Hey there! We've all been there â that moment when you try to make a purchase, and the dreaded message pops up: âYour credit card payment has been declined.â It can be a bit frustrating, especially when you're in the middle of something important. But don't worry, we're here to help you understand what might have happened and how to resolve this issue quickly. Stick around as we dive into the reasons behind payment declines and what steps you can take next!

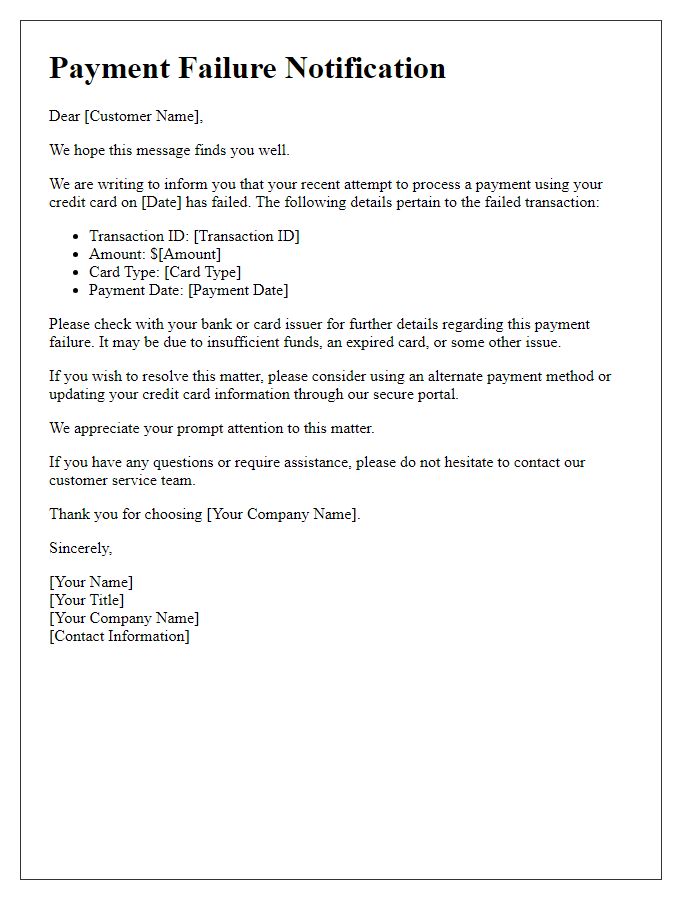

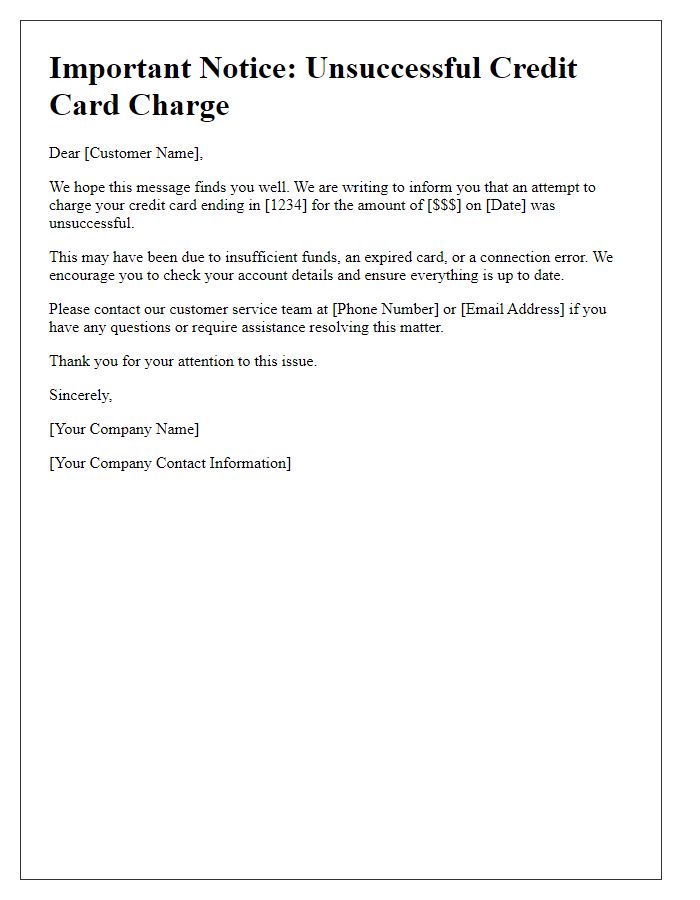

Cardholder Information: Name, account number.

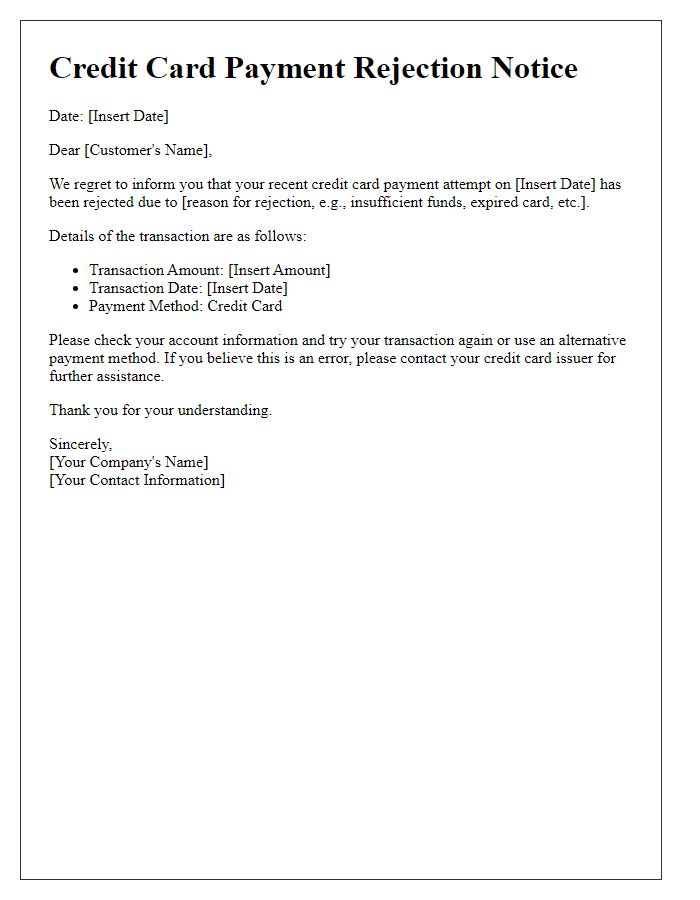

Credit card payment decline notifications often provide important details regarding the unsuccessful transaction. A notification typically includes the cardholder's name (such as John Doe), a masked account number (like **** **** **** 1234), merchant information (store or online service name), transaction amount (e.g., $45.99), and date of the attempted transaction (e.g., March 15, 2023). The notification may also suggest actions for the cardholder, such as verifying account details with the issuing bank (example: First National Bank) or checking for available credit limit, which can affect future transactions. Key reasons for decline might include insufficient funds, expiration of the card, or potential fraud alerts, which require immediate attention to ensure continued access to credit services.

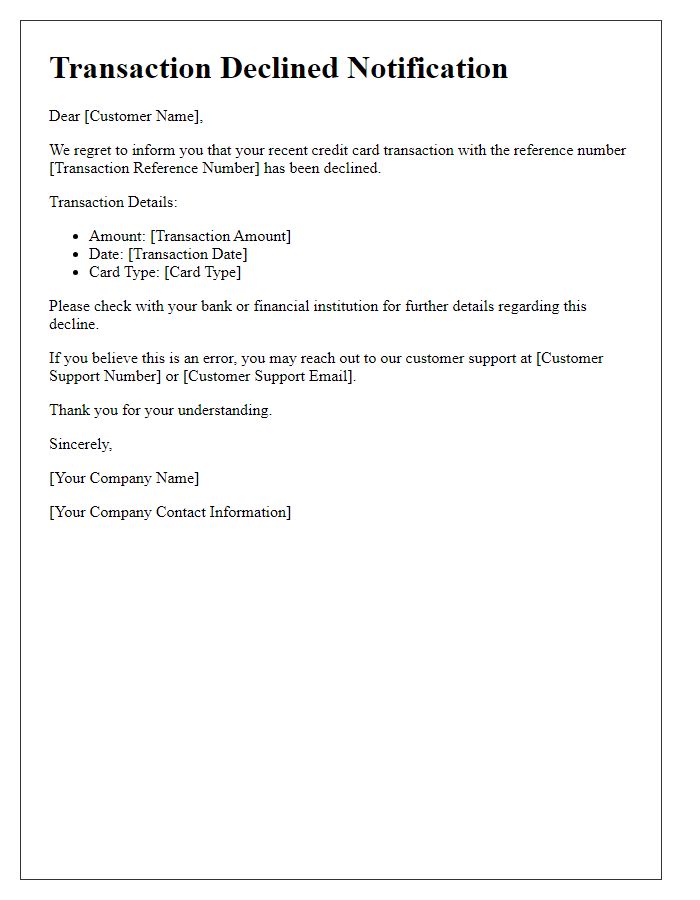

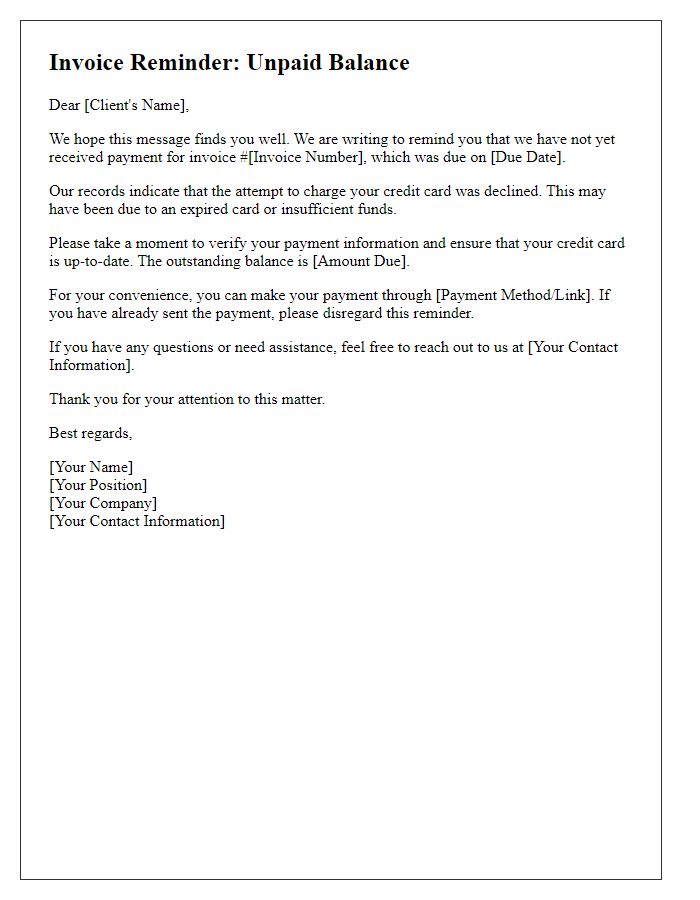

Transaction Details: Date, amount, merchant.

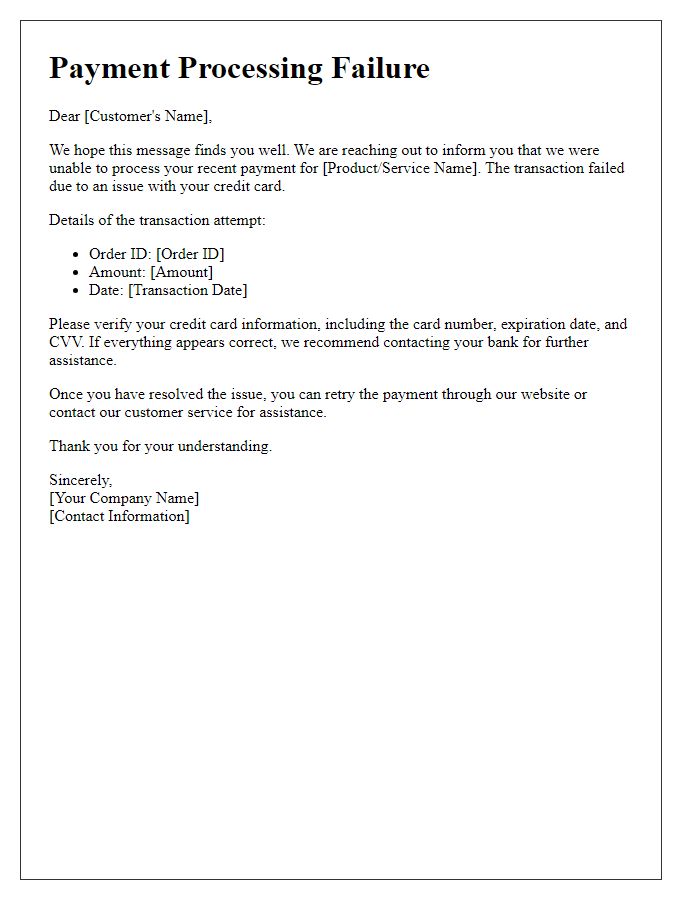

Credit card payment declines can create considerable inconvenience for consumers. A declined transaction typically includes key details such as transaction date (the specific day the purchase attempt occurred), transaction amount (the financial sum associated with the purchase), and merchant name (the business entity where the attempt was made). For instance, a declined transaction on March 15, 2023, for an amount of $89.99 at 'Tech Gadgets Store' highlights the scenario clearly. Factors contributing to this decline could involve insufficient funds, exceeding credit limits, or even potential fraud prevention measures activated by the issuing bank. Understanding these components can aid users in resolving payment issues promptly, ensuring seamless shopping experiences in the future.

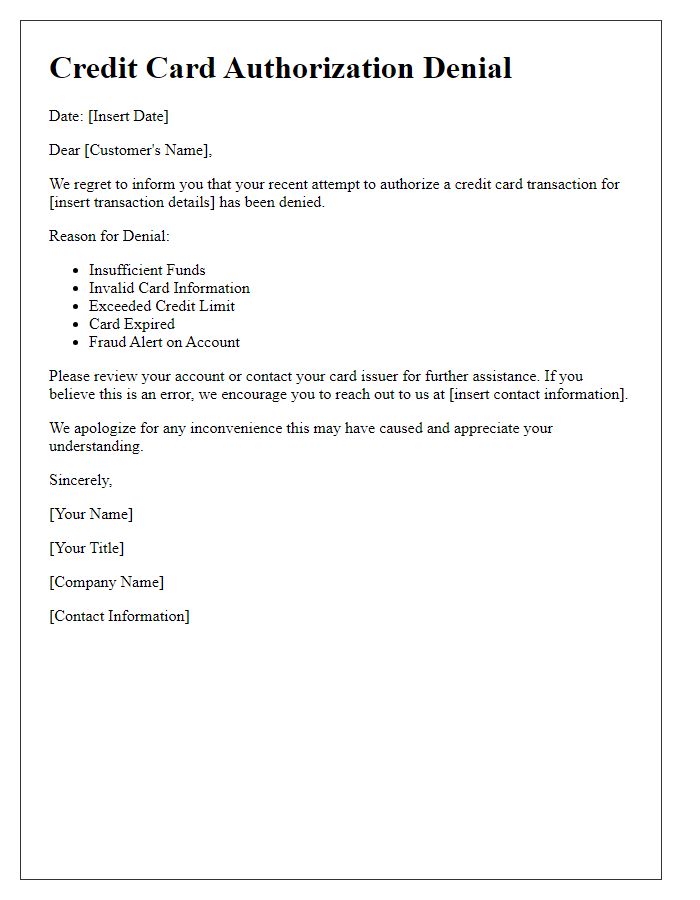

Decline Reason: Insufficient funds, expired card.

A notification of a declined payment can occur when a transaction is attempted with a credit card that either lacks sufficient funds or has reached its expiration date. Insufficient funds may arise when the available balance falls below the transaction amount, preventing the payment from being processed. An expired card indicates that the cardholder has not updated their payment information prior to the card's validity expiration, which typically lasts for three to five years from the date of issuance. Users facing this issue will need to review their account status or update their payment methods accordingly to avoid disruptions in service or automatic transactions linked to subscriptions.

Resolution Steps: Update payment method, contact support.

Credit card payment declines can disrupt transactions across various platforms, impacting online purchases. Common reasons include insufficient funds, expired cards, or incorrect billing information. Users should consider updating their payment method by accessing their account settings, where they can enter current card details or choose alternative payment options like digital wallets or bank transfers. If issues persist, contacting customer support is advisable, allowing representatives to assist with troubleshooting specific payment errors or providing alternative solutions. Customers are encouraged to resolve such issues promptly to avoid service interruptions or delays in receiving purchased items.

Contact Information: Customer service number, email.

A declined credit card payment often results in customer frustration and confusion. Immediate communication is crucial to address this issue efficiently. For instance, a notification can include relevant contact information such as the customer service hotline (typically available at 1-800-xxx-xxxx) and an email address (often support@financialinstitution.com). Providing these details allows customers to reach out easily, ensuring they can inquire about their account status. Additionally, clear guidance on common reasons for declined transactions, such as exceeding credit limits or expired cards, can assist customers in resolving issues swiftly. Timely notifications enhancing customer experience can lead to increased trust and satisfaction with financial services.

Comments