Are you feeling overwhelmed by shared debts and unsure where to turn? Navigating the murky waters of financial obligations can be challenging, especially when it involves multiple parties. In this article, we'll explore effective strategies for crafting a shared debt settlement offer that not only safeguards your interests but also fosters goodwill among all involved. So, let's dive in and discover how you can take charge of your financial future!

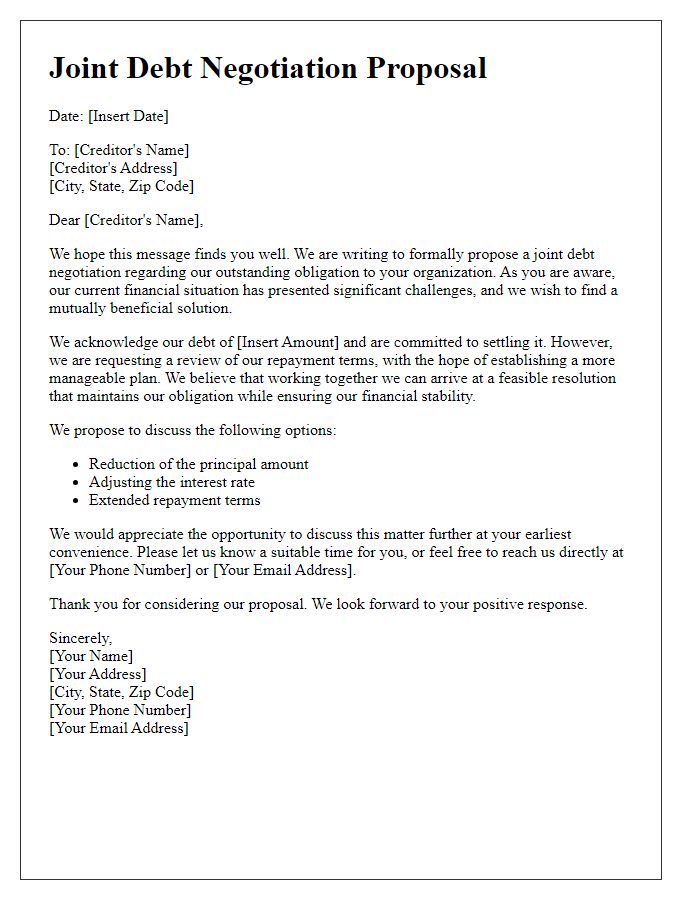

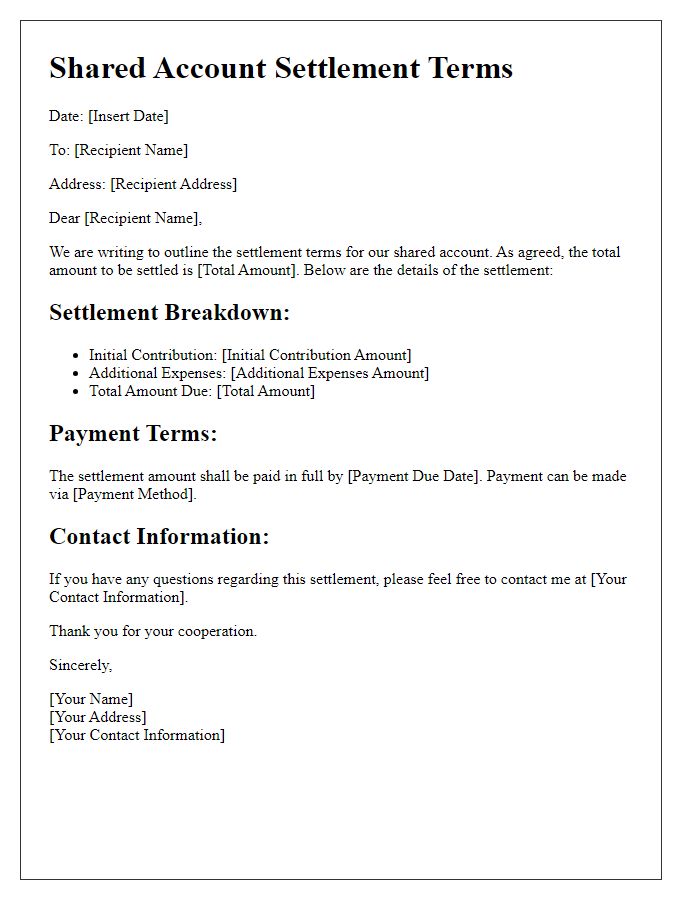

Creditor and debtor information

A shared debt settlement offer typically includes essential information that outlines the agreement between the creditor and debtor. The creditor's information details the name of the financial institution, contact address, account number associated with the debt, and the amount owed. The debtor's information encompasses the individual's full name, current address, and any relevant identification numbers, such as Social Security Number or taxpayer identification for verification purposes. Additionally, terms of the settlement may specify the agreed-upon payment amount, any potential reduction in the total debt, the timeline for the settlement, and communication methods for confirming the arrangement. This comprehensive information not only aids in record-keeping but also serves to protect all parties involved in the transaction.

Debt details and reference number

Shared debt settlement offers can represent a mutual decision between debtors to resolve financial obligations collectively, aiming for a more manageable payment solution. Importance of clarity in defining debt details, such as total amount owed (e.g., $15,000), individual contributions, and respective reference numbers, optimizes communication and enhances accountability among parties. Including relevant dates, such as the last payment date (e.g., June 15, 2023) and proposed settlement expiration (e.g., December 31, 2023), establishes a clear timeline for responsibilities. Highlighting terms of the offer, e.g., a proposed 30% reduction in total liability, strengthens negotiation positions by providing a quantifiable basis for decision-making. Such comprehensive documentation promotes transparency, stemming future disputes while actively addressing outstanding financial commitments.

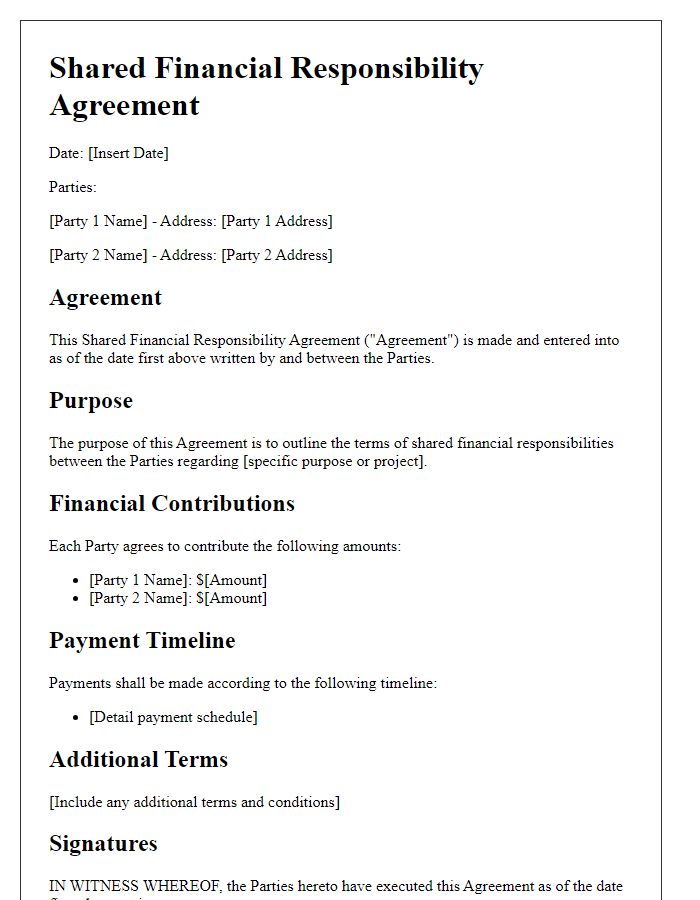

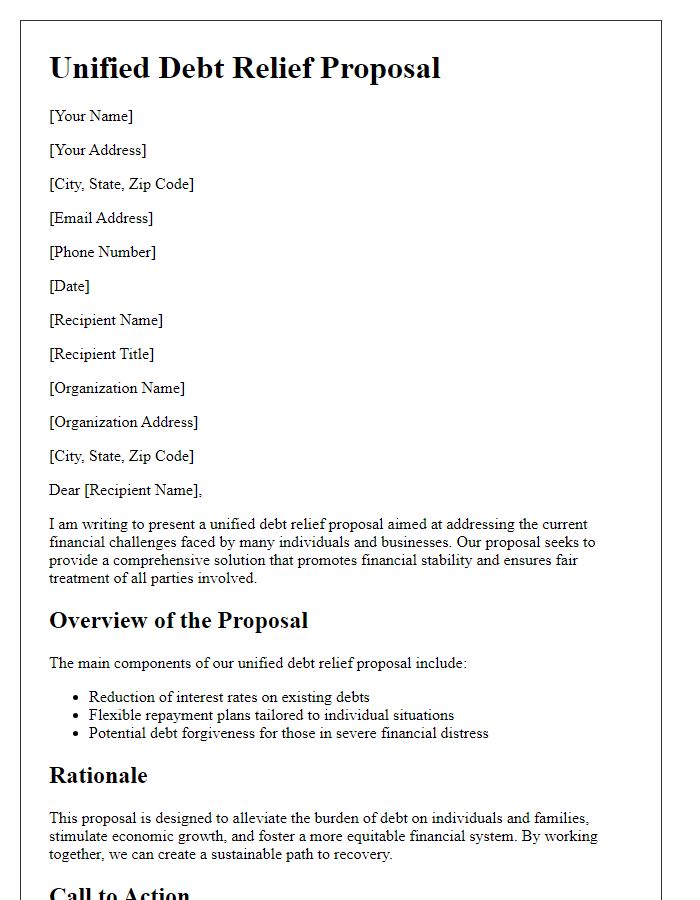

Settlement amount and payment terms

In scenarios involving shared debt, the negotiation of a settlement amount can significantly alleviate financial burdens on all parties involved. A proposed settlement amount, typically ranging from 30% to 70% of the total owed, can effectively promote agreement among creditors and debtors alike. Payment terms usually dictate a structured plan, such as installments spread over six to twelve months, ensuring manageable monthly contributions. This approach not only fosters a sense of financial responsibility but also aims to safeguard credit scores for individuals, as timely payments can prevent additional negative reports to credit bureaus like Experian or TransUnion. Clear communication during this negotiation process, especially if involving legal entities or financial advisors, is crucial to achieving a mutually beneficial resolution.

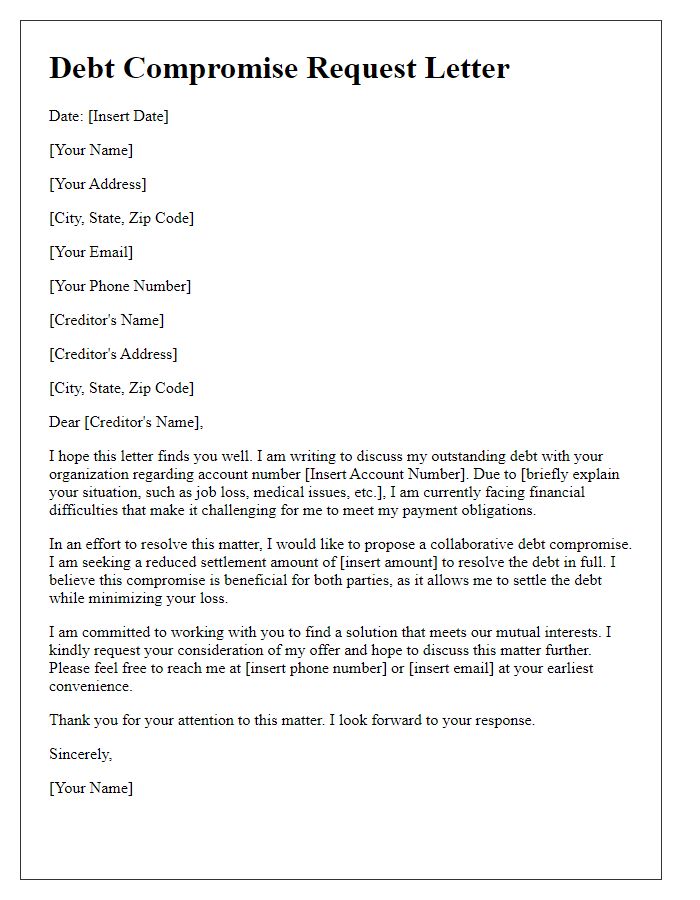

Justification for reduced offer

Debt settlement offers often arise from negotiations aimed at alleviating financial burdens. A significant factor justifying a reduced settlement offer may include financial distress, such as medical bills or job loss, impacting one's ability to pay. The current economic climate, marked by inflation rates around 8% in some regions, further complicates timely payments. Creditors may also consider age of the debt, especially if it exceeds three years, which can diminish its collectability. Another key element could include documentation of income changes, demonstrating inability to meet full obligations. Additionally, maintaining a positive relationship with creditors through timely communications can enhance chances of acceptance for reduced offers.

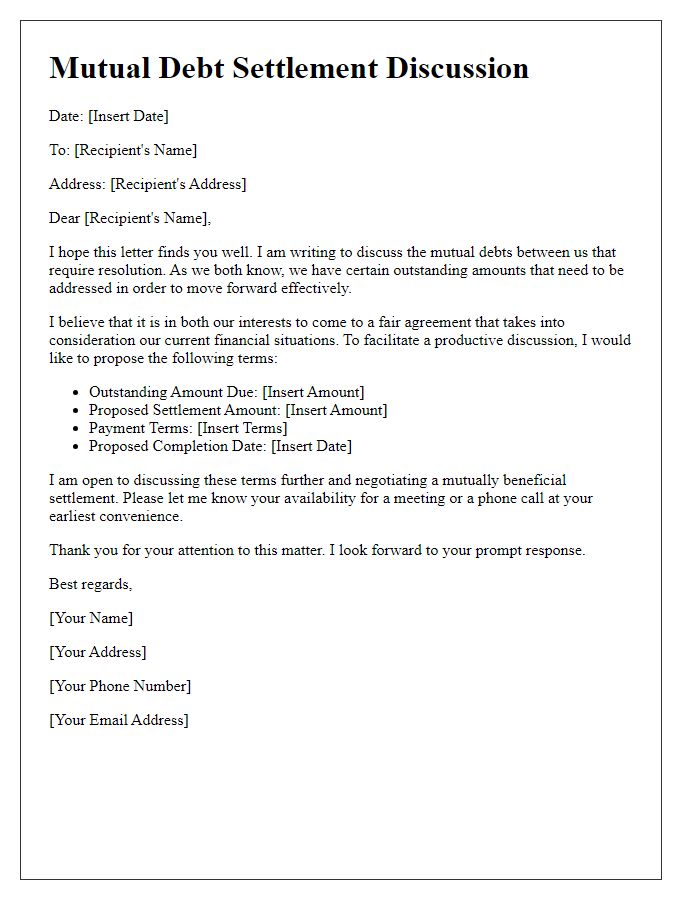

Contact information for further communication

In debt settlement negotiations, clear communication is crucial for resolving financial obligations amicably. An effective shared debt settlement offer should include direct contact information to facilitate ongoing discussions. Essential details include a primary contact person's name, job title (such as Financial Consultant), phone number (with area code), and an email address (e.g., example@email.com) for document exchanges. Additionally, providing office hours (e.g., Monday to Friday, 9 AM to 5 PM) helps schedule conversations efficiently. Including alternate contact methods, such as a fax number or a secondary email, can further enhance communication flow, ensuring all parties remain informed and responsive throughout the settlement process.

Comments