Have you ever found yourself in a tough spot financially, especially when your business is facing unexpected income interruptions? It can be daunting to explain these challenges, especially when applying for a business loan. In this article, we'll explore how to effectively communicate your situation in a letter template designed specifically for this purpose. Join us as we dive into key strategies and tips to craft a compelling narrative that captures your circumstances and keeps your lender informed.

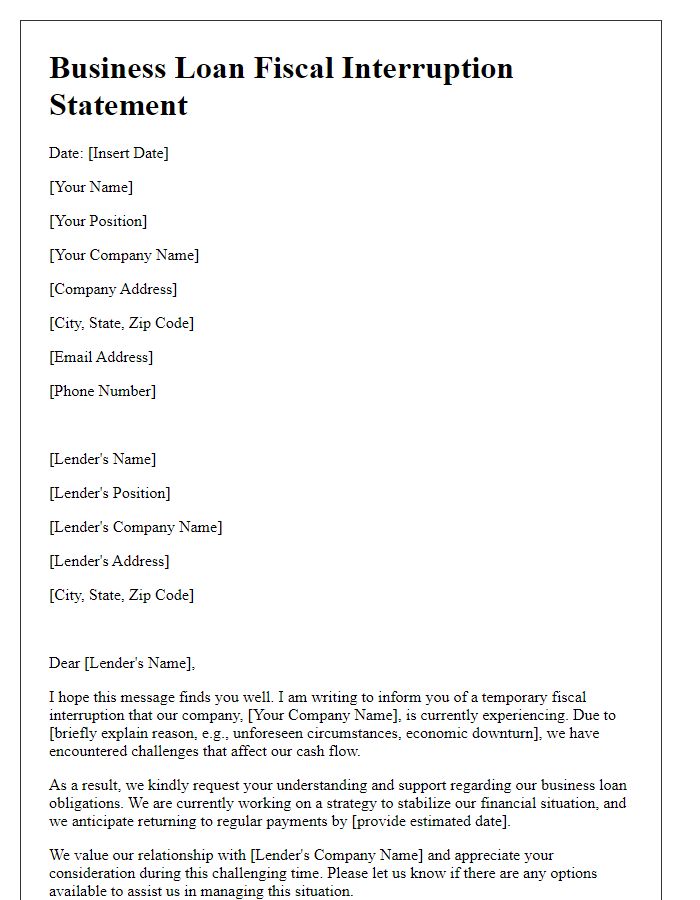

Clear Subject Line

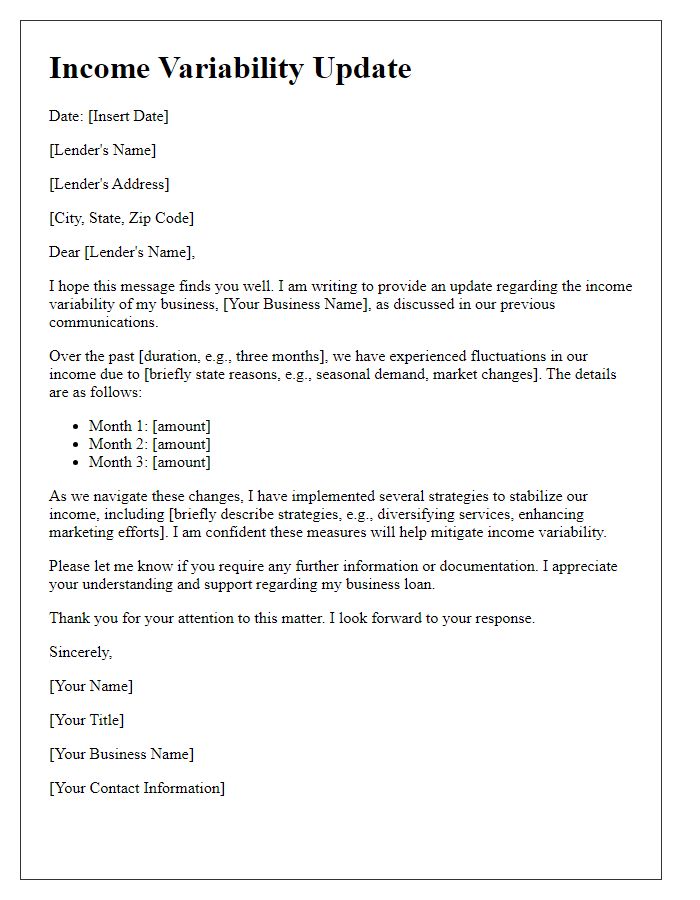

In many cases, businesses face unexpected financial challenges that can hinder cash flow, such as economic downturns, global events, or shifts in consumer behavior. For instance, small businesses that rely on seasonal tourism can experience income interruption during off-peak months or due to restrictions affecting travel, such as those imposed during the COVID-19 pandemic. These interruptions can lead to reduced revenues, impacting the ability to repay loans obtained from lenders, such as banks or credit unions. Documenting specific instances of income loss, including percentage drops or dollar amounts, can provide a clearer picture to lenders when explaining the situation. Transparency about the reasons for income interruption, alongside a strategy for recovery, can help build trust and foster a collaborative approach for renegotiating loan terms.

Formal Salutation

A significant drop in business revenue can impact operations, particularly for small businesses relying on consistent cash flow. Factors such as economic downturns, localized events like natural disasters or pandemics, and seasonal fluctuations can contribute to income interruption. For example, restaurants often experience decreased patronage during off-peak seasons or unprecedented events, affecting their ability to service loans. Comprehensive documentation of income statements, along with forecasts and recovery plans, is essential for lenders assessing the viability of future repayments. Additionally, transparent communication regarding the situation enhances trust and fosters potential assistance or restructuring options.

Concise Introduction

The recent global pandemic has significantly impacted various sectors, leading to unexpected income interruptions for many businesses. In particular, small enterprises, facing sudden declines in revenue streams, have struggled to maintain operations and fulfill financial obligations such as loan repayments. Current economic conditions, including decreased consumer spending and supply chain disruptions, underscore the challenges faced by businesses in managing cash flow effectively. As a result, some owners are seeking targeted support to navigate these turbulent times and sustain operations until recovery begins.

Detailed Explanation of Interruption

A business loan can face significant income interruption due to unforeseen circumstances, such as economic downturns, natural disasters, or global events like the COVID-19 pandemic. For instance, many small businesses in the hospitality industry, particularly restaurants located in urban centers, experienced a dramatic reduction in revenue, with some reporting a 70% decline in sales during lockdown periods in 2020. Additionally, supply chain disruptions have led to increased operational costs and delayed product availability, further straining cash flow. Business owners may find it challenging to cover fixed expenses, such as rent for commercial spaces in bustling areas like Times Square, which can exceed $50,000 monthly, creating an urgent need for financial support. This context highlights the complexities surrounding income interruptions, necessitating clear communication with lenders regarding the specific challenges faced and future recovery plans.

Proposed Solutions or Next Steps

An income interruption in a business loan situation often arises due to unforeseen events, such as economic downturns, natural disasters, or global pandemics like COVID-19. Key stakeholders, including lenders and borrowers, require a clear understanding of the proposed solutions to navigate financial difficulties. One effective approach involves restructuring the loan terms, potentially reducing interest rates or extending the repayment period to accommodate fluctuating income levels. Additionally, implementing a temporary moratorium on payments can provide immediate cash flow relief. Other strategies include applying for government relief programs designed to support struggling businesses or exploring alternative financing options, such as lines of credit or grants. Clear communication with financial institutions is vital to establish a collaborative plan that ensures business viability while fulfilling loan obligations.

Comments