Are you considering helping a loved one build their credit by becoming a co-signer on their credit card? It's a generous gesture, but understanding the implications is just as important as the action itself. In this article, we'll break down what a credit card co-signer agreement entails, the responsibilities it involves, and how it can affect both parties' credit scores. So, if you're ready to learn more about making informed financial decisions together, keep reading!

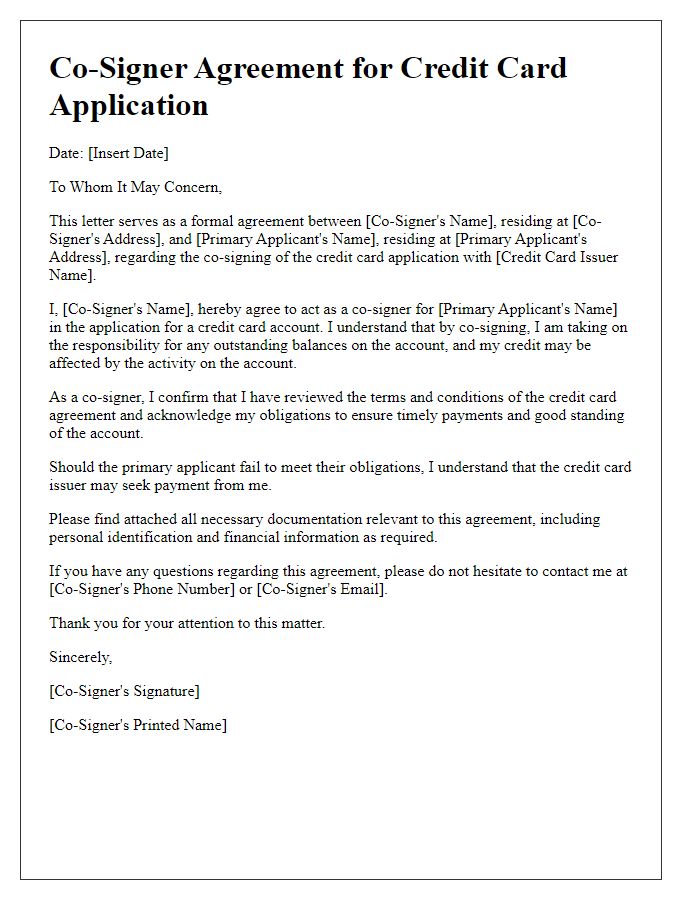

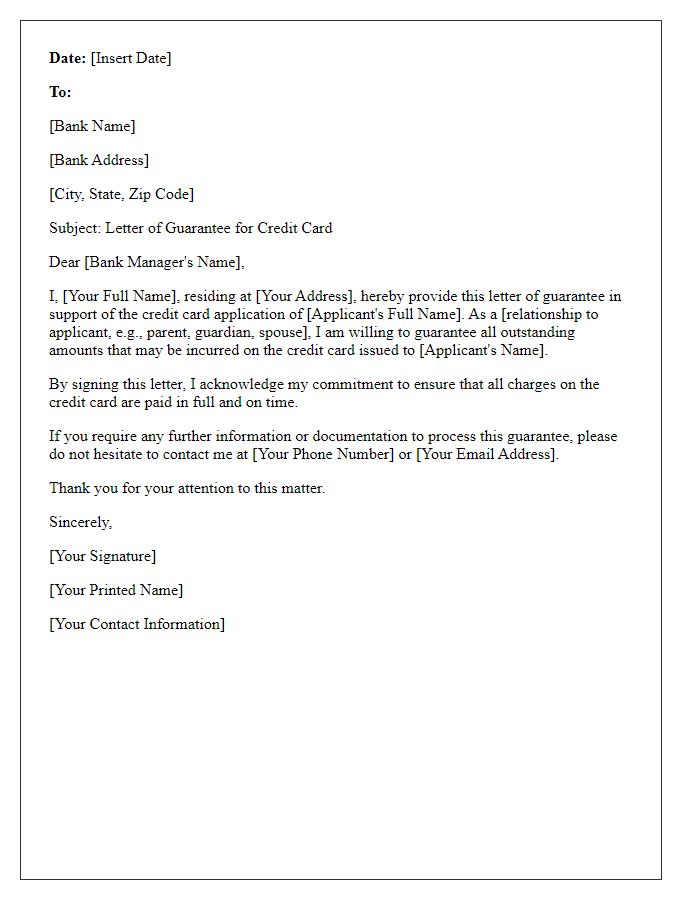

Clear Identification of Parties

A credit card co-signer agreement involves clear identification of the parties involved in the financial contract. The primary cardholder, typically the individual who will be using the credit card, is identified by full name, current address, and Social Security Number (SSN), ensuring accurate credit reporting and accountability. The co-signer, who agrees to take on the responsibility for the credit card debt if the primary cardholder defaults, is also required to provide similar information including full name, address, and SSN. This identification process is crucial as it establishes a legal framework for the co-signing relationship, protecting the interests of both parties and allowing financial institutions to assess credit risk accurately. Understanding the implications of this agreement is vital, particularly considering that co-signers may impact their credit scores based on the primary cardholder's usage and repayment behavior.

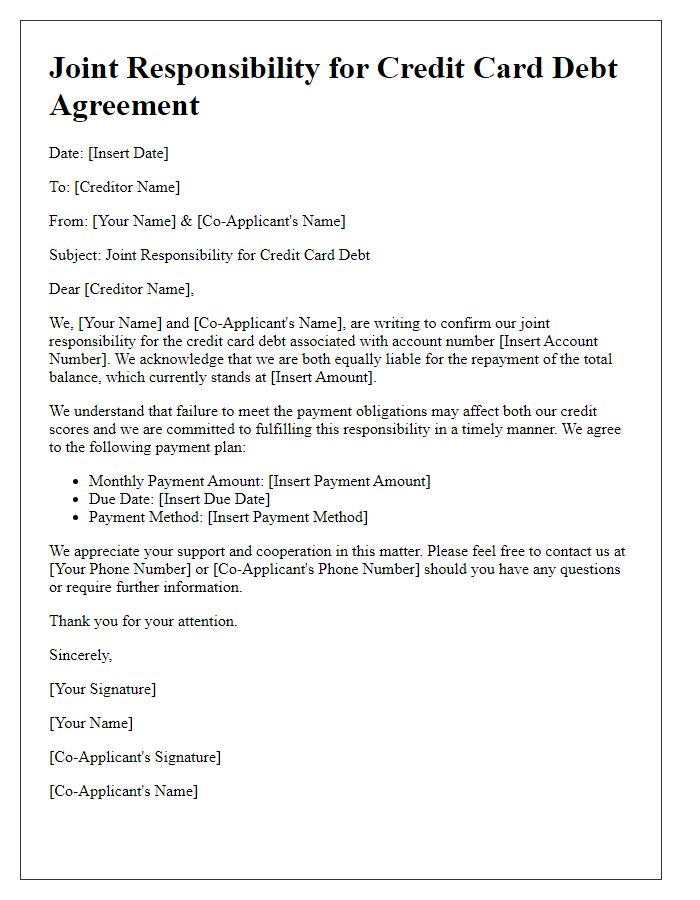

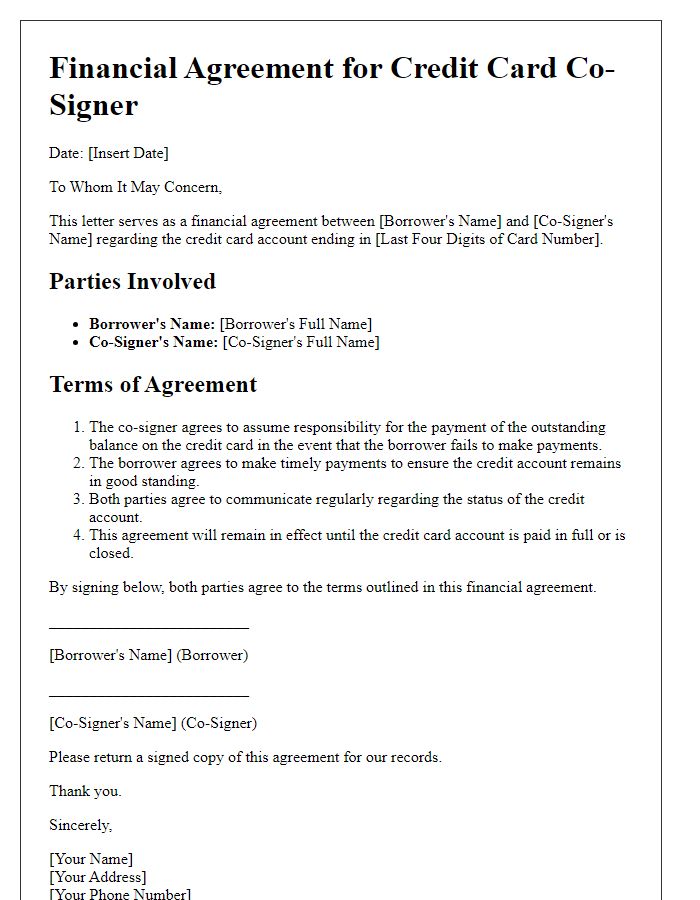

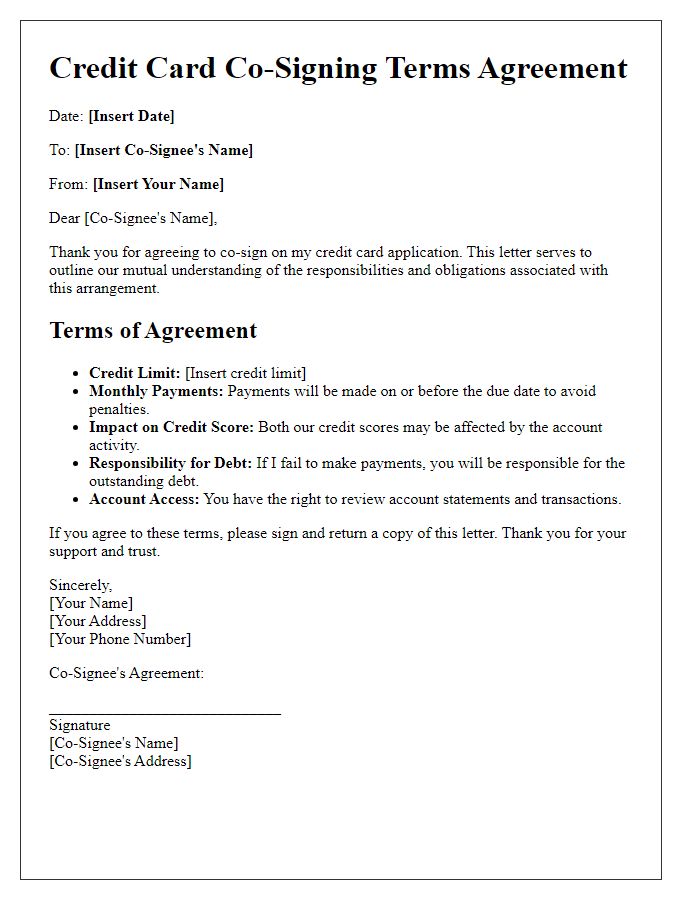

Terms and Conditions

A credit card co-signer agreement ensures accountability between the primary cardholder and the co-signer. The agreement typically outlines obligations concerning repayment responsibilities, which include the credit limit set by the financial institution, interest rates (often around 15%-25% APR), and monthly payment schedules. Both parties must understand the impact on credit scores; late payments can negatively affect both individuals' credit reports. The agreement also specifies consequences for defaults, including potential legal actions or fees. A clear understanding of usage restrictions, such as limits on exceeding the credit limit and the necessity of notifying the co-signer for significant purchases, is essential for fostering trust and financial responsibility.

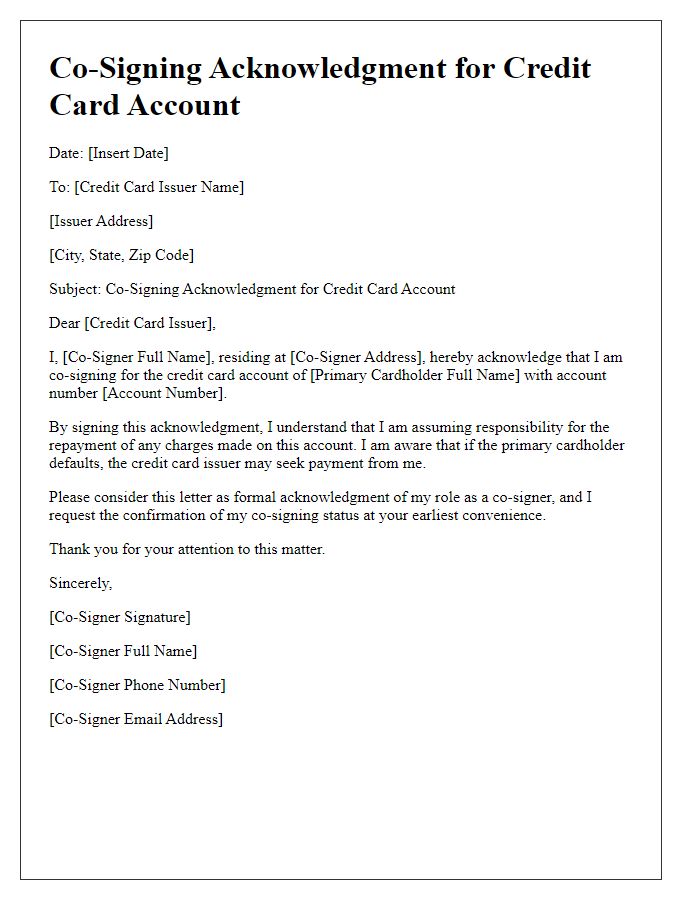

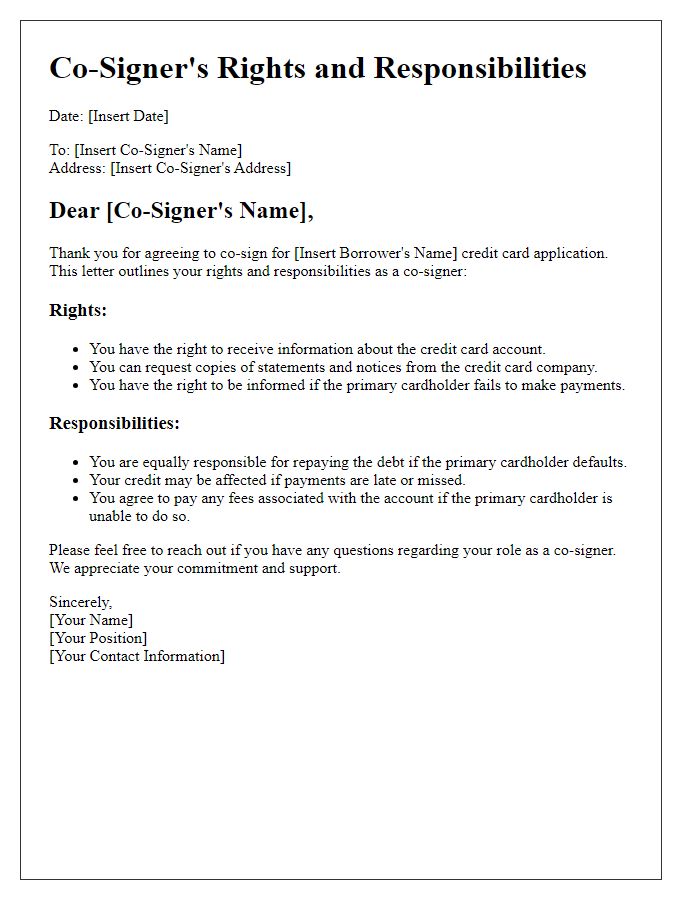

Responsibilities and Obligations

A credit card co-signer agreement establishes the responsibilities and obligations of both the primary cardholder and the co-signer, typically involving individuals such as family members or close friends. The primary cardholder, often a student or someone with limited credit history, utilizes the card issued by financial institutions like Visa or American Express to manage expenses, while the co-signer guarantees payment, assuming financial liability. This contractual arrangement often includes specific terms regarding joint responsibility for monthly payments, which can average around $200 to $500, along with potential fees for late payments or exceeding the credit limit. Defaulting on these obligations can severely impact the credit scores of both parties, with negative consequences lingering for seven years. It's crucial for both individuals to understand their rights and responsibilities, including the risk of legal action by the card issuer, such as collection efforts, should the debt remain unpaid.

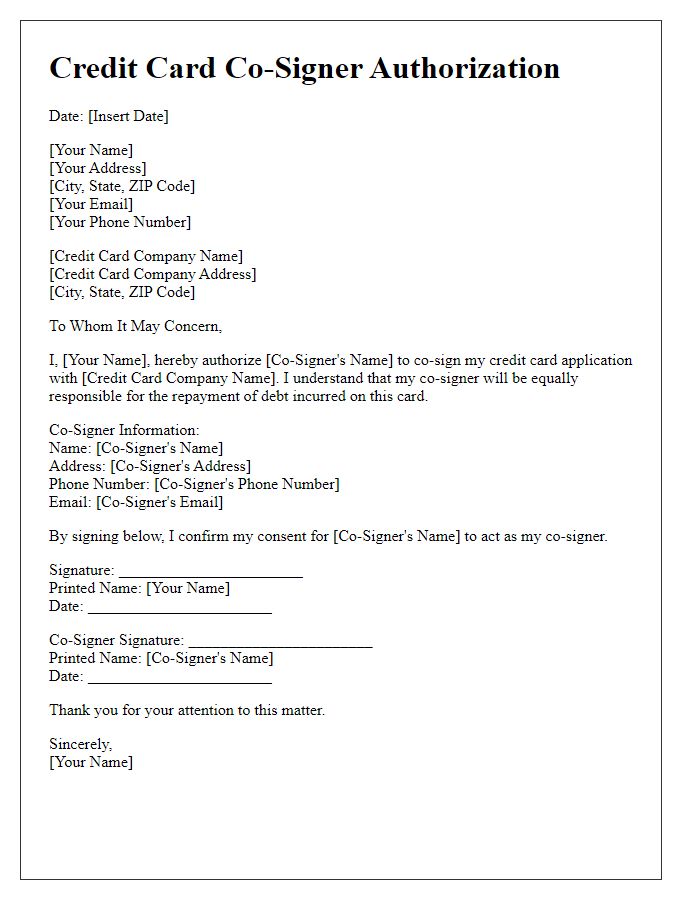

Credit Card Details

A credit card co-signer agreement typically includes essential information about the credit card details pertaining to the shared financial responsibility between the primary cardholder and the co-signer. The agreement should specify the credit card issuer, such as Visa or MasterCard, and include the unique credit card number (often 16 digits). It should also detail the credit limit allocated to the card, which may range from a few hundred to several thousand dollars, depending on the creditworthiness of the applicants. The agreement must outline the billing cycle, commonly spanning 30 days, and state the associated annual percentage rate (APR), possibly ranging from 0% introductory offers to 29.99% for individuals with lower credit scores. Payment due dates and minimum payment requirements should be clearly specified to avoid potential late fees and negative credit reporting. The responsibilities and liabilities of both primary cardholder and co-signer must be articulated, ensuring mutual understanding of their obligations towards timely payments and account management.

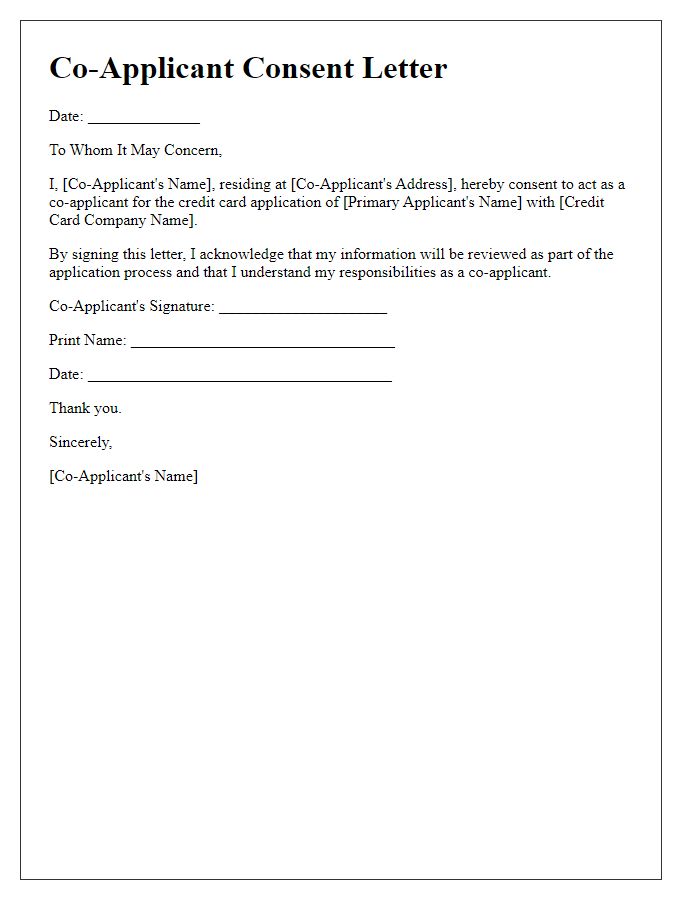

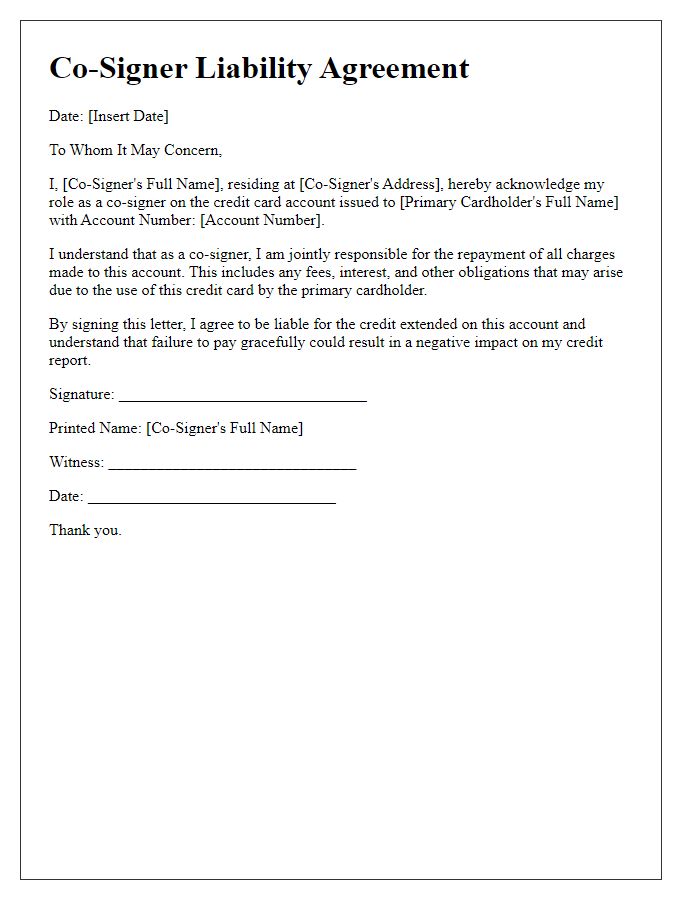

Signature and Date Blocks

Co-signing a credit card agreement ensures shared responsibility for the payment of the debt incurred on the account. Both parties, typically the account holder (primary borrower) and the co-signer, must provide signatures to validate the agreement. The signature section may include designated lines for each individual's signature, alongside corresponding date fields to confirm when each party signed the document. It is crucial to note that the co-signer's credit history will be impacted by the primary borrower's payment behaviors, making understanding the responsibilities clear during this process essential for both parties. This agreement aid in building or improving credit scores, contingent on timely payments made on the account.

Comments