Are you feeling overwhelmed by high loan interest rates and looking for a way to ease your financial burden? You're not aloneâmany individuals find themselves in similar situations, seeking relief from mounting payments. In this article, we'll explore how to effectively request a loan interest reduction, equipping you with the tips and templates you need to communicate your needs clearly. Ready to take control of your finances? Let's dive in!

Personal and financial information

To request a loan interest reduction, personal and financial information should include: full name, confirming identity with a Social Security number or Tax ID, current address detailing the residential state or region, contact number for direct communication, email address for official correspondence, loan account number linked to the specific loan, current interest rate clearly stated, monthly payment amount specifying regular commitments, total outstanding loan balance listing principal and accrued interest, employment details including employer name and duration of employment, monthly income showing consistent earnings, and additional financial obligations such as credit card debts or other loans impacting financial stability. This information is crucial for assessing eligibility and potential for interest rate modifications.

Current loan details

Current loan details include principal amount totaling $150,000, monthly payment scheduled at $1,200, and interest rate fixed at 5.5%. The loan originates from ABC Bank, initiated in March 2020. Over the past three years, economic factors caused fluctuations resulting in lower market rates. Current promotional rates offered by competitors now average around 3.0%, creating financial strain on borrowers. Reduction in interest rate from 5.5% to 3.5% could significantly lower monthly payments, improving financial stability and encouraging timely repayment.

Reason for requesting interest reduction

High interest rates on loans, particularly for variable-rate loans such as those tied to the prime rate, can significantly impact monthly financial obligations. Borrowers may experience fluctuating payments due to shifts in market conditions, making budgeting difficult. Economic indicators such as inflation rates (recently averaging 6.2% annually in the U.S.) can further strain resources. In addition, situations such as job changes, health emergencies, or unexpected expenses can arise, prompting the need for a temporary reduction in interest rates. A lower interest rate can provide immediate relief to borrowers, improving cash flow and enhancing the ability to meet repayment obligations. Further, a reduced interest rate can also allow borrowers to redirect funds toward essential needs, fostering better financial stability during challenging times.

Supporting documents or evidence

Requesting a loan interest reduction can significantly decrease monthly financial burdens for borrowers struggling with mounting payments. When preparing a formal request, essential supporting documents may include recent bank statements, showcasing current financial standing, income verification forms such as pay stubs or tax returns, and a detailed budget report highlighting expenses versus income. Additionally, a letter of hardship explaining any unforeseen circumstances like job loss or medical emergencies serves to strengthen the case. Providing evidence of timely payments prior to any difficulty can further demonstrate reliability to the lender, reflecting a commitment to managing loan obligations responsibly.

Offer to negotiate terms

Individuals facing financial pressure often seek a loan interest reduction to ease monthly payment burdens. A compelling request could include relevant personal financial circumstances, current interest rates compared to market averages, and timely payment history to establish reliability. Pursuing negotiation might include proposing alternative repayment options, such as extending the loan term or modifying payment schedules to ensure a feasible yet responsible path towards loan repayment. Engaging in these discussions can foster mutual understanding with the lender, potentially resulting in a more manageable financial obligation.

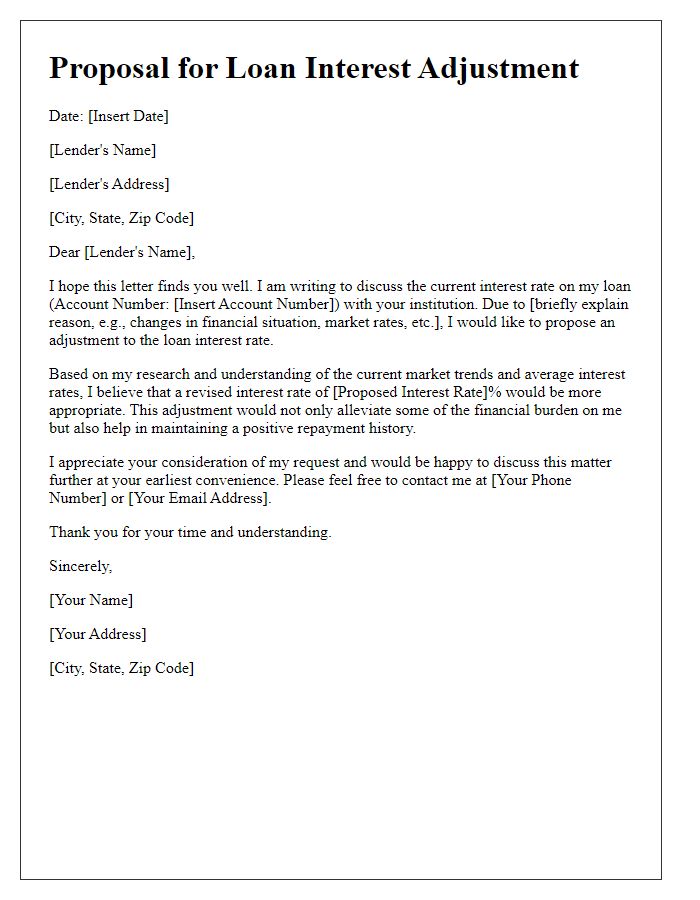

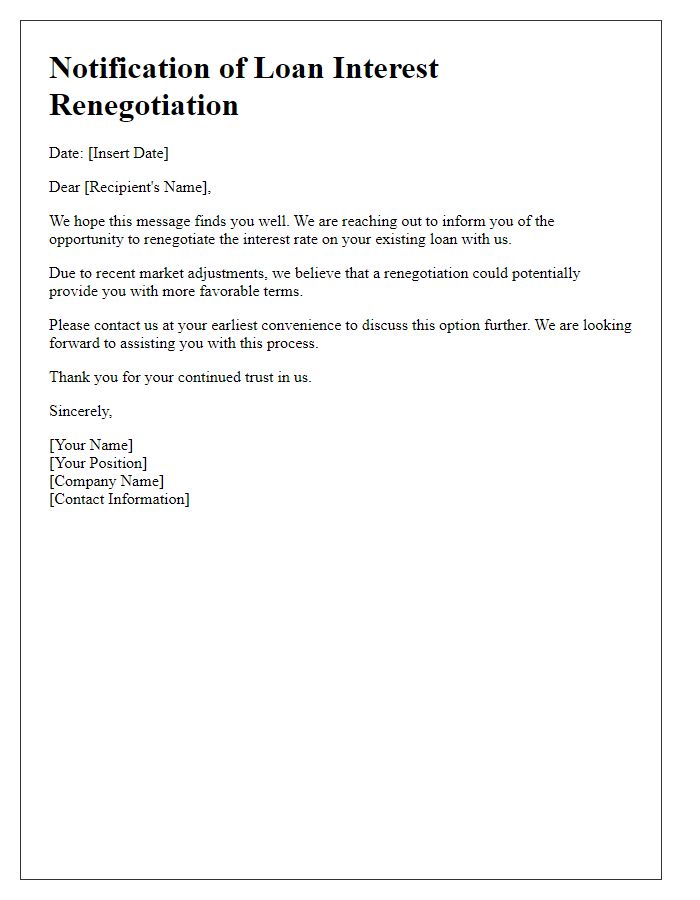

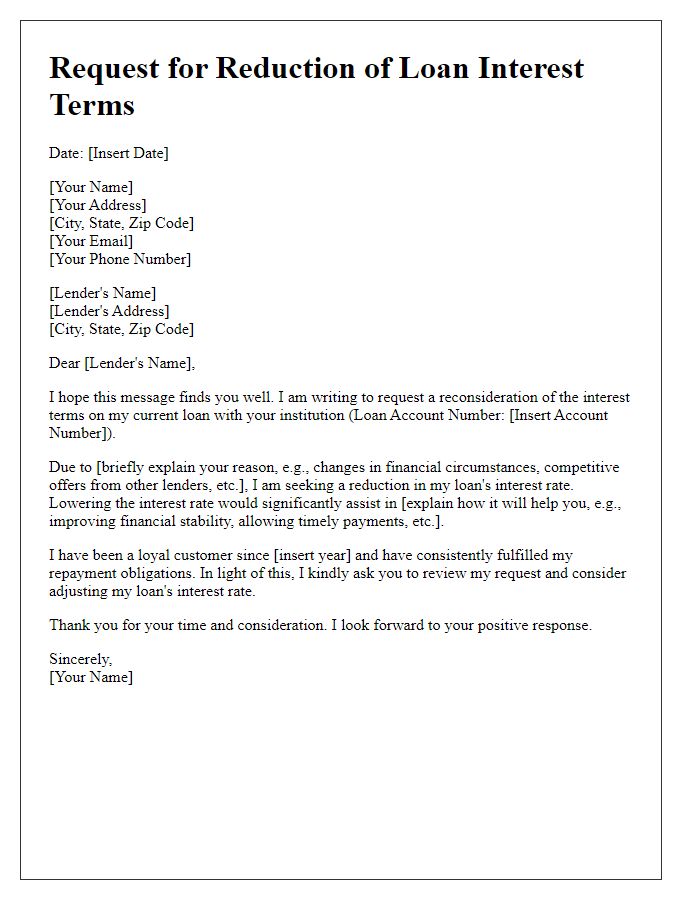

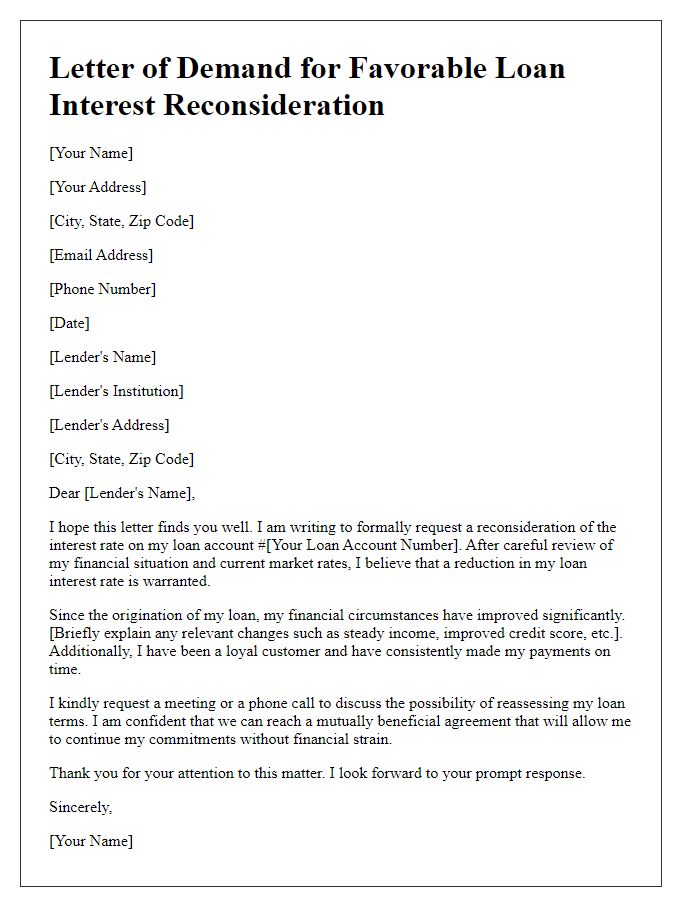

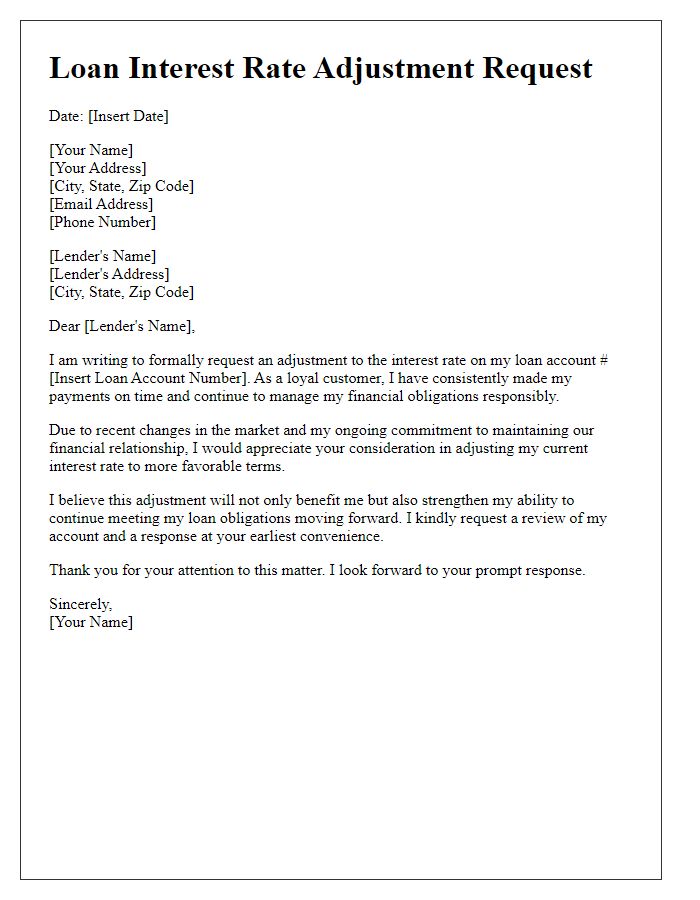

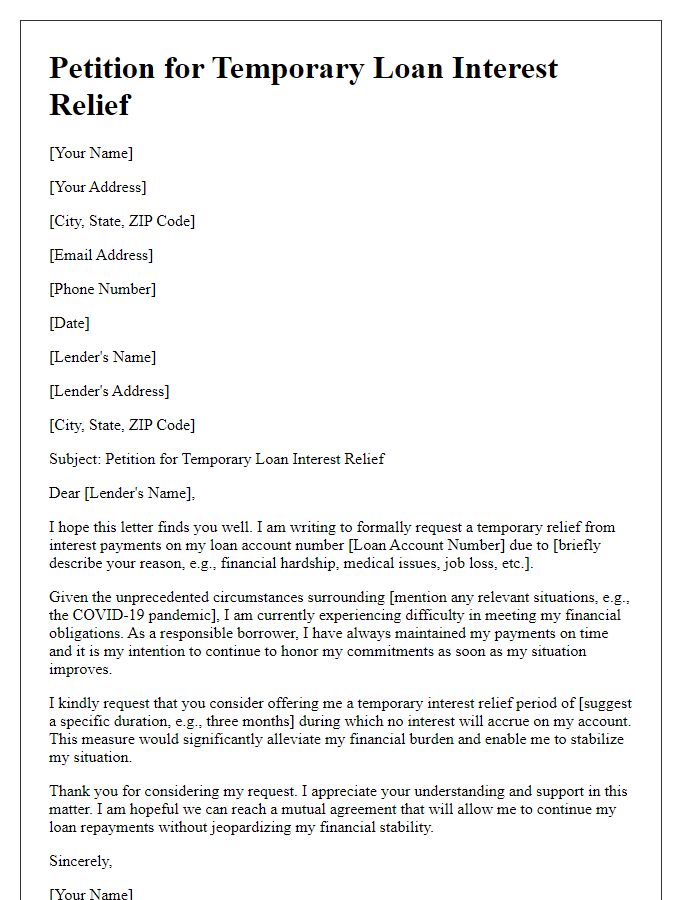

Letter Template For Requesting Loan Interest Reduction Samples

Letter template of application for interest rate reduction on existing loan

Comments