Are you considering a revision of your mortgage rate agreement? It's a smart move that could save you a significant amount on your monthly payments. In this article, we'll walk you through the essential steps to successfully navigate this process, ensuring you're well-informed and equipped with the right tools. So, grab a cup of coffee and dive in to discover how you can optimize your financial future!

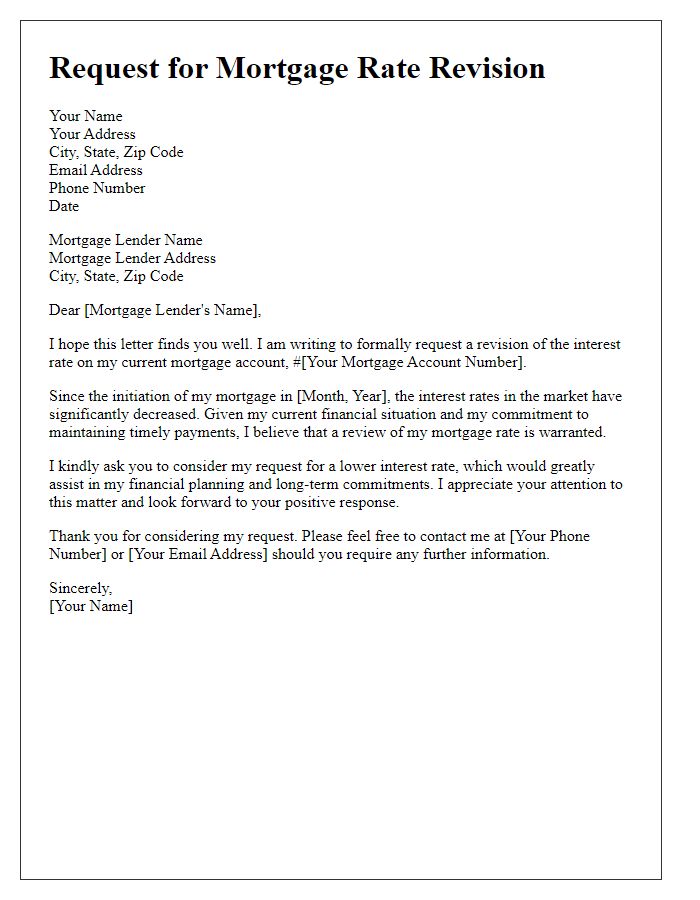

Borrower Information

The mortgage rate agreement revision process requires comprehensive borrower information, including full name, residential address (street, city, state, ZIP code), social security number, and contact information (phone number, email). Documents such as the original mortgage agreement (dated and signed), recent pay stubs (preferably for the last two months), and bank statements (covering the last two months) also play a crucial role in assessing eligibility for a revised rate. Additionally, information about current loan balance, property value (estimated through recent appraisals or market analysis), and payment history (showing any late payments or consistent on-time payments) is essential for lenders when evaluating the request for adjustments.

Lender Details

Revising mortgage rate agreements typically involves important discussions with financial institutions. Key entities include the lender, which may be a bank such as JPMorgan Chase, a credit union like Navy Federal, or a secondary mortgage market entity such as Fannie Mae. Mortgage rates, often influenced by the Federal Reserve's interest rate decisions, can fluctuate significantly; for example, a 30-year fixed mortgage rate might range from 2.5% to 4.5% depending on economic conditions and the borrower's credit score. The timeline for submitting a revision request can vary, but lenders usually respond within 30 days. Additionally, closing costs and fees--averaging around 3% to 6% of the loan amount--should also be considered during this process to fully understand the financial implications of any mortgage adjustments.

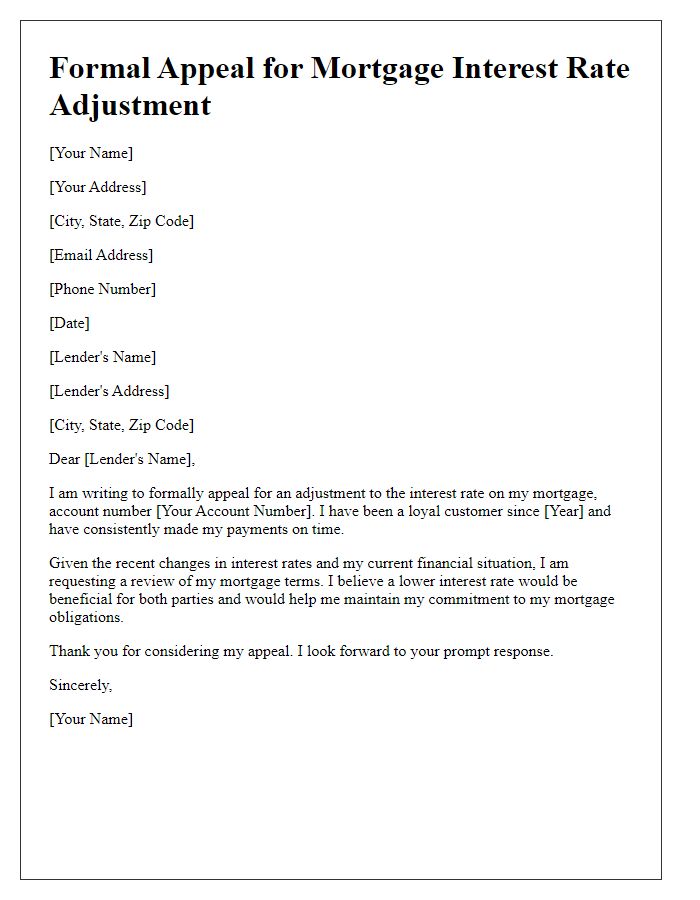

Current Mortgage Terms

Current mortgage terms typically include key details such as the loan amount (for example, $250,000), interest rate (such as 4.5% fixed), loan term (usually 30 years), and monthly payment amount (approximately $1,263). These terms determine the total cost of the mortgage over its lifespan, including the total interest paid (which could exceed $186,000 over 30 years). Understanding the implications of rate changes, including how adjustments to the interest rate can impact monthly payments and total interests, is essential for financial planning and budget management. A revised agreement can address changing market conditions and potential savings on overall costs.

Requested Rate Changes

Adjusting mortgage rates can significantly impact borrowers' financial positions, especially considering fluctuations in prevailing interest rates. For example, a change from a fixed rate of 4.5% to a new suggested rate of 3.7% could lead to substantial savings over the loan term, particularly for a 30-year fixed mortgage of $300,000. The timing of such modifications can also be crucial, with current market trends influenced by economic indicators like the Consumer Price Index (CPI) and Federal Reserve interest rate decisions. Homeowners should meticulously review their agreements to understand potential fees or penalties associated with changing terms, ensuring clarity in communication with lenders located in their specific regions.

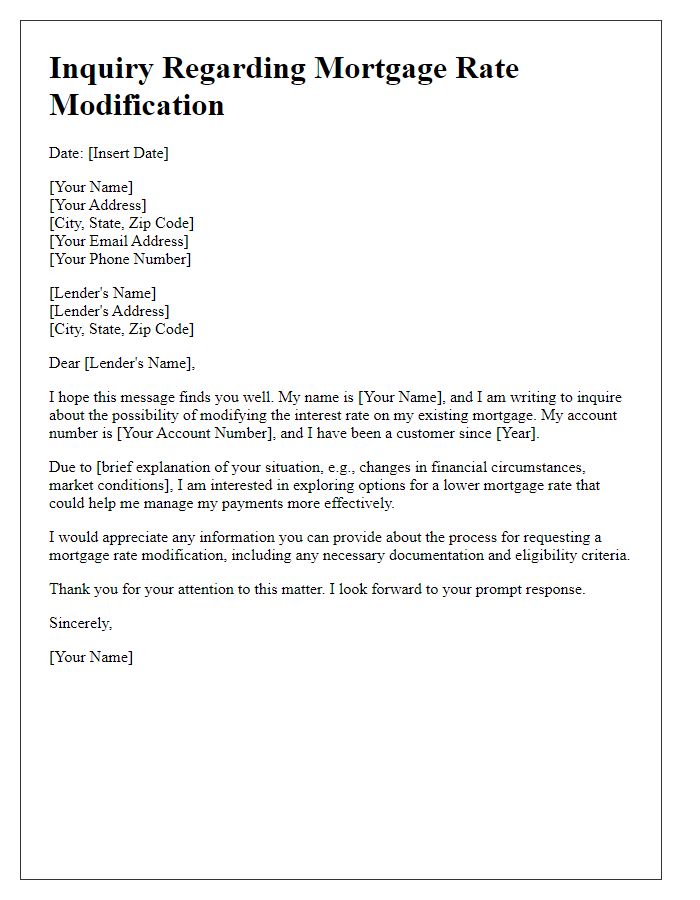

Supporting Financial Documentation

Revising a mortgage rate agreement involves submitting supporting financial documentation, including recent pay stubs, tax returns from the previous two years, and bank statements to verify income and savings. Lenders often require a current credit report, showcasing any changes in credit score since the original agreement, particularly if improvements have occurred that could positively impact the mortgage terms. Additionally, documentation outlining debt-to-income ratio calculations plays a crucial role in assessing financial stability. Property appraisal reports may also be requested as they help determine the current market value of the home, influencing the loan-to-value ratio and ultimately impacting the revised rate. Overall, providing comprehensive and accurate documentation facilitates a smoother negotiation process with lenders for more favorable mortgage terms.

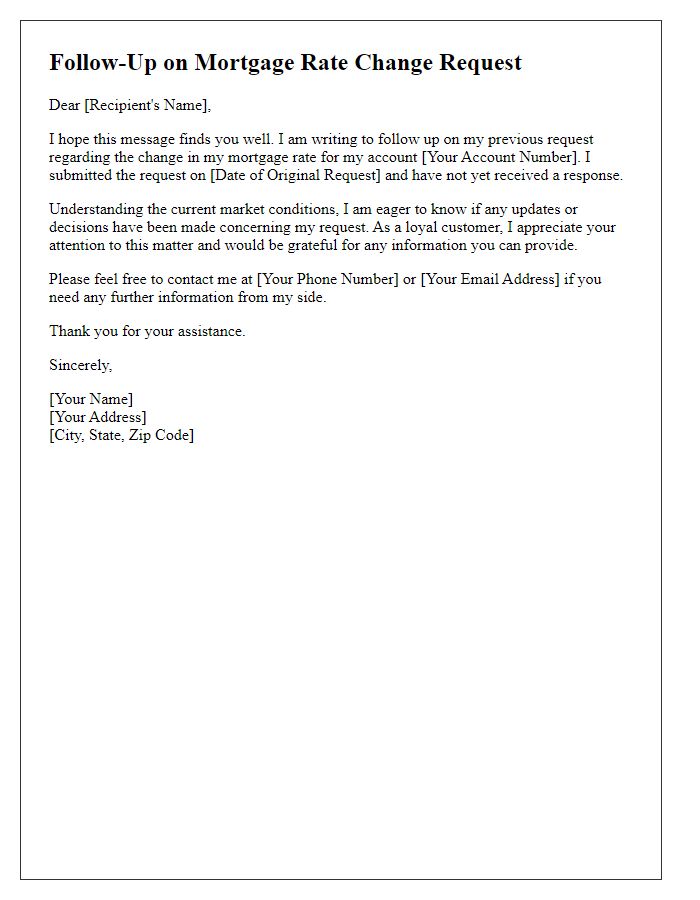

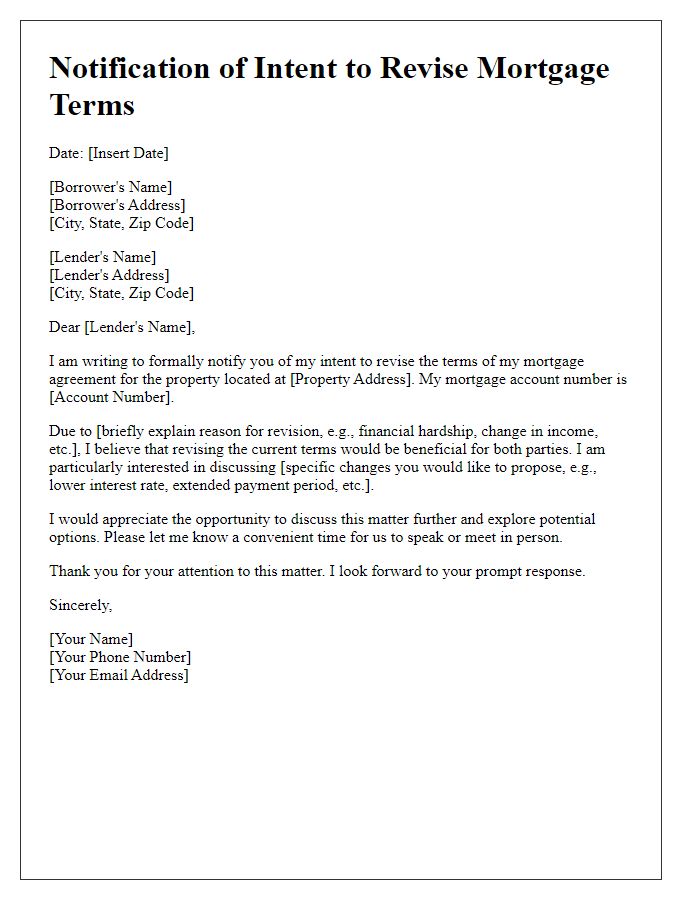

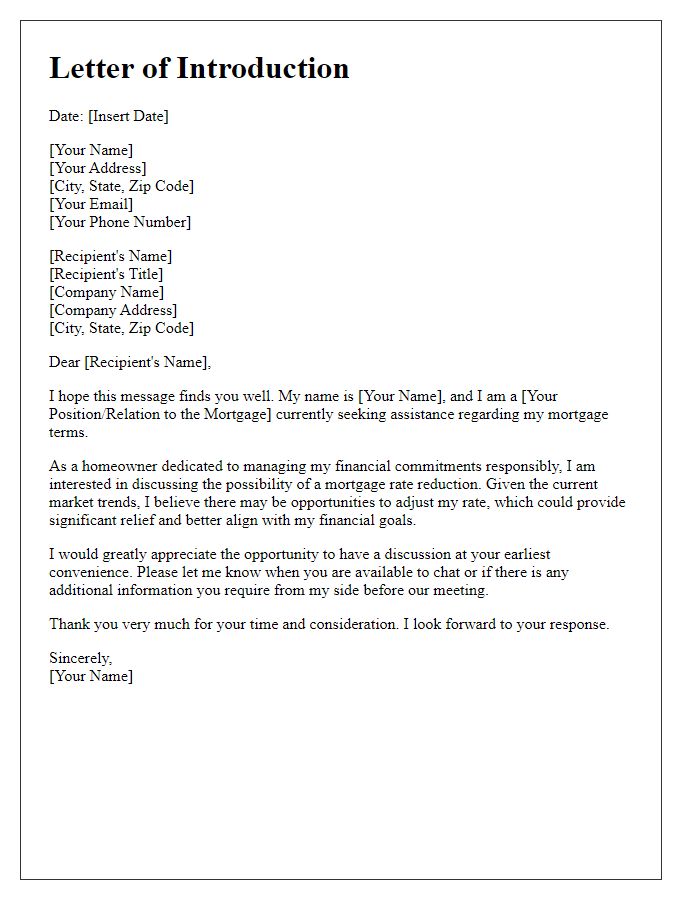

Comments