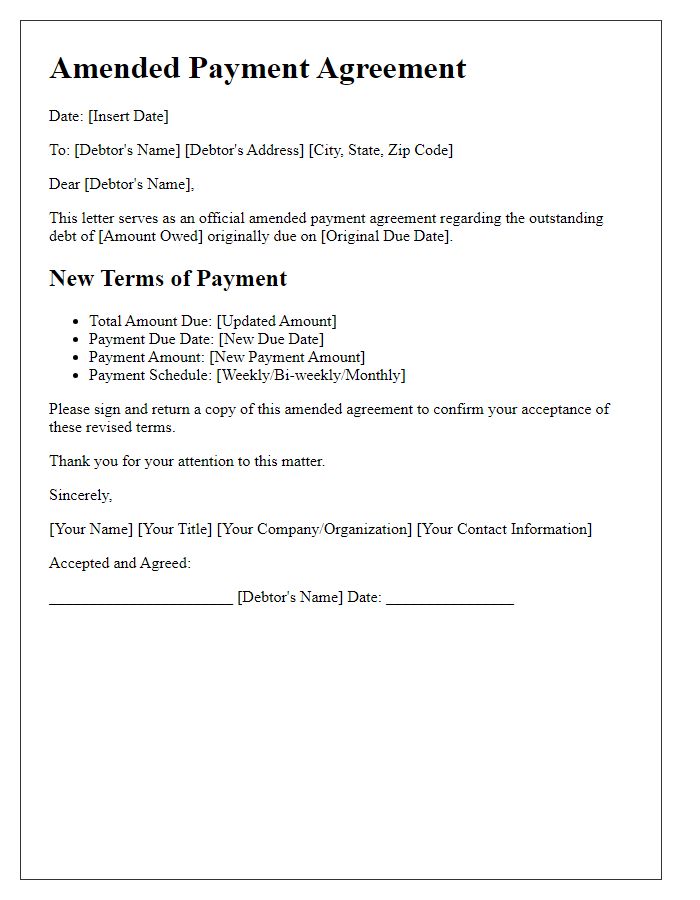

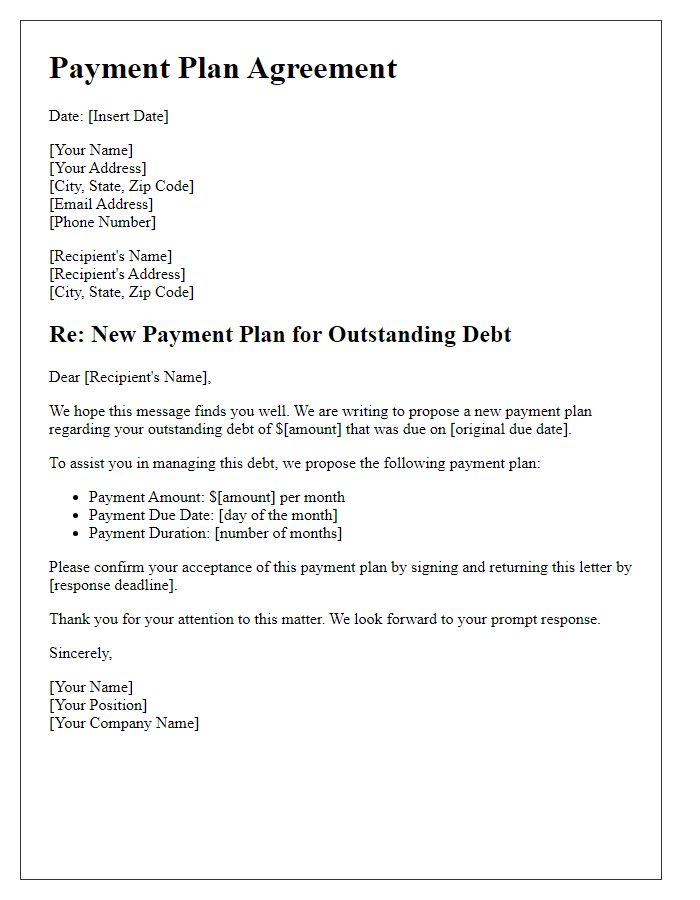

Proposed Payment Plan Details

The proposed payment plan outlines a structured approach for settling outstanding debts, aimed at facilitating financial stability. This plan specifies a monthly payment of $500, targeting a total debt amount of $12,000 to be cleared within 24 months. Key milestones include scheduled reviews every six months to assess progress and make necessary adjustments. Locations such as the local courthouse may be relevant for legal documentation of the agreement. The plan also considers interest rates, typically around 5% for unsecured debt, which may affect the overall payment timeline. Additionally, communication channels such as email and certified mail will ensure all parties stay informed regarding updates or potential changes to the agreement.

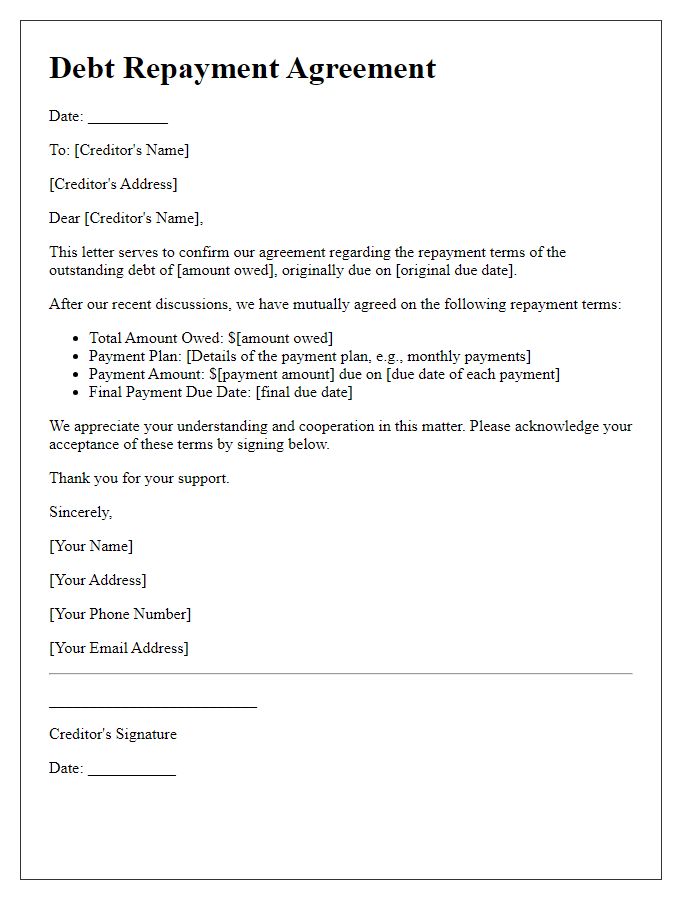

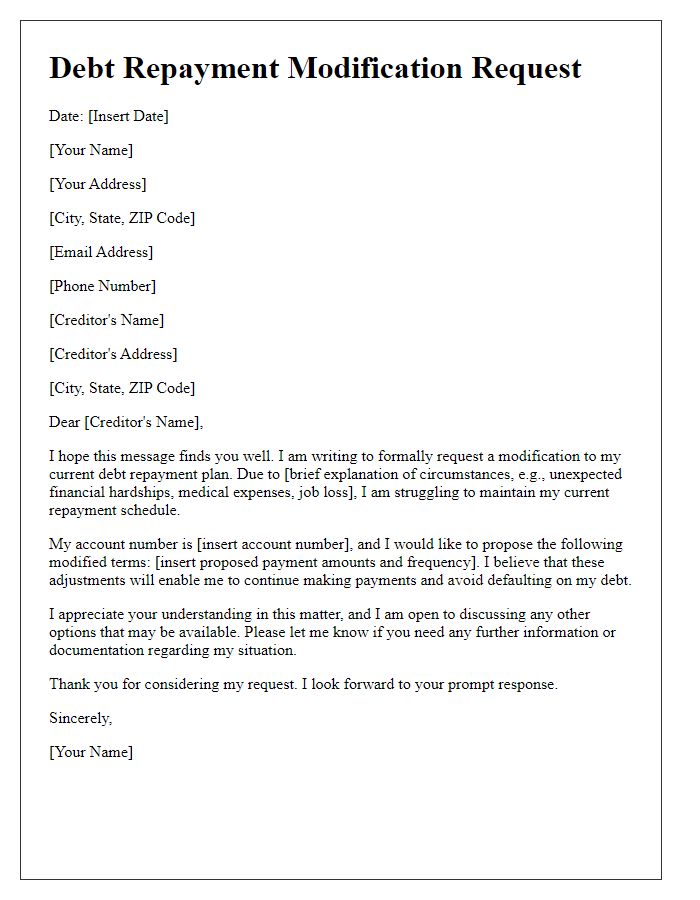

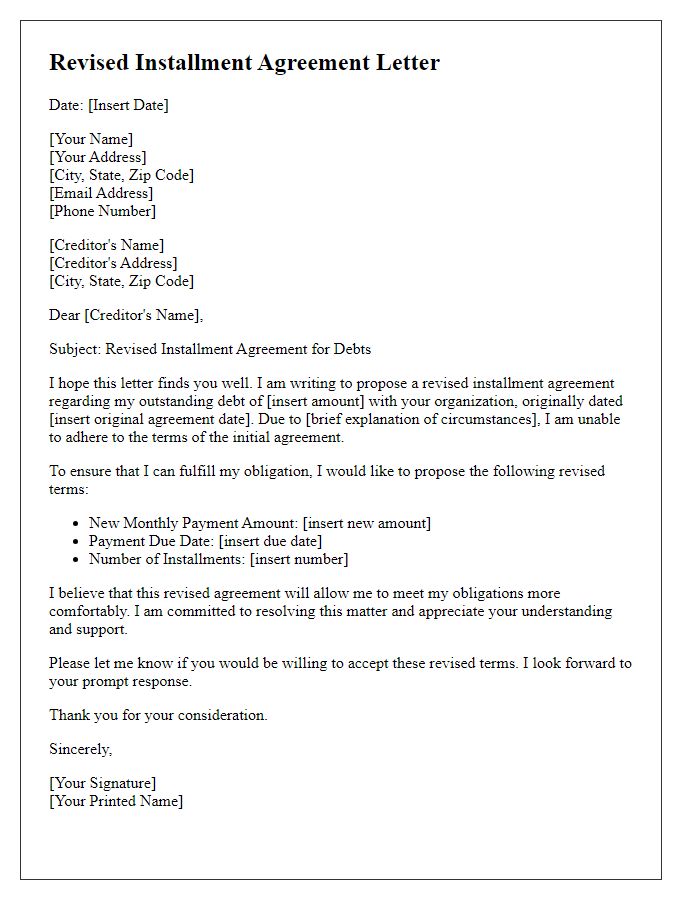

Request for Understanding and Cooperation

Revised debt payment plans often arise from unforeseen circumstances requiring flexibility in financial commitments. A typical request may involve a detailed explanation of current financial struggles, including job loss or medical emergencies. The proposed payment schedule should outline specific amounts, frequency (such as monthly payments), and the total duration of the revised plan. Relevant entities might include the creditor's name, account number, and contact information. Emphasizing good faith cooperation and a willingness to comply with terms fosters a mutual understanding. Such communication can also outline potential benefits for both parties, including improved chances of debt recovery for the creditor and eased financial burden for the debtor.

Contact Information for Further Discussion

A revised debt payment plan can significantly impact personal finances, particularly for borrowers wishing to stabilize their economic situation. For instance, individuals who are managing multiple loans (like credit card debt or personal loans) often seek to consolidate payments to reduce monthly financial obligations. Providing comprehensive contact information serves as a crucial step towards facilitating further discussions on payment terms, which may include extended timelines, lower interest rates, or reduced total payments. Key details such as phone numbers, email addresses, and physical locations (such as the offices of financial advisors or lending institutions) enhance accessibility. This approach can lead to constructive negotiations, ultimately enabling borrowers to regain financial stability in their lives.

Comments