Are you stuck in a tangle of mutual debts and wondering how to resolve them amicably? A mutual debt resolution agreement can be the perfect solution to clear the air and settle obligations in a fair manner. This type of letter outlines the terms of the agreement, ensuring that both parties understand their responsibilities and commitments. Ready to learn how to draft a comprehensive mutual debt resolution agreement? Let's dive in!

Clear identification of parties involved.

A mutual debt resolution agreement requires clear identification of the parties involved to ensure transparency and accountability. For instance, Party A can be defined as John Smith, residing at 123 Main Street, Springfield, Illinois, born on January 15, 1985, with the contact number (555) 123-4567 and Party B identified as Jane Doe, living at 456 Elm Street, Springfield, Illinois, born on February 20, 1990, reachable at (555) 765-4321. The inclusion of full names, addresses, birth dates, and contact information for both parties guarantees unambiguous identification, which is essential for enforcing the agreement in case of disputes or misunderstandings. This level of detail is crucial for legal validity and mutual recognition of obligations.

Detailed description of the debts and obligations.

In a mutual debt resolution agreement, clearly outlining the debts and obligations is essential for establishing transparency and ensuring mutual understanding. Outstanding balances may include personal loans amounting to $5,000, a credit card debt of $2,500 with a 19% interest rate, and an unpaid utility bill totaling $300. The agreement should specify repayment timelines, such as a monthly payment schedule of $500 over the next year, and outline consequences for late payments, such as additional interest fees or service interruptions. Obligations of both parties must be defined, including information on whom to contact for questions and how disputes will be resolved. The document should also include details regarding any collateral, such as property or assets involved in securing the debts, to provide additional clarity on the terms of the agreement.

Agreed terms of repayment or resolution.

Mutual debt resolution agreements commonly outline specific terms regarding the repayment of debts between two parties, such as individuals or organizations. Defined repayment schedules can enhance clarity; for example, monthly installments might be set to tackle a total outstanding debt of $10,000 over a period of 12 months. Interest considerations may also be included, where parties agree to a reduced rate, leading to a fair arrangement that circumvents potential legal actions. Furthermore, a signed document may ensure both parties acknowledge the agreement through the inclusion of notary public verification, facilitating a legally binding contract. Clear delineation of obligations, including due dates and methods of payment, such as bank transfer or check, typically bolsters the effectiveness of such agreements and fosters accountability.

Signatures of all parties.

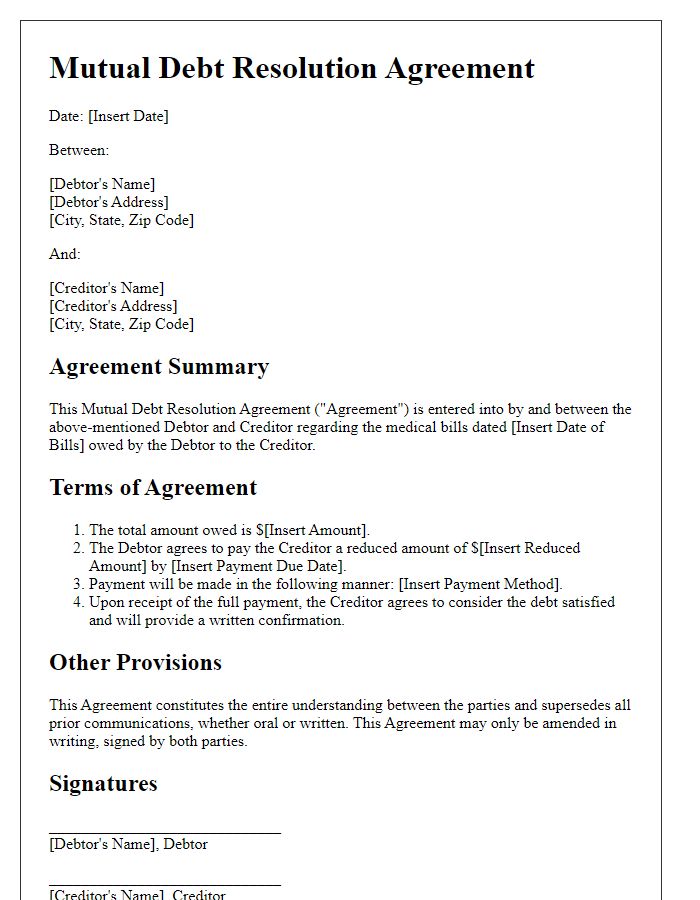

A mutual debt resolution agreement is essential for formalizing the understanding between all parties involved in settling outstanding debts. This document should include the full names of all parties, along with their respective roles and responsibilities concerning the debt. Detailed information such as the date of the agreement, the total debt amount to be resolved, and specific payment terms or settlement amounts should be clearly outlined. Additionally, provisions for any potential late fees or disputes must be included to prevent future misunderstandings. Signatures of all parties, representing their consent to the terms outlined, are crucial, along with dates to signify when the agreement was entered into. Notarization may also be beneficial to enhance the enforceability of the contract.

Legal considerations and governing law.

In mutual debt resolution agreements, legal considerations often emphasize the importance of compliance with applicable laws, such as the Uniform Commercial Code (UCC) in the United States, which governs commercial transactions. Parties should define the governing law, commonly specifying a jurisdiction such as the state of New York, known for its comprehensive contract laws. Clear terms regarding dispute resolution processes, including mediation or arbitration, are crucial to prevent future conflicts. Both parties must ensure that the agreement adheres to fairness doctrines and does not violate state or federal regulations regarding debt collection practices, which can vary significantly across different jurisdictions. In summary, legal clarity and jurisdictional compliance are vital for a robust mutual debt resolution agreement.

Letter Template For Mutual Debt Resolution Agreement Samples

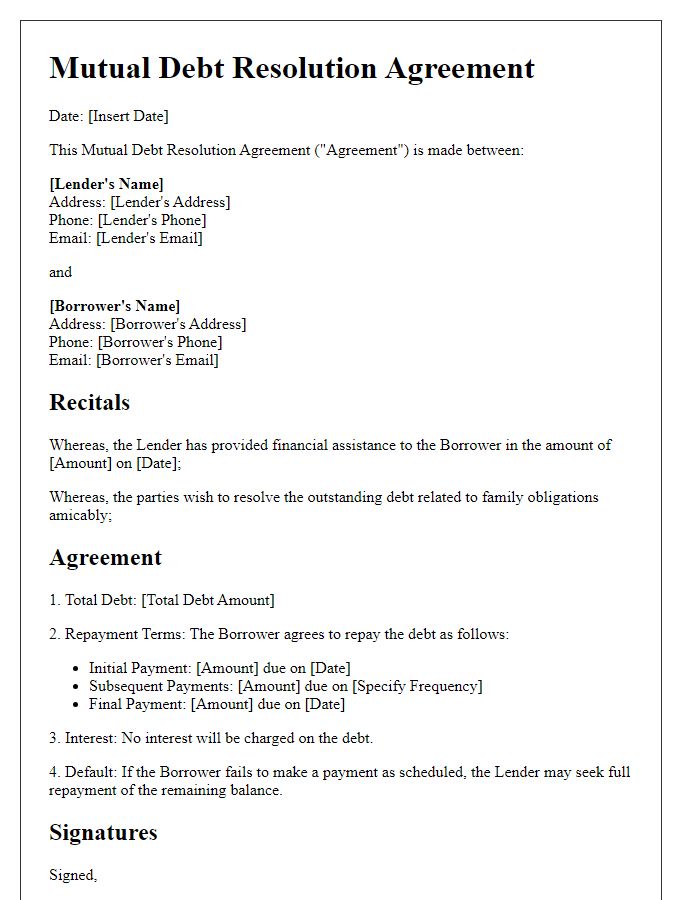

Letter template of mutual debt resolution agreement for family obligations.

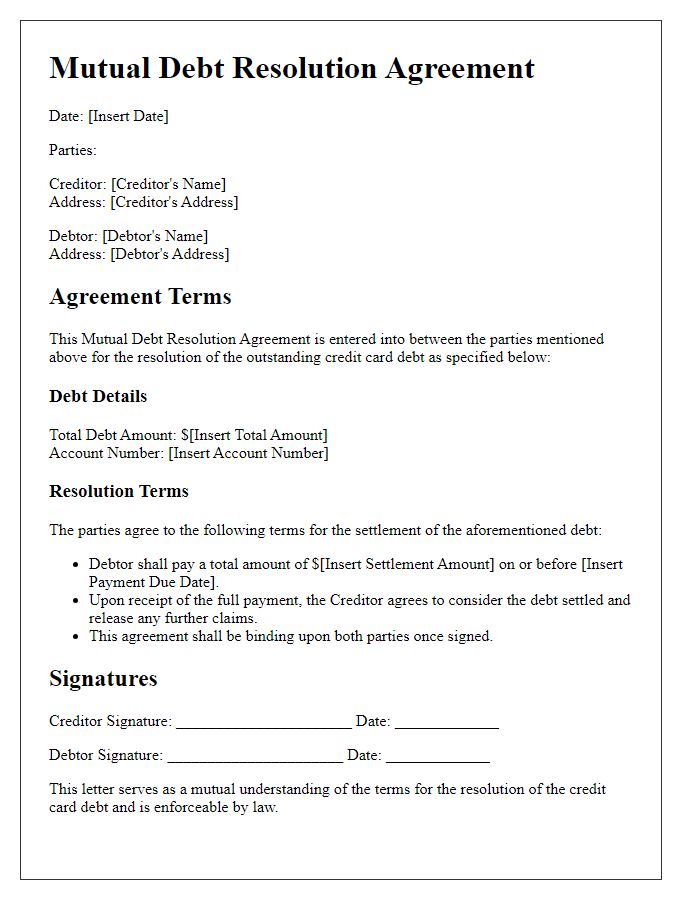

Letter template of mutual debt resolution agreement for credit card debt.

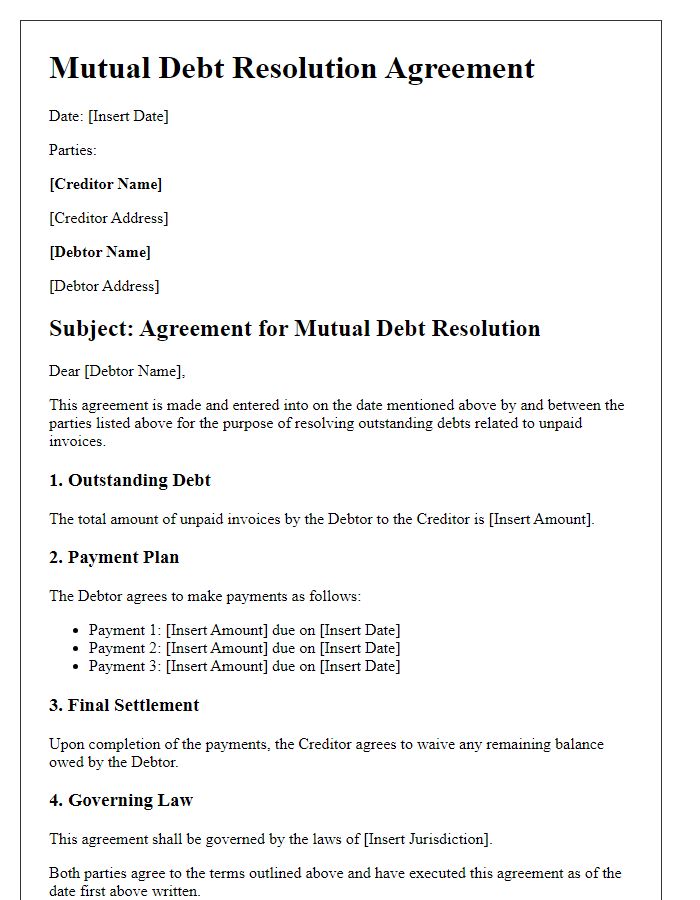

Letter template of mutual debt resolution agreement for unpaid invoices.

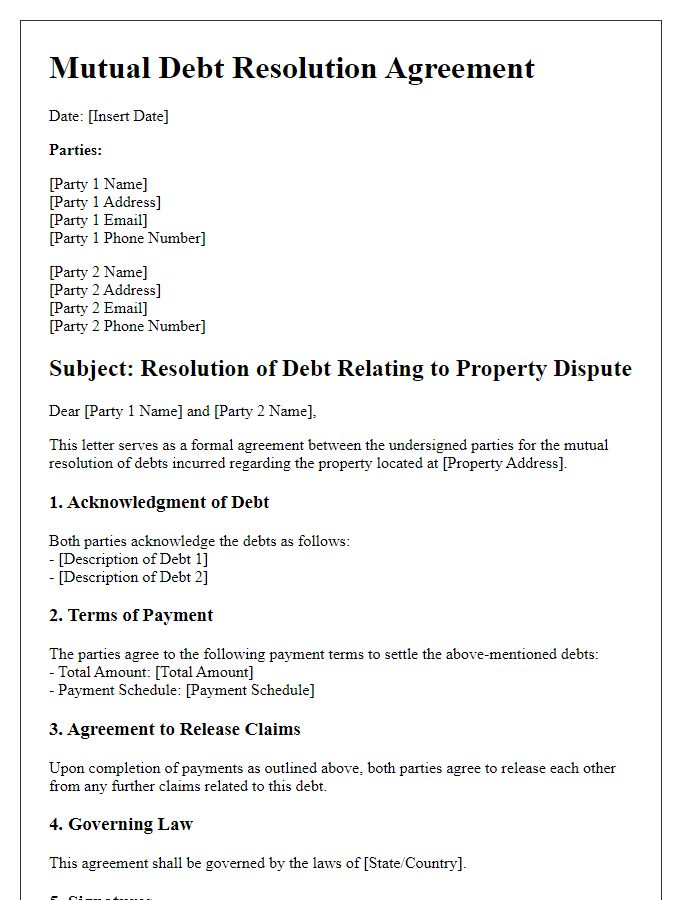

Letter template of mutual debt resolution agreement for property disputes.

Letter template of mutual debt resolution agreement for partnership debts.

Comments