Are you feeling a bit overwhelmed by your credit card payment due date? You're not alone! Many people find it challenging to manage their finances when due dates don't align with their pay schedule. Luckily, changing your payment due date can make a significant difference, and in this article, we'll explore how to request this change smoothly. Stick around to learn more about simplifying your payment routine!

Account details and cardholder information

Changing the due date of credit card payments can significantly influence cardholder financial management. For instance, a new due date may align better with a cardholder's paycheck schedule. This adjustment can promote timely payments, avoiding late fees (which can average $30 - $39 depending on the credit card issuer), and improving credit scores (which can be impacted by timely payment history). The process typically requires the cardholder to provide account details such as the 16-digit credit card number, expiration date, and personal identification information, like full name, address, and Social Security number. Maintaining organized records during this process, including date of request and confirmation, can ensure a smoother transition and help prevent any potential issues with payment processing.

Clear request statement for due date change

Credit card payment schedules can significantly impact financial management. A clear request for a due date change (for instance, moving from the 15th of each month to the 25th) can help align payment timelines with income deposits, enhancing cash flow. This adjustment is particularly relevant for individuals with biweekly paychecks, where aligning payment dates can prevent late fees and improve credit utilization ratios. Financial institutions, such as banks or credit card companies, often consider these requests favorably, especially for customers with good payment histories and responsible credit usage.

Reason for due date change request

A credit card payment due date change can significantly impact financial planning for cardholders. Making alterations to the due date can be beneficial for individuals expecting payroll on specific dates, such as the 15th or 30th of each month, allowing better alignment with income cycles. In circumstances like financial hardship or unexpected expenses, such as medical bills or car repairs, a due date adjustment can provide temporary relief by extending the payment period. Financial institutions often consider the requests to accommodate their customers' needs, potentially enhancing customer satisfaction and loyalty while also reducing the risk of late payment penalties that can accrue, leading to increased debt and damaged credit scores.

Preferred new due date selection

Adjusting the payment due date for credit card accounts can enhance financial management. Many credit card issuers, such as Visa or MasterCard, allow customers to select a new due date to align with their pay schedule. For instance, if the original due date falls on the 15th of the month, a customer may request to change it to the 30th, providing a more convenient timeframe for managing cash flow. This adjustment can be beneficial in avoiding late fees, enhancing credit scores, and improving overall financial health. Customers can typically complete this request through the issuer's website, mobile app, or by contacting customer service directly.

Contact information for follow-up communication

A credit card payment due date change can significantly impact financial planning and budgeting for cardholders. Specific date changes may cause inconvenience for users who have set up automatic payments, typically occurring on the first of the month. Cardholders relying on consistent cash flow may experience penalties for missed payments, leading to adverse effects on credit scores, typically measured on a scale of 300 to 850. Keeping track of such changes through secure channels, like online banking apps or customer service numbers, ensures effective communication. Customers should verify contact information for follow-up communication, such as reliable phone numbers or dedicated email addresses, to address any queries or concerns regarding their accounts promptly.

Letter Template For Credit Card Payment Due Date Change Samples

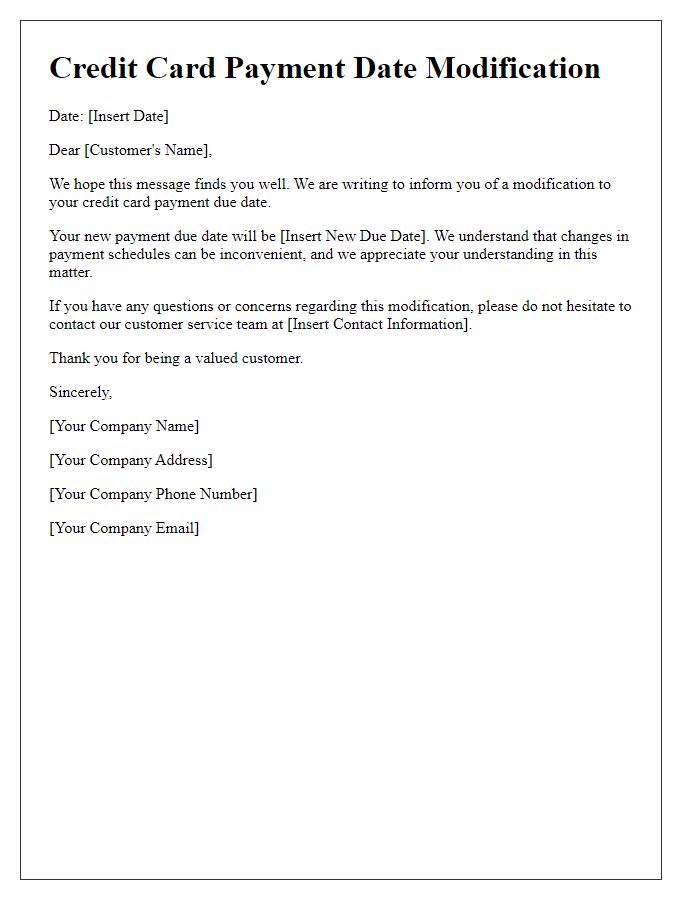

Letter template of notification for credit card payment date modification

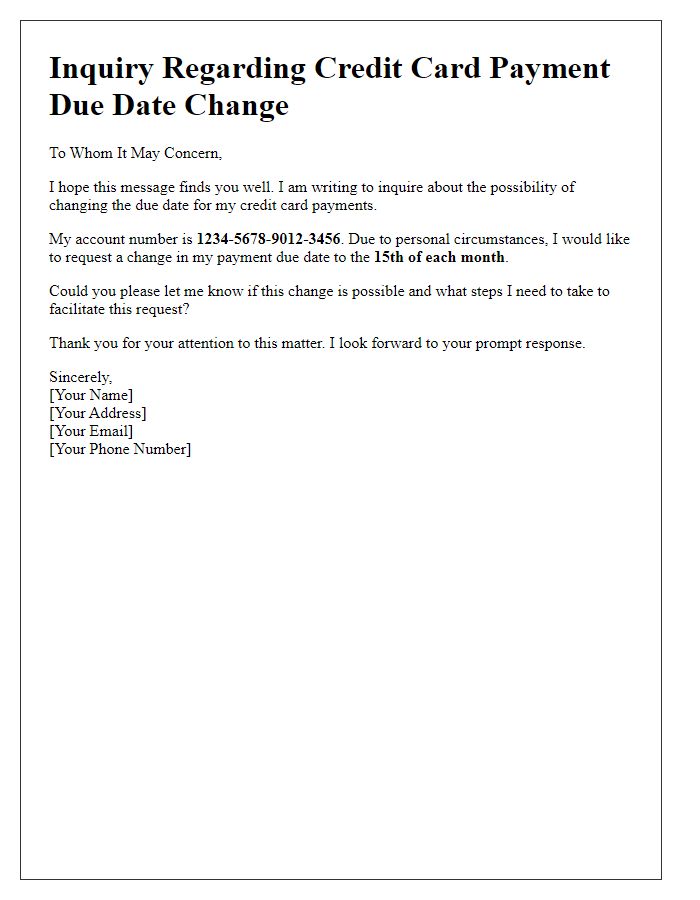

Letter template of inquiry regarding credit card payment due date change

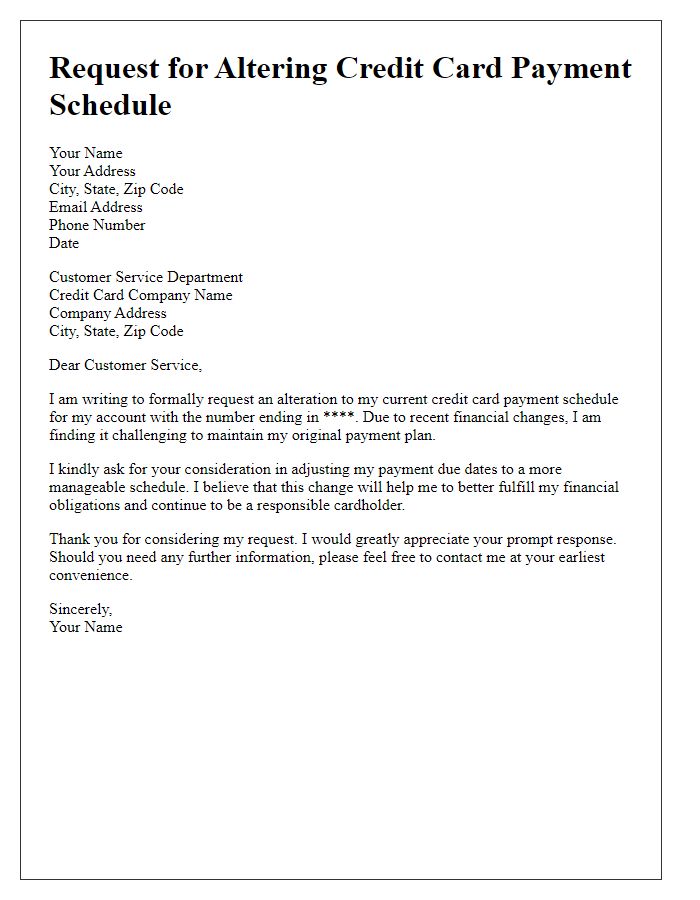

Letter template of formal request for altering credit card payment schedule

Letter template of submission for credit card payment due date relocation

Letter template of complaint regarding credit card payment due date issues

Letter template of confirmation for credit card payment due date alteration

Comments