Hey there! If you've ever found yourself wondering how to navigate the sometimes tricky waters of debt collection follow-ups, you're not alone. Many people dread the thought of reaching out to debtors, but a well-crafted letter can make all the difference in encouraging timely payments while maintaining a positive relationship. So, if you're looking for effective strategies and sample templates to guide you through this process, keep reading for some helpful tips!

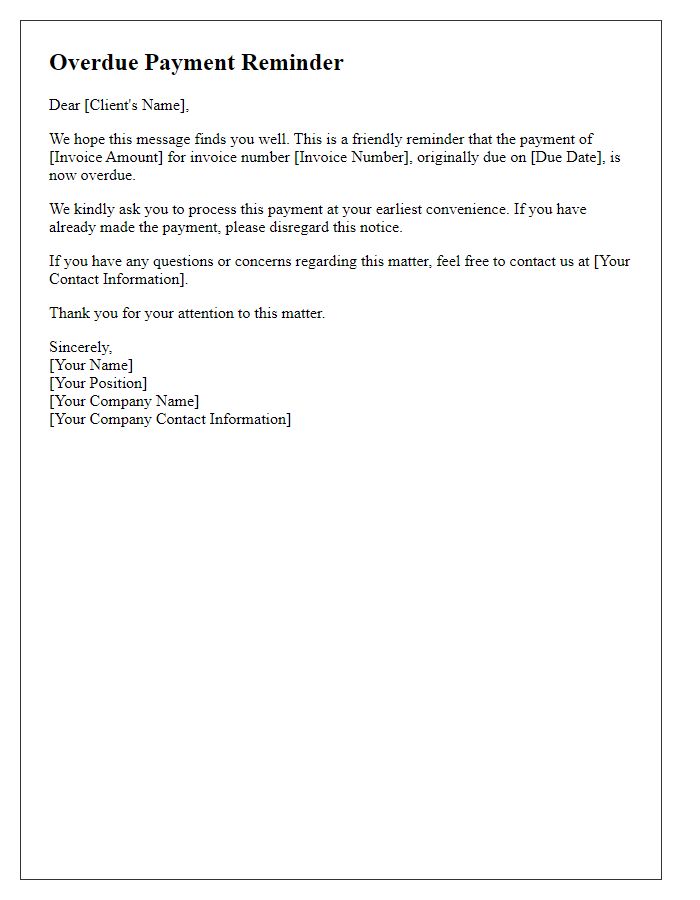

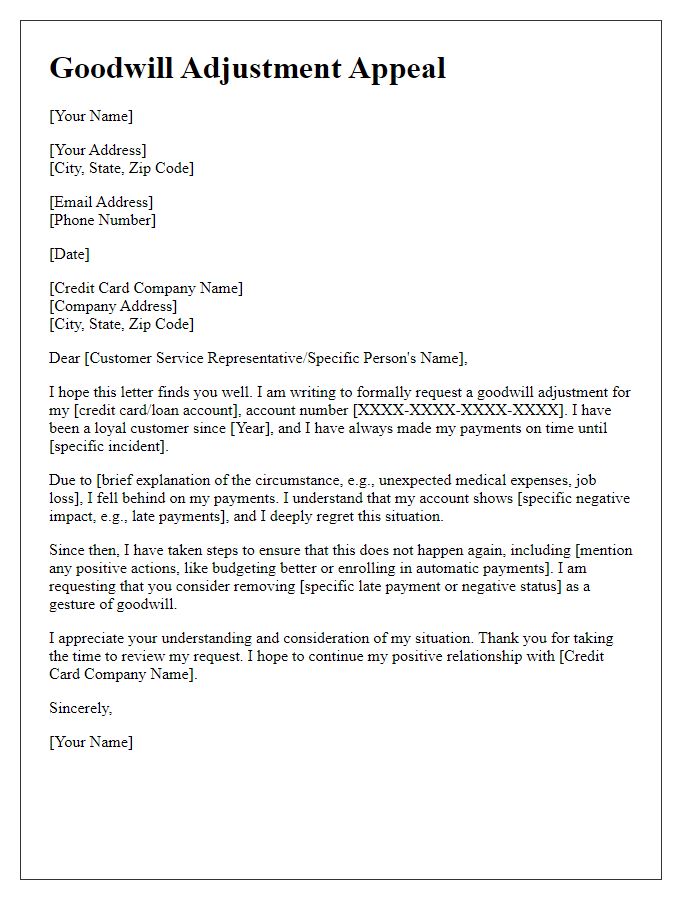

Tone and Language

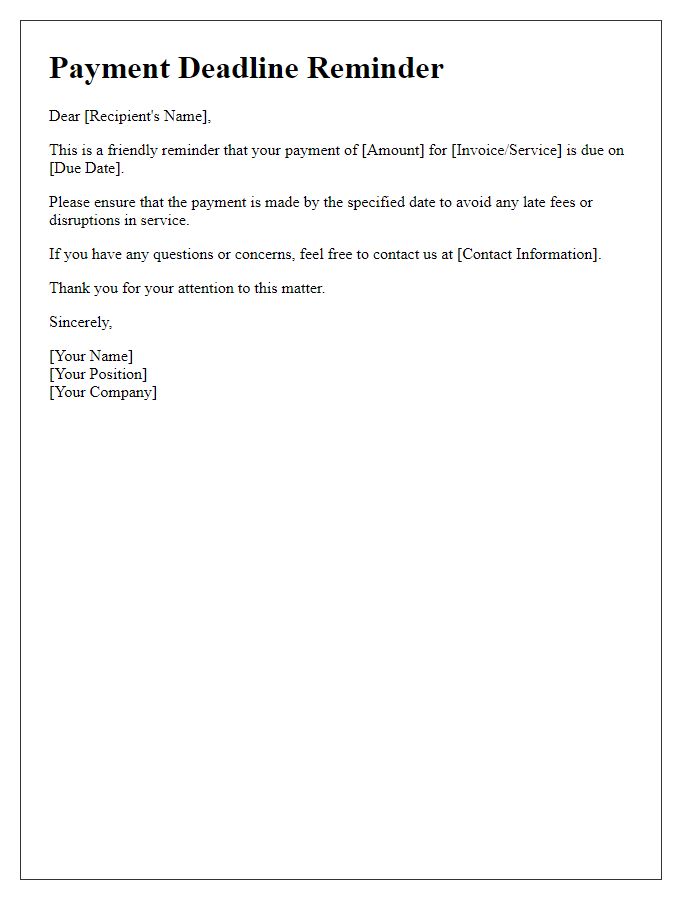

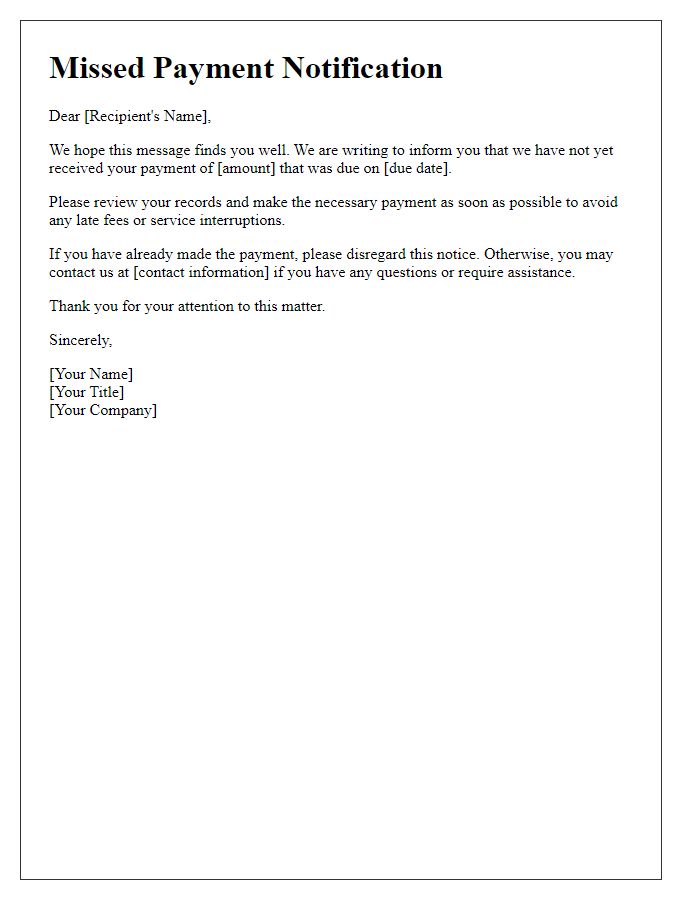

A professional and firm tone is essential for a debt collection follow-up letter, ensuring clarity and urgency while remaining respectful. The language should be direct, using clear terminology related to the outstanding debt, such as the amount owed, due dates, and the consequences of non-payment. For instance, phrases like "payment is overdue by X days" or "please remit payment by [specific date]" establish urgency. The letter should also express a willingness to assist, using language such as "please contact us if you have questions" to maintain professionalism. Including a call to action, such as "settle this matter promptly to avoid additional fees," emphasizes the seriousness of the situation while keeping the door open for dialogue.

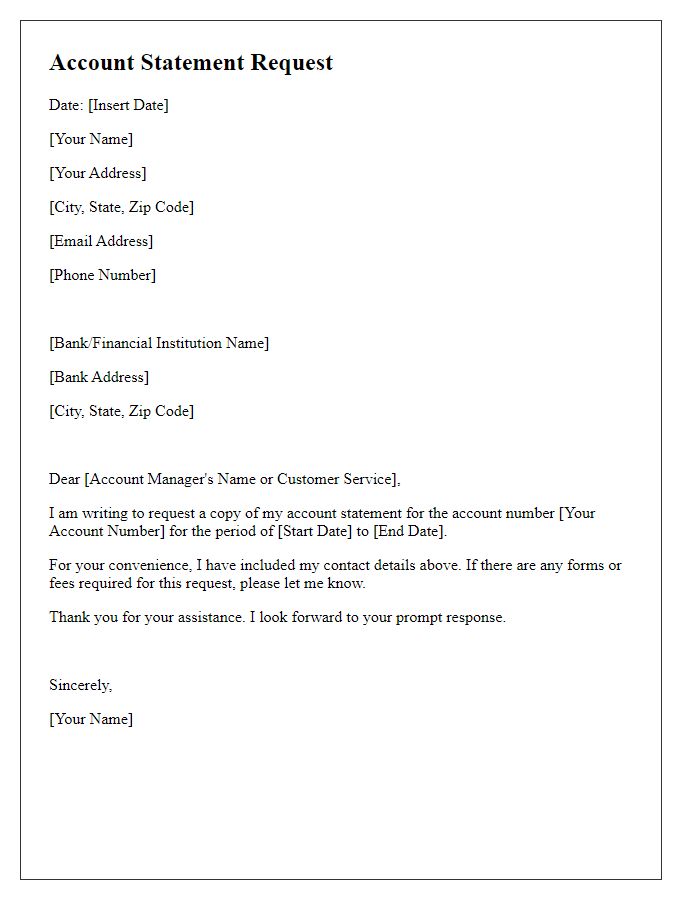

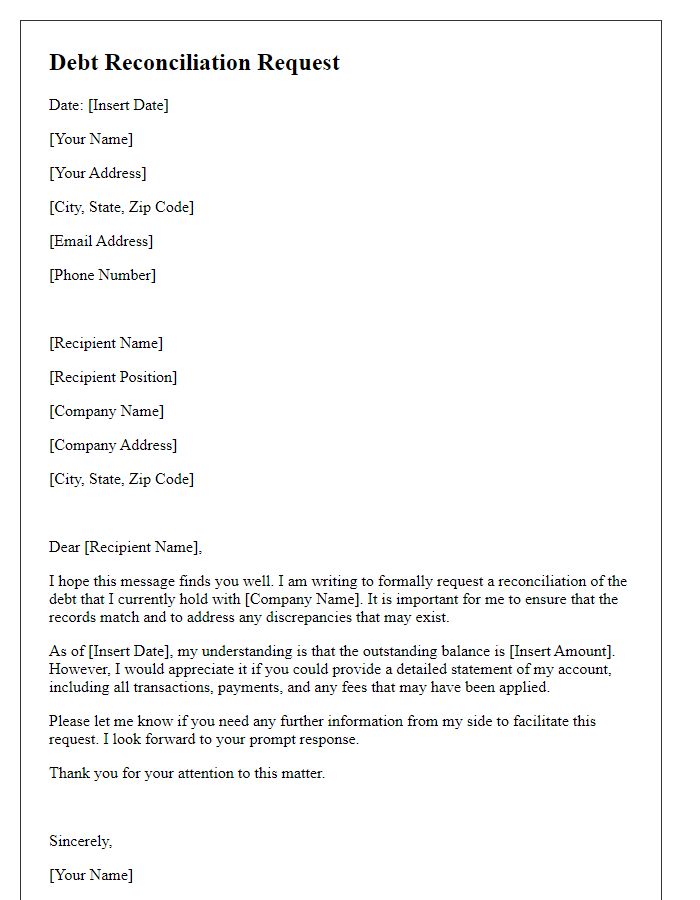

Contact Information

Unpaid invoices can significantly impact cash flow for businesses, particularly small to medium-sized enterprises (SMEs) in various industries. Following up on outstanding debts requires clear and concise communication, often including vital contact information, such as business name, address, phone number, and email address of both parties involved. This information ensures prompt responses and facilitates the resolution of payment discrepancies. Additionally, providing a detailed account of the outstanding balance, due dates, and previous correspondence dates can reinforce the urgency of the matter. Ensuring contact information is accurate can improve the efficiency of the debt collection process in accordance with regulations set by local financial authorities.

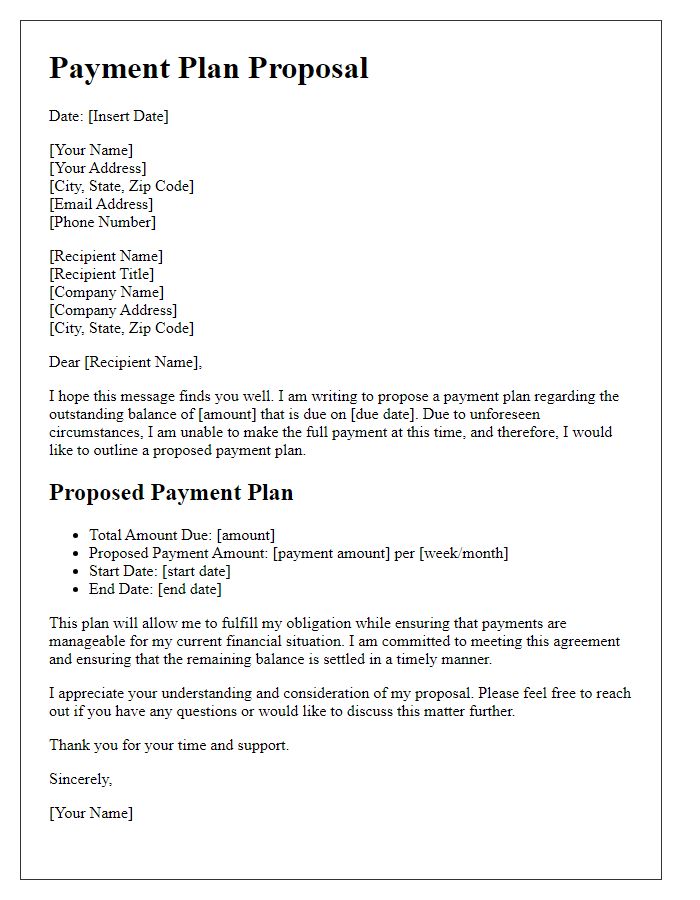

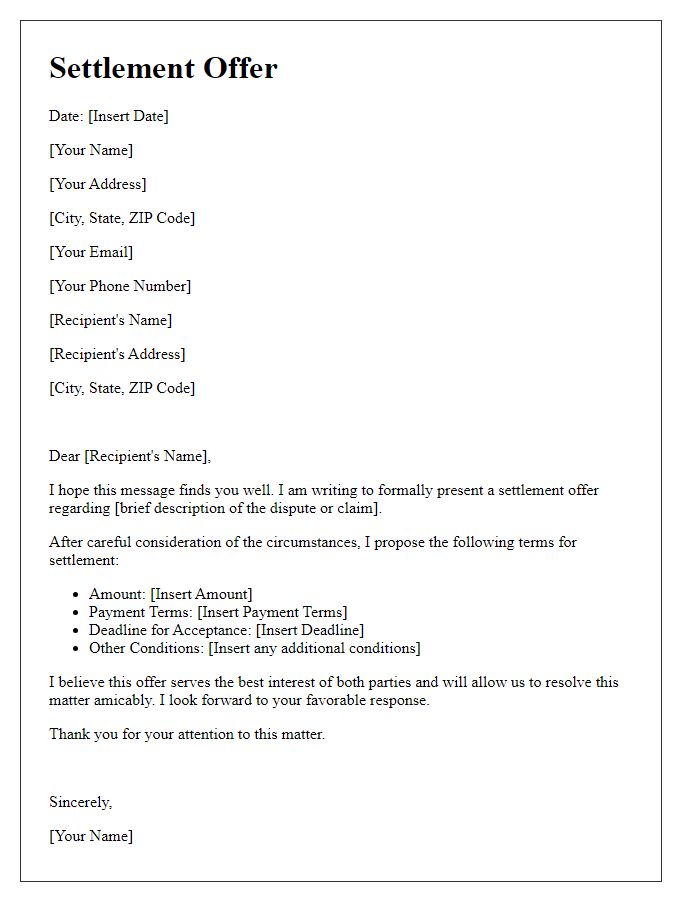

Payment Details and Instructions

A comprehensive debt collection follow-up can effectively enhance payment clarity. When outlining payment details, include the total amount owed, specific due dates, and any applicable interest rates, which can foster urgency. Providing clear instructions, such as accepted payment methods (credit card, bank transfer, or online payment systems like PayPal), can reduce confusion. Additionally, incorporating contact information for inquiries or disputes, using a dedicated email (collections@company.com) or phone number (1-800-555-0199), ensures open communication. Creating a professional tone while maintaining an empathetic approach can also help in promoting positive engagement with the debtor.

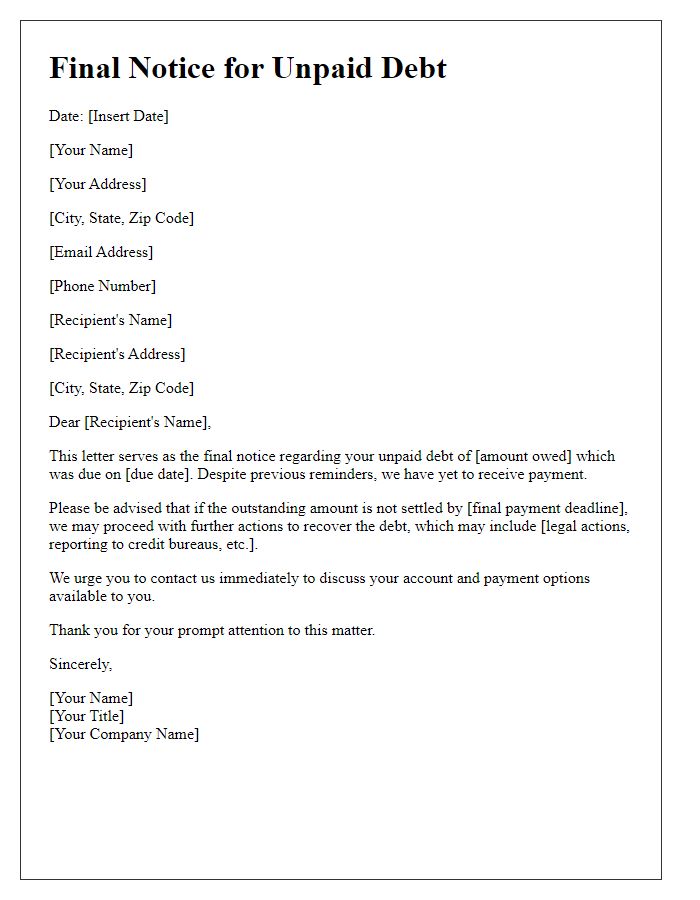

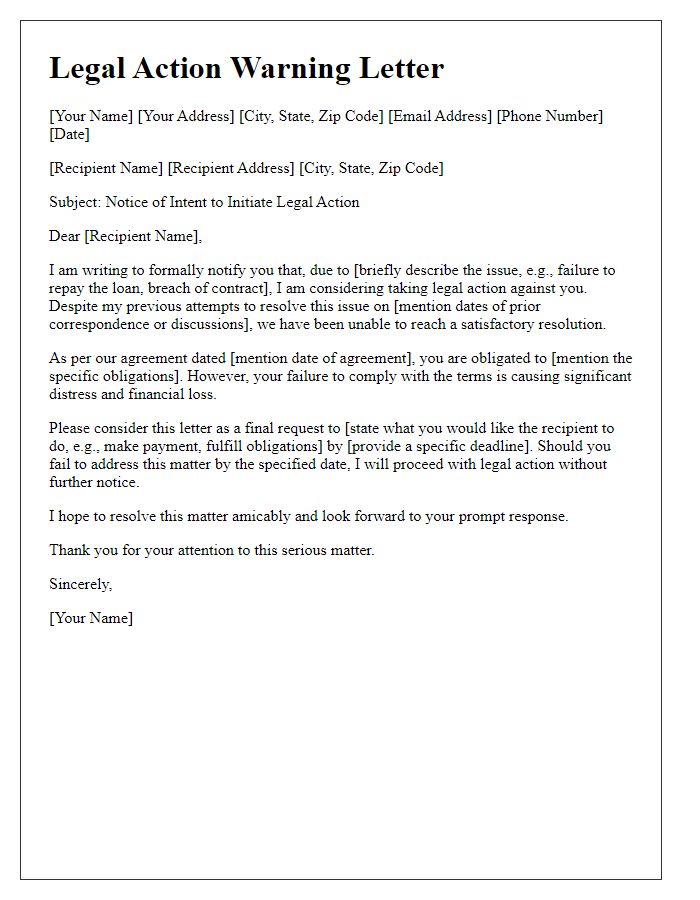

Consequences of Non-Payment

Consistent non-payment of outstanding debts can lead to severe repercussions for individuals and businesses. Credit scores, crucial in determining borrowing capacity, may plummet, negatively impacting loan approvals and interest rates. Collection agencies may become involved, initiating additional fees and legal action, complicating the resolution process. Legal proceedings might culminate in wage garnishments or lien placements on assets, jeopardizing financial stability. The variety of implications emphasizes the importance of timely debt resolution and proactive communication with creditors to avoid detrimental outcomes.

Legal Disclaimers

Unpaid debts may lead to serious consequences including negative credit reporting. Debt collection agencies, such as XYZ Collections, must comply with regulations outlined in the Fair Debt Collection Practices Act (FDCPA) which protects consumer rights. Failure to respond may result in legal actions initiated in specific jurisdictions, potentially in your local district court. In addition, collection costs may be added to the principal debt amount, increasing overall financial liability. It is crucial to respond to any communications to avoid escalation and preserve legal options.

Comments