In today's digital age, choosing how you receive your credit card statements can make managing your finances a lot easier. Many consumers are now opting for paperless options, but some still enjoy the familiarity of a physical statement arriving in the mailbox. Whichever preference you have, it's important to know how to navigate your credit card issuer's options to ensure you get your statements in the format that suits you best. Ready to find out how to set your postal statement preferences? Read on!

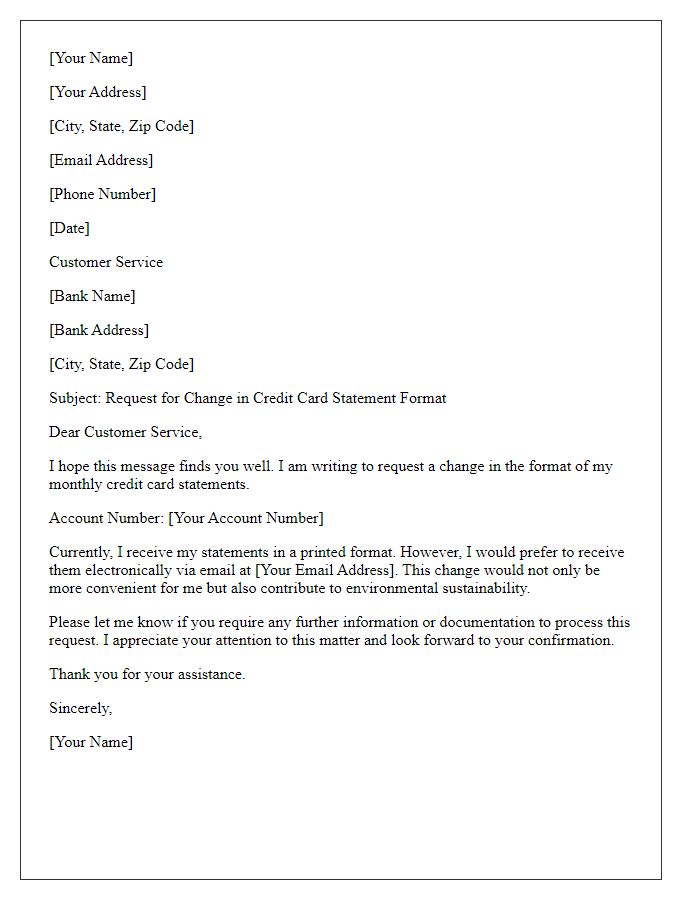

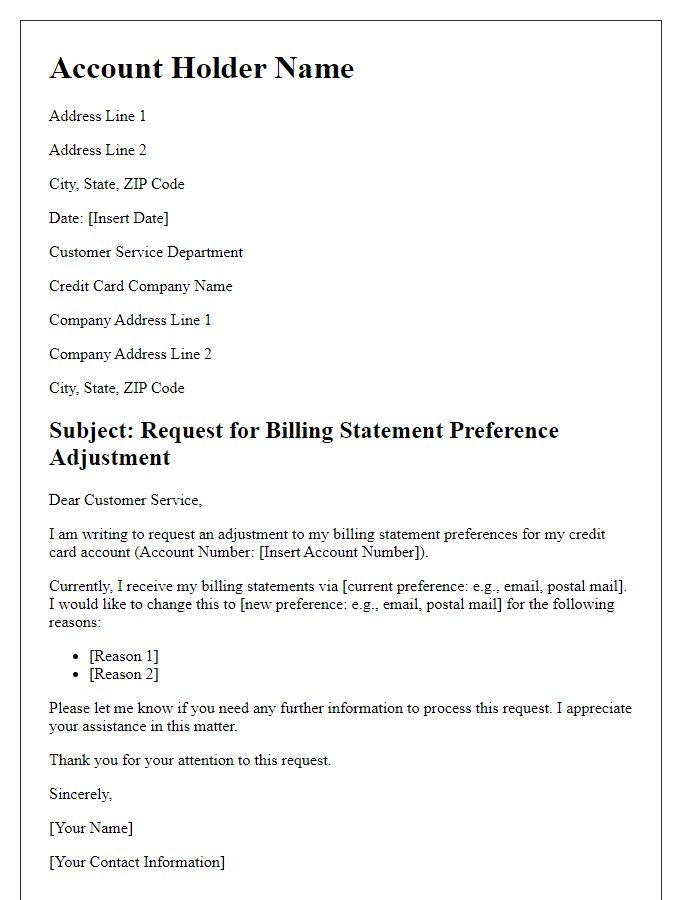

Recipient's Name and Address

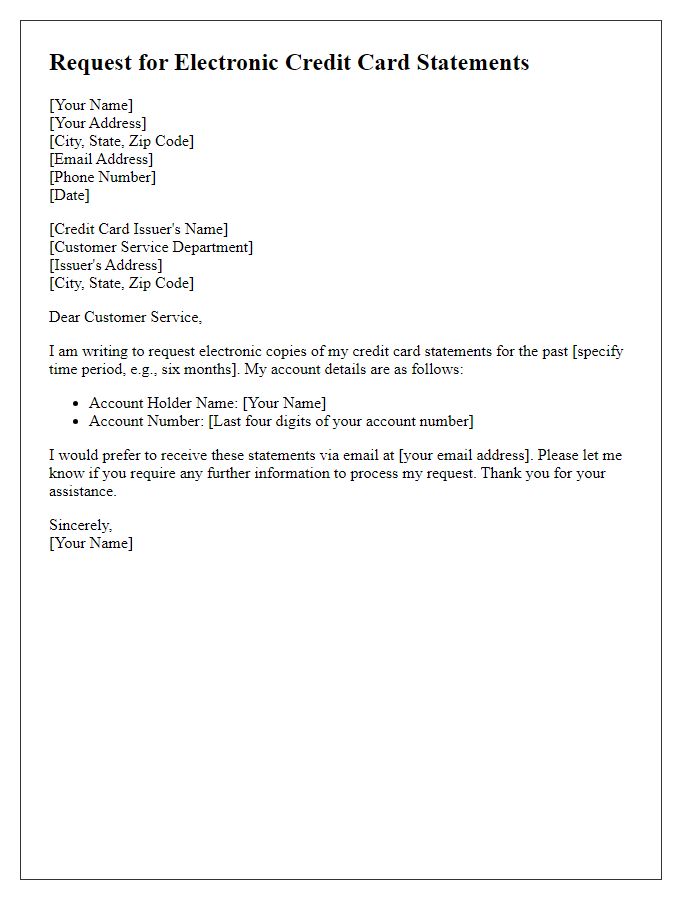

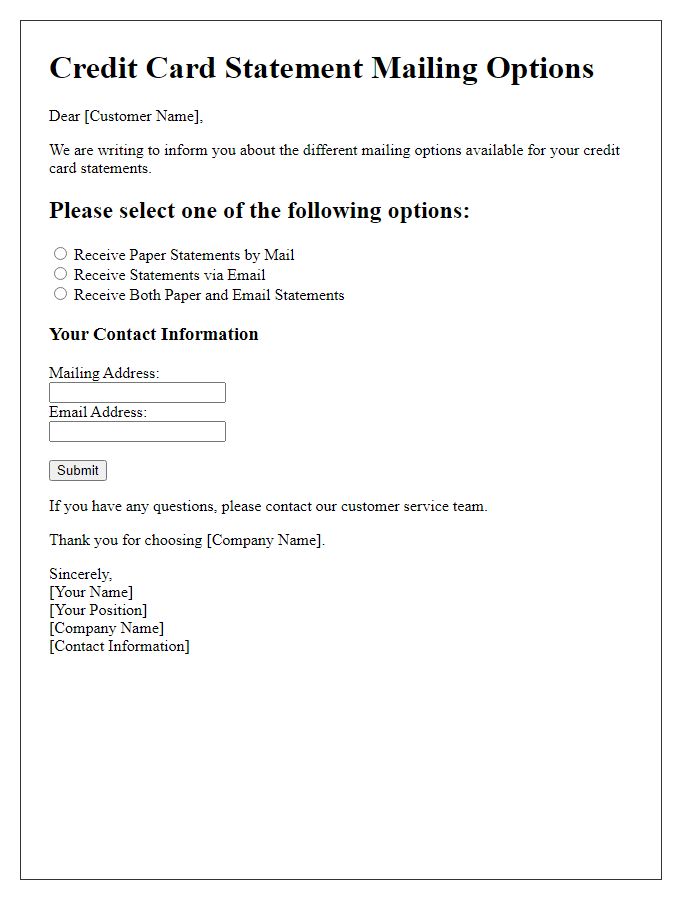

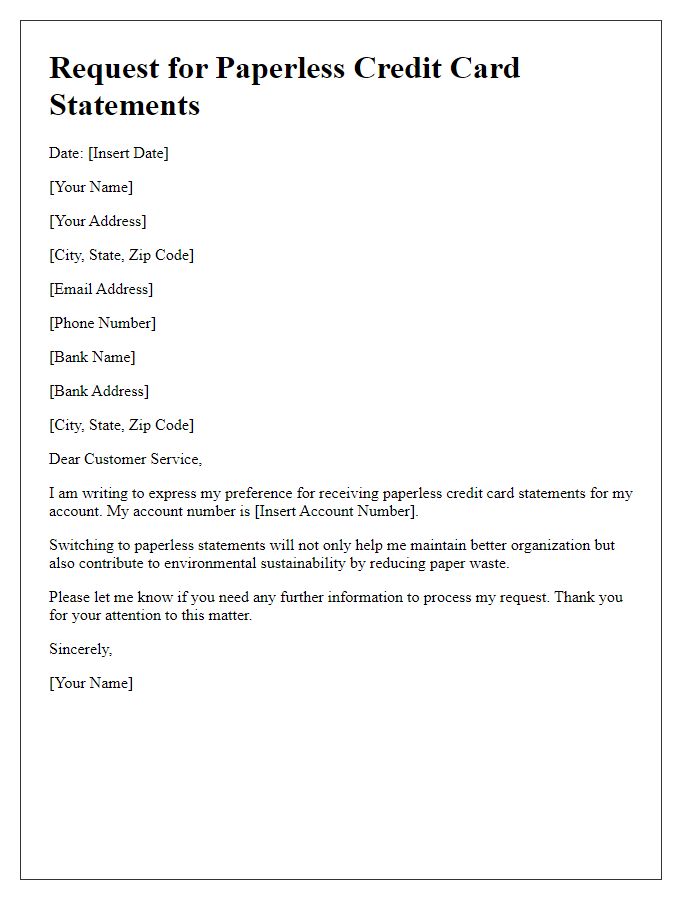

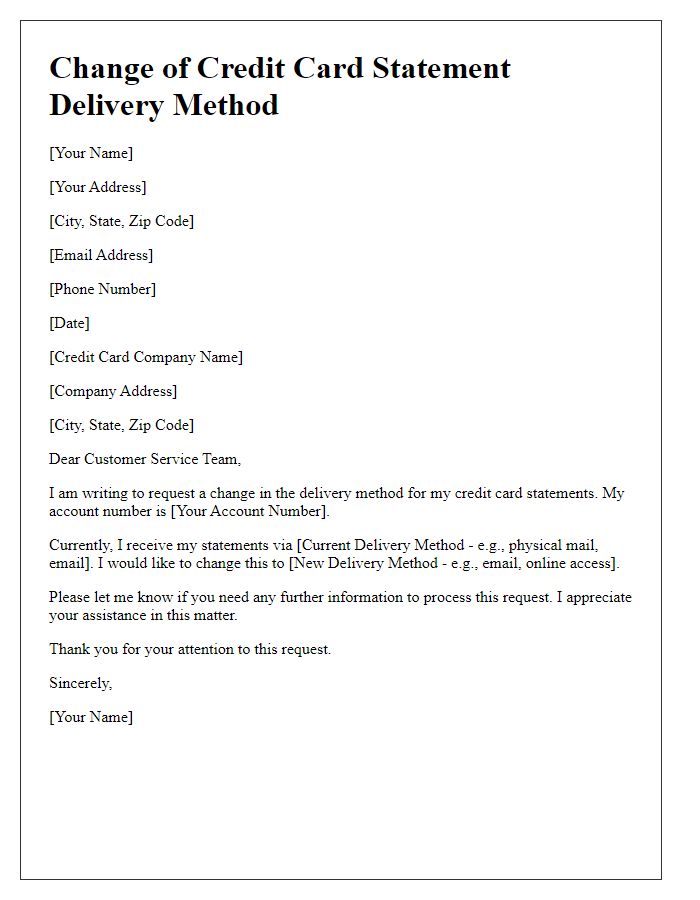

Credit card holders often have preferences regarding how they receive their statements, particularly when it comes to postal delivery. Opting for electronic statements can reduce paper waste significantly, aligning with sustainable practices in places like Europe, where recycling rates reach over 60%. Consumers may also desire statements to be sent to secure locations, ensuring their financial privacy remains intact. For example, some individuals prefer mail delivered to a P.O. Box, reducing the risk of identity theft. Furthermore, the frequency of statements, such as monthly versus quarterly, can impact budgeting and financial planning, particularly for individuals managing household expenses. In this context, understanding and communicating these preferences can enhance customer satisfaction and ensure timely access to important financial information.

Account Information and Number

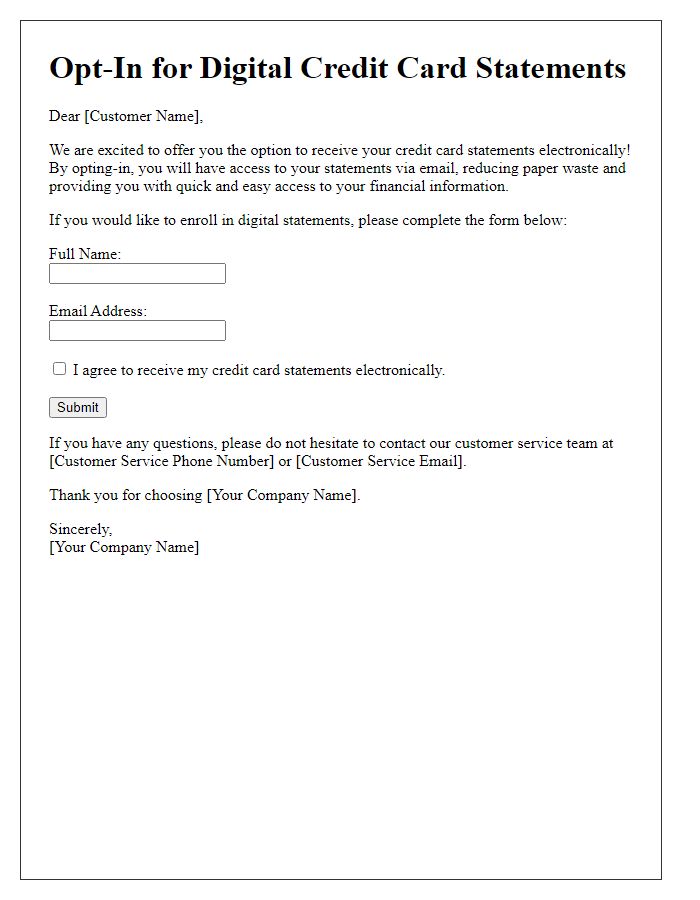

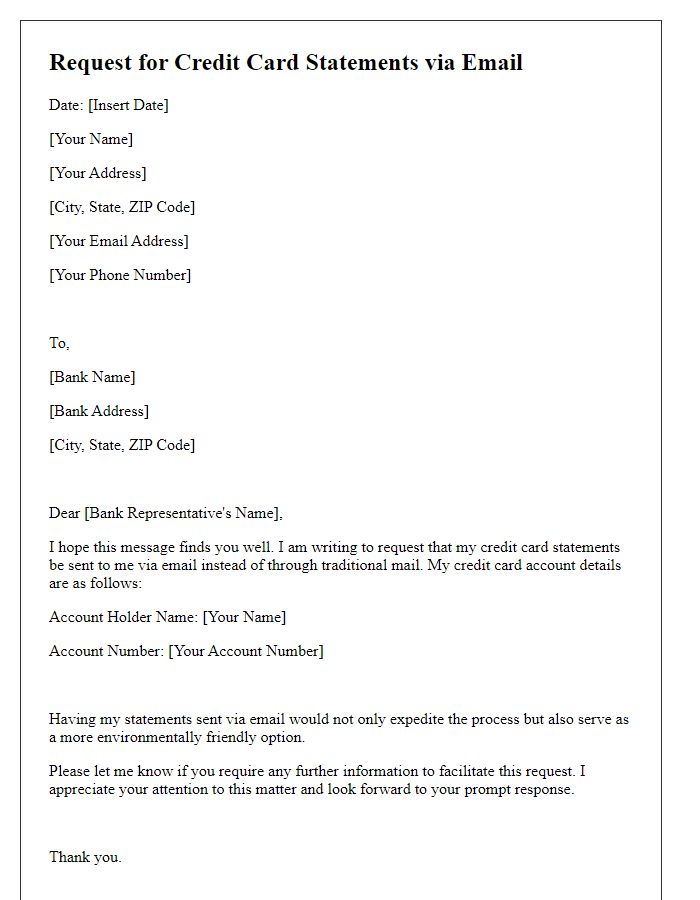

Credit card postal statements often provide essential information regarding account activity, balance, and payment due dates for cardholders. The account information typically includes the account holder's name, a unique account number (usually 16 digits), and the bank or financial institution's name. Cardholders may choose their statement preference, either opting for physical mail sent to their registered address or electronic format through email. Choosing electronic statements can not only enhance accessibility but also promote environmental sustainability, reducing paper waste. Keeping an eye on vital details, such as transaction history, minimum payment requirements, and interest rates, is crucial for effective personal finance management.

Preference Request Statement

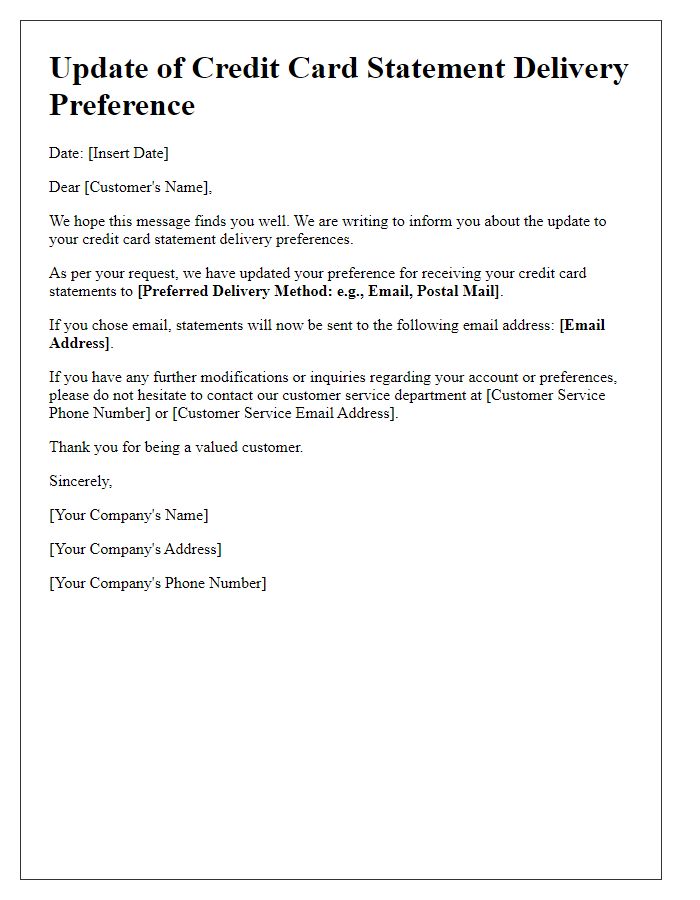

Individuals often prefer receiving their credit card statements via postal mail for various reasons, including privacy concerns and the desire for a tangible record. The communication involves specifying a preference change, such as opting for a physical statement rather than electronic delivery. Notable banks, like Bank of America or Wells Fargo, accommodate these requests through customer service representatives or online banking platforms. Typically, this request may include essential account details, like the account number, cardholder name, and mailing address, ensuring proper identification. Confirmation of this request usually occurs within one billing cycle, as organizations strive to maintain customer satisfaction while adhering to privacy regulations such as the Gramm-Leach-Bliley Act. Understanding the timelines and policies in place for the statement delivery changes is crucial for maintaining financial clarity.

Contact Details for Follow-Up

Credit card companies often offer postal statement preferences for customers who wish to receive their account information through physical mail. Ensuring accurate contact information is crucial for timely delivery and communication. The postal service typically requires a full name (for example, John Smith), a complete mailing address (including street number, city, state, ZIP code), and a valid phone number (preferably a mobile number for speedy follow-ups). Email addresses can serve as an additional contact method, enabling digital correspondence alongside physical statements. Accurate information helps streamline the process of resolving any potential issues that may arise with statements or transactions.

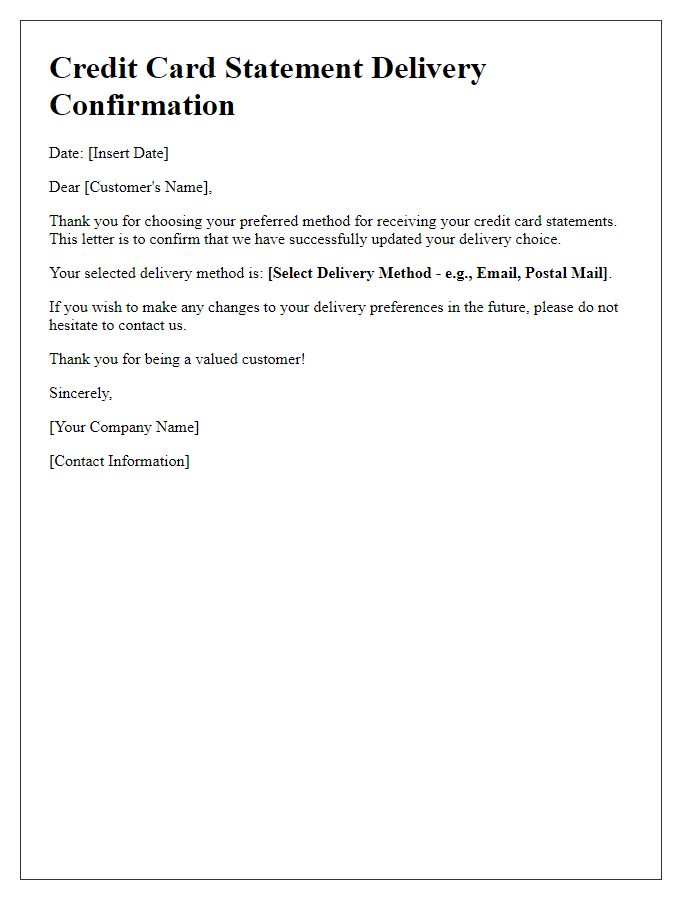

Signature and Date

Credit card statements are often sent via postal mail, impacting consumer preferences regarding the format of their financial documents. Many individuals prefer electronic statements for convenience, while others opt for printed documents due to security concerns. Postal statements typically include vital information such as account balance, due date, and transaction details, printed on official bank letterhead. Consumers indicate their preferences through a signature, which authenticates their request, and a date, marking the submission for record-keeping. Keeping track of these preferences is crucial for financial institutions to deliver personalized service aligned with customer expectations.

Comments