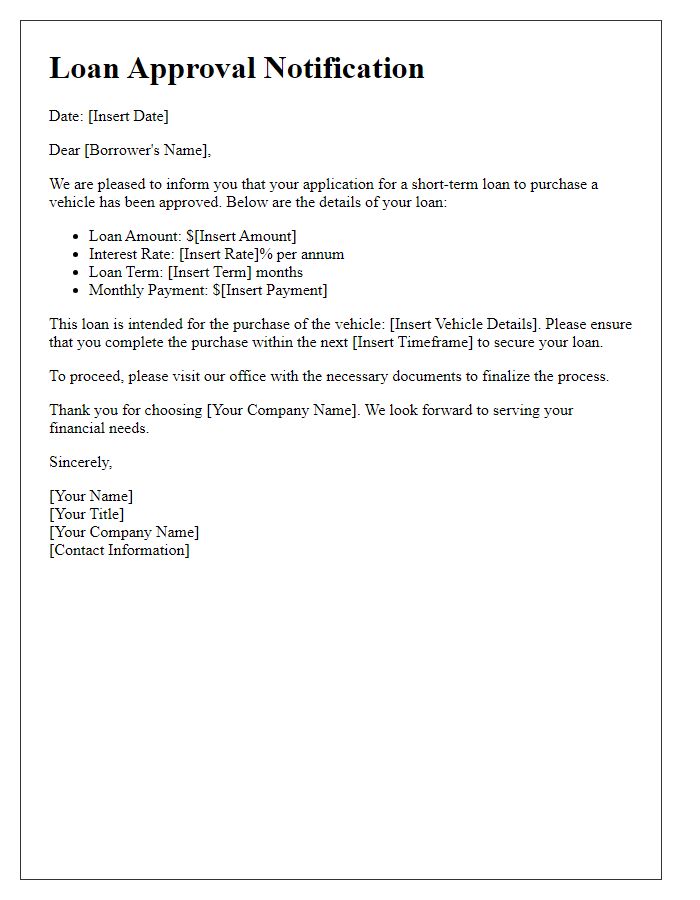

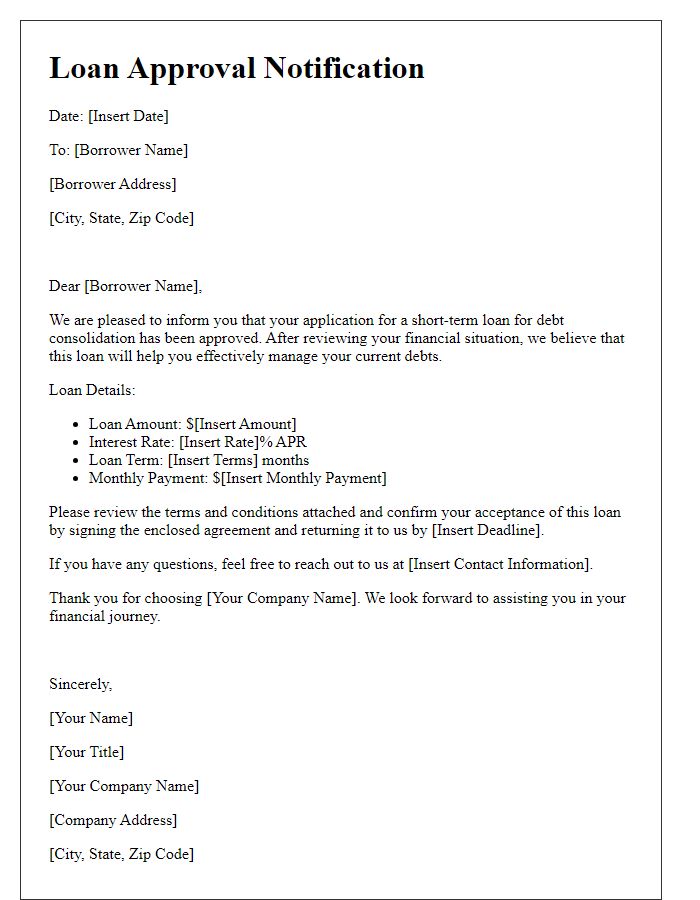

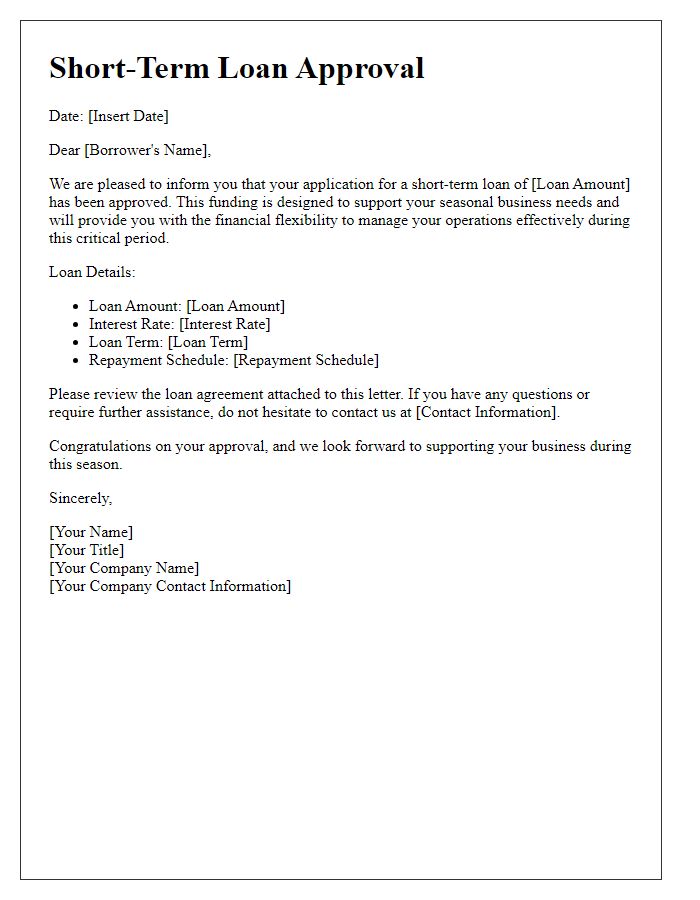

Are you in need of a quick financial boost? Whether it's for an unexpected expense or a special occasion, securing a short-term loan can be a seamless solution. Our letter template for short-term loan approval simplifies the process and ensures you present all necessary information to increase your chances of approval. Dive into our guide to discover tips and examples that will help make your application stand out!

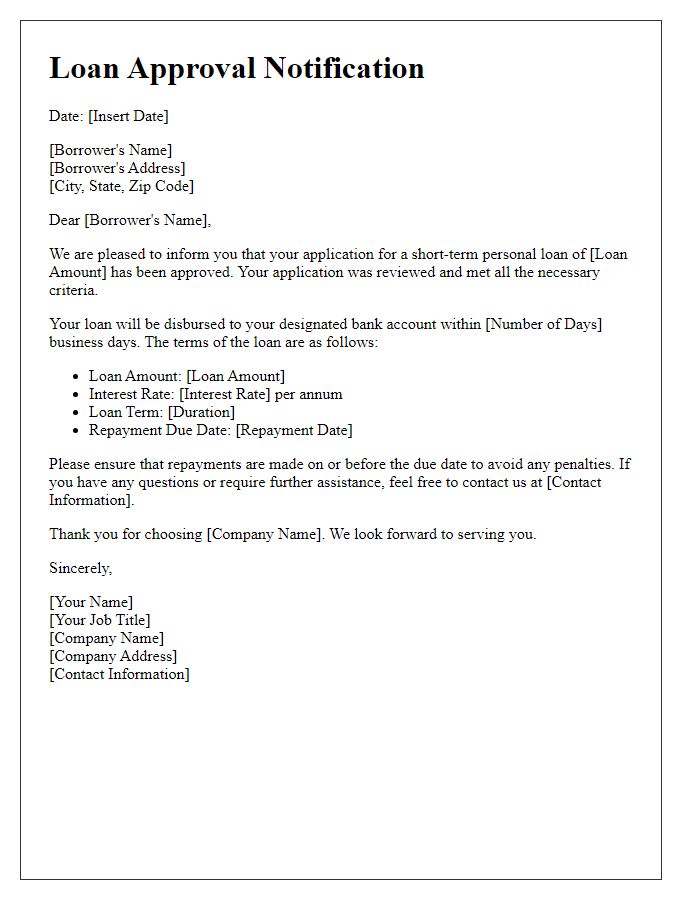

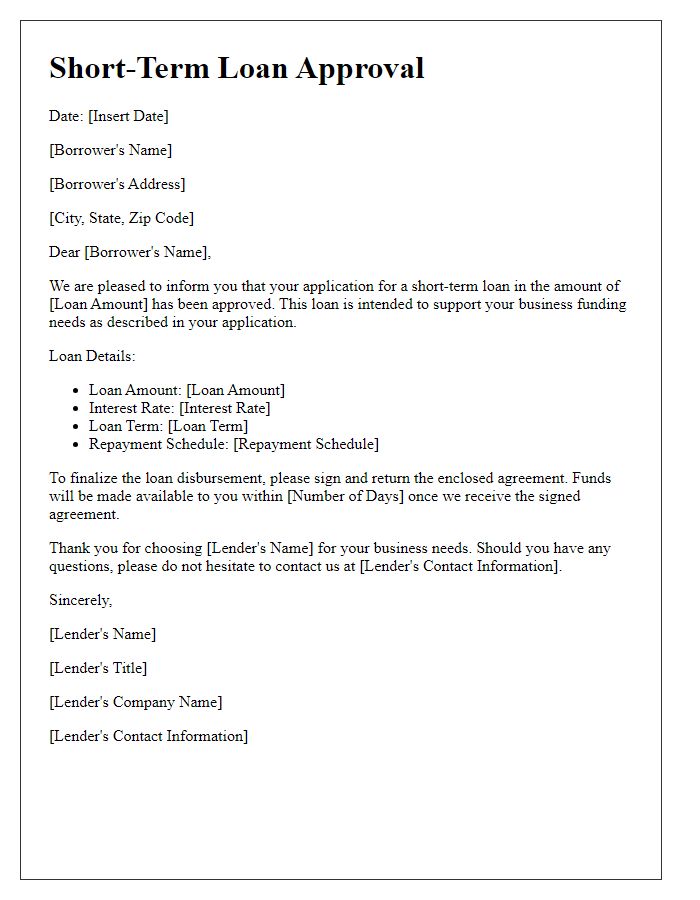

Loan amount and terms

A short-term loan approval typically involves specific loan amounts and terms tailored to individual borrower needs. Common loan amounts range from $1,000 to $50,000, with repayment periods often spanning 3 to 12 months. Interest rates may vary significantly, usually falling between 5% to 30%, depending on the lender's evaluation of the borrower's creditworthiness. Borrowers may also be required to provide collateral, such as property or other valuable assets, to secure the loan. Additionally, fees associated with loan processing and origination can range from 1% to 5% of the total loan amount, impacting the overall cost of borrowing. Understanding these aspects is crucial for borrowers considering a short-term loan.

Interest rate and repayment schedule

Short-term loans often come with specific interest rates tailored to the borrower's creditworthiness and the lender's policies. Typical interest rates for short-term loans can range from 5% to 30%, depending on the amount borrowed and duration of the loan. Repayment schedules usually span a few months to a year, with monthly installments designed to align with the borrower's financial capabilities. Lenders often provide clear breakdowns of principal and interest, ensuring that borrowers understand their obligations. Key terms may include specific due dates and potential penalties for late payments or defaults, which can impact overall costs significantly.

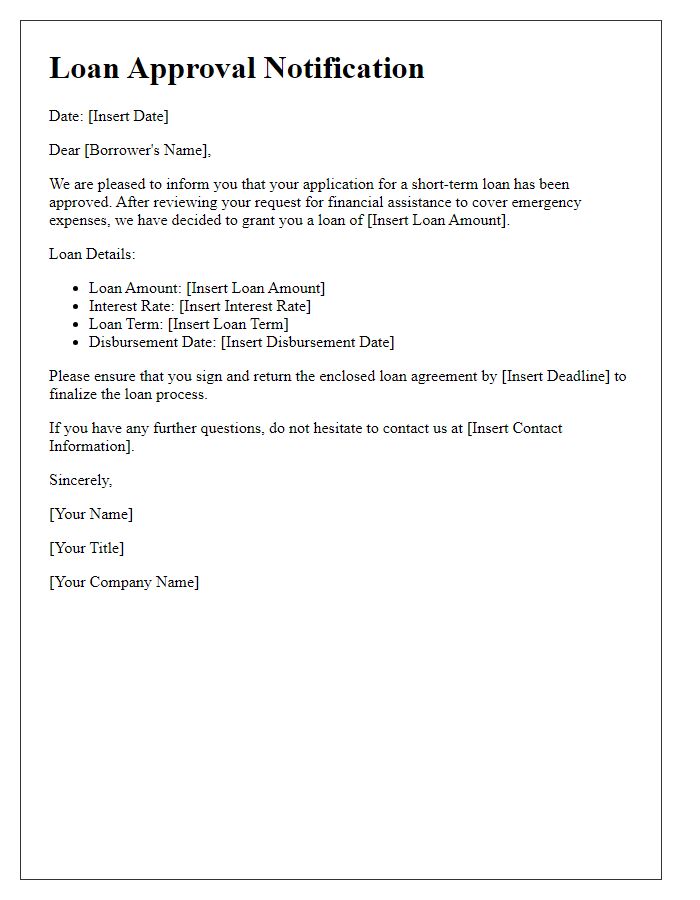

Borrower's personal and financial information

Short-term loans often require specific borrower personal and financial information for approval, ensuring lenders evaluate the applicant's creditworthiness. Essential details include full name, permanent address, date of birth for age verification, and Social Security Number for identity confirmation. Additionally, financial information such as monthly income, employment status (full-time, part-time, or self-employed), and bank account details are crucial. Lenders typically require recent pay stubs or tax returns to verify income stability. Credit score, obtained from agencies like Equifax or TransUnion, also influences approval chances. Providing accurate, comprehensive information increases the likelihood of securing the loan.

Approval conditions and requirements

Short-term loans offer quick financial relief to individuals or businesses facing cash flow issues, often with approval conditions encompassing creditworthiness assessments, income verification, and collateral requirements. Typically, lenders such as banks or credit unions review applicants' financial history (including credit scores above 600) to determine eligibility. Additionally, a steady income (often requiring proof of stable employment or bank statements from the last three months) is essential to ensure the borrower can repay the loan on time. Furthermore, having collateral (assets like vehicles or real estate) may enhance the likelihood of approval, as it provides the lender with security should the borrower default. Interest rates for short-term loans can vary significantly, often ranging from 6% to 36%, depending on the lender and risk factors associated with the borrower.

Contact information for inquiries and assistance

Approval of short-term loans often requires clear communication channels for inquiries and assistance. Essential contact details include a dedicated customer service hotline (e.g., 1-800-555-0199) available Monday through Friday from 8:00 AM to 8:00 PM EST. Additionally, an email support option (support@loancompany.com) allows for inquiries outside business hours. For urgent matters, a live chat feature on the company website (www.loancompany.com) provides real-time assistance. FAQs on the website address common concerns (application process, repayment terms), while a physical mailing address (123 Finance Ave, Suite 100, New York, NY 10001) is available for formal correspondence regarding loan terms and agreements.

Comments